Earnings drive the equity markets

Geopolitical forces and company earnings are dominating the sentiment towards stocks. The potential for war in the Middle East as the war in Ukraine continues on. War is a terrible even at any time. In economic terms the impact on Crude prices is already being felt. Prices increased by more than 5% on fears of the potential impact on crude supply from the Middle East.

All of my Blog Posts contain Affiliate Links to products or services that are known to me. I may receive art any time a commission if a purchase or subscription is made via an Affiliate link.

Subscribe to

KEY ECONOMIC DATA

On the economic front in the United States, the University of Michigan’s Oct consumer confidence index slid -5.1 points to a 5-month low of 63.0. This fell short of the forecasted of 67.0. Inflation expectations climbed as well, weighing on markets. Year-on-year inflation predictions unexpectedly rose to +3.8%, higher than the expected rate of 3.2%. On the plus side, the Sep import price index ex-petroleum declined -0.3% m/m, missing estimates of -0.1% m/m. The core rate of retail sales in the United States is expected to rise slightly from August. The forcasted statistics on industrial output and housing starts are for growth month-on-month.

FURTURE EARNINGS AND RISING LONG TERM INTEREST RATES

Hanging over the market will be the continued uncertainty over interest rates. First off the Long-end of the U.S. Yield Curve. One has to consider that, while choppy, yields are set to rise. This could be by 100 basis points or more in 2024. Short-term rates, the expectations are 10% or less that the FOMC will raise rates by +25 basis points at its next meeting. This meeting concludes on November 1.

THE NEXT MOVE FOR THE FOMC?

For the final meeting of 2023, markets are predicting a 30% likelihood of a 25-basis point hike at the December 13 meeting. Into 2024, markets are anticipating that the FOMC will begin decreasing rates. Possibly in the second half of 2024 in reaction to a predicted decline in US economic activity. Thus expect the rotation and normalization of the yield curve. Investors will need to focus and adjust their Equity Risk Premium accordingly.

Euro Stoxx 50 closed down -1.48%. China’s Shanghai Composite Index closed down -0.64%. Japan’s Nikkei 225 today closed down -0.55 %.

