Efficient, Effective and Profitable Investing via Sectors

The reasoning behind the 11 industrial sectors is to put companies together based on their underlying economic drivers. The logic is that investors will develop a better understanding of the dynamics of different industrial grouping of the economy. When investors are better informed, they can make more efficient, effective, and hopefully profitable investment decisions.

After reading this blog post, try testing your knowledge, do the Quiz, click HERE.

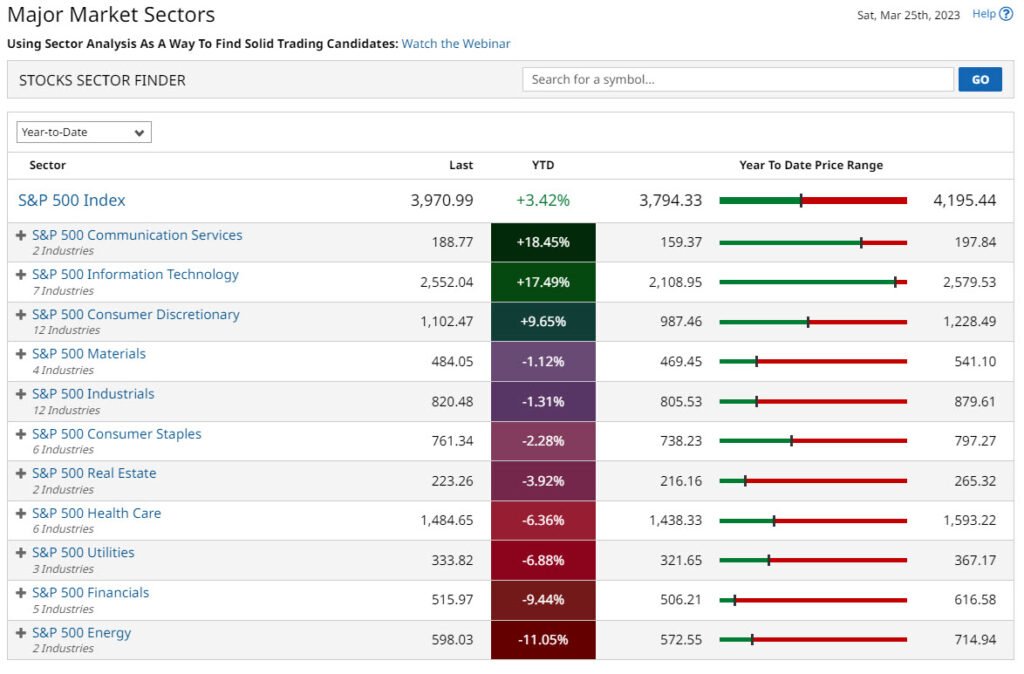

There are two classification systems used by investment professionals and financial analysts. The two systems are the Global Industry Classification Standard (GICS) and the Industry Classification Benchmark (ICB). More on these later. The two classifications aid in assessing the performance of different companies within the same sector. This makes investing highly efficient, effective, and profitable as there is a sector index as a benchmark. Thus, the performance of a portfolio is measured against a relevant sector index.

NYSE: 11 INDUSTRIAL GROUPS

The 11 industrial groups listed below, represent a broad range of industries, and companies. Within each industrial group, the stocks share similar business characteristics, face similar economic and regulatory pressures. Investors and financial analysts use these industrial groups. Listed further on in the blog post will be, the key companies and ETFs representing each group.

The 11 Industrial Groups are:

Energy

Materials

Industrials

Consumer Discretionary

Consumer Staples

Health Care

Financials

Information Technology

Communication Services

Utilities

Real Estate

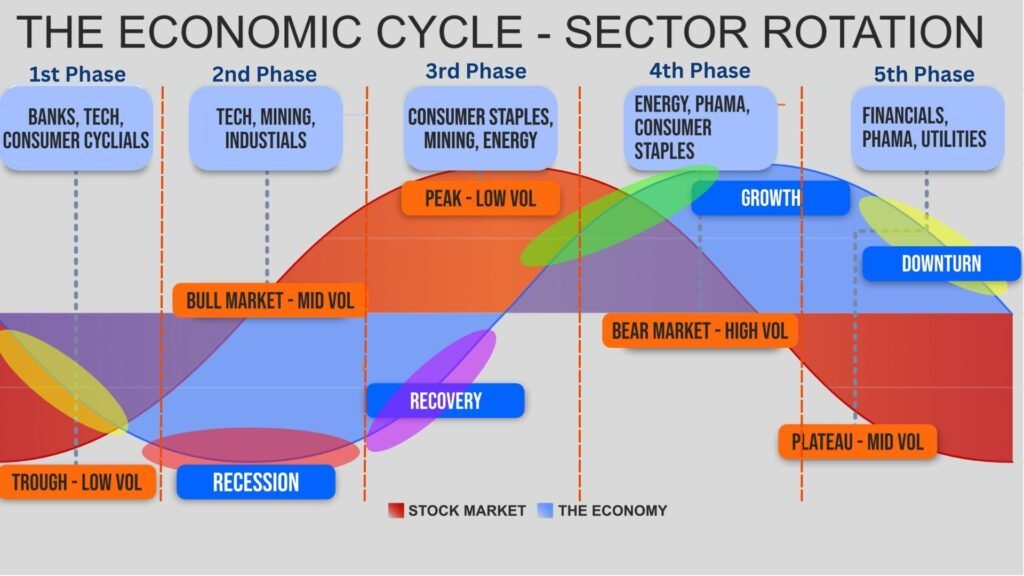

SECTOR ROTATION AND ALLOCATION

Aiming for efficient, effective, and profitable investing

This is done via Sector Allocation and Rotation and referencing the current phase in the economic cycle.

In the 1st phase:

The economy is experiencing a decline in economic growth. While the Equity Market has reached the Bottom after a period of price decline or Bear Market.

In the 2nd phase:

The economy is in a recession. While the Equity Market has entered a new growth phase, key sectors, Tech, Mining, Industrials.

In the 3rd phase:

The economy is in a recovery phase. While the Equity Market peaked, key sectors, Staples, Mining, and Energy.

In the 4th phase:

The economy is in a growth phase. While the Equity Market has peaked and is entering a Bear Market.

In the 5th phase:

The economy is experiencing a decline in economic growth. While the Equity Market is in the late stages of a Bear Market.

11 INDUSTRIAL SECTORS: STOCKS AND ETFS

A detailed description of each industrial group on the NYSE

INDUSTRY CLASSIFICATION

In the Stock Market, companies are classified together into Industries based on their primary business activity. Industry Classification is an economic taxonomy that classifies companies into Industrial groupings. In general, this is based on the dominant business by revenue. Also taken into consideration is a similar style of industrial production, similar or competing products, and a similar financial structure.

Industry Classification can be further divided into Super Sectors, Sectors, and Sub-Sectors. The Industry Classification of companies allows market participants to analyse companies operating in similar businesses. Hopefully, this offers a better understanding of the competitive forces a company is facing and the appropriate valuation metrics that could reasonably be applied.

ETFS AND STOCKS

Investors can invest in the ETFs or stock mentioned in this article by opening a brokerage account. This could be either with a financial institution that provides access to the NYSE and other stock exchanges. Or investors can invest via one of the many online APPs, such as Robinhood. Investors can then look for the ETFs or stock they want and place a buy order for the desired number of shares.

Data and Graphs by ![]()

ETFs can offer investors a low-cost and efficient approach to obtain exposure to a diverse range of stocks within each industrial sector. While investing via stocks an investor is taking on more stock specific risk. However, before making an investment decision, investors should conduct research and understand the risks involved with each ETF.

ENERGY

THE ENERGY SECTOR

Stocks in the discovery, production, refining, and distribution of energy products. These companies operate in a range of industries. Including oil and gas, renewable energy, and utilities.

Investing in NYSE-traded energy businesses can give investors exposure to the energy industry. Impacting the sector are variety of factors. Geopolitical events, commodity pricing, and government policies. Comprehensive research and due diligence are in necessary before making any investment decisions. The earnings of companies in the energy business may be volatile and uncertain.

CHEVRON (CVX)

Chevron operates across the world and one of the world’s largest oil and gas businesses. Operating as a fully integrated company, from oil production to refining and marketing. Chevron is well-positioned to deal with the volatility of oil and gas prices. Being a fully integrated firm involved in all elements of the oil and gas industry. Chevron’s operations are divided into two major segments: upstream and downstream. Transportation and chemicals are two of Chevron’s other businesses. Chevron’s current pipeline of oil and gas development projects is impressive.

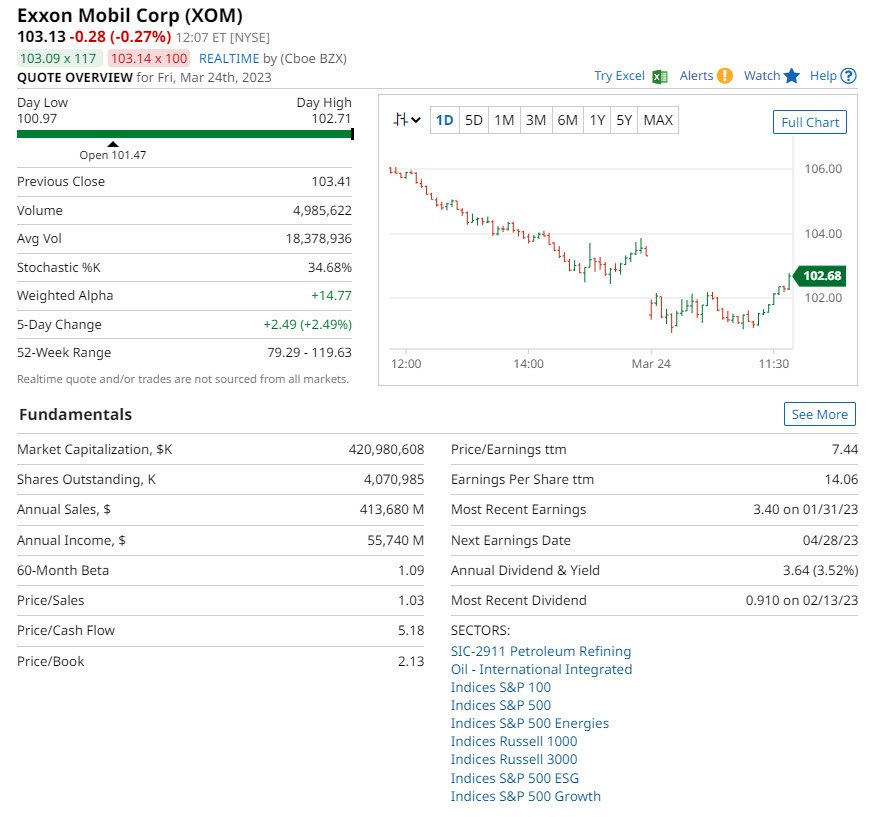

ExxonMobil Corporation (XOM)

ExxonMobil is a comparatively lower-risk energy sector bet. It is considered a bellwether company in the energy field. Exxon has an optimal integrated capital structure that has provided industry-leading returns. Management’s strong track record of discipline in CAPEX across the commodity price cycle. The firm holds some of the most productive upstream properties in the world. Other assets include the world’s largest refining operations. Exxon pays regular a dividend and has a solid credit profile in the energy industry. A considerable budget for critical oil and gas projects. ExxonMobil’s operations are divided into three major segments: upstream, downstream, and chemical.

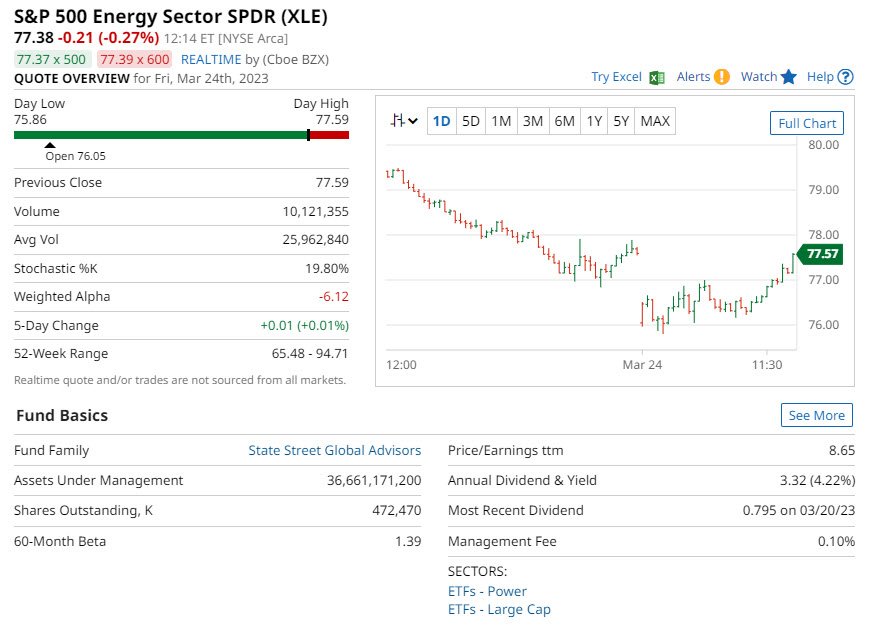

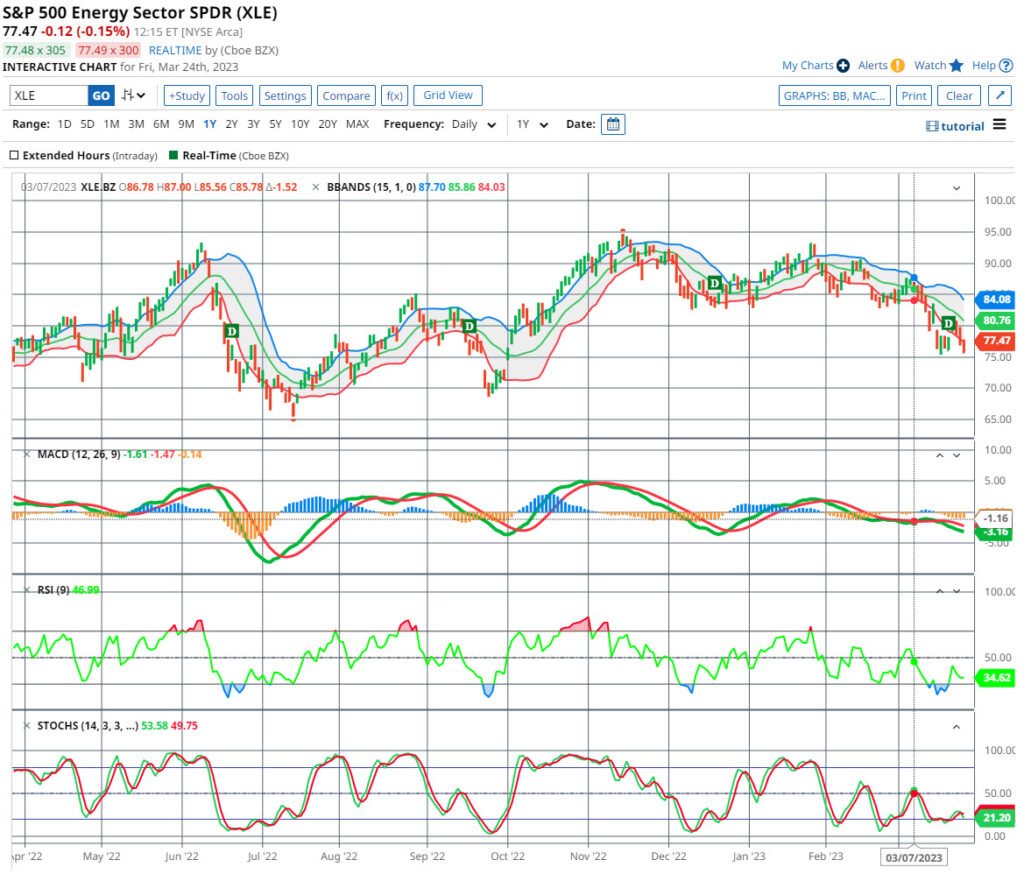

Energy Select Sector SPDR Fund (XLE)

Energy Select Sector SPDR Fund (XLE)

The Fund aims to offer investment returns both price appreciation and yield. Performance is to be highly correlated to the Energy Select Sector Index.

