Making money in stocks

Remember, stocks lead earnings and earnings, lead the economy

Considering everything that happened in Q1 2023 and there has been a lot. Bank collapses, stubborn inflation, rising interest rates and continued talks of a recession. The stock market continues to rebound. The S&P 500 is up over 7% and the NASDAQ 100 up over 21%. How to make money is stocks?

A pleasant experience after a difficult 2022, when the S&P closed down 19% and the NSADAQ 100 was down around 30%.

Economists and financial commentators point to several problems in the U.S. economy. The U.S. yield curve is inverted, which normally indicates a recession.

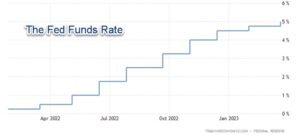

Inflation remains high and the Federal Reserve continues the inflation fight. Thus, further rises in interest rates are expected.

With all the negative sentient out there, what gives??

Repeat and remember the easy phase, the heading of this paragraph. Stocks lead earnings and earnings, lead the economy.

That’s how to make money in stocks.

5 critical factors impacting stocks in 2023

The first quater defied expectations. The rate of returns on the SPY and the QQQ seen so far in 2023 have been strong. But, they are unlikely or will not continue for the remained of 2023. Equally, it is highly unlikely to see a stock market crash in 2023.

Let’s take a look at the 5 critical influences, good or bad, on stocks for the rest of 2023. Rated in importance from most to least, just in case you don’t get to the end.

- Earnings

- Banks

- Oil Price

- Inflation

- Interest Rates

EARNINGS

Earnings: Making Money in Stocks

Confusing?

Yes, economists and market commentators are still forecasting a recession in 2023. Earnings growth of +5% while the continued calls for a recession is, to say the least, contradictory.

What gives?

Are forward earnings estimates actually underestimated?

Graphs and data by Finscreener

BANKS

Banks: A key Sector to make money in stocks

What does this mean for banks as an investment in 2023?

SUBSCRIBE TO FINSCREENER

OIL PRICE

Oil Price: A Double Edged Sword

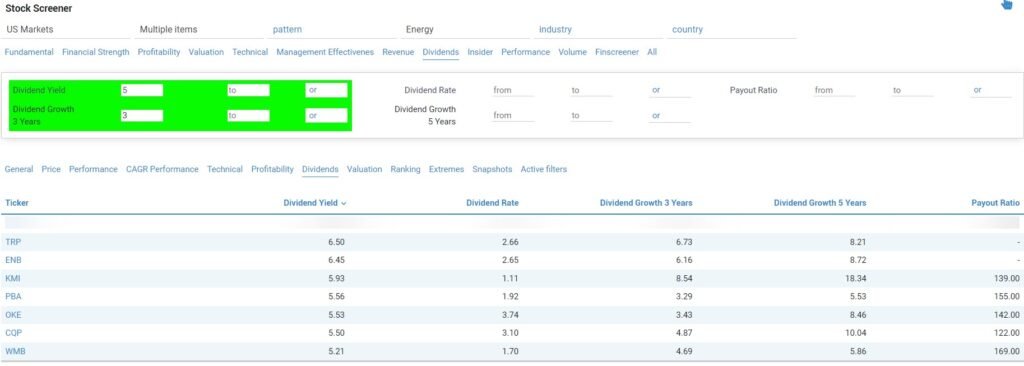

As a potential major player to make money in stocks, th oil price is back. In 2022, a Bear Market year for stocks, the Energy Sector massively outperformed up over 50%. This week, oil prices soared when OPEC+, announced output restrictions. This was completely unexpected by the markets. The oil benchmarks, Brent crude and WTI, rose over 6% the day of the announcement.

This is a double-edged sword for stocks. A higher oil price will raise concerns for economists due to concerns over inflation. Market commentators expect this to be positive for the Energy Sector. The sector was an underperformer in Q1. The key is, as some argue, it depends for how long the higher oil price is sustained. A couple of days compared to the remainder of 2023.

Crude oil prices have been relatively consistent year to date. Still, at $80 per barrel, the price is down around 21% compared to 2022. In a manipulated market such as oil, it is near impossible to predict the price, even near term. Nevertheless, predictions of the oil price at around $100 a barrel, this means, selectively, energy stocks are interesting. At this point, energy stocks should be the focus of dividend investors. See the table below.

INFLATION

Inflation Worries Easing

To understand inflation and the impact on stocks is to focus on the Federal Reserve. They continue to say the main focus is to fight inflation. On that basis, inflation remains well above the 2% target. Currently, the inflation rate stands at 6.0% YoY in February 2023. Thus, further interest rate hikes are expected. This rate was the lowest since September 2021, in line with market expectations. Down from 6.4 percent in January and well down from the 9.6% peak in 2022.

What the Fed is really focused on is core inflation rate. This excludes volatile items such as food and energy. In February, for a fifth consecutive month, it was down to 5.5%. The lowest since December 2021. The next announcement for March will be April 12. The market estimate is 5.0%.

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

INTEREST RATES

Interest Rates