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

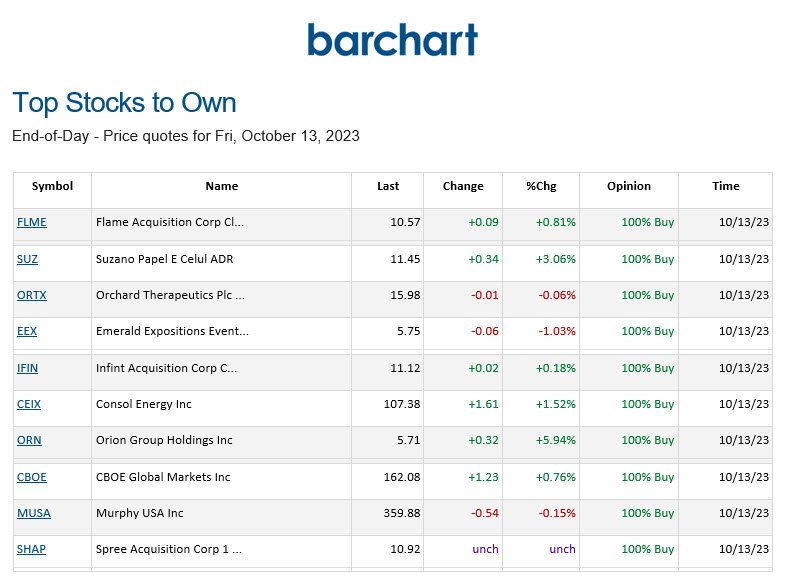

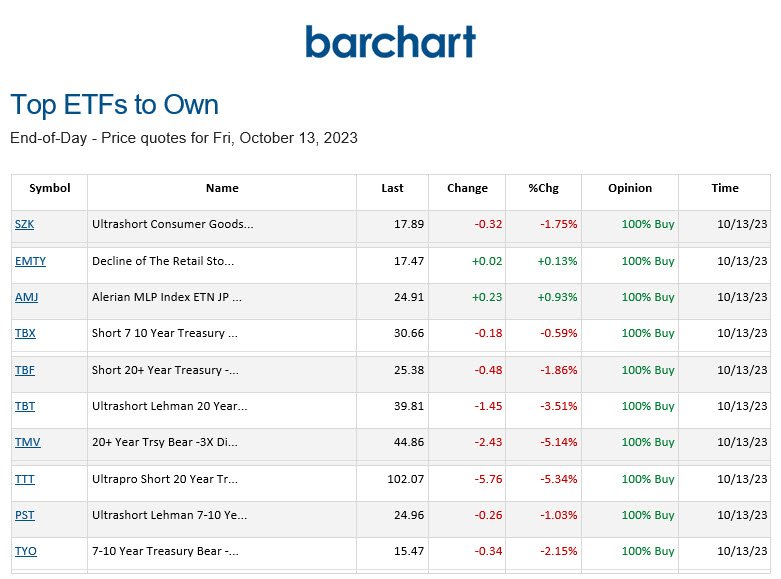

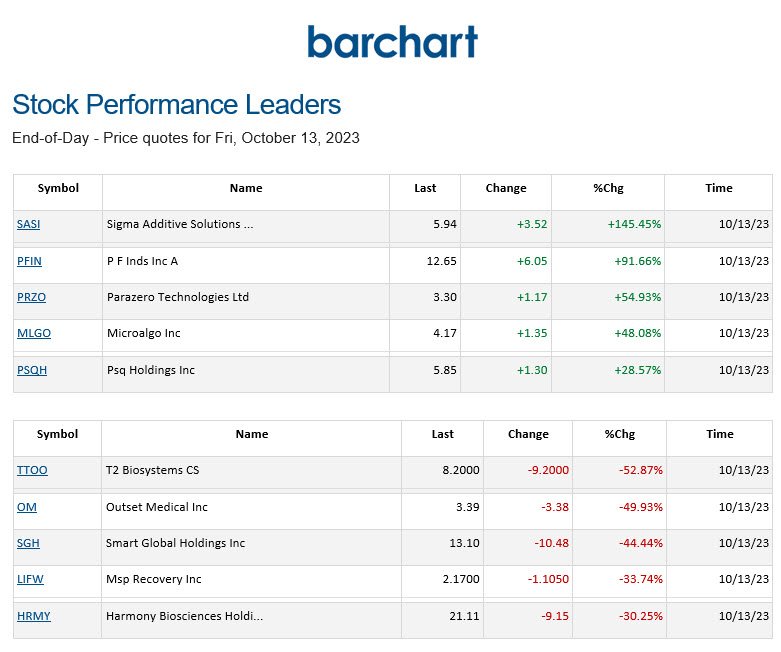

BARCHART: QUICK STOCK IDEAS

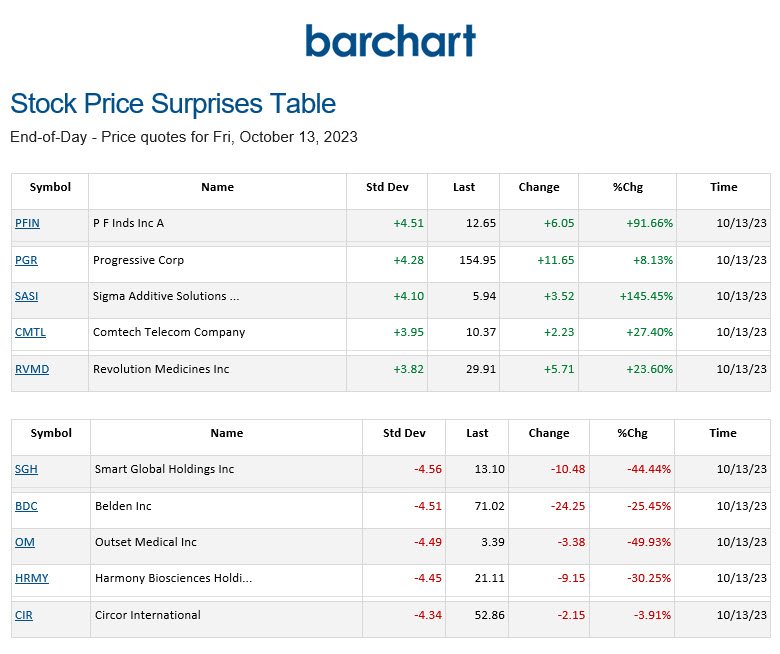

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

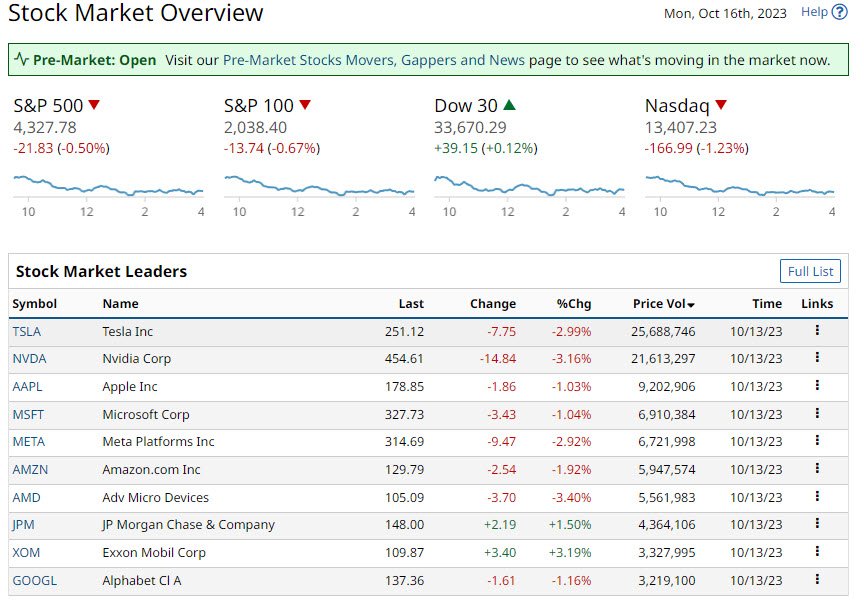

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.