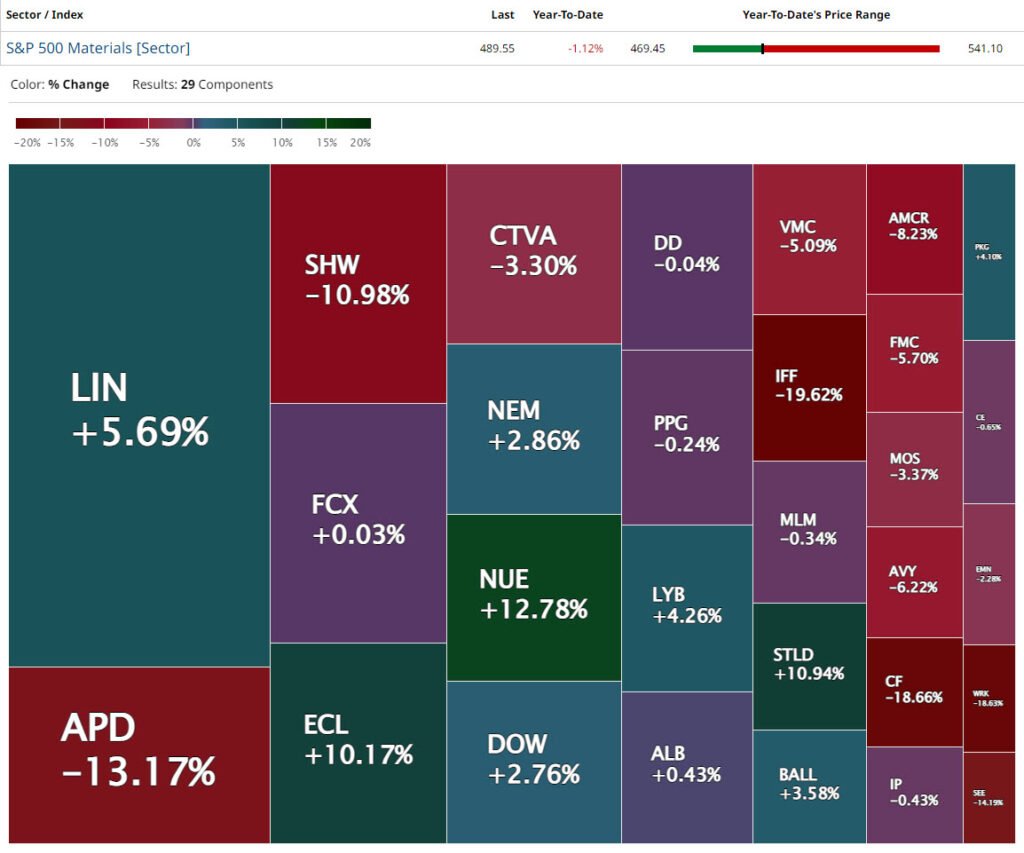

MATERIALS

The materials sector includes listed companies. Companies that extract, manufacture, and distribute raw materials and industrial goods. This covers a variety of industries, chemicals, metals and mining, and construction materials.

Investing in NYSE-listed materials stocks can give investors access to many industries. The manufacturing and distribution of raw materials and industrial goods. These industries are affected by commodity prices, product demand, and global economic conditions. Research and analysis is required, the materials business may be volatile and risky.

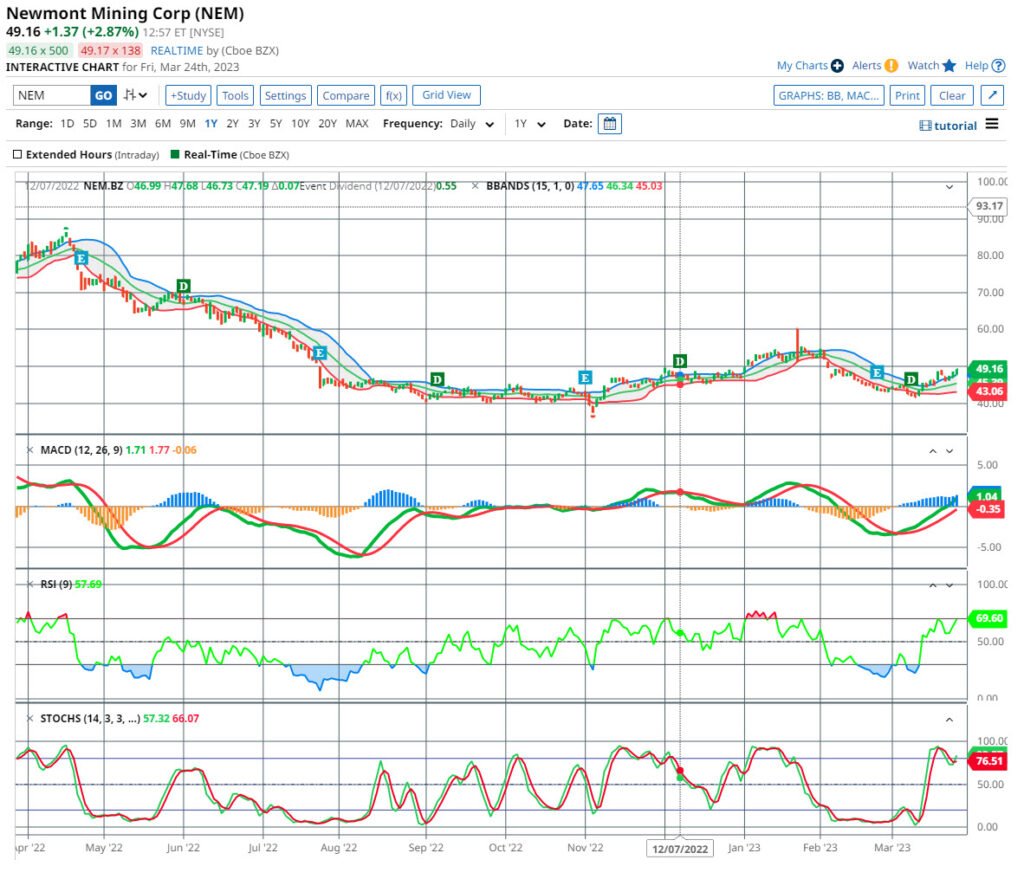

Newmont Mining Corp (NEM)

Newmont Corp. is one of the world’s top gold producers, having mines in Nevada, Peru, Australia, and Ghana. The operating segments of Newmont are North America, South America, Australia, and Africa. The North America segment operates in Mexico, Canada, and the United States. Suriname, Peru, Argentina, and the Dominican Republic are all part of the S. America segment. Boddington and Tanami comprise the Australia segment. The Tanami mine is wholly owned and operated by Newmont.

Freeport-McMoRan Inc. (FCX)

Freeport-McMoRan Inc. is a mineral exploration and development company. It mines and mills copper, gold, molybdenum, silver and smelts and refines concentrates. The company’s operations are principally carried out through its operating subsidiaries. They are PT Freeport Indonesia, Freeport-McMoRan Corporation, and Atlantic Copper. PT Freeport Indonesia’s main asset is the Grasberg mine in Papua, Indonesia. One the world’s largest copper and gold reserves. Freeport operates its mines in four key divisions. North America copper mines, South America mining, Indonesia mining, and Molybdenum mining. Freeport runs open-pit copper mines in Arizona and New Mexico in North America. The firm also own molybdenum mines in Colorado. The corporation operates copper mines in Peru and Chile in South America.

Materials Select Sector SPDR Fund (XLB)

Materials Select Sector SPDR Fund (XLB)

The XLB SPDR Fund aims to offer returns in line with the Materials Select Sector Index. This is regarding both price and yield performance.

![]()

Barchart is a financial data and technology provider that offers a variety of tools and resources for investors. For this article information about exchange-traded funds (ETFs) was researched using Barchart. A wide range of ETFs can be screened on Barchart by performance data, charts, news, and analysis. These are only some of the data that can searched for using Barchart. The user interface allows for a search for a specific ETF, or a perusal of the available options based on asset class, investing strategy, industry, and other criteria.

Barchart also features analysis and comparison tools for exchange-traded funds (ETFs). Users can compare the performance of several ETFs side by side, and screeners allow users to filter ETFs based on parameters like expense ratio, yield, and asset class. Investors may learn more about ETFs and other investment vehicles, as well as keep up with market news and analysis, through Barchart’s news and analysis and instructional materials.

In summary, Barchart can be a helpful tool for anyone who want to learn more about ETFs, conduct in-depth analysis, and then make educated investment decisions.

I am a member of the Barchart Affiliate Program, please use the attached link if you would like the Subscribe.

Subscribe to

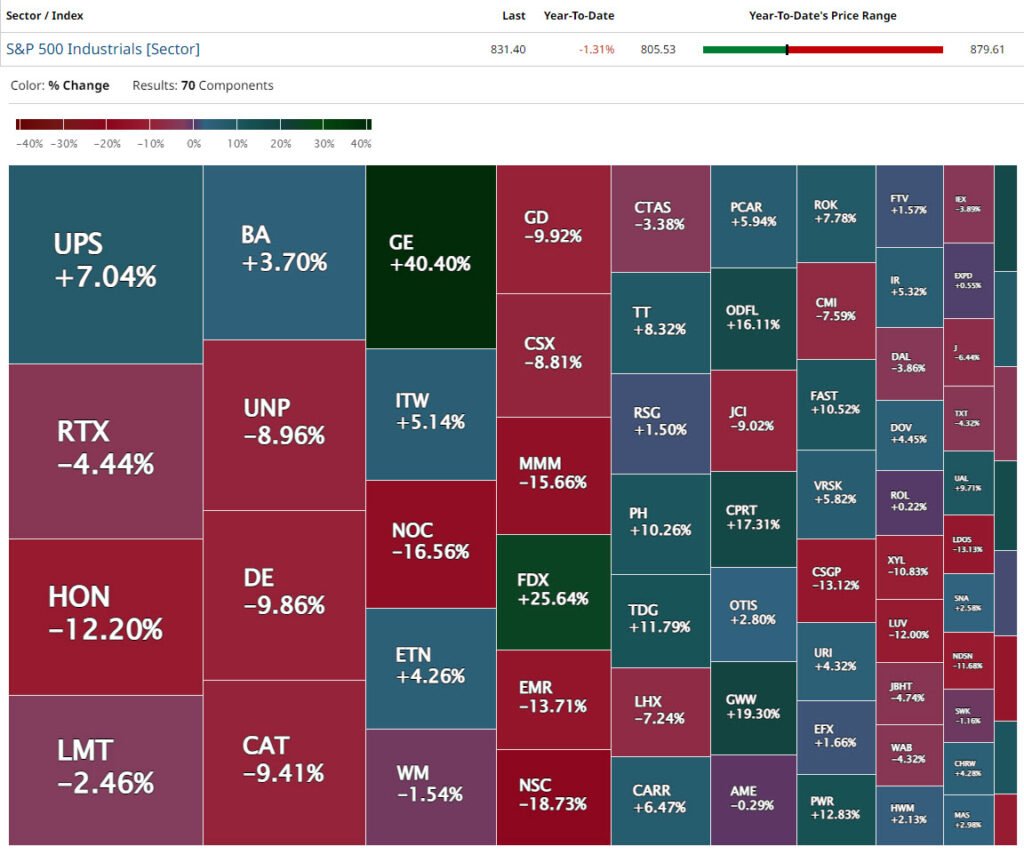

Industrials

The Industrial Sector includes corporations that manufacture and distribute capital goods. This covers machinery, equipment, and industrial products. Various sub-sectors are Aerospace and defence, building and engineering and electrical equipment. As well as components, manufacturing, shipping, and transportation.

General Electric, Caterpillar Inc are two of the Industrial Sector stocks. They all are well-known and have a substantial impact on the economy and stock market.

The NYSE-listed Industrial Sector is a major component of the US economy. The companies in this sector supply crucial goods and services to the U.S. economy. The industry is competitive, and it has encountered challenges in recent years. Global economic uncertainty, trade conflicts, and the COVID have been major impacts. The Industrial Sector will play a role in defining the US economic recovery near term.

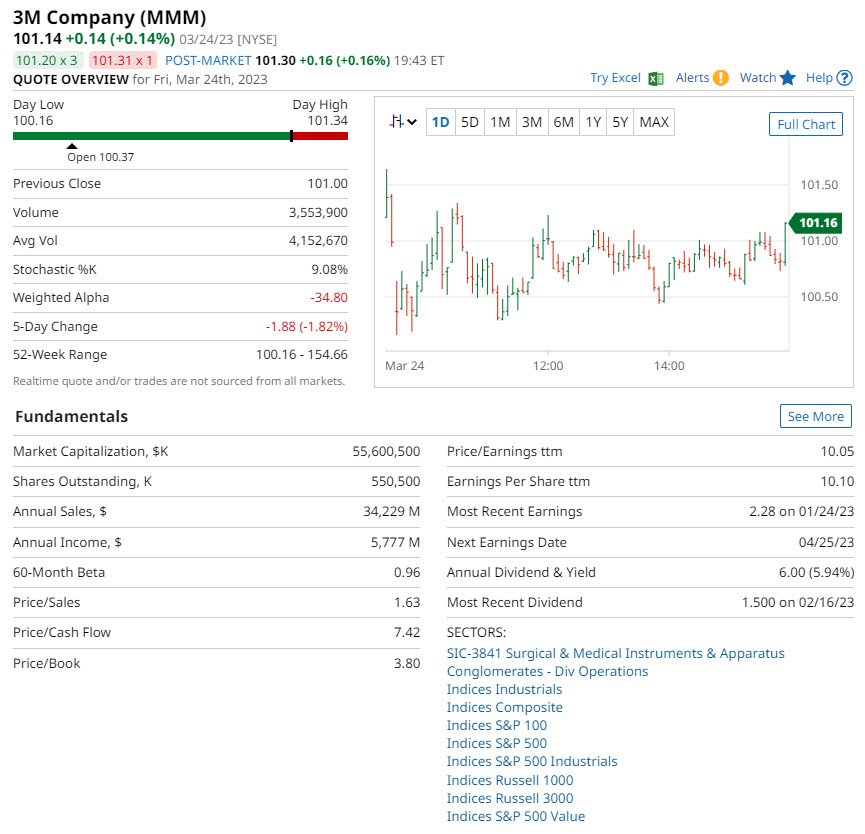

3M Company (MMM)

3M Company and its subsidiaries operate as a diversified technological company. Manufacturing facilities are located around the world. Serving a diverse customer base, 3M has four main segments. The Safety & Industrial segment. This segment services customers in the global electrical, safety, and industrial markets. The Transportation & Electronic. Services original equipment manufacturers in the global electronics and transportation industries. Customers in the global healthcare industry are served by the Health Care segment. This covers oral care, medical solutions, food safety, separation, and purification technologies. Consumer products include office supplies, stationery, home renovation items, and homecare items.

