THE equity market risk premium

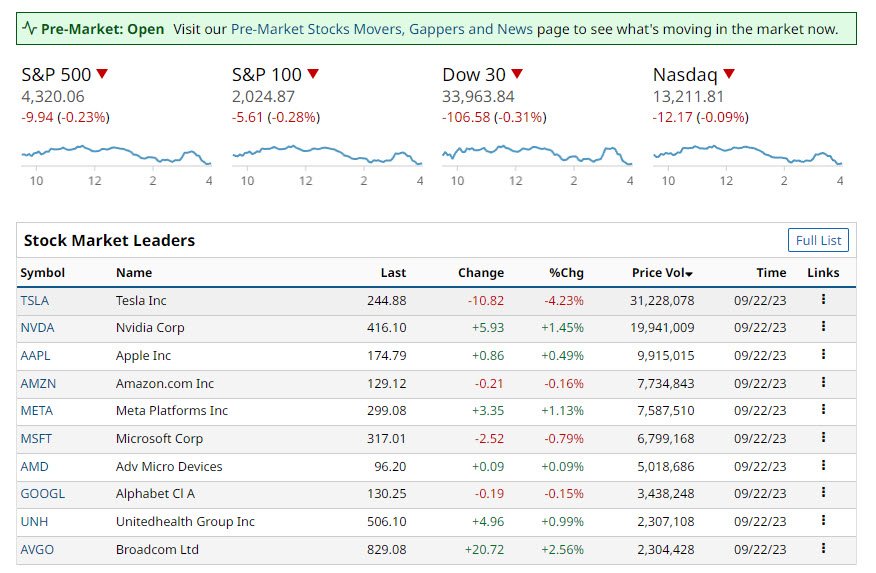

The weakness in stocks continues in the U.S. stock markets as the S&P 500 fell to lows last seen in May. A three-and-a-half month low as the Equity Market Risk Premium starts to rise. Many Fed officials continue to spook the market with their negative comments. Most comments surround the fact that interest rates may need to remain higher for longer. This should not be unexpected. Further tightening, which is not currently factored in is not out of the question. At the current rate of decreasing inflation. The 2.0% target inflation is unlikely to meet until well into 2024.

Markets are pricing a 25% likelihood that the FOMC will raise the funds rate by +25 basis points at the November 1 meeting. Then a further 50% chance of a further 25 basis point rise, at the December 13 meeting. Markets expect that the FOMC will begin decreasing rates in Q3 2024. this move would be in reaction to a projected slowdown in the US economy.

In fact, investors must consider that yields on U.S. 10-year treasuries could be around 150 basis points higher than the current 4.44%. Thus, the broader market was under pressure Friday. The drop in bond yields on Friday triggered some short covering in technology firms. This kept the Nasdaq 100 barely in positive territory. More of a technical trade than a bull market signal.

All of my Blog Posts contain Affiliate Links to products or services that are known to me. I may receive art any time a commission if a purchase or subscription is made via an Affiliate link.

Subscribe to

higher long-term rates impacts the equity market risk premium

Investors are leaving stocks due to the likelihood of higher long-term interest rates. Which is likely going to be for an for an extended period of time. Thus, the Equity Market Risk premium rises to around 8.0% if 10-year yields are around 6.0%. Global outflows from equity funds were close to $17 billion in the week ending September 22.

The small-cap and industrial stocks

Where is the pain being felt the most? It is in the small-cap and industrial stocks in the United States. This often indicates a warning of a recession. The debate will continue about a possible recession and some investors see this as investing noise. In 2023, share indexes have already outperformed expectations. Some investors will view this down draft as a buying opportunity.

S&P 500 has lost about 8%

The S&P 500 has lost about 8% from its August 1 peak. In comparison, the small-cap Russell 2000 Index has lost more than 11% since its July 31 high. Does not seem mush but the Russell 2000 did not experience a strong rally in the first half of 2023. If an economy is in a slump, steep declines in small-cap and industrial equities are common.

The S&P 500 Index (SPY) on Friday closed down -0.23%, and the Nasdaq 100 Index (QQQ) closed up +0.05%.

