STOCK INVESTORS FOCUS ON risk premium

The week ahead will be one to navigate carefully for stock investors. Storms outside the stock market are brewing. They could hit the stock markets with waves of uncertainty. The two immediate concerns are the votes for the new leader of the U.S. House of Representatives. The other is rising yields at the long-end of the U.S. Yield Curve.

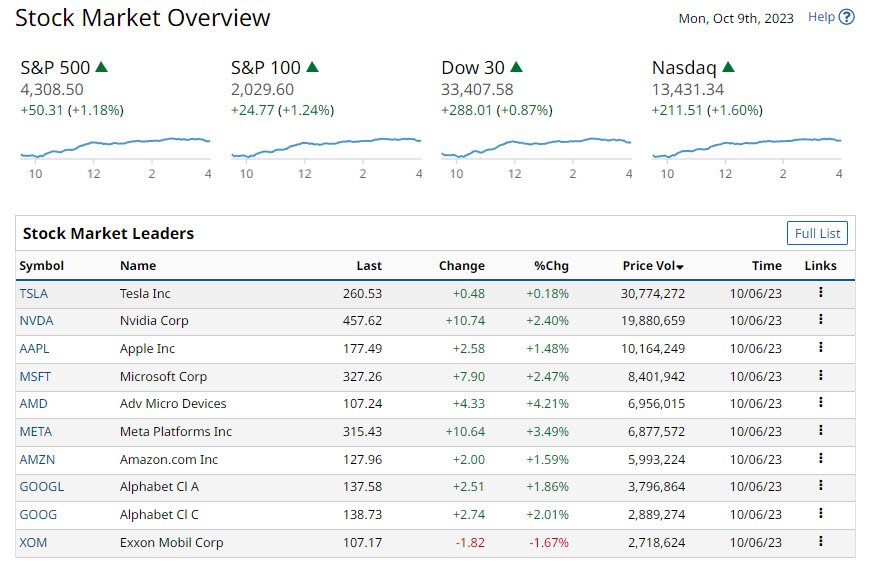

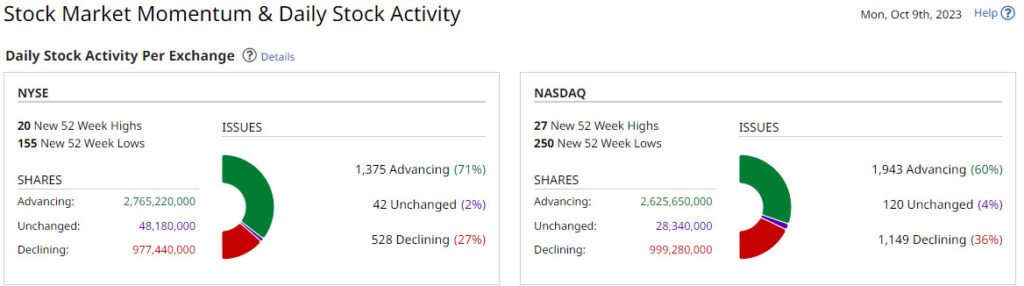

Both are set to dampen newfound optimism of equity investors. The very recent tick up on the two major index ETFs the SYP and the QQQ can be seen in the two graphs. The S&P 500 Index (SPY) on Friday closed up +1.18%, and the Nasdaq 100 Index (QQQ) closed up +1.70%.

U.S. stock investors

For U.S. stock investors the keyway to navigate the two uncertainties is this. First, to understand a new speaker will be found, no big deal. For Interest Rates, invest in stocks with the idea that the total return, price plus dividends, must be at least 8%. For stocks rated on higher valuation multiples, PE Ratio, Price to Sales or Price to Free Cash Flow. The specific Equity Market Risk Premium must be higher.

