China’s economic trajectory is decoupling from the U.S.

Subscribe to

the banks will change their shareholder base

In May 2023, several regional bank failed. This has led the US bank regulators to require regional banks to strengthen their liquidity strategy. This includes Citizens Financial Group, Fifth Third Bancorp, and M&T Bank. Institutions with assets ranging from $100 billion to $250 billion.

Take note this issue is not lending standards, in fact, the loan books of the above banks remain sound. It covers liquidity standards, everything from capital and liquidity to technology and compliance. Following the failures of First Republic Bank, Signature Bank, and Silicon Valley Bank.

The regulators were seen to some extent at fault. This has led the regulators to hunt down potential weak points in the system. Do keep in mind that, earlier in the summer, the major U.S. banks passed the stress tests. Morgan Stanley, for example, has a core capital ratio of over 15%, well above requirements.

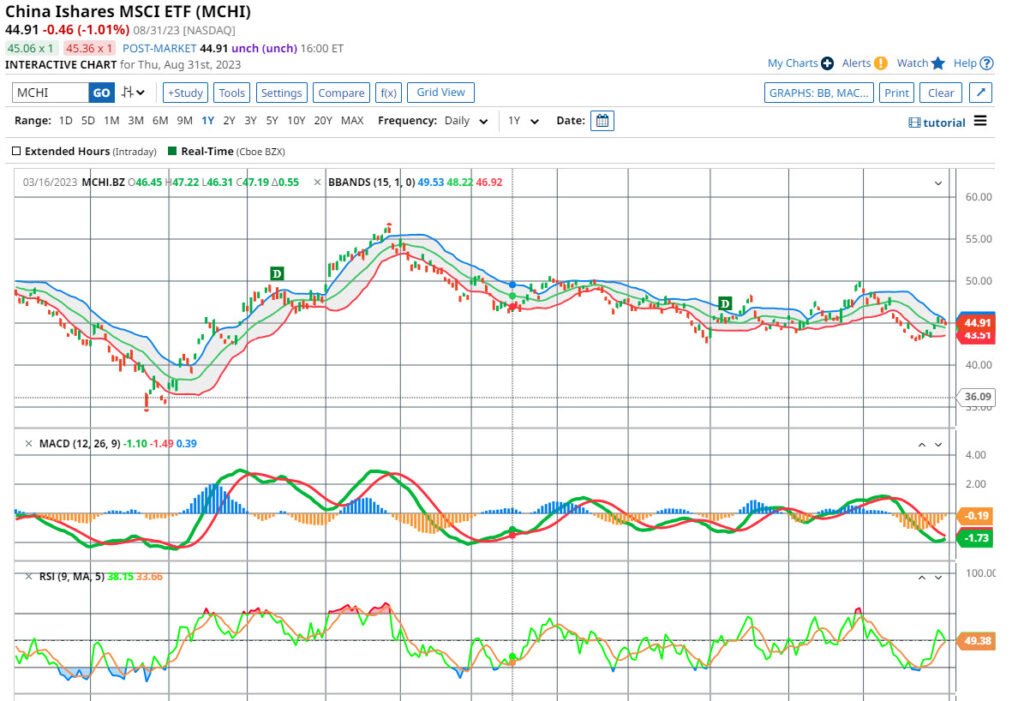

China’s economic trajectory

The big unknown is China. The Chinese economy is weak but not collapsing. Chinese GDP is expected to expand 5.1 % this year, 4.5 % next year, and 4.6 % in 2025. In contrast, the US is expected to expand 2% this year, 0.9 % next year, and 1.9 % in 2025. While it is not correct to directly compare the two economies, they are different, vastly different. The issue being raised is the drop in growth in China, compared to the U.S. with a stable growth trajectory.

In recent months, economic data has been bleak. Chinese households spend less than planned and save more. Businesses are borrowing and investing less. While the jobs situation is stable, youth unemployment has skyrocketed. Thus Beijing has stopped releasing data.

China’s economic trajectory has changed. The GDP grew 9% annually from 2000 to 2019. Chinese growth appears to be dropping to half that rate. That rate could drop further due to massive debt and an aging population. Before the epidemic, the US GDP increased approximately 2% annually. That implies US growth remains unchanged for the past two decades.