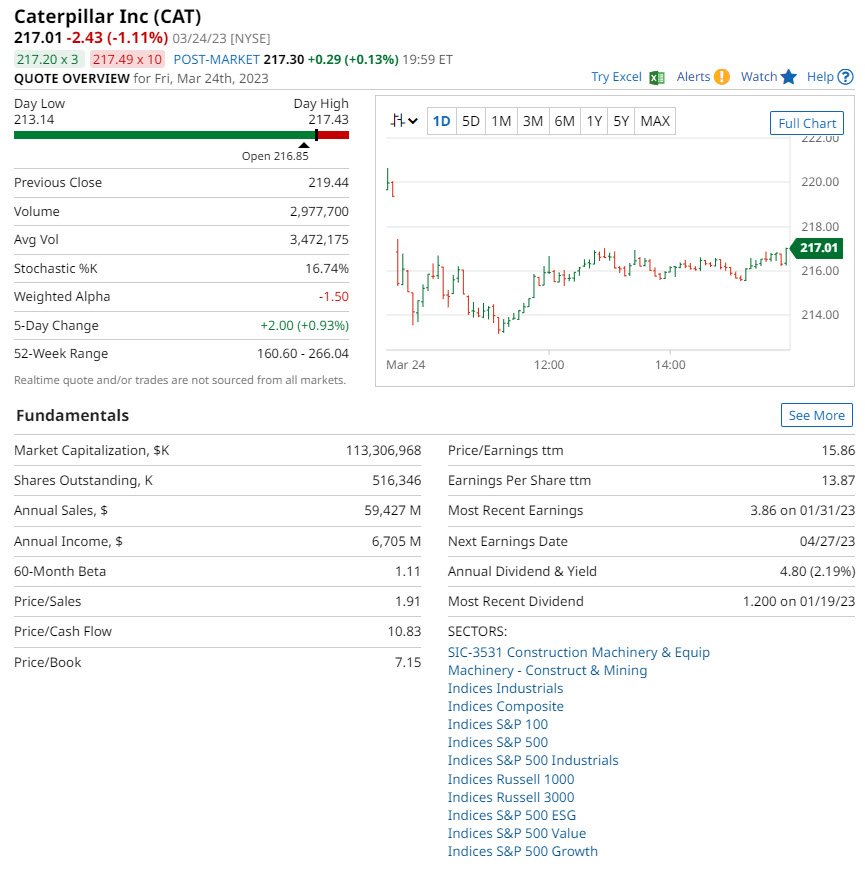

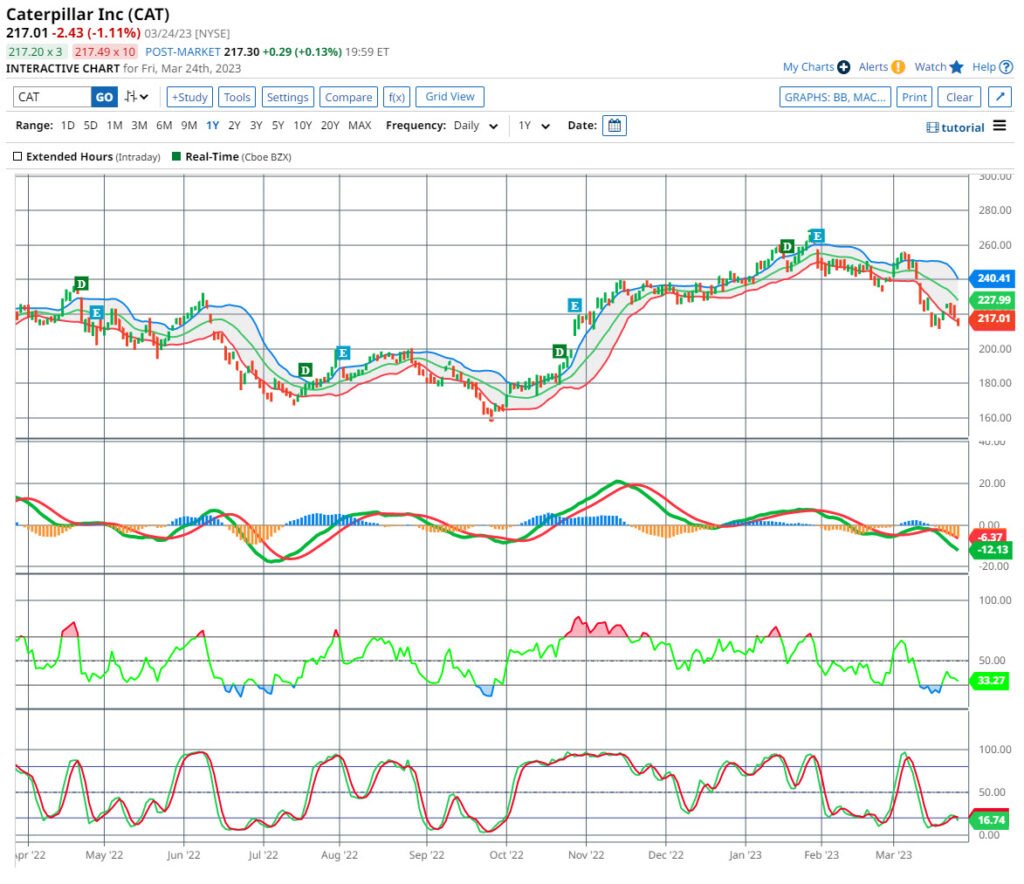

Caterpillar Inc. (CAT)

Caterpillar is the world’s preeminent manufacturer of equipment. This covers mining equipment, construction, diesel, and natural gas engines. The power plants are used in many areas, industrial gas turbines, and locomotives. Caterpillar has a history extending more than 100 years. Caterpillar operates through three core segments. Construction industries, resource industries, and energy and transportation. Through its Financial Products section, they offer finance and related services.

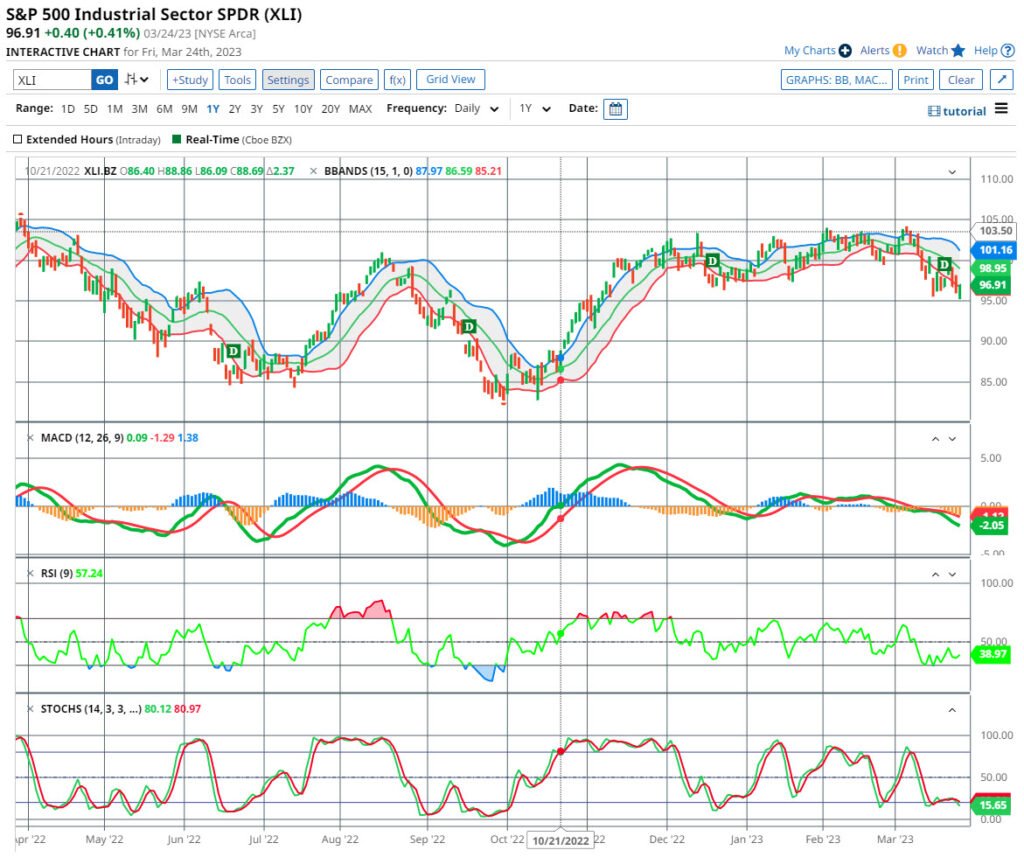

Industrial Select Sector SPDR Fund (XLI)

Industrial Select Sector SPDR Fund (XLI)

The XLI SPDR Fund aims to achieve investment returns both in price and yield. Before fees, the returns should correspond to the Industrial Select Sector Index.

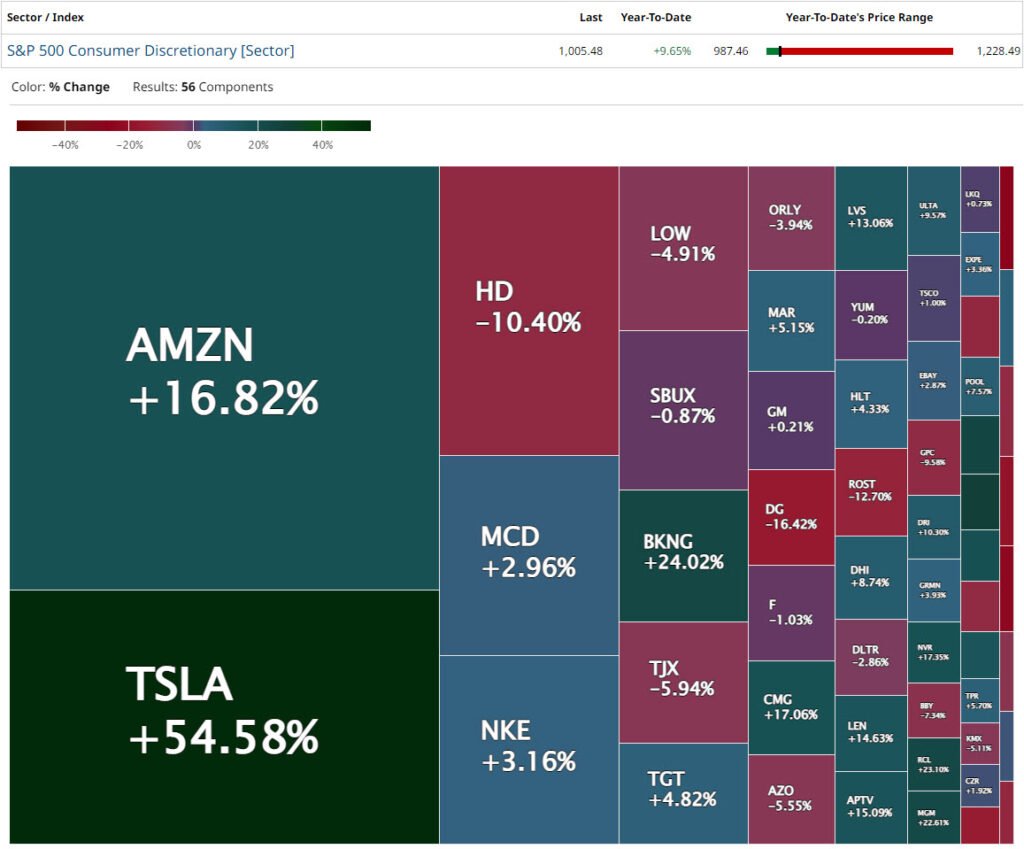

Consumer Discretionar

The companies in the Consumer Discretionary sector has a range of goods and services. They are not strictly necessary for meeting their daily necessities. These companies tend to be more vulnerable to changes in economic conditions. Thus, earnings may be more volatile.

Amazon and Walt Disney are examples of corporations in the Consumer Discretionary sector. These businesses tend to be more susceptible to variations in earnings. This is a result of purchasing habits and trends among consumers.

The Consumer Discretionary sector is a vital component of the economy. It produces goods and services that improve the quality of life for consumers. The sector is for investors seeking chances in dynamic and growth-oriented stocks.

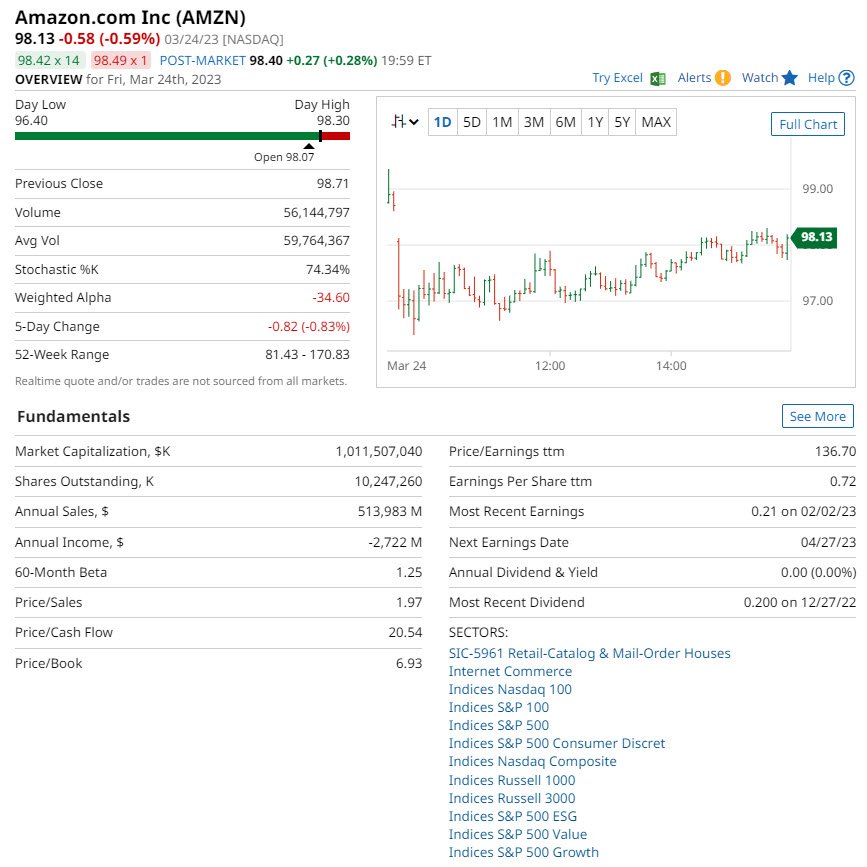

Amazon Inc. (AMZN)

Amazon is one of the world’s largest e-commerce companies, operating around the world. Its online retail operation the Prime program, backed by a huge delivery network. The Whole Foods Market acquisition established a physical retail supermarket footprint. Amazon is in cloud computing, in the Infrastructure Service via Amazon Web Services. This is one of its high-margin businesses. With its Alexa-powered Echo gadgets, Amazon has also become a household name. Amazon reports revenue is in three segments, North America, International, and AWS. Amazon caters to three types of customers, consumers, sellers, and web developers.

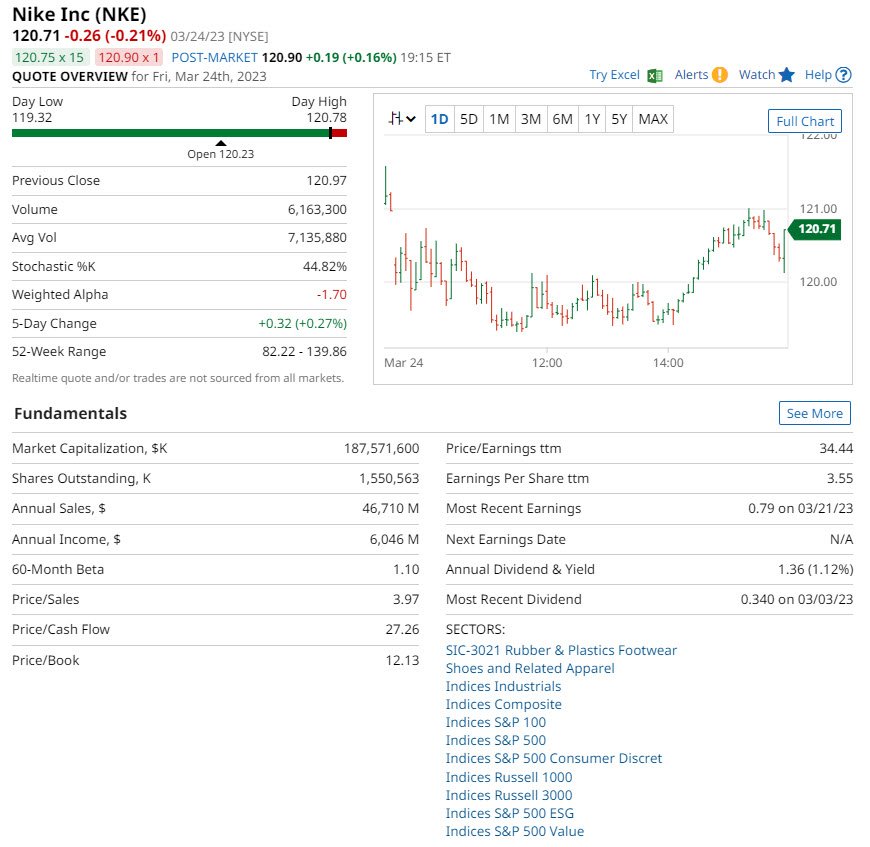

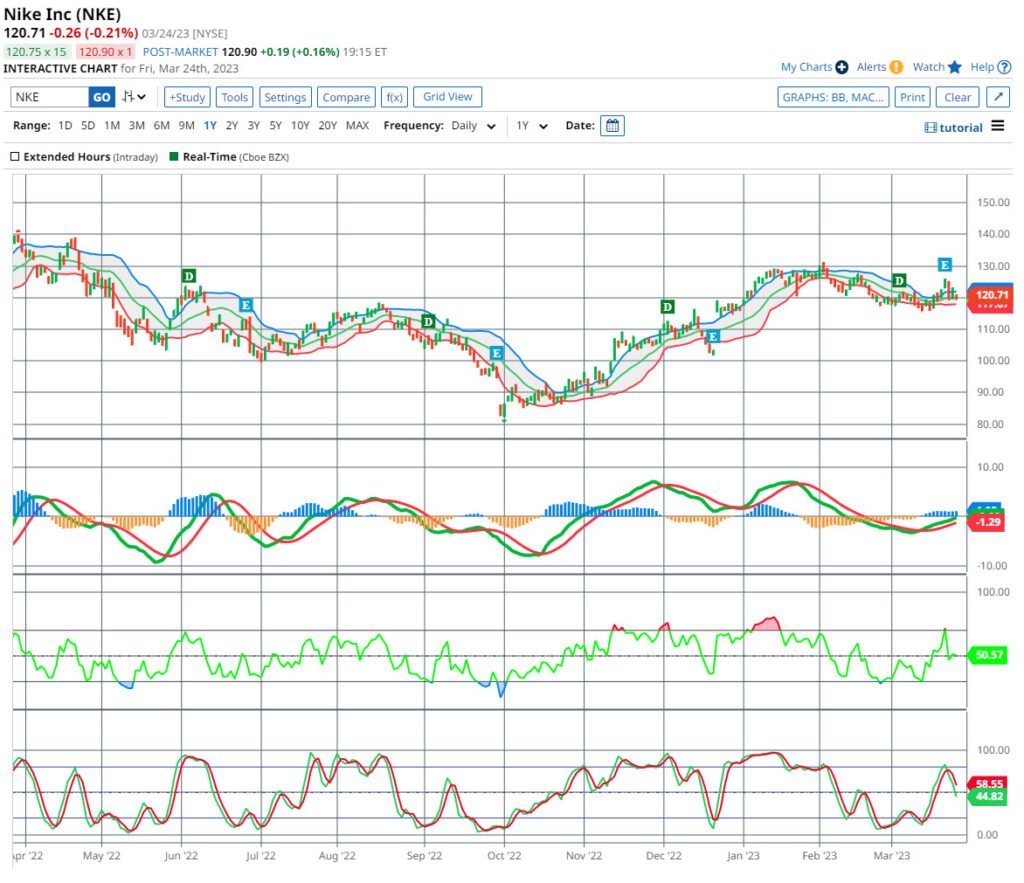

Nike Inc. (NKE)

