INFLATION AND DEBT CEILING: STOCKS FALL

INFLATION

SEMI CONDUCTOR STOCKS

Subscribe to

BARCHART’S Pick of the day: Kodiak Sciences Inc (KOD)

NVIDIA Corporation (NVDA): Approaching $1tn in Market Cap

NVDA up around 25%

“The simplest way to think about it is that over the next ten years, most of that trillion dollars will be essentially generative AI. This will compensate for all the growth in data centers still.”

An explainion of the present debt ceiling debate and Inflation

The Debt-Ceiling debate refers to the current discussion about how much the US government borrows. Borrowings are to fund its operations and meet its financial obligations. The debt ceiling is a statutory limitation imposed by Congress. This is based on the total amount of outstanding debt that the US Treasury may issue.

The deficit is financed by the issuing of Treasury instruments such as bonds. When the government spends more money than it receives in taxes this is the deficit. This needs to be funded. The bonds issued by the U.S. Treasury are assets for investors. They are purchased by both domestic and international investors. The government, can only issue debt up to the debt ceiling limit.

THE DEBATE

The debate occurs when the government is approaching or has reached the debt ceiling. Thus additional borrowing, issuing of Bonds is required to fund its operations. At this point, Congress must act to raise or suspend the debt ceiling. After which the Treasury may continue borrowing money and meeting its financial obligations. Funds are required by the government for its programs, salaries, and interest on existing debt.

The debt ceiling argument is a contentious political topic and no different this time. The discussion involves concerns about government spending, fiscal responsibility, and long-term economic implications. Some believe that raising the debt ceiling is necessary to avoid a potential default on US loans.

THE ECONOMY AND INFLATION

An event such as this would lead to major economic impacts both in the U.S. and abroad. One key concern is that a failure to raise the debt ceiling will lead to higher borrowing rates. Also a loss of confidence in the US economy, and financial market disruptions. Inflation remains above target and as mentioned above target.

The recent release of the minutes from the last FOMC meeting indicates the internal debate. The notes stated that upside risks to the inflation forecast remained a prominent element influencing the policy outlook, with inflation still far above the committee’s longer-run goal

BARCHART: TOP STOCKS TO OWN

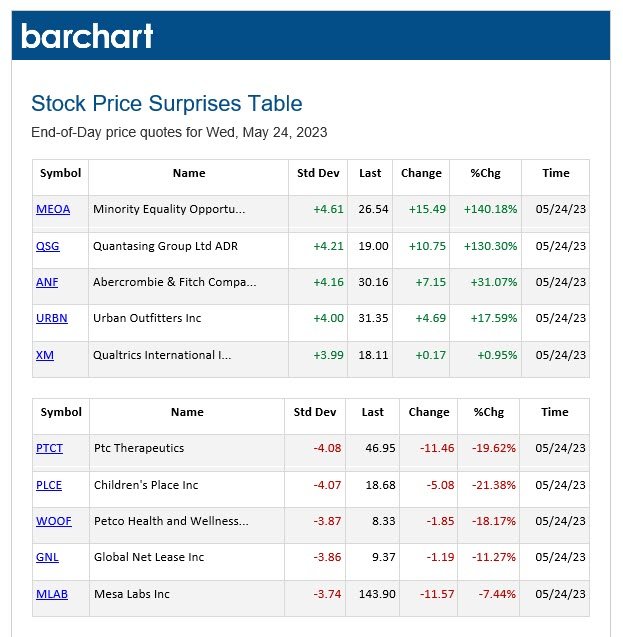

PRICE SURPRISES AND VOLATILITY

For 25 May. Barchart lists Price Surprises both upside and downside. This is for volatile stocks, as indicated by standard deviation compared to their past 20 days of data.

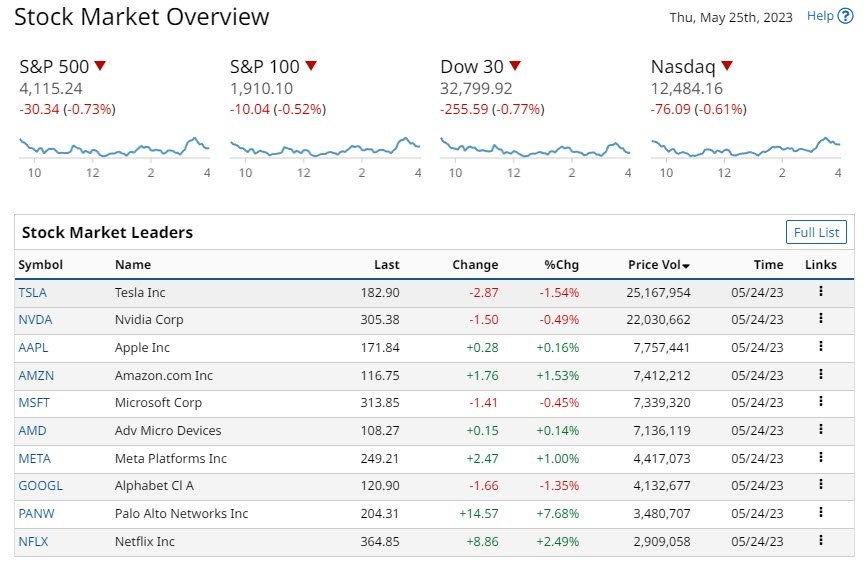

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

One Response

The Debt Debate continues plus Inflation Stock Markets fall

[url=http://www.gpyh40cp72z3l52857roo51g344wz3lis.org/]ukebtwtfelq[/url]

akebtwtfelq

kebtwtfelq http://www.gpyh40cp72z3l52857roo51g344wz3lis.org/