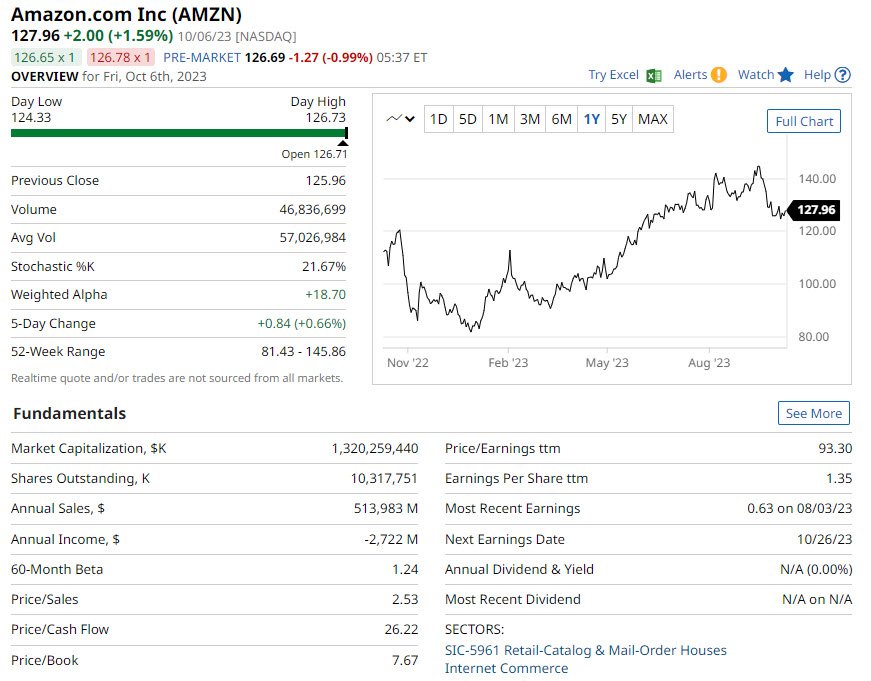

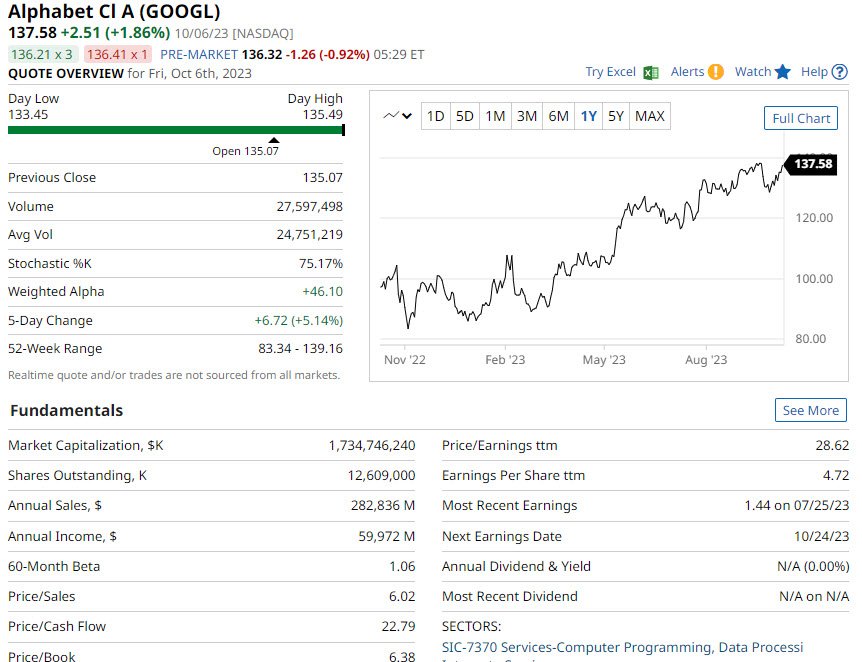

Over 12% total return would be a start. Thus, there are legitimate concerns over some major Tech Stocks in the Magnificent Seven. Investors should note concerns over Amazon, Google and Apple.

Amazon seems best positioned

Each has an individual story, of the three Amazon seems best positioned. For individual stock investors. Stocks saw modest gains on Friday after recovering from early losses. The QQQ, the Nasdaq 100, reached a 2-week high. The September payrolls data was solid, plus the increase in average hourly wages was smaller than anticipated. Combined they are dovish signals for Fed policy.

All of my Blog Posts contain Affiliate Links to products or services that are known to me. I may receive art any time a commission if a purchase or subscription is made via an Affiliate link.

Subscribe to

higher long-term rates impacts STOCK INVESTORS

Payrolls data plus the increase in average hourly wages indicate the U.S. economy is solid but not fantastic. I discussed last week the possible weak signs of global deflation. I want to stress this is not about to happen and if it did it would be a catastrophe. What I am highlighting are the perils of taking the tightening of Monetary Policy too far.

STOCK INVESTORS ARE LOOKING AT THE DIRECTION OF MONETARY POLICY

The expectations of market participants are for a 30% likelihood that the FOMC will increase the Fed funds rate. This would be by 25 basis points at the November 1. Then at the subsequent meeting a 45% chance which finishes on December 13. This will change to decreasing expectations if. The U.S. economy starts to show significant signs of weakness. Or the yields at the long end continue to increase.