Nike Inc. designs, develops, and markets athletic footwear, clothes, equipment, and accessories across the world. Utilizing a robust brand portfolio that includes Nike Pro, Nike Golf, Nike, and Air Jordan. The company offers premium, well-designed, and high-quality items. Items that are in step with the most recent client trends. NIKE is the global market leader in athletic footwear, clothing, equipment, and accessories. Nike’s swoosh’ emblem and ‘just do it’ slogan are globally recognisable. There are six major product categories offered by Nike. Running, Nike basketball, Jordan brand, football, training, and clothing.

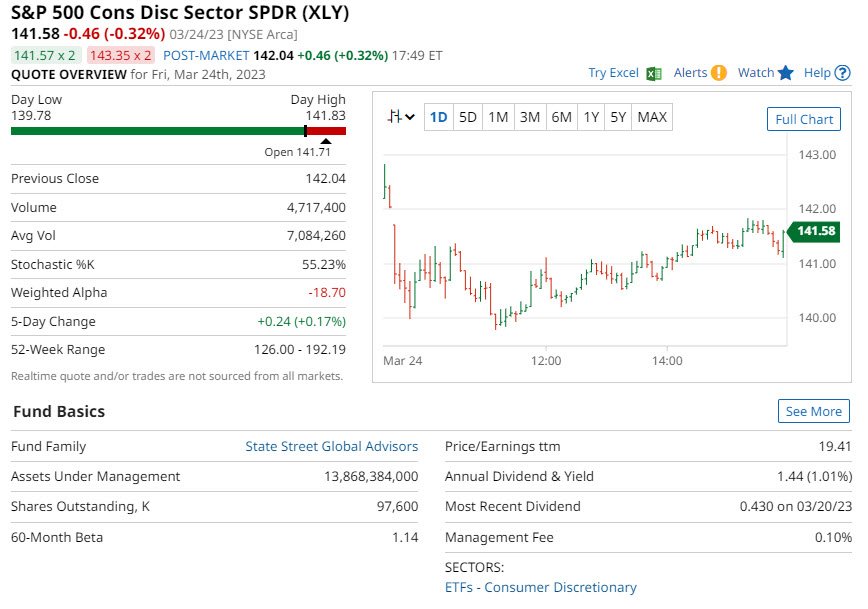

Consumer Discretionary Select Sector SPDR Fund (XLY)

Consumer Discretionary Select Sector SPDR Fund (XLY)

The XLY SPDR Fund aims to have investment returns, that correspond a benchmark index. This is in terms of price and yield to the Consumer Discretionary Select Sector Index.

Consumer Staples

The Consumer Staples Sector’s constituent companies manufacture daily necessities for life, products needed by people. These businesses are often less responsive to changes in the economic climate. Their income stream is steadier and more defensive in nature.

Procter & Gamble, PepsiCo, are some of the largest firms within the Consumer Staples on the NYSE. These corporations have a lengthy history of consistent earnings growth. In general, they distribute dividends to their shareholders.

The Consumer Staples sector is a significant part of the economy. The companies provide individuals with the necessary goods and services. As such, it is commonly regarded as a defensive industry. The stocks are considered stable, long-term investments.

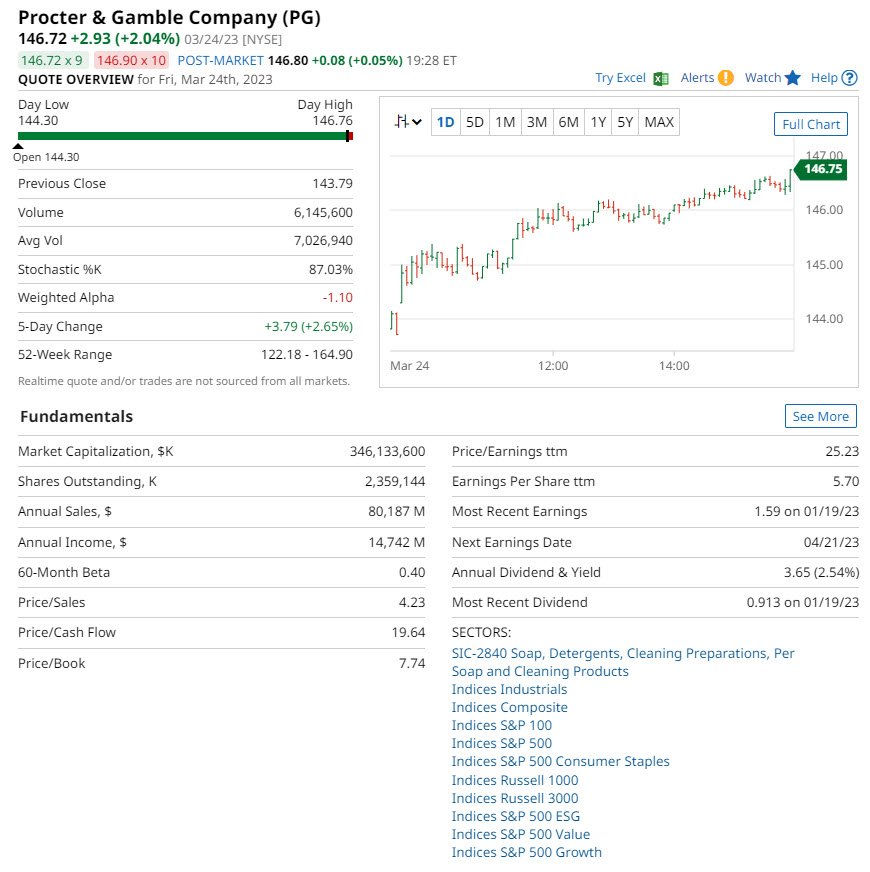

Procter & Gamble Co. (PG)

The Procter & Gamble Company, usually known as P&G, is a manufacturer of branded consumer goods. There are five reportable segments for the company. Personal Care includes hair care products, antiperspirants, deodorants, and personal cleansing. Grooming, consists of Shave Care goods, razors, shave products, and appliances. Health care consists of gastrointestinal, fast diagnostics, respiratory, and supplements. Fabric and Home Care covers categories like air care, dish care, fabric enhancers. Baby, Feminine, and Family Care. This consists of paper towels, tissues, and feminine care items.

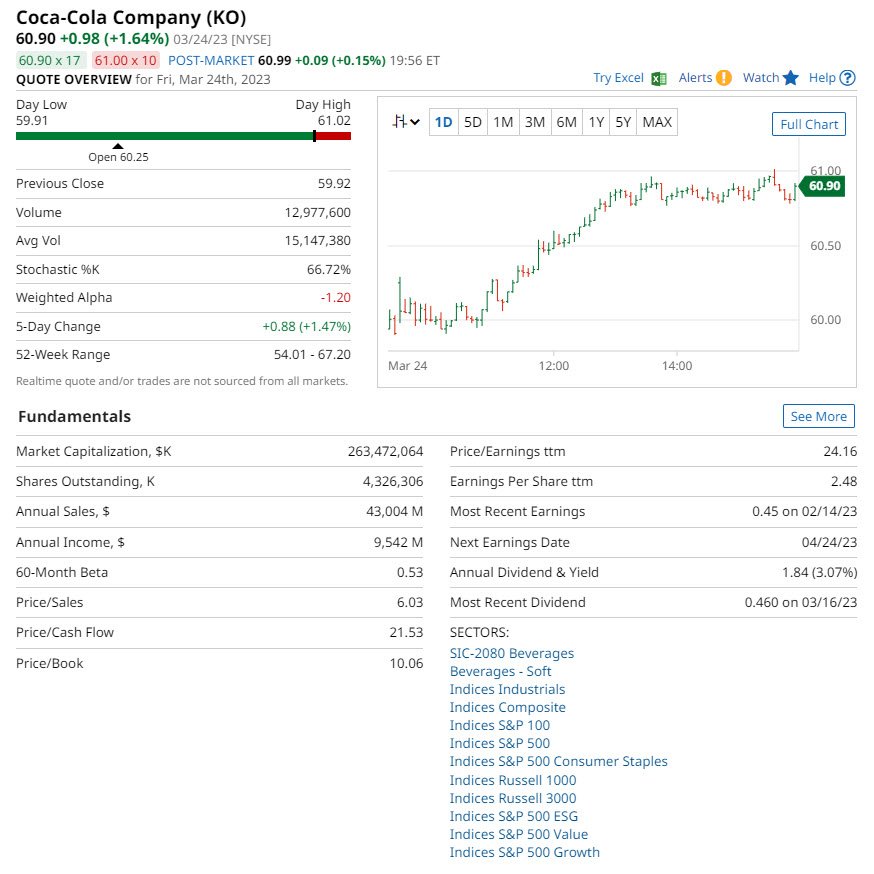

The Coca-Cola Company (KO)

The Coca-Cola Company’s excellent brand equity, marketing, research, and innovation. It has gained a significant market share in the non-alcoholic beverage business. Coca-Cola Energy, and Coca-Cola Plus Coffee, are the new additions the range. Beverage goods range from sodas to energy drinks in the company’s portfolio. Aside from sparkling soft drinks, the company sells a wide variety of still beverages. This includes water, improved water, juices and juice drinks, sports, and energy drinks. Coca-Cola discloses operating results by geographical segment.

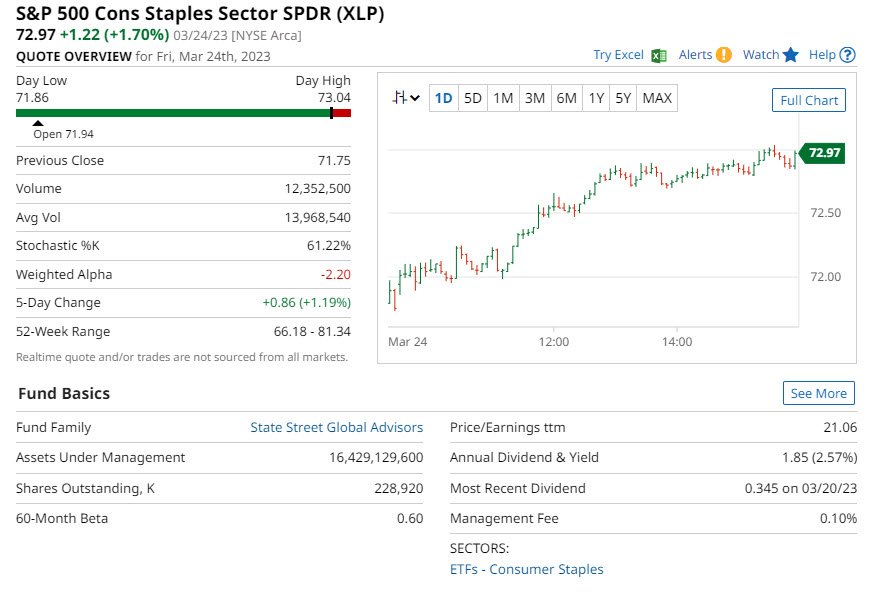

Consumer Staples Select Sector SPDR Fund (XLP)

Consumer Staples Select Sector SPDR Fund (XLP)

The XLP SPDR Fund aims to offer investment returns corresponding to a benchmark index. This is the Consumer Staples Select Sector Index.

HEALTH CARE

The Health Care sector covers companies that provide health care products and services. This covers pharmaceuticals, biotechnology, medical equipment, and health care facilities. Demand for health care products and services is quite resilient to economic cycles. The health care industry is an essential part of the economy.

Johnson & Johnson and Pfizer are some of the prominent firms in the Health Care sector. They have a strong focus on R&D to generate future growth.

The Health Care industry contributes significantly to the economy. It provides crucial products and services improving health and quality of life. The sector is for investors seeking stable and growing companies. Companies with a strong emphasis on innovation and research.

sector covers companies that provide health care products and services. This covers pharmaceuticals, biotechnology, medical equipment, and health care facilities. Demand for health care products and services is quite resilient to economic cycles. The health care industry is an essential part of the economy.

Johnson & Johnson and Pfizer are some of the prominent firms in the Health Care sector. They have a strong focus on R&D to generate future growth.

The health care industry contributes significantly to the economy. It provides crucial products and services improving health and quality of life. The sector is for investors seeking stable and growing companies. Companies with a strong emphasis on innovation and research.

Johnson & Johnson (JNJ)

Johnson & Johnson’s most significant competitive advantage is its diverse business model. It operates in three divisions: pharmaceuticals, medical devices, and consumer products. Its variety allows it to endure economic cycles more successfully. J&J has one of the most extensive R&D budgets among pharmaceutical businesses. J&J’s global operations are separated into three divisions. Pharmaceutical, medical devices, and consumer. The company’s medications address a wide range of therapeutic areas. They include including neurology, cardiovascular and metabolic, immunology. As well as cancer, pulmonary hypertension, infectious illnesses, and vaccines. The Medical Devices Segment operates in orthopaedics, surgery, interventional solutions, and vision. Consumer Segment items include baby care, skin health, oral care, and wound care. As well as over-the-counter (OTC) pharmaceutical medicines.

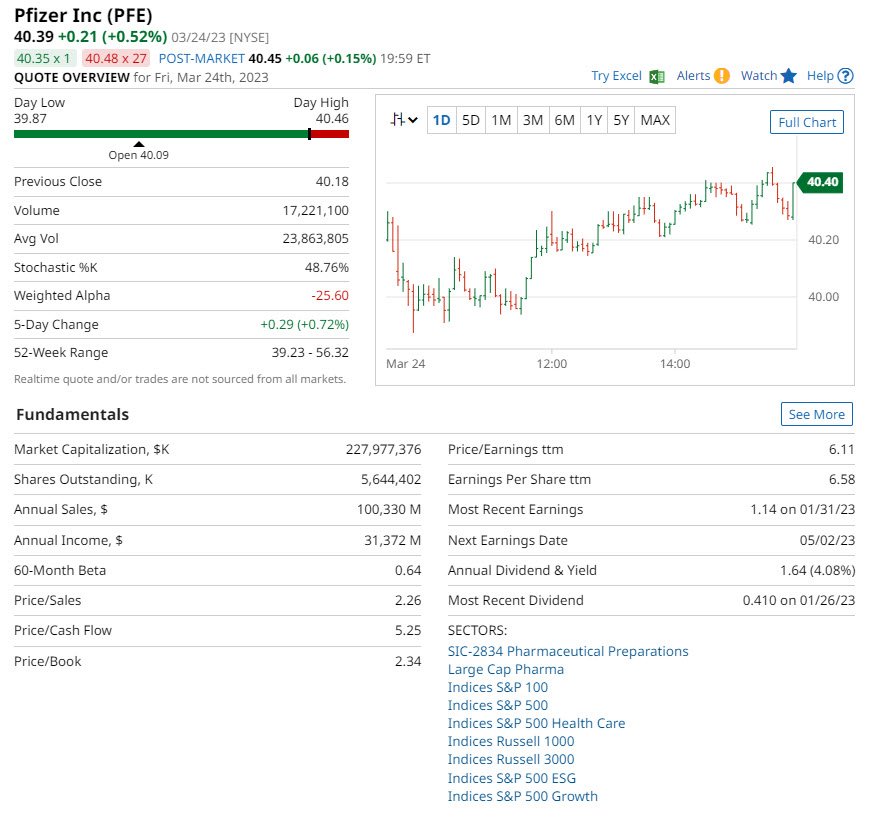

Pfizer Inc. (PFE)

Pfizer Inc. is a global biopharmaceutical corporation founded on research. The company has a strong pipeline of late-stage programs that can drive growth. Pfizer sells a wide range of pharmaceuticals and vaccines. The six units are Oncology, Inflammation & Immunology, Rare Disease. Hospital, Vaccines, and Internal Medicine. Pfizer is a smaller firm with a diverse portfolio of novel medications and vaccines.

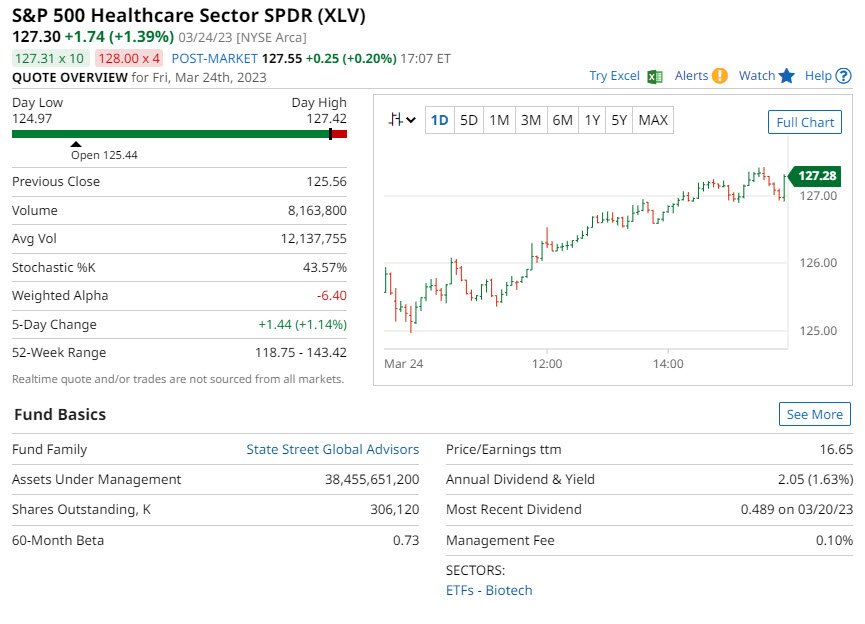

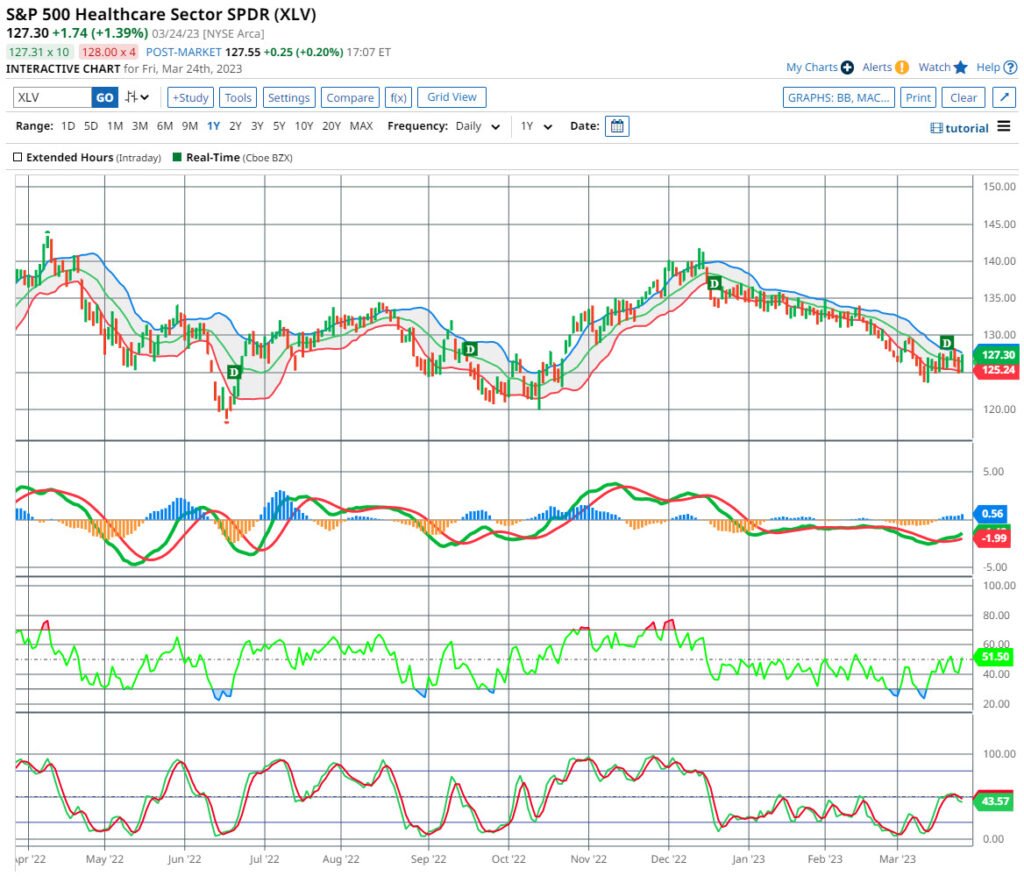

Health Care Select Sector SPDR Fund (XLV)

Health Care Select Sector SPDR Fund (XLV)

The XLV SPDR Fund investment returns should correspond to a benchmark index. This index is the Health Care Select Sector Index. This will be in both price and yield performance.

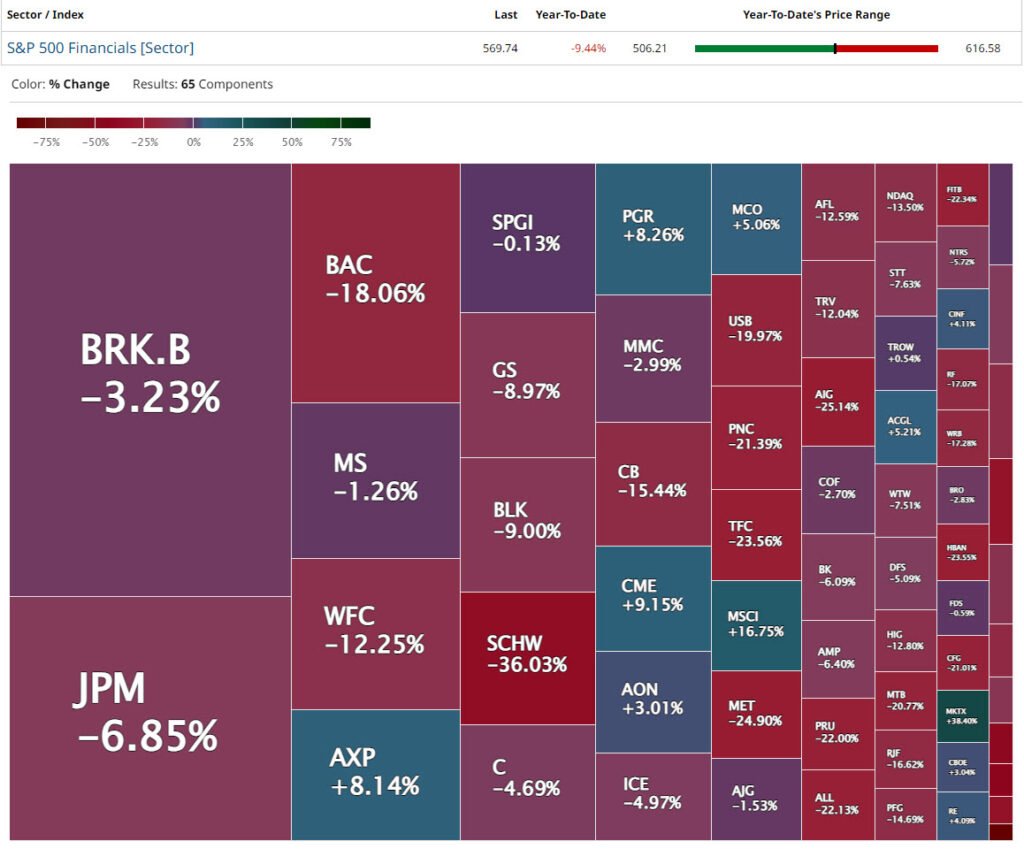

Financials

The Financials Sector consists of companies providing financial services. These services cover banking, investment management, insurance, and real estate services. The financial sector plays a significant role in the economy. The sector by mediates capital distribution. This could be to firms and individuals, they manage risks, and enabling transactions.

Two major companies in the Financial Sector are JPMorgan Chase and Goldman Sachs. A high priority is placed on risk management and maintaining strong balance sheets.

The financial sector is important to the economy, in providing financial service. The sector may be an appealing option for some investors seeking dividend-paying stocks.

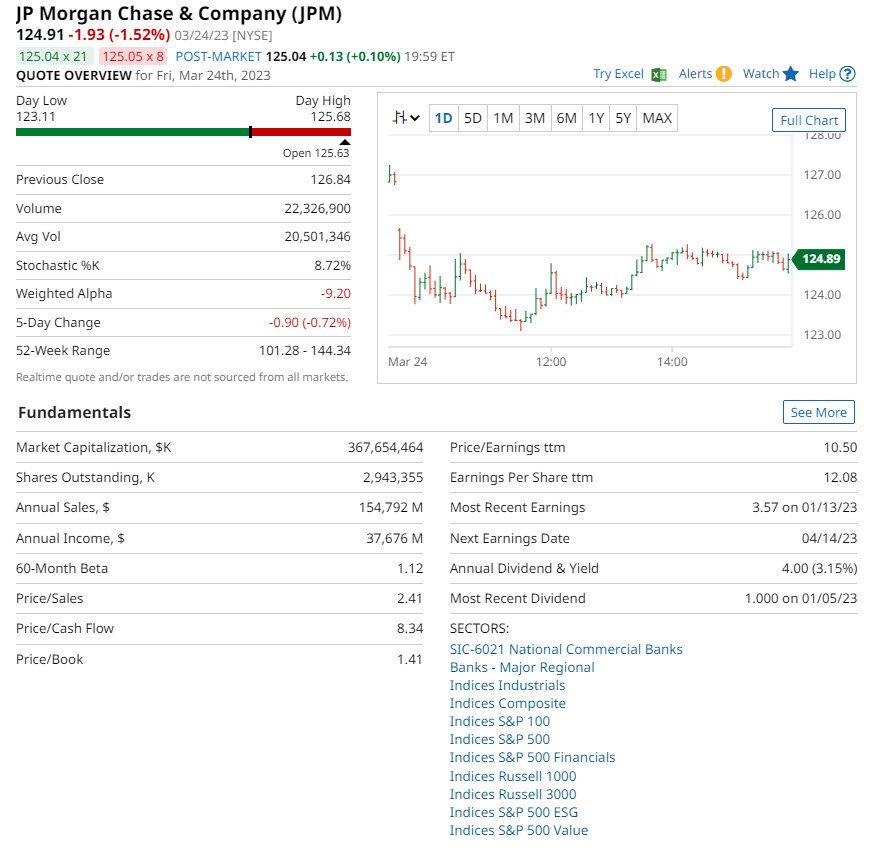

JPMorgan Chase & Co. (JPM)

JPMorgan Chase & Co. is one of the world’s largest financial services companies. JPMorgan splits its operations into five reportable segments. The Consumer & Community Banking section. This section provides personal assistance at bank branches and automated teller machines. Also, it has online, mobile, and telephone banking services to customers and companies. Corporate & Investment Bank provides a range of IB, market-making, and wholesale payments services. This is to a global client base, corporations, investors, financial institutions, and governments. Commercial Banking division provides lending, wholesale payments and investment banking services. This is to corporations, municipalities, financial institutions and non-profit groups. Asset and Wealth Management serves institutions, retail investors, and high-net-worth individuals. Corporate segment consists of Treasury & Chief Investment Office and Other Corporates.

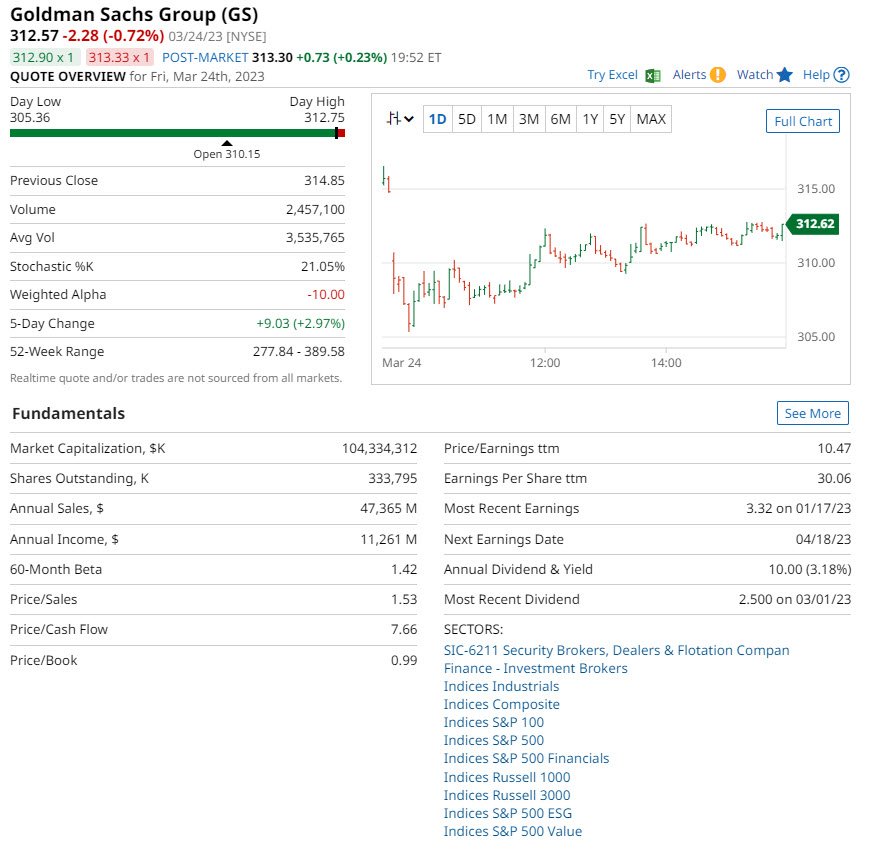

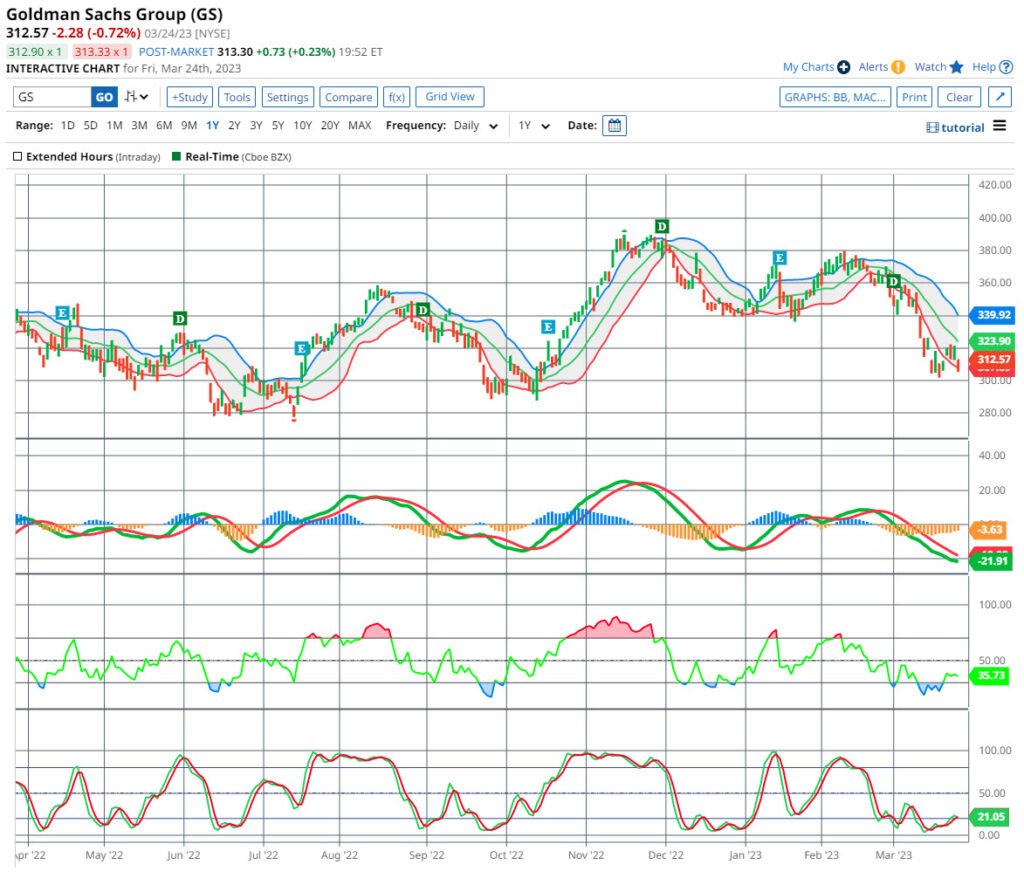

Goldman Sachs Group, Inc. (GS)

The Goldman Sachs Group, Inc. is a leading worldwide financial holding business. The company offers a diverse customer base IB, securities, and investment management. It is divided into four sections. The IB section includes financial advisory, underwriting, and corporate financing. Fixed Income, Currency, and Commodities comprise the Global Markets business. Covering client-execution activities in credit products, interest rate products, mortgages, currencies, and commodities. Consumer & Wealth Management covers management and deposit-taking operations relating to wealth management.

