SECURITIES AND EXCHANGE COMMISSION V COINBASE

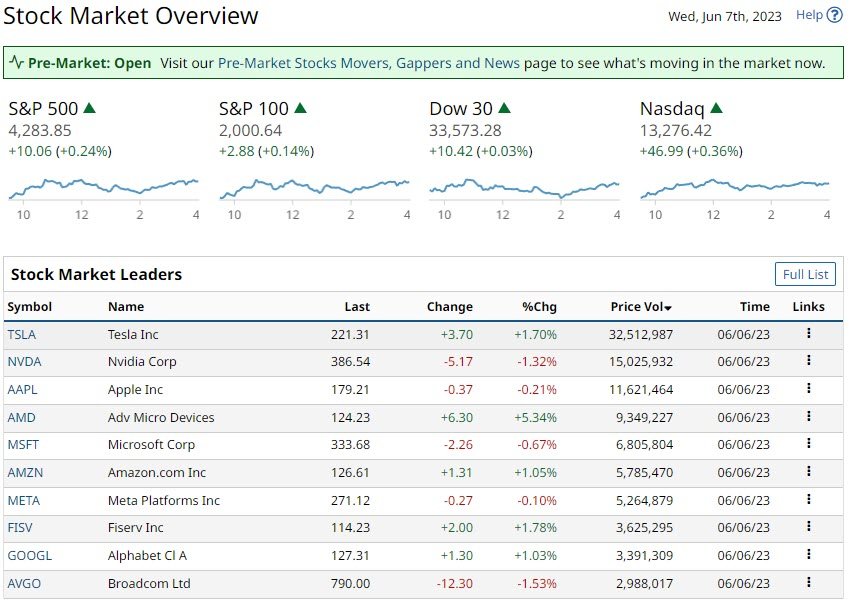

On Tuesday, the SPY closed up +0.245%, and the QQQ was flat +0.01%. The stock markets was bolstered by regional bank stocks.

The Reserve Bank of Australia raised cash rates by +25 basis points to 4.10%. After this the focus was back on the global growth story and the future direction of interest rates. Predictions are that the Fed is unlikely to cut interest rates until 2024.

In investing in stocks there will be opportunities here, there always are. There must be the understanding that the world’s economies will operate with persistent inflation. Further monetary policy will remain tight.

Also in the news are crypto currencies. The Securities and Exchange Commission has filed a lawsuit against Coinbase. This was the day after Binance and its affiliates were hit with similar allegations. The lawsuit claims that Coinbase is operating an unregistered securities exchange. Also, it is marketing an unregistered security to the public. Crypto tokens are securities, and thus they are subject to U.S. Securities Laws. Take a look at the video I made after the FTX Collapse.

On to stocks

Regional bank stocks rose, helping to boost the market as a whole. Intel also gained more than 3%. INTC announced it will sell a portion of its Mobileye stake for $1.48 billion. Merck & Co closed down more than -2 percent, leading pharmaceutical stocks lower. This is due to the government having the ability to negotiate prescription medicine pricing. This will be directly with pharmaceutical companies.

Overseas stock markets Tuesday settled mixed. The Euro Stoxx 50 closed up +0.05%. China’s Shanghai Composite closed down -1.15%, and Japan’s Nikkei Stock Index closed up +0.90%.