The U.S. 10-year T-note yield reached a 16-year high. Part of the reason given for the was based on speculation that the Fed may stop raising the Fed Funds Rate. The increase in yields at the long end implies a significant tightening of financial conditions. Thus, doing the job for the Fed. Keep in mind the long end of the yield curve has a greater influence on the broad economy than the short end.

The consumer price index data, which is due out this week. It follows a hot U.S. jobs report up 336,000 and it may be key to activity in the stock market. If the recent trend of weakening inflation continues. In their investment scenario. Investors should think about possibilities involving a recession or a soft landing. At the moment this does not mean investing in the late cycle sectors such as Utilities or Healthcare. In fact, ivestors should position themselves for a year-end rally in stocks.

The consumer price index data, which is due out this week. It follows a hot U.S. jobs report up 336,000 and it may be key to activity in the stock market. If the recent trend of weakening inflation continues. In their investment scenario. Investors should think about possibilities involving a recession or a soft landing. At the moment this does not mean investing in the late cycle sectors such as Utilities or Healthcare. In fact, investors should position themselves for a year-end rally in stocks.

Amazon (AMZN)

Google (Googl)

Google (Googl) is under pressure. Try to think of a venture launched over the past 10-years that is doing well. YouTube – no, Google +, Google Glasses, Google Fiber, Google Nexus and Google Bard. Well maybe give it time. For the moment ChatGPT is certainly at centre stage.

OK, if you think of Google’s AI potential is underestimated by the market, maybe making the stock a buy. Google’s Bard chatbot is growing rapidly, while OpenAI’s ChatGPT growth has flattened. But that’s the call and then there is also Google Cloud.

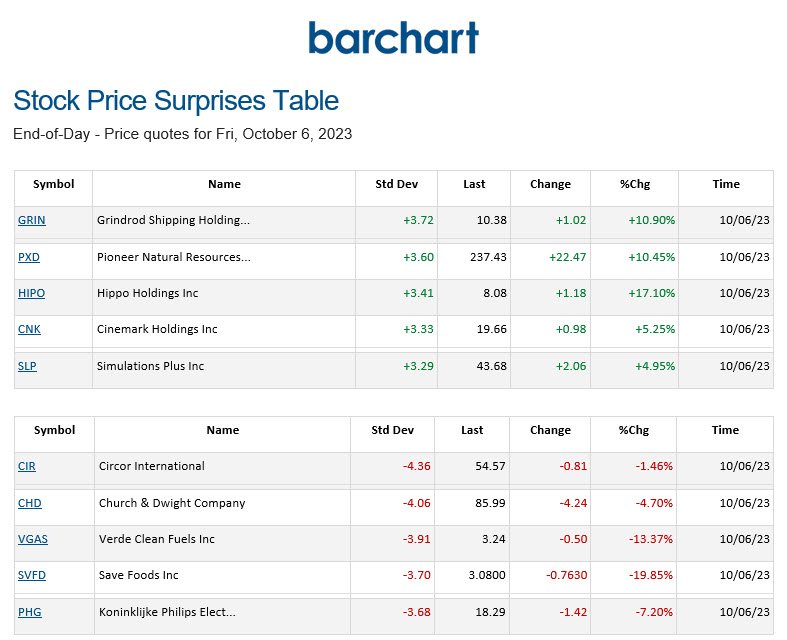

Pioneer Natural Resources closed up more than +10%. Exxon Mobil is in talks to buy the business in a deal worth up to $60 billion, M&A news also helped lift stock prices.

THE EARNINGS SEASON STARTS TODAY

The Q3 earning season for major U.S companies is here. To add drama to the earnings storm, analysts have raised their sales and EPS forecasts. This has been done for 10 of the 11 major groups in the S&P 500 Index.

Tuesday, October 10th earnings spotlight. PepsiCo (PEP) and Neogen (NEOG)

Thursday, October 12, the focus on earnings. Fastenal (FAST), Delta Air Lines (DAL), and Walgreens Boots Alliance (WBA).

Friday, October 13, the major banks will kick off. JPMorgan Chase (JPM), Wells Fargo (WFC), BlackRock (BLK), and Citigroup (C).

The yields on U.S. and European bonds increased on Friday. The yield on 10-year T-notes increased to 4.78%, touching a 16-year high. German 10-year bund yield increased by 0.7 basis points to 2.88% . The yield on 10-year UK gilts increased +3.2 basis points to 4.57%.

Foreign stock markets ended Friday with varied results. Euro Stoxx 50 ended the day up 1.09 %. The Golden Week holidays caused the Shanghai Composite Index in China to be closed. Nikkei 225 in Japan finished down 0.26%.

