THE GOLD PRICE AND GOLD AS AN INVESTMENT

The function of gold can be as a safe-haven asset. Stability in the gold price is one reason why gold is viewed as an investment. During periods of economic uncertainty such as a recession or, worse, a depression gold benefits. Or as an economy moves into a boom-bust cycle. Or when there is price instability, inflation, or deflation. During periods of volatility in investments, the gold price per ounce soared. Take a look at the graph of the Gold Price during and after the 2008 Global Financial Crisis.

Gold bars or coins, gold futures, gold exchange-traded funds, and gold mining stocks. Are all options available to investors who want to invest in gold. The gold market is to buy or sell gold as a commodity or investment. Often quoted in the news is the gold price per ounce.

During these periods of uncertainty, investors turn to gold to secure their wealth. A common saying is that “I want to see the same number of zeros.” This is due to the fact that gold has held its value throughout time. This is especially the case during periods of turmoil in the investment markets. Often leading to periods of currency depreciation.

A BRIEF HISTORY OF GOLD AND THE GOLD PRICE

For thousands of years, gold has been a currency, a form of barter, and a store of value. From ancient times to the present, gold has played a significant part in our history. Because of its scarcity and intrinsic value. Gold in its various forms, became a preferred store of wealth and means of exchange.

Around 2500 BC, gold was first utilized as a form of currency in ancient Egypt. The ancient Greeks, Romans, and Chinese all employed gold. There was no gold price, just gold, utilized as a form of payment for international trade. Throughout Europe during the Middle Ages, gold coins existed in exchange. Arezzo in Italy was a major centre for gold production dating back to Roman times, and it still is today.