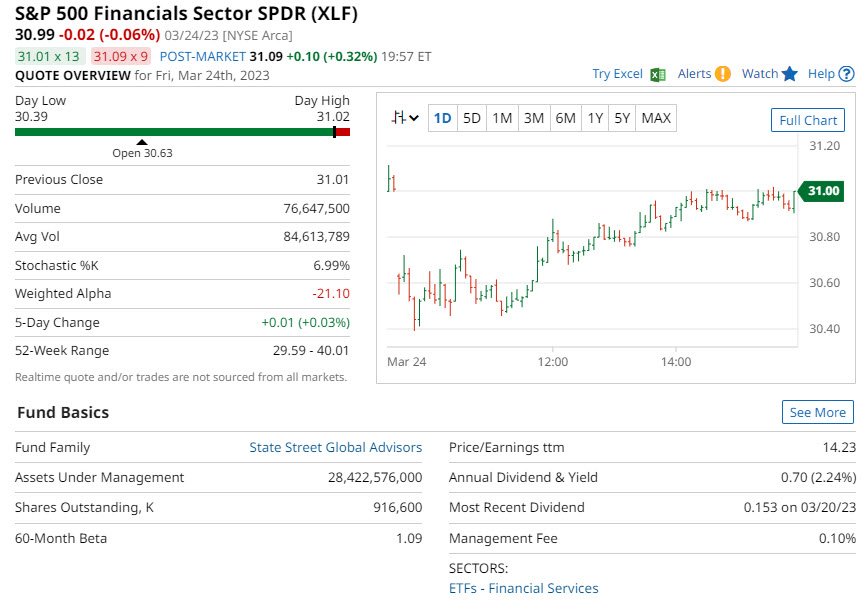

Financial Select Sector SPDR Fund (XLF)

Financial Select Sector SPDR Fund (XLF)

The XLF SPDR Fund aims to offer investment returns correlated to a benchmark index. The index is Financial Select Sector Index.

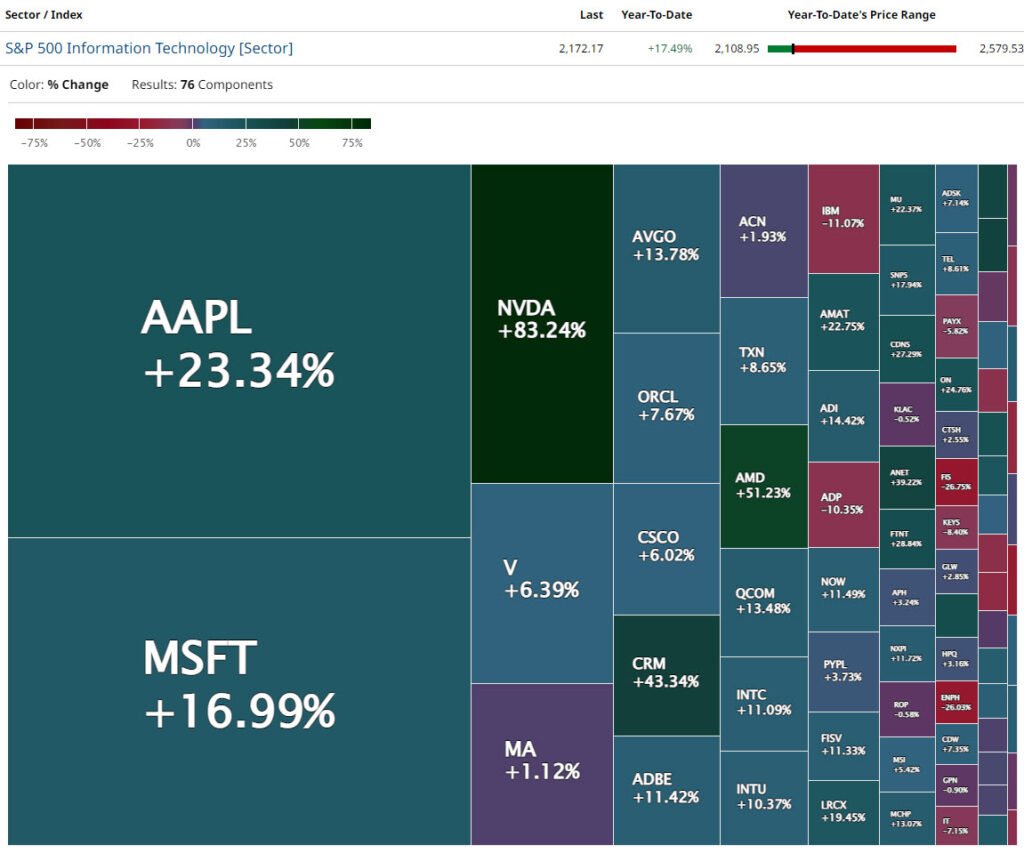

Technology

On the NYSE, firms in the IT industry provide a wide range of products and services. This includes enterprise software, cloud computing, artificial intelligence, and cybersecurity. As well as e-commerce, social media, and digital advertising. On the NYSE, some of the world’s largest and most well-known corporations are listed in the IT industry.

These firms have a substantial impact on the global economy. IT companies drive innovation in a variety of fields. As technology advances, the IT sector on the NYSE is expected to be a vital driver of growth and innovation. This is likely to be for many years to come.

Businesses in the IT sector include communication services, internet, cable, and wireless services. As well as content providers, such as media companies. Changing consumer behaviour, technical innovation, and government regulations frequently impact the sector.

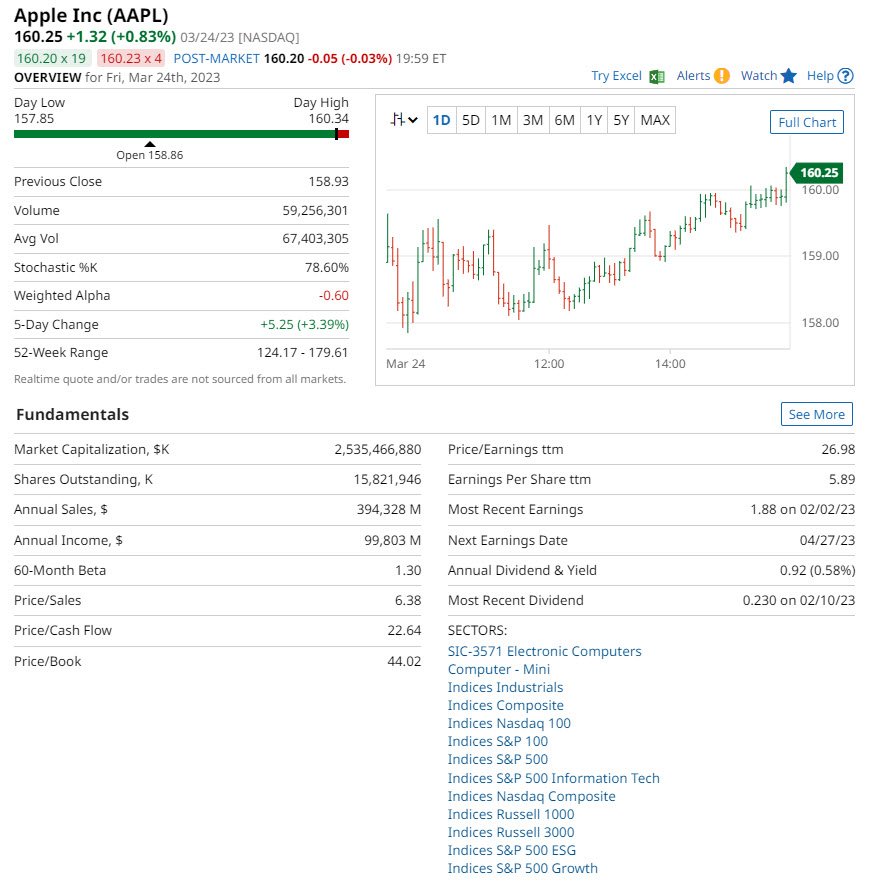

Apple Inc. (AAPL)

Apple’s business revolves entirely around its flagship iPhone. The Services portfolio includes the Cloud, App Store, Apple Music and Apple Pay. Furthermore, non-iPhone gadgets such as the Apple Watch and AirPod have acquired appeal. Due to the Apple Watch and AirPods, Apple leads the Wearables and Hearables segment. Apple also creates, manufactures, and markets the iPad, MacBook, and HomePod. The devices are powered by software applications such as iOS, macOS, watchOS, and tvOS. Apple also offers subscription-based Apple News and Apple Card. As well as Apple Arcade, a new Apple TV app, Apple TV channels, and Apple TV, a new subscription service.

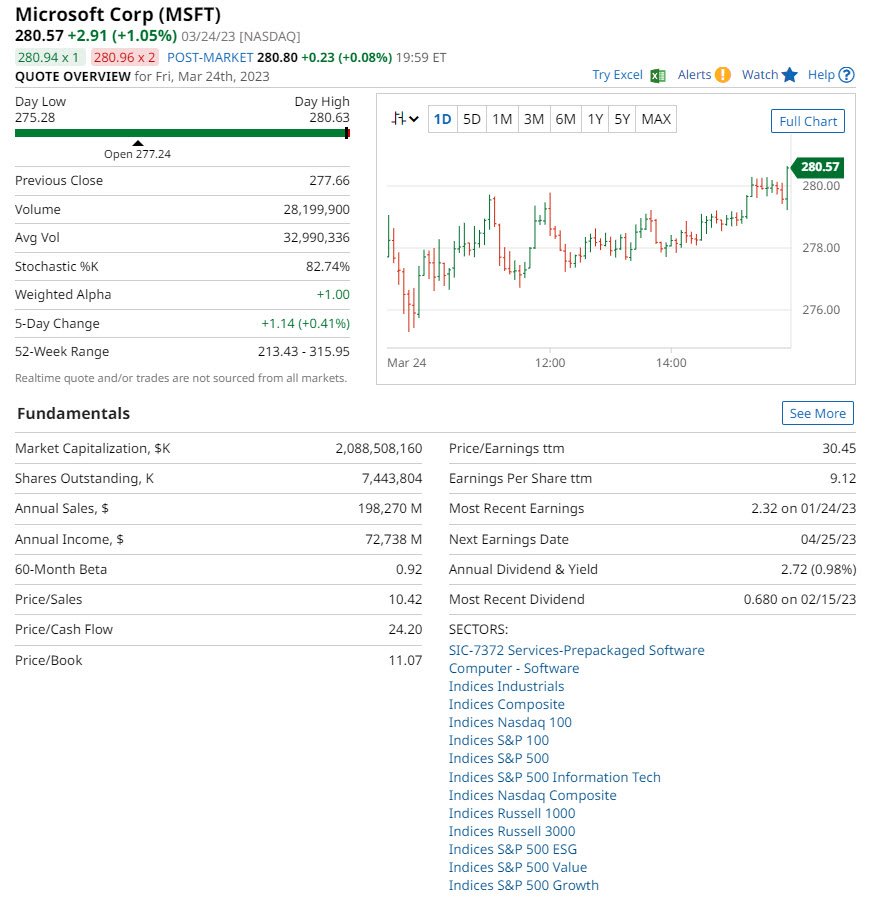

Microsoft Corporation (MSFT)

Microsoft Corporation is one of the world’s largest providers of broad-based technology. With more than 80% of the market share for operating systems, they lead the PC software market. Microsoft 365 application is a popular productivity software suite across the world. Microsoft offers, operating systems, productivity apps, server applications, desktop, and server management tools. PCs, tablets, games and entertainment consoles, phones, are all designed by the firm.

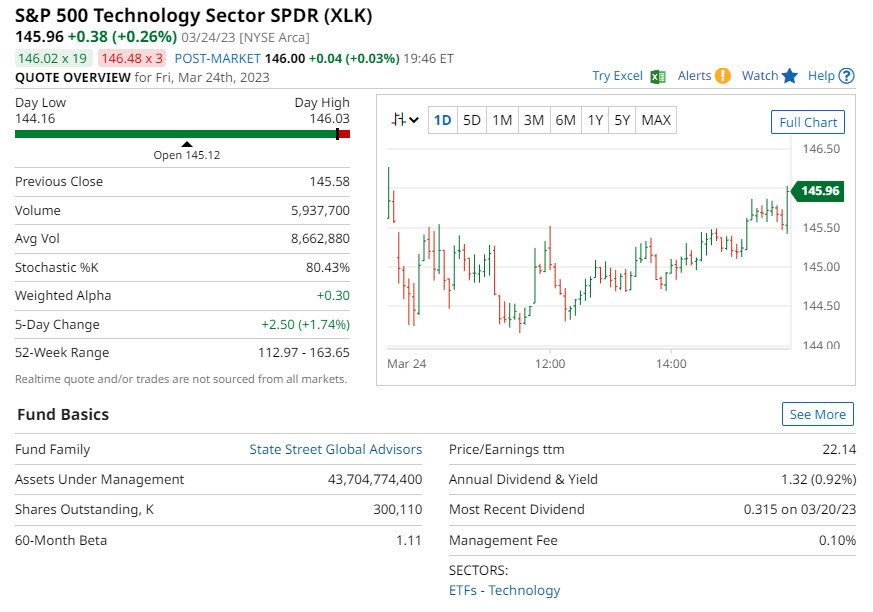

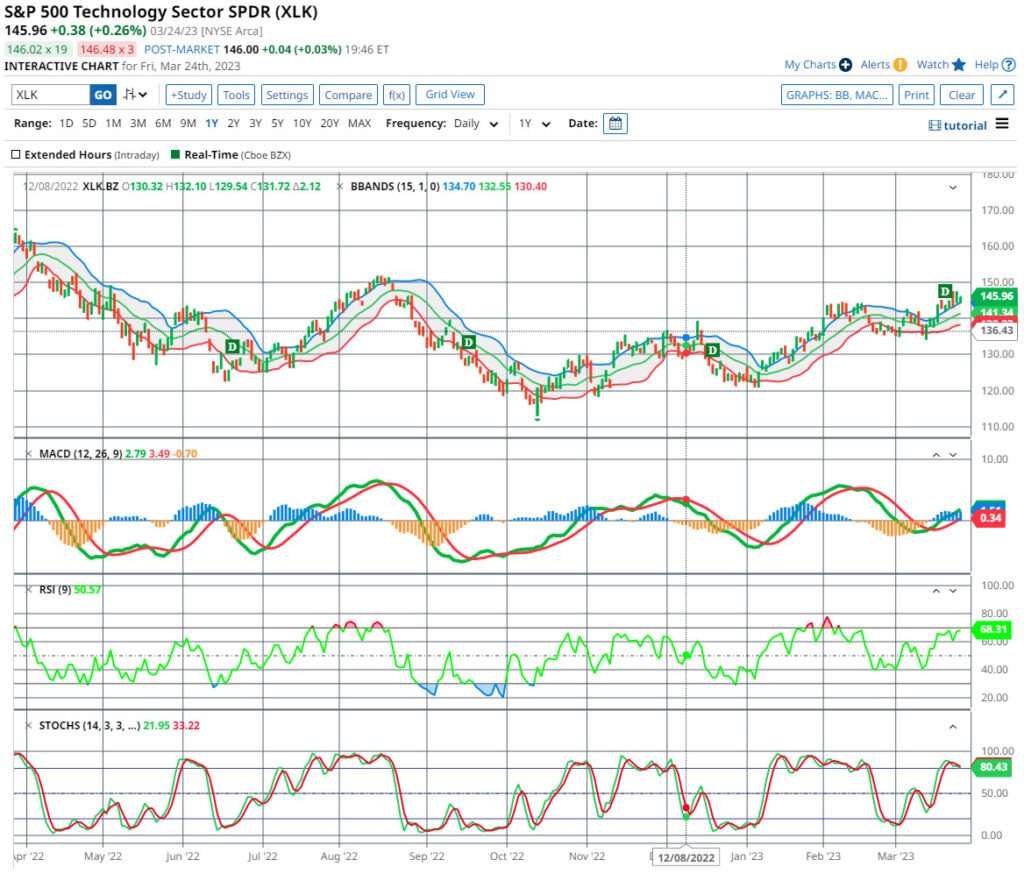

Technology Select Sector SPDR Fund (XLK)

Technology Select Sector SPDR Fund (XLK)

The XLK SPDR Fund’s investment returns should correspond to a benchmark index. This is for both price and yield performance of the Technology Select Sector Index.