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

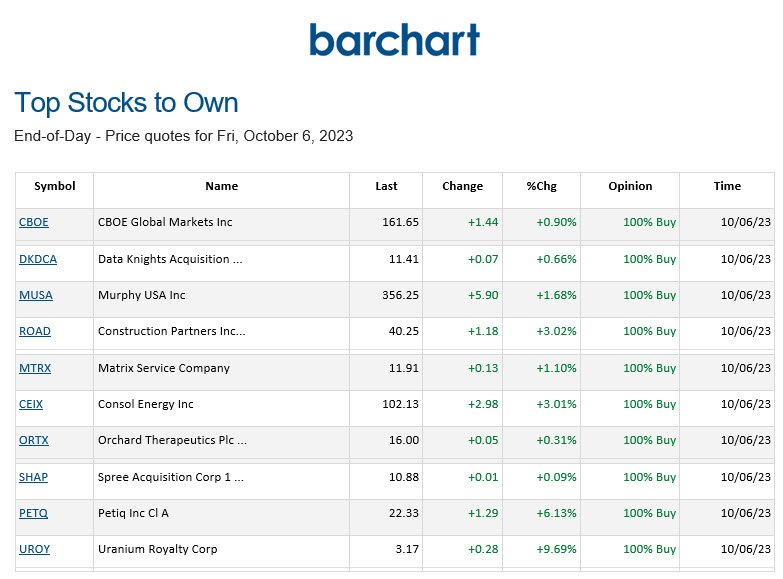

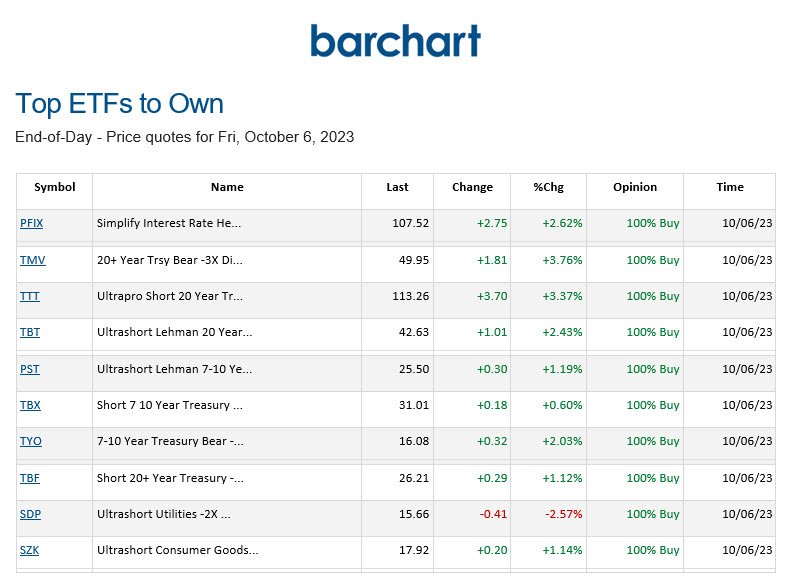

BARCHART: QUICK STOCK IDEAS

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

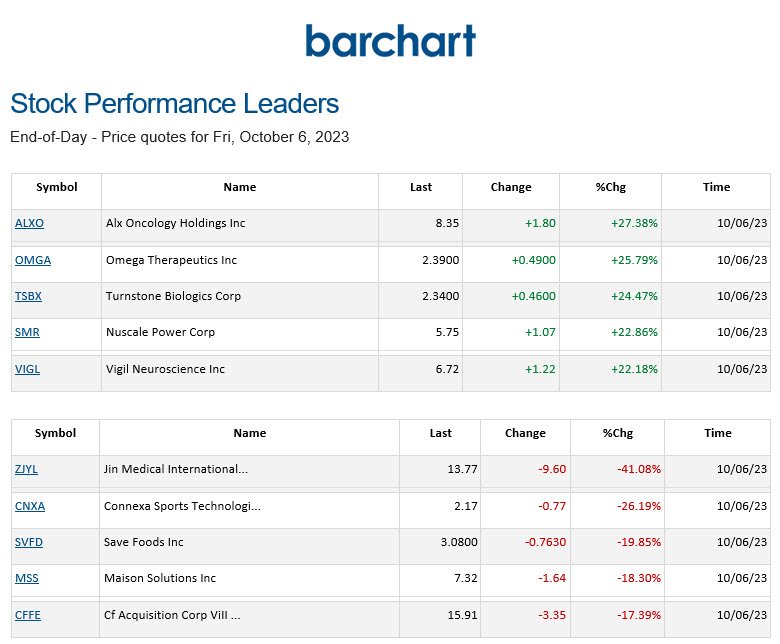

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.