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

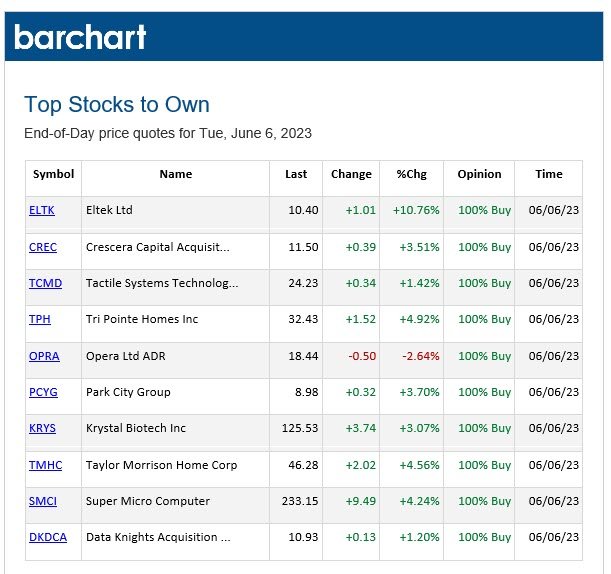

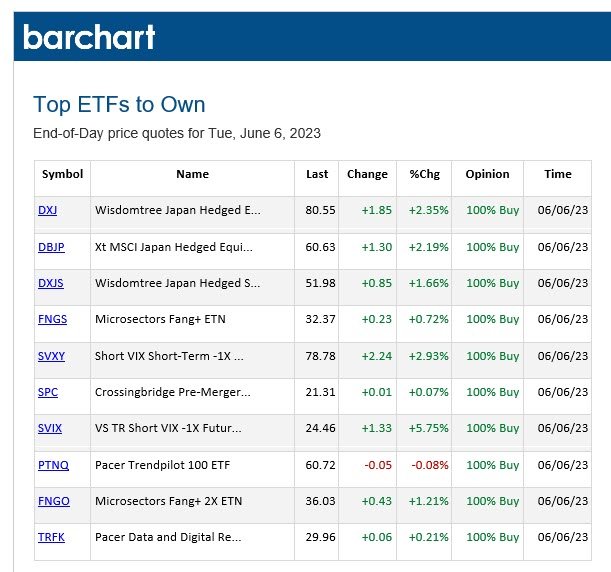

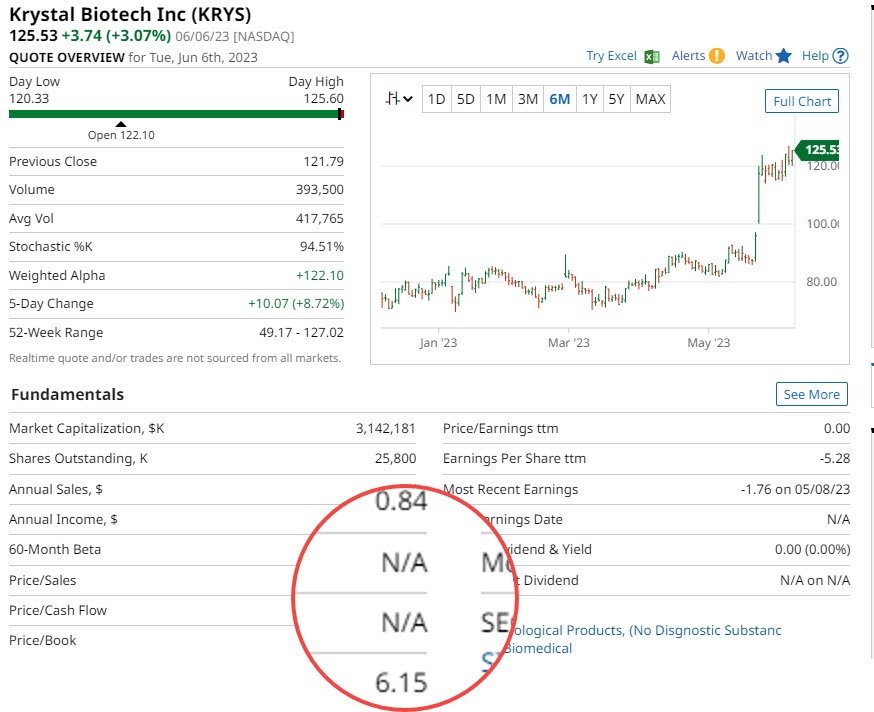

BARCHART: QUICK STOCK IDEAS

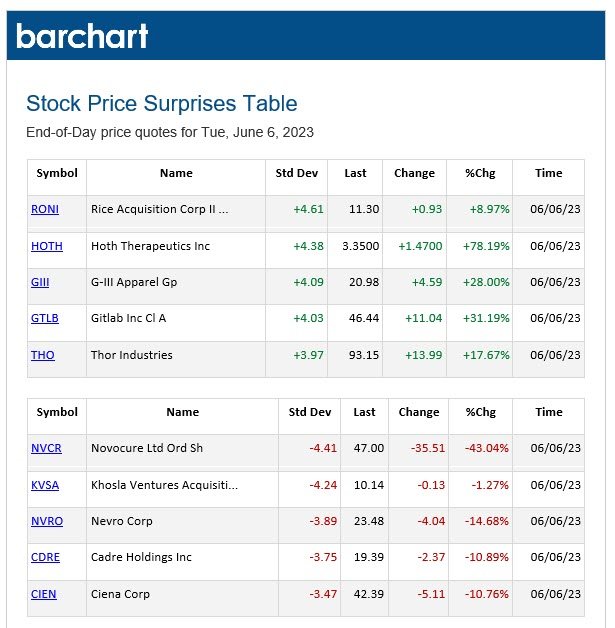

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.