In modern times

Well, no

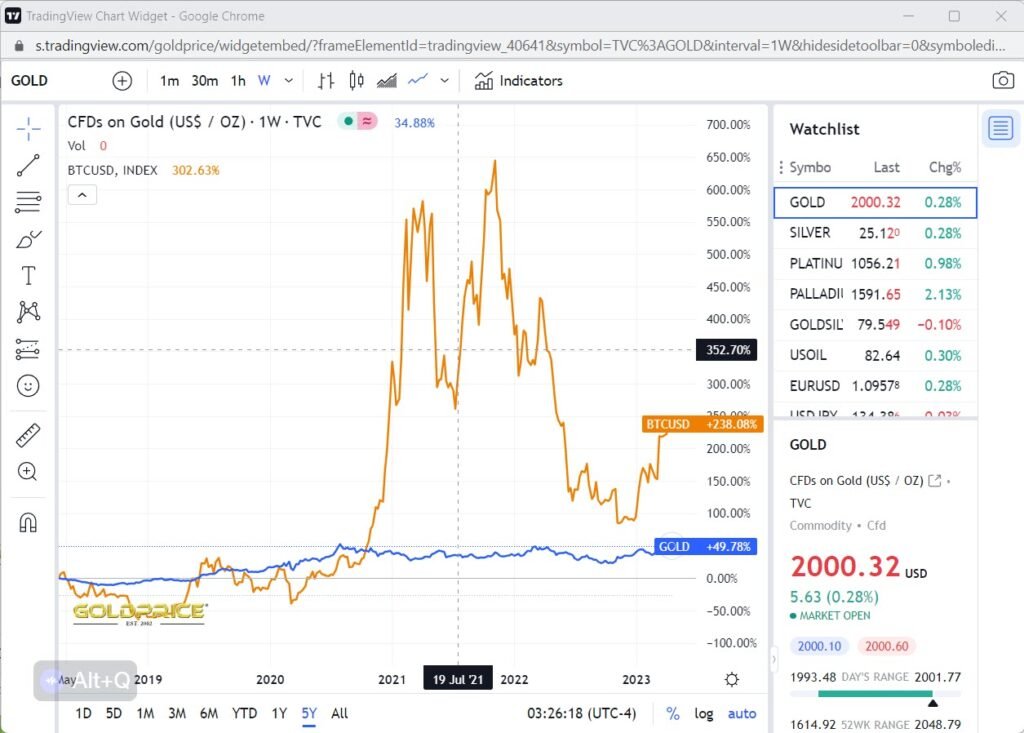

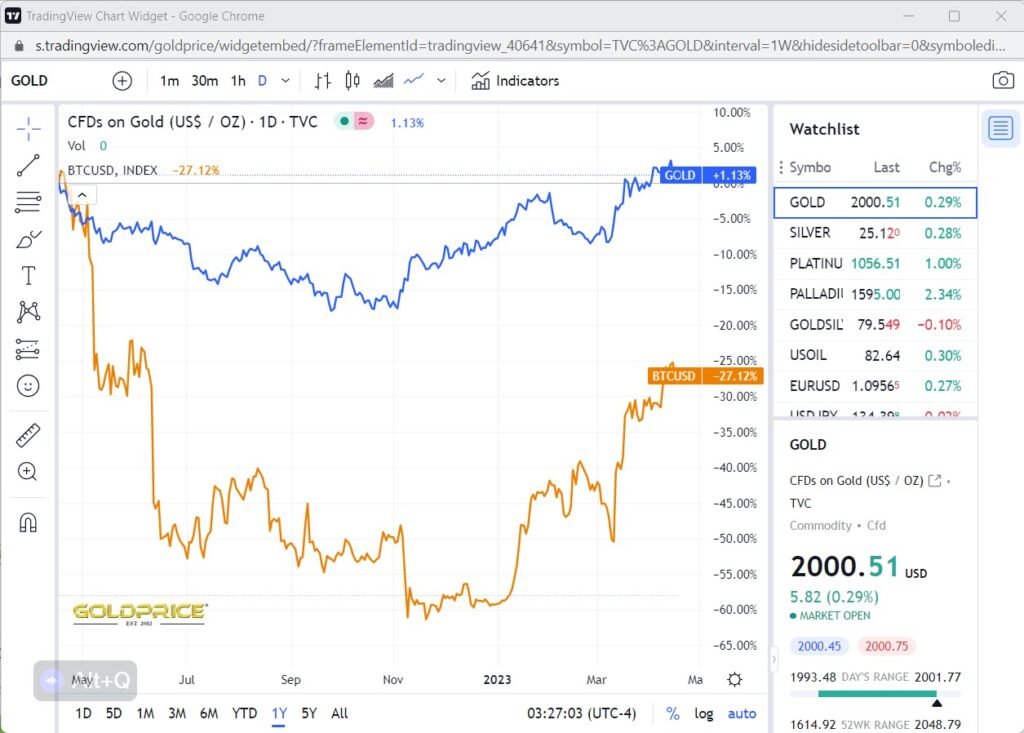

Gold Price v Bitcoin USD

Graphs by TradingView

Regarded as a safe haven, gold remains an important investment today. This is in part because the gold price is out of the reach of government manipulation. In April 2023, gold price is currently trading at around $2,000 per ounce.

SUBSCRIBE TO FINSCREENER

5 reasons to buy gold and it is not the gold price

5 reasons to invest in gold

Inflation hedge

Safe Haven

Portfolio diversification

Tangible asset

Capital appreciation

Inflation Hedge

Historically, gold has been regarded as a buffer against inflation. The gold price tends to climb during periods of high inflation. During this inflationary period, gold has fulfilled its role.

Investors protect their purchasing power and maintain the value of their possessions. Holding gold during times of rising inflation and interest rates achieved this goal.

Safe Haven

Investors frequently view gold as a safe-haven asset. The gold price tends to hold its value during times of economic and political crisis. When the stock markets are unpredictable as is perceived at this point. Or, there is geopolitical unrest, such as the War in Ukraine or uncertainty over Taiwan. Investors can turn to gold to safeguard their wealth.

Portfolio diversification

Purchasing gold can help diversify an investment portfolio. The portfolio can be of stocks and fixed income securities. The gold price has a low level of correlation with other asset classes like equities and bonds. Investing in gold can assist in lowering a portfolio’s risk and volatility.

A tangible asset

Gold is a tangible item that has been utilized for thousands of years as a store of value. Gold, unlike paper currency, cannot be created or easily manipulated by governments or central banks, making it a long-term store of value. This is one aspect where crypto-currencies have been compared to gold.

Capital appreciation

Gold does have the potential for capital appreciation and depreciation. Gold should be viewed as a long-term investment, an opportunity for capital appreciation. When the demand for gold rises and the price rises, investors might profit from the gold price. More to the point, gold is viewed as a diversification asset.

Changes in the gold price can be viewed in terms of the most expensive producers, the South Africans. When the gold price falls below around $1,200 the South African producers go off-line. This is due to the high costs of production due to the depths of the mine shafts. It is crucial to note that gold can undergo price volatility and decreases. Thus, investing in gold on a long-term investment horizon is best.

5 investment strategies to invest in gold

Physical gold

Purchasing physical gold, such as gold bars or coins, is one of the most conventional ways to invest in gold. This will be at the current gold price. These can be purchased from a reliable dealer or broker and kept in a safe or vault. There are hazards associated with investing in physical gold. These include storage, insurance, and the constant threat of theft. Gold bars can be melted down, and thus the identity is altered.

The London Good Delivery gold bar can be identified and is recognised in the global gold market. It is regarded as the gold bar’s highest standard.

The London Bullion Market Association (LBMA) has qualified 52 gold refiners. They are known as Good Delivery refiners. These refineries are located in Switzerland, the U.S, Canada, Australia, and the UAE.

Gold can be ideal for your IRA. Check out Augusta Precious Metals IRA

Gold ETFs

SPDR Gold Shares (GLD)

In total, the ETF has $50 billion in assets under management. This is one of the largest and most popular. GLD follows gold bullion prices and is backed by actual gold stored in vaults.

iShares Gold Trust (IAU)

Aberdeen Standard Physical Gold Shares ETF (SGOL).

Invesco DB Gold Fund (DGL)

VanEck Merk Gold Trust (OUNZ)

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

Derivatives

With gold futures contracts, investors are able to buy or sell gold at a future date and price. Gold futures contracts are based on the gold price as gold is the underlying commodity.

Futures contracts are leveraged instruments. Using gold futures is specialised and this is a more advanced investment plan with a high level of risk.

Gold Mining Stocks

Gold mining stocks are stocks of firms that mine for gold. The world’s major gold mining companies are likely to be listed in the U.S. Canada or Australia. These equities are often influenced by gold price. As well as the mining company’s financial performance.

Mutual Funds

Follow, learn and maybe gain some investment ideas trading with EToro. The platform has over 30 million traders and investors. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider