Arrogance, Incompetence, Deregulation gives Credit Suisse and SVB

A quick recap, at the close yesterday – S&P 500 Index -0.70%, the Dow Jones Industrials Index -0.87%, and the Nasdaq 100 Index +0.42%.

Bank stock continue to be in focus, due to liquidity concerns. If last week’s two U.S bank failures SVB and Signature were not enough, Credit Suisse added fuel to the fire. The issue is that Credit Suisse is 3 times SVB at CHF 600 billion in total assets. Credit Suisse’s share price dropped 25% as the Saudi National Bank, said enough is enough. Thus, there will be no more money for Credit Suisse, and it is now left struggling to install its turnaround plan. The Swiss National Bank had to announce a backup plan for Credit Suisse, CHF 50 million in liquidity. A much need backstop because the other major banks have exposure to Credit Suisse.

NASDAQ benefits from Bond Yields

Not all gloom and doom as the Nasdaq 100 rose Wednesday after U.S. bond yields fell. Bond yields around the world fell to month lows, as the banking turmoil gathered pace. The expectation is that the Central Banks will limit further interest rate increases. Later this week, ECB could raise rates by 25 bps, not 50bps. While next week’s FOMC meeting, there is now less than 50% chance of a 25-bps increase. The U.S. 10-year T-note yield fell to 3.380%, 10-year German bund yield fell to 2.110% and the 10-year UK gilt yield fell to 3.251%.

U.S. Economic data

U.S Economic data provides a mixed picture, on Inflation, Consumption and Manufacturing. Inflation data in the U.S. February PPI final demand increased +4.6% y/y, less that the forecasted rate. The PPI ex-food and energy +4.4% y/y, the slowest year-on-year increase in the past two years. General business condition as measured by the Empire Manufacturing Survey fell from -18.8 to -24.6. This was below expectations. Then Retail sales fell 0.4% m/m in February, in line with expectations.

BANK STOCKS IN FOCUS

Arrogant, Incompetent Bank Management

The Bank Sector remain weak, and there are several long-term issues at play. The Twitter Bank runs have begun and be careful what you wish for. Many of the Regional Bank protested against increased regulation. Thus, the above USD 200 billion limit in total assets was set back in 2008. This now is at the mercy of Twitter for future stress in the banking system.

The 4 largest U.S. banks by Total Assets, face far greater supervision than the Regional Banks. In trillions of Total Assets, JPMorgan USD 3.20, Bank of America USD 2.42, Citigroup USD 1.77, Wells Fargo USD 1.72. For these banks so far so good.

Follow, learn and maybe gain some investment ideas trading with EToro. The platform has over 30 million traders and investors. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

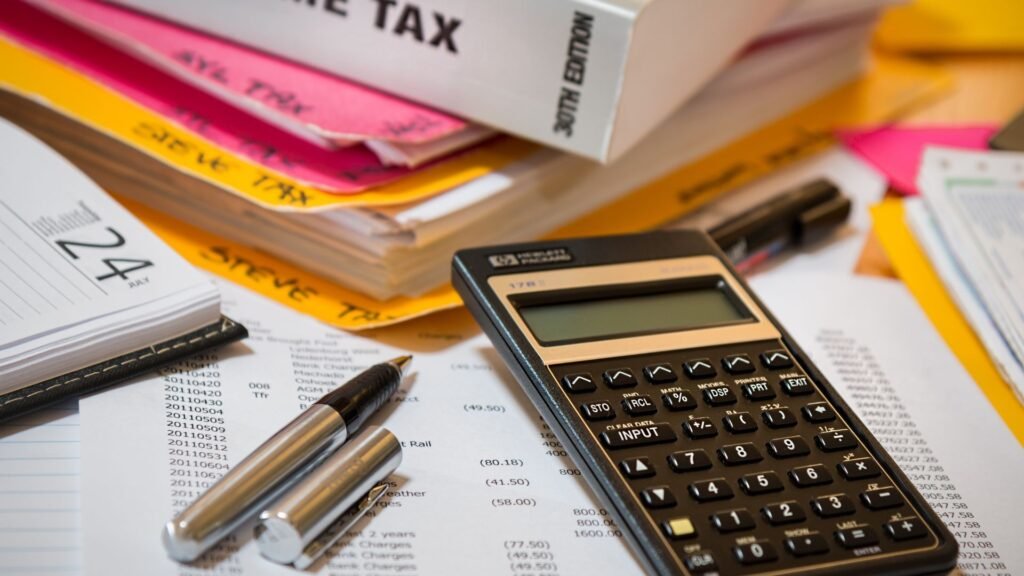

THE ACCOUNTING FIX

THE ACCOUNTING FIX

What I term, the Accounting Fix, or Securities Held to Maturity needs to change. The U.S. banks currently have market-to market losses of USD 620 billion in unrealized losses. These are U.S Treasuries and Mortgage Backed Securities, all with high credit ratings. The credit ratings is not the issue, this measures the risk of default. The paper losses are due to the rapid rise in interest rates, thus these bonds have decreased in price. Yes, I understand if held to maturity, they will be repaid at 100.

There is no impact on the banks’ regulatory by selling available for sale securities. Their value is marked-to-market, and a provision taken against the Income Statement. It is not the same, in a run on the bank, liquidity is critical. In the case of Silicon Valley Bank the USD 42 billion in securities sold had to come from the Held to Maturity. The bank incurred a realised loss of USD 1.8 billion and no provision had been made.

MONETARY POLICY AND VENTURE CAPITAL

SILICON VALLEY BANK

It is true that the impact of monetary policy on the real economy has a long lag time and can vary. No doubt the Feds recent tightening of monetary policy caused the unrealised losses. Is this main the issue? Loose monetary policy combined with Quantitative Easing over years is the issue.

From here for banks and in particular SVB, it gets interesting. Venture Capital funds in Silicon Valley were pumped full of free money. This massively increased their ability to fund start up projects in the Tech Sector. It is quite likely that business ideas received capital at very low interest rates. Businesses or ideas which would not have been funded under normal interest rates. Silicon Valley Bank was the go-to bank and a major beneficiary of all this business.

Subscribe to

BANKS IN CRISIS

Bank CEOs and Deregulation

The debate over cause of this Bank crisis is beginning in earnest. The cocktail of arrogant bank CEOs and deregulation has been widely pinpointed. Also, the run-on Silicon Valley Bank has been the first fueled by Twitter. This expanded communication offered by Twitter will be a growing issue in the future. Withdraw first and ask questions later.

Back to Venture Capitalists and their role in the demise of their cherished bank. Their role in urging their clients to withdraw their deposits in the first hours of the bank run played a role. This cannot be ignored and sparked the panic that ultimately doomed the bank. But to do otherwise would have been reprehensible.

INSIDER TRADING

The real SVB story as investigations by both the SEC and the Justice Department is unfolding. Insider trading is first on the list as SVB’s Senior Management sold their SVB shares. The amount is around USD 5 million alone in January and February. The CEO Gregory Becker sold $3.6 million in company shares. Once this became known this “added fuel to the panic” and the ran to withdraw deposits. It does not stop here. In the hours before the FDIC stepped in, the bank paid the 2022 bonuses to SVB employees.

To keep clients from diversifying their banking relationships, SVB may have “exclusivity clauses”. Clauses that may have made it difficult for clients to diversify their deposits. The executives of SVB Bank testified to Congress that SVB “does not present systemic risks”. SVB business in “low risk activities,” bolstering the case for regulatory relief. Ultimately this request was granted.

Anyone for Gold?

Gold and silver hit 5-week and 1-month highs this morning. Today’s safe haven buying of precious metals followed Credit Suisse Group AG’s turmoil.

The Precious Metals should benefit from falling global bond yields. If the USD strengthens then the price of Gold and Silver are likely to be capped.

2 Responses

I’m not sure where you’re getting your information, but good topic.