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

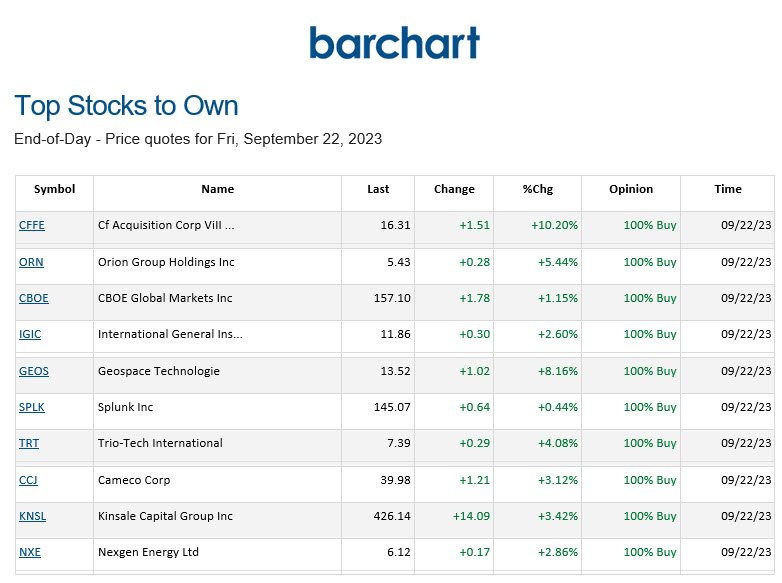

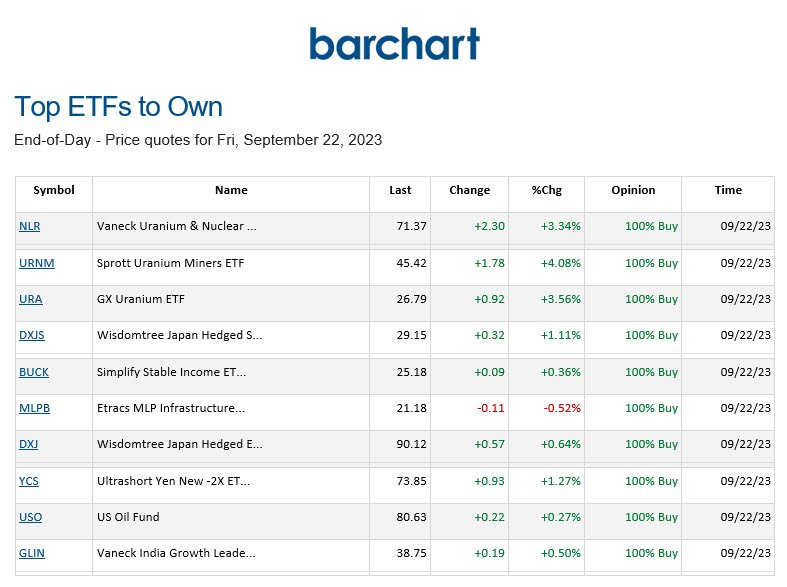

BARCHART: QUICK STOCK IDEAS

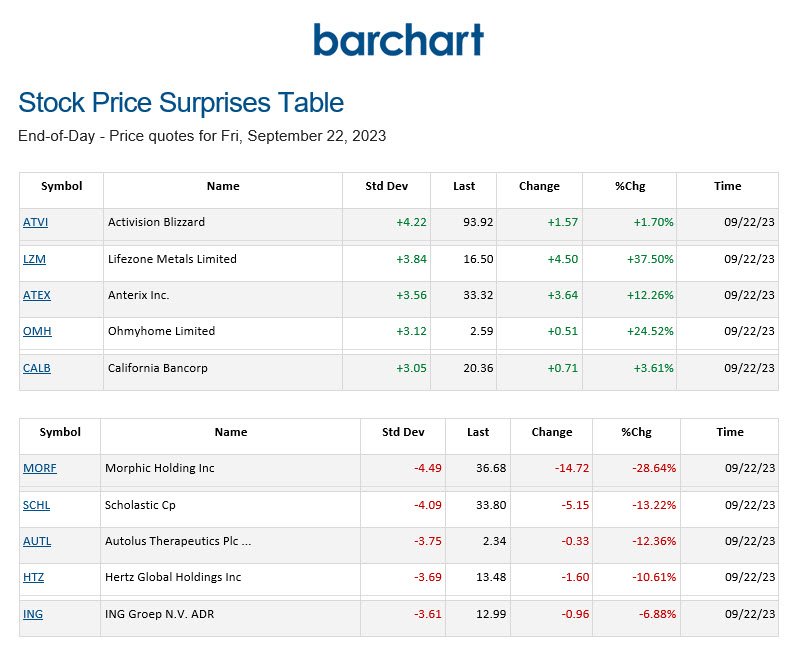

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

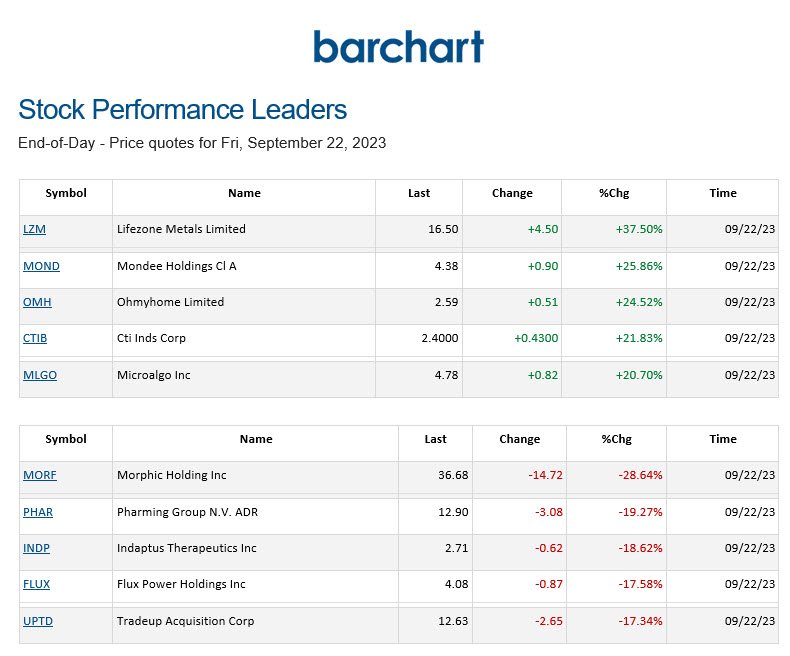

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.