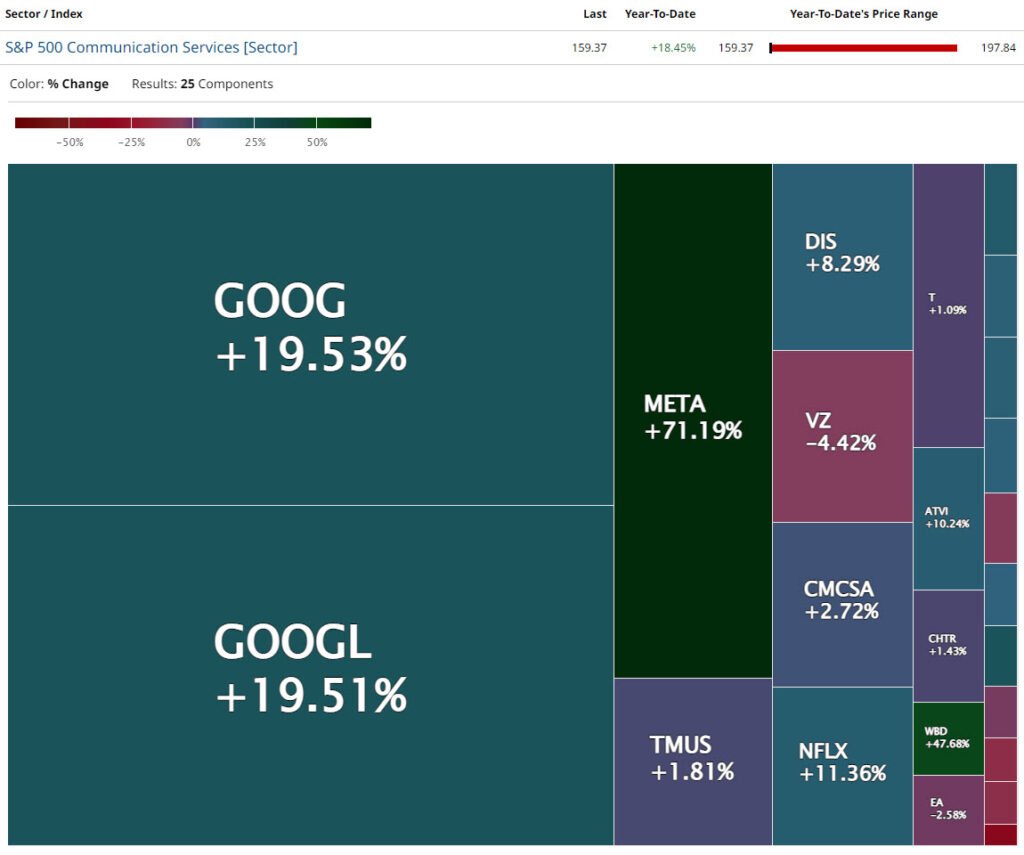

Communication

The Communication Services sector covers companies that provide communication and media services. This includes telecommunications, entertainment, media, and advertising. This sector is new, having been added in 2018 as part of a reclassification of the S&P 500 sector structure.

Sub-sectors include wireless and wireline telecommunications services, cable and satellite TV services. Along with, streaming media services, social media platforms, video games, and advertising.

The NYSE’s Communication Services sector is critical to modern communication and entertainment. These companies have a large impact on the worldwide economy. As technology advances, the sector will remain an engine of growth and innovation.

Verizon Communications Inc. (VZ)

Verizon Communications Inc. provides communication services. This includes local phone service, long distance service, cellular service, and data services. Verizon is the largest wireless carrier in North America. It serves millions of users countrywide, following the acquisition of Alltel Wireless Corp. in early 2009.

Verizon and Amazon Web Services will design low latency mobile applications using 5G. This is the world’s first telecom company to do so. Version has announced a cable industry price breakthrough with Mix & Match. This is on the FiOS platform, allowing viewers to combine TV and Internet services.

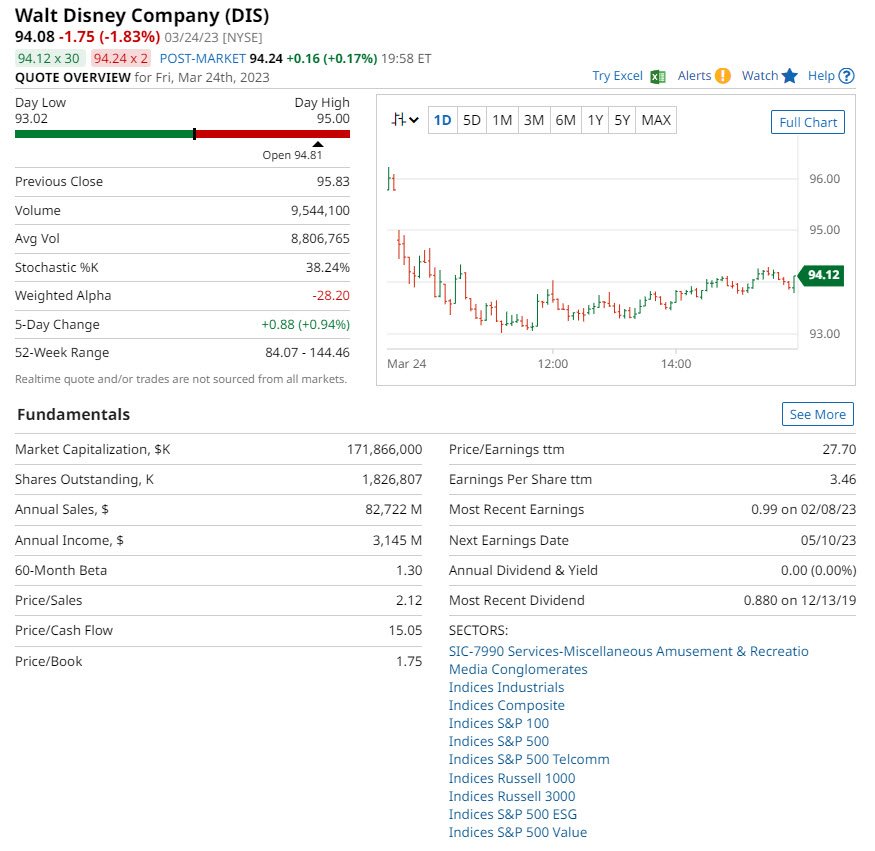

Walt Disney Company (DIS):

Walt Disney Company has assets that span movies, television, publishing, and theme parks. In October 2020, Disney reorganized its media and entertainment operations. From 2021, Disney has consolidated its media and entertainment businesses. Disney Media and Entertainment Distribution (DMED) across three significant lines of businesses. Linear Networks, Direct to- Consumer and Content Sales and Licensing.

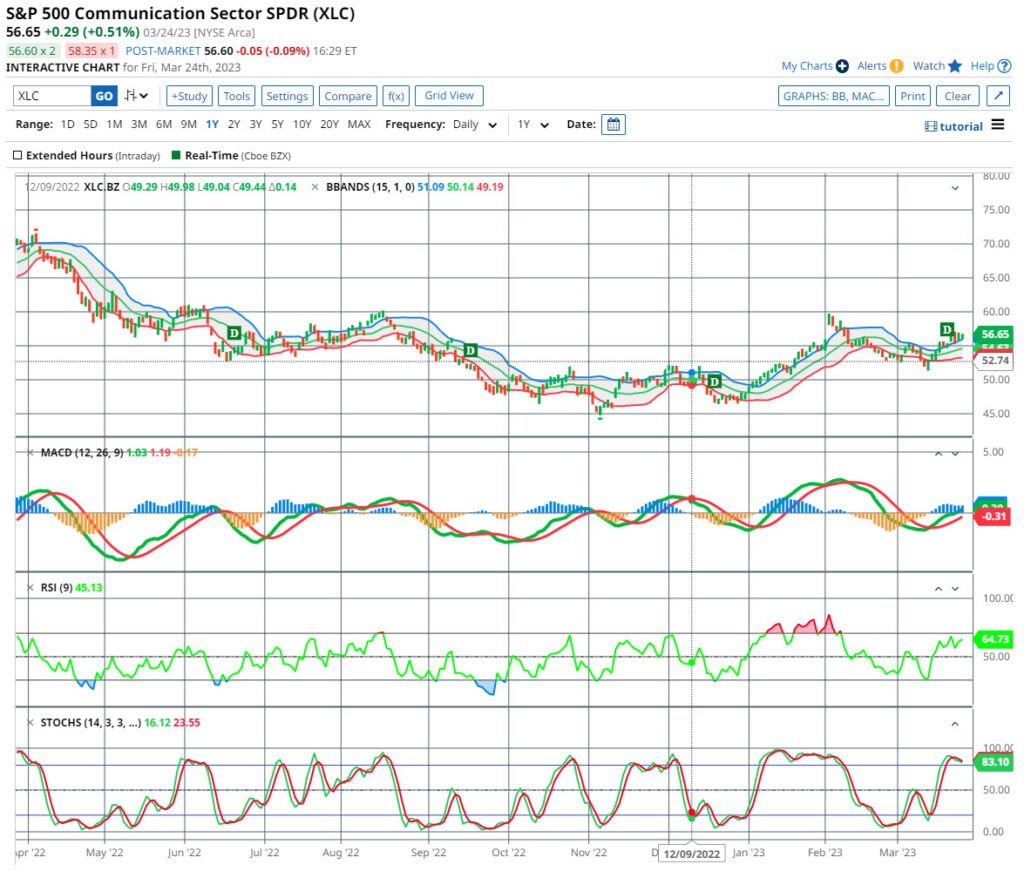

Communication Services Select SPDR Fund (XLC)

Communication Services Select Sector SPDR Fund (XLC)

The XLC SPDR Funds investment returns should correspond to a benchmark index. This is for price and yield performance of the Communication Services Select Index.

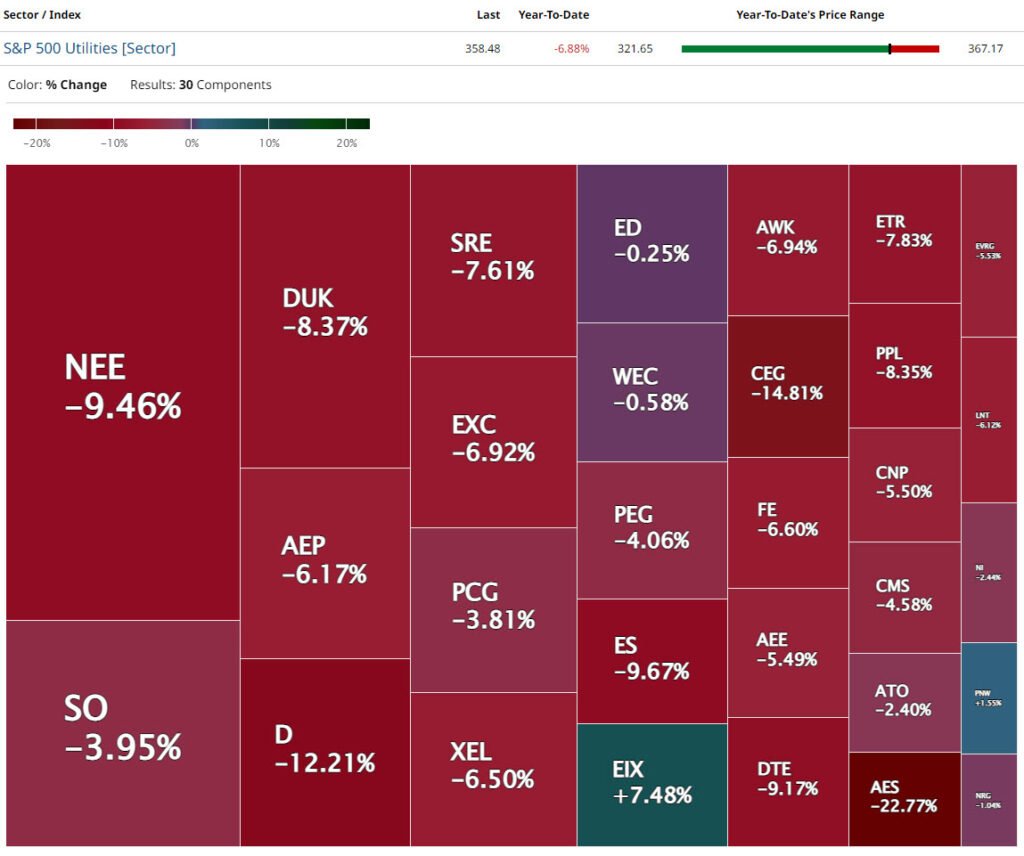

Utilities

The Utilities sector includes companies providing electricity, natural gas, water, and other utilities. They are crucial services provided to clients and are necessary for a modern society. There is consistent demand for utilities services regardless of economic situations. The sector is a classic defensive sector.

The Utilities sector is known for its consistent and predictable revenue sources. Thus, the sector is appealing to investors seeking consistent income and long-term development.