The U.S. economic trajectory is stable

Throughout all the rises in interest rates, the U.S. Consumer remains solid and the data backs this up. Personal expenditure in the United States increased by +0.8% m/m in July, while Personal income increased by +0.2% m/m. The weekly first jobless claims report in the United States showed a a stronger labor market. While continuing claims increased to 1.725 million, indicating a weaker labor market.

The restrictive policy will continue to influence the economy. The markets are discounting a +25 bp rate rise at the September 20 FOMC meeting at only 12% probability. Then at the November 1 meeting of the FOMC a +25 bp rate hike with a probability at 36%. The Fed is possibly at risk of tightening too much. This is becoming important considering there are the expectations that yields at the long-end will rise. The Fed’s goal is to cool inflation. Not bring unwarranted economic hardship.

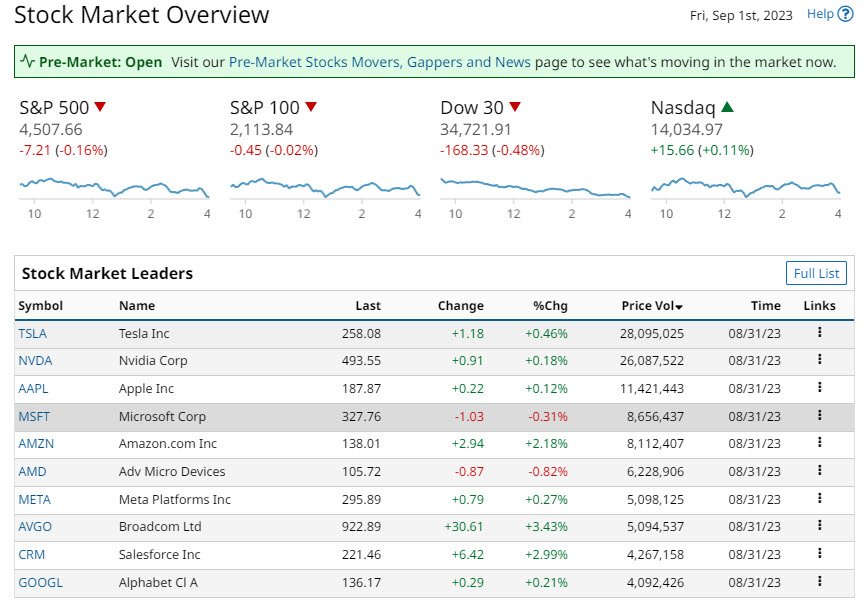

The Euro Stoxx 50 finished -0.42 % down. The Shanghai Composite Index in China fell -0.55 %. The Nikkei Stock Average in Japan finished up 0.88 %.

