KEEP IN MIND WHAT DRIVES STOCKS IS EARNING

Always keep in mind, equities lead earnings and earnings lead the economy. U.S. stocks markets have slumped recently. There are many reasons given and after the weekend events in Russia why not also through in geopolitical anxiety. This is on top of the usual reasons being a weaking global economy and bad economic data. This is coming from all parts of the world, China, Germany and Australia.

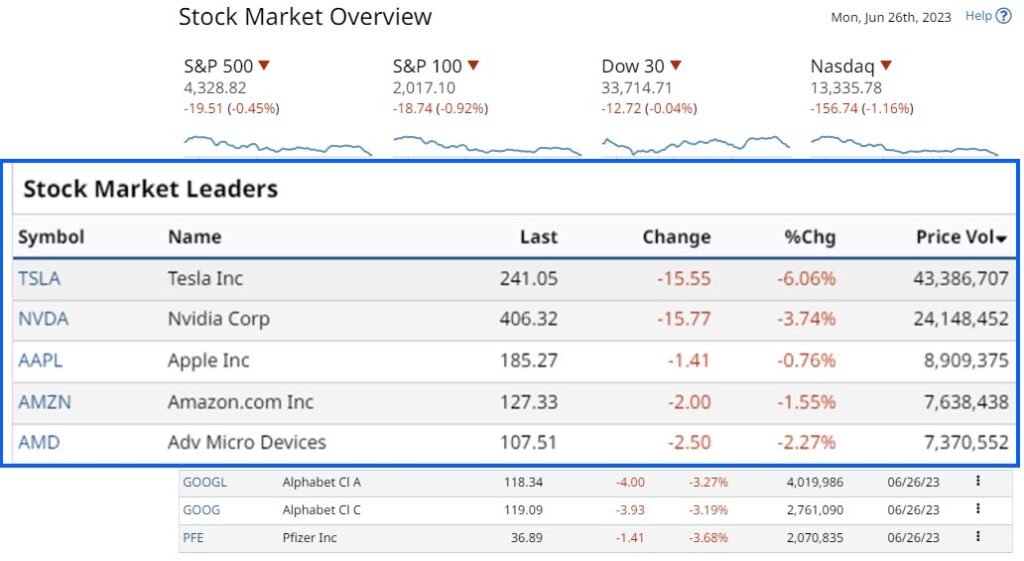

On Monday the SPY was down -0.45%, and the Nasdaq 100 QQQ fell -1.36%. The major tech stocks are driving the market lower. This can all be expected as the Magnificent Seven accounted for 80% of the rally in 2023. The major tech companies experienced selling pressure. The mega-cap tech losers included NVIDIA (NVDA), minus -3.7%, Meta (META), down -3.6%, Alphabet (GOOG), down -3.3%. Also, Microsoft (MSFT), falling -1.9%, Netflix (NFLX), down -1.9%, and Amazon (AMZN), down -1.6%.

The riddle to be resolved is this a continuation of the 2022 Bear Market. Or a normal correction phase in a longer-term Bull Market. To resolve this riddle a clear understanding of the market drivers in 2023 must be made. To do this keep in mind, equities lead earnings and earnings lead the economy.

Subscribe to

Alpha Metallurgical Resources Inc (AMR)

Keep in mind expectations for future EPS growth

Thus, the major driver for stock markets will be expectations for future earnings or EPS growth. It is the case that over the past couple of months there have been a lot of upward earnings adjustments. Around 50% of the Russell 2000 stocks have received earnings upgrades recently. That’s quite impressive. But not unexpected.

The rally in stocks in 2023 has been powerful and to date with limited drawdowns. The main drawdown so far in 2023 was the banking crisis in March. The catalyst was clear, and a solution was or is being implemented. The bank stress tests will be issued shortly. Thus, following the dramatic failure of SVB and other banks, there were relatively minor implications. The broader stock markets moved on, in particular mega-cap tech stocks.

The rally in mega cap tech stocks

Driving the stock markets in 2023, apart from earning has been a combination of the following. One key one has been the end of the 15-month long rising interest rate cycle. There is the growing expectation of the Fed adopting a more dovish posture to monetary policy. There is possibly another 50 basis points in rises in the pipeline. But while inflation remains outside the target range don’t count your chickens, so to speak.

Subscribe to

MARKET MOVERS

Even with the Nasdaq 100 falling -1.36%, Semiconductors stocks dominated the Nasdaq 100. Gains ranged from +1.5% to +2.8%. GLOBALFOUNDRIES (GFS), Lam Research (LRCX), Applied Materials (AMAT). Qualcomm (QCOM), ON Semiconductors (ON), and NXP Semiconductors were all up on the day.

The Euro Stoxx 50 finished slightly higher +0.21 percent higher, the Shanghai Composite index closed down -1.48%..

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

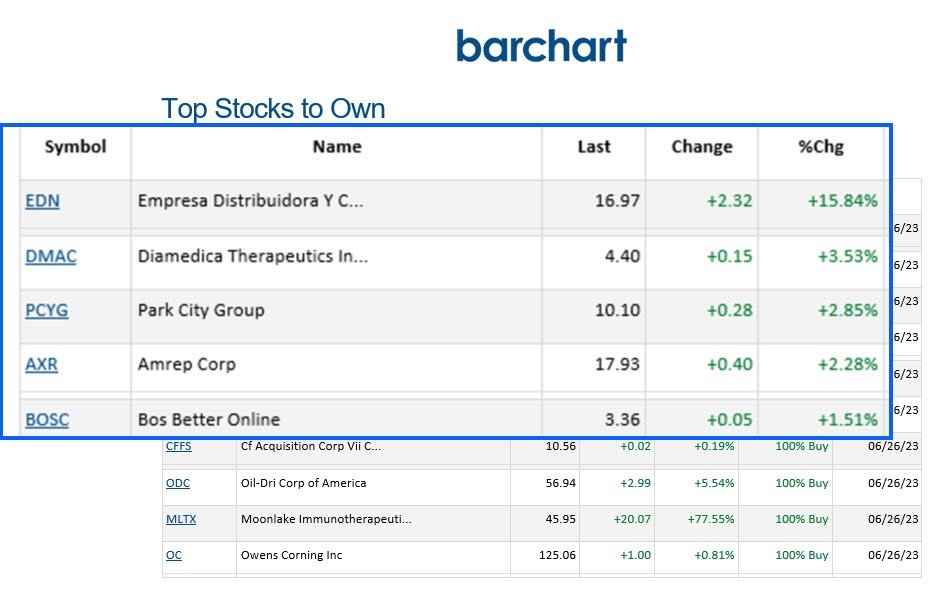

BARCHART: QUICK STOCK IDEAS

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.