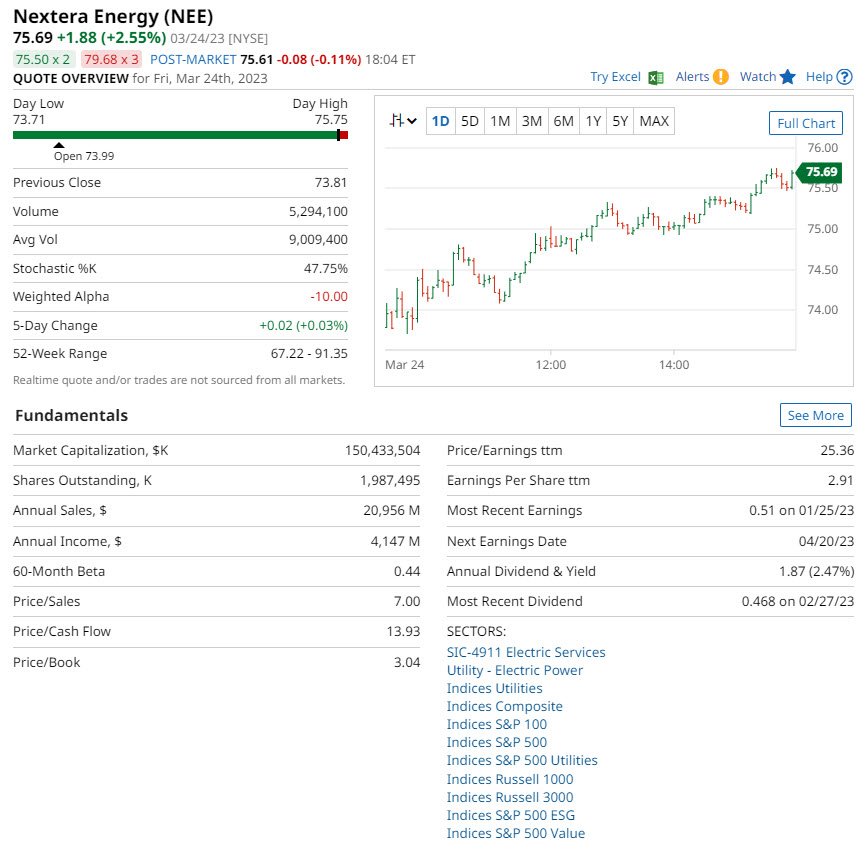

NextEra Energy, Inc. (NEE)

NextEra Energy Inc. is a public utility holding company that generates, transmits, distributes, and sells electricity. It has operations in the United States and Canada. NextEra offers both regulated and unregulated energy-related products and services. The principal subsidiaries of NextEra Energy are the following. Florida Power & Light Company (FPL), Gulf Power Company, NextEra Energy Resources LLC (NEER). NextEra Energy Capital Holdings is NextEra’s wholly owned subsidiary. NextEra Energy Partners, LP’ created in 2014 to own, manage clean energy projects. NextEra Energy generates a significant amount of electricity from wind and solar energy. Through its subsidiaries, the corporation advocates for increased use of clean fuel sources.

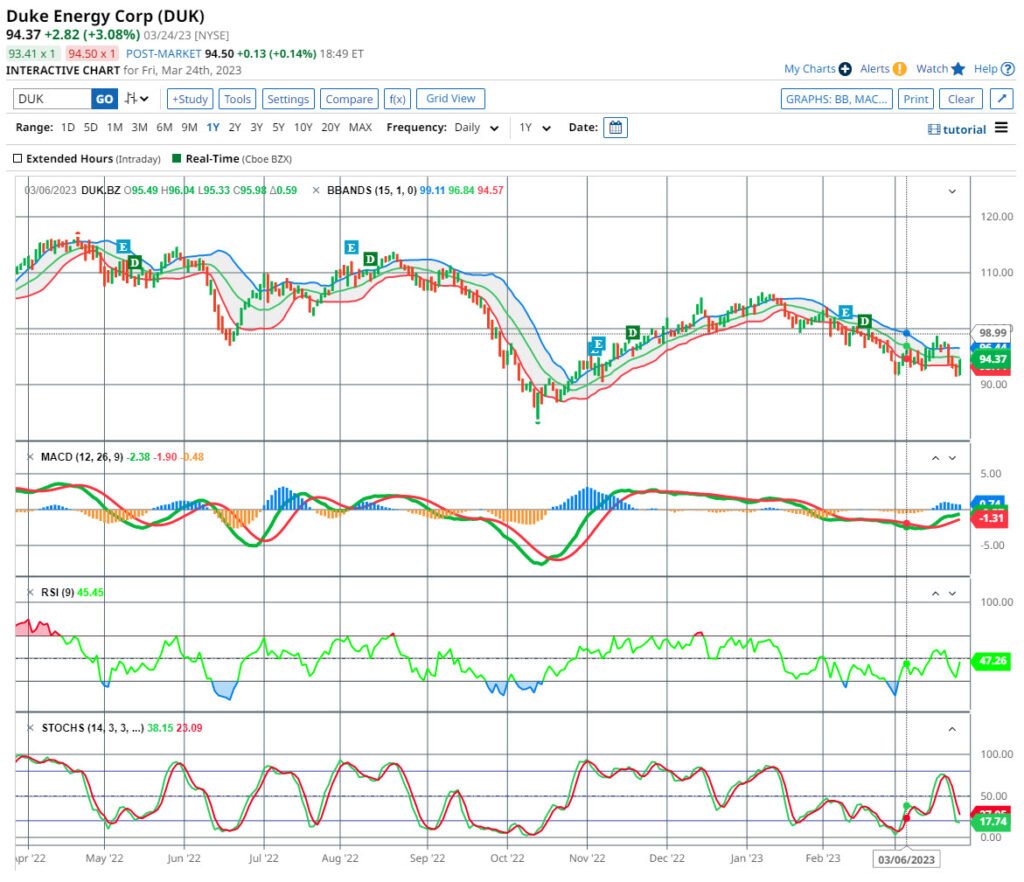

Duke Energy Corporation (DUK)

Duke Energy Corporation is one of the country’s largest energy holding firms. Customers are served through its Electric Utilities and Infrastructure business unit. The Gas Utilities and Infrastructure business distributes natural gas across several states. Its Commercial Renewables business unit manages a growing portfolio of renewable energy projects across the United States.

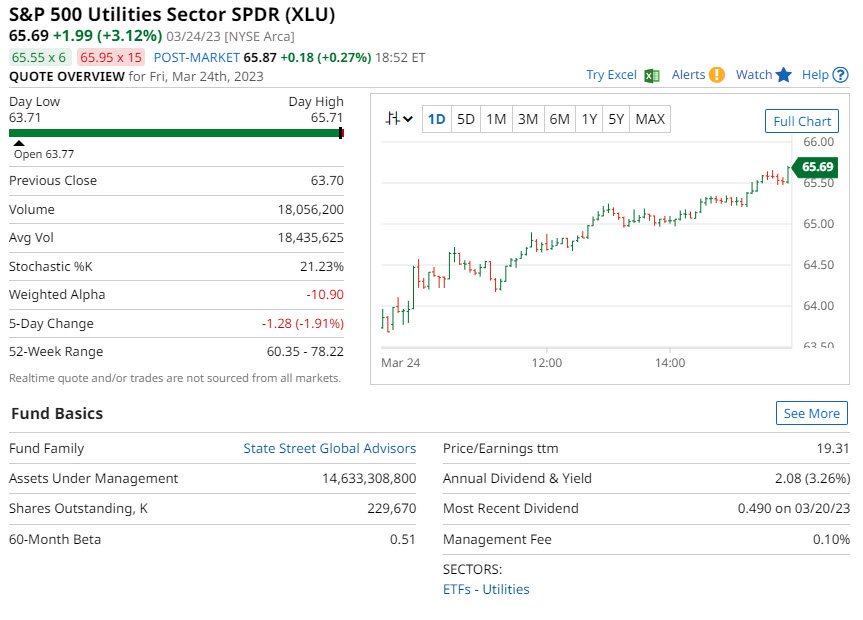

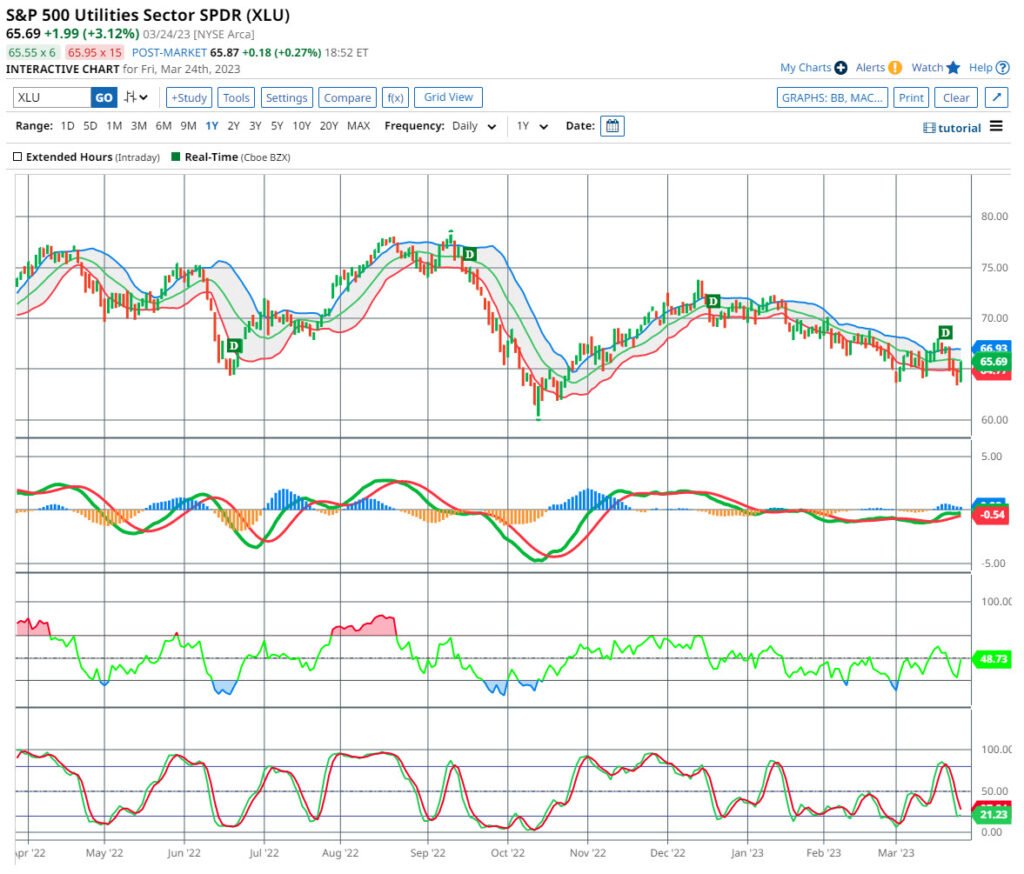

Utilities Select Sector SPDR Fund (XLU)

Utilities Select Sector SPDR Fund (XLU)

The XLU SPDR Fund’s investment returns should correspond to a benchmark index. This is for price and yield performance of the Utilities Select Sector Index.

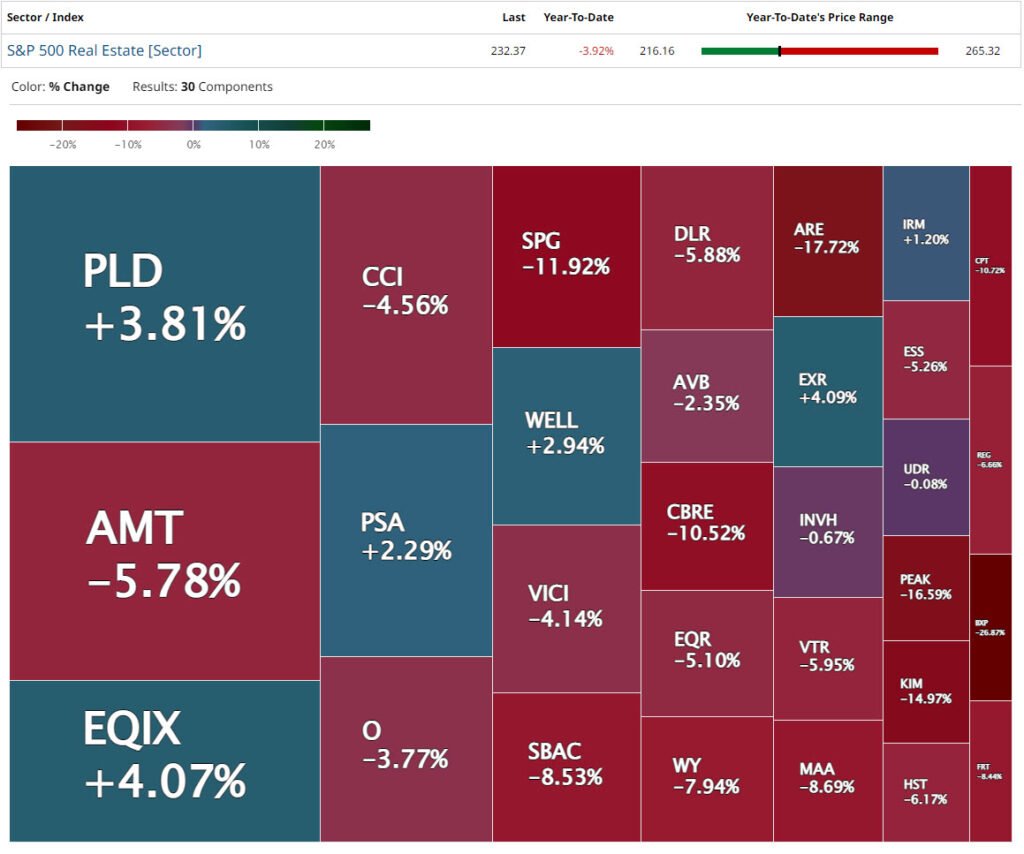

REAL ESTATE

The Real Estate sector includes publicly traded corporations. They are involved in the ownership, development, and management of real estate properties. These businesses operate in a variety of sub-sectors. They including residential, commercial, industrial, retail, and hospitality.

Investing in listed real estate companies gives investors exposure to real estate. This does not require buying physical properties.

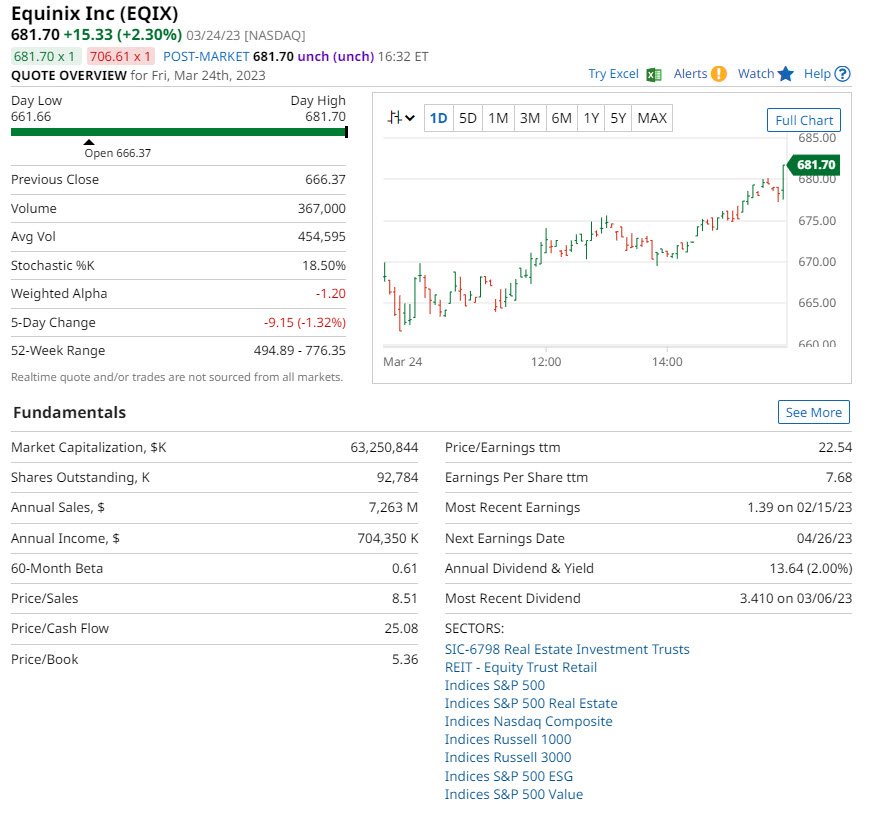

Equinix, Inc. (EQIX)

Equinix, Inc. is a global provider of digital infrastructure. Equinix combines a global footprint of International Business Exchange (IBX). Covering data centers, interconnection solutions, and network edge services. It consists of one-of-a-kind businesses, digital ecosystems, and expert consultation and support. It operates across the Americas, Middle East, Africa, and Asia-Pacific. These geographic regions are the company’s three reportable segments. It operates a direct sales force as well as a channel marketing campaign. Operating on a recurring revenue model including colocation, interconnection, and managed IT infrastructure. These services are recurring as clients are invoiced at fixed rates on a regular basis. This is for the duration of the contracts. Examples of non-recurring income are installation services.

Real Estate Select Sector SPDR Fund (XLRE)

Real Estate Select Sector SPDR Fund (XLRE)

The XLRE SPDR Fund’s investment returns should correspond to a benchmark index. This is for price and yield performance of the Real Estate Select Sector Index.