Goldman Sachs remains a leader in investment banking

Goldman Sachs is a leading global investment banking firm. Their activities are investment banking (20% of net revenue), global markets (40%), asset management (25%). As well as consumer and wealth management (15%) segments. Fixed Income, Currency, and Commodities comprise the Global Markets business.

Covering client-execution activities in credit products, interest rate products, mortgages, currencies, and commodities. Consumer & Wealth Management covers management and deposit-taking operations relating to wealth management.

Foe more information on the recent banking crisis, click HERE.

![]()

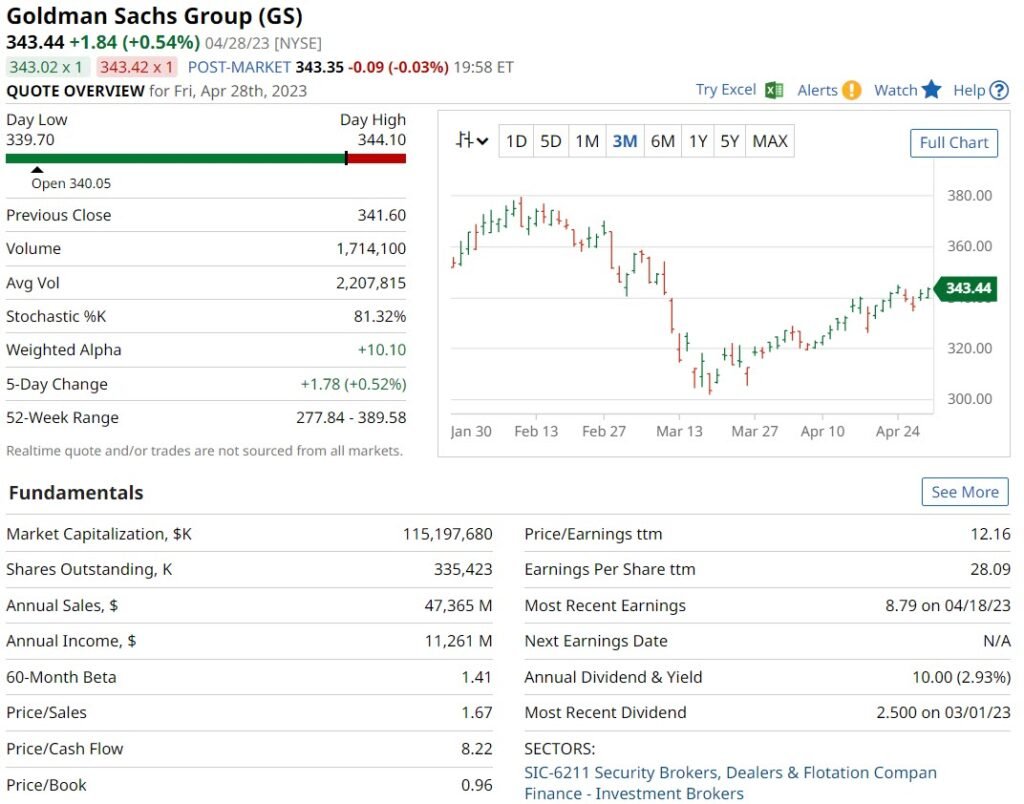

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions. The website is designed for individual traders and investors, as well as institutional clients, including banks, brokers, and hedge funds.

Barchart provides users with access to real-time and historical data on a wide range of financial instruments. Included are stocks, futures, options, currencies, and cryptocurrencies. The website also offers a variety of tools and services for trading and investing. Customizable charts, technical indicators, and screeners for identifying potential investment opportunities.

In addition to its data and trading solutions, Barchart provides news and analysis on the financial markets, with articles and commentary from a team of experienced financial journalists and analysts.

Overall, I find Barchart to be a comprehensive platform for traders and investors looking to stay up-to-date on financial market data and news. Provides access a range of tools and services to support a wide range of investment strategies.

Subscribe to

RECENT EARNING RELEASED WHAT IT MEANS

Goldman Sachs’ announced Q1-2023 EPS was $8.79, higher than Consensus Estimate of $8.13. Projected EPS estimates were $7.70. A much-improved performance compared to the poor Q4-2022 results reported in January. Compared to YOY, net revenues came in at $12.22 billion, a decline of 5%. In addition, the top line came in lower than the $13.02 billion Consensus Estimate. According to our projections, overall revenues came in at $12.8 billion.

GOLDMAN SACHS SLIDING FORWARD EARINGS ESTIMATES

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

Financials Sector ans Goldman Sachs

The Financials Sector consists of companies providing financial services. These services cover banking, investment management, insurance, and real estate services. The financial sector plays a significant role in the economy. The sector by mediates capital distribution.

This could be for firms and individuals. They manage risks, and enable transactions. The financial sector is important to the economy, in providing financial service. The sector may be an appealing option for some investors seeking dividend-paying stocks.

One Response