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

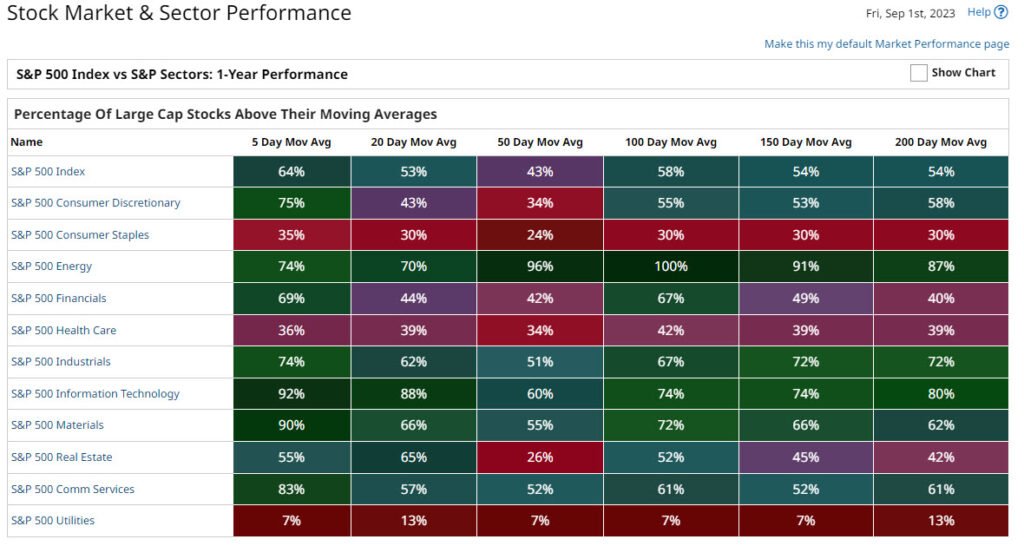

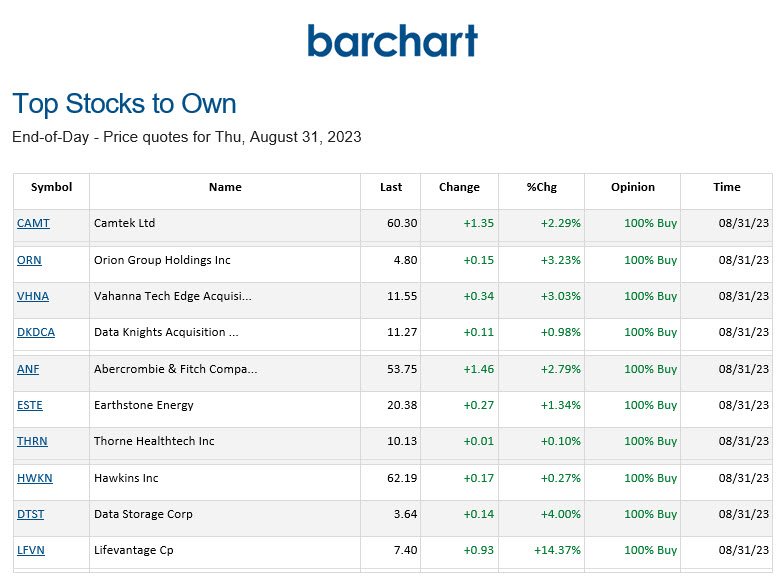

BARCHART: QUICK STOCK IDEAS

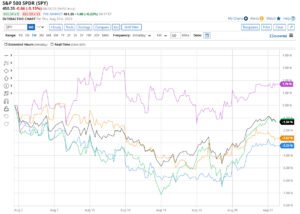

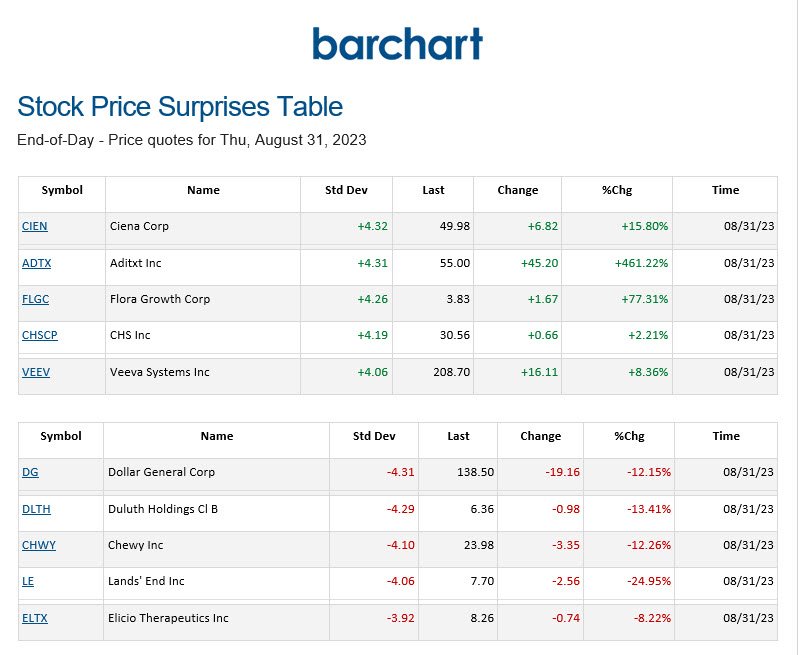

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

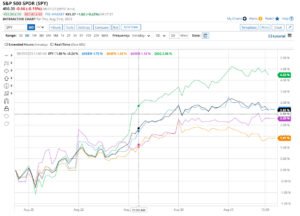

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.