March madness is usually college basketball – this time the banks

March Madness is usually associated with college basketball. Congratulations to all the teams and the winners, UConn men’s and LSU women’s. The unusual edition of March madness in 2023 came to the bank sector. The collapse of Silicon Valley Bank started the turmoil.

This event on March 10 was the second largest in U.S. history. It didn’t stop there. The fear was real, and the contagion effect led to the collapse of a couple of other banks. Then there was the big one, Credit Suisse, and the 167-year history consumed by USB over a weekend in March.

To test your knowledge, do the Quiz based on this blog, please click HERE.

bank’s edition of March Madness

So, what led to the bank’s edition of March Madness? Then what did Q1 2023 results last week say? The collapse of the three banks in the U.S. and the long overdue demise of Credit Suisse. Were they related, and what happened? In U.S. banks, the core problem was, as usual, the assets, but not the usual culprit being bad loans.

No, it was classic interest rate mismanagement. SVB invested in U.S. treasuries, and as interest rates rose, these bonds lost value. This was something any well-run bank and the regulators should have noticed. Then managed the issue. It wasn’t. The “Accounting Fix” needs a fix. For more information, please click HERE.

Follow, learn and maybe gain some investment ideas trading with EToro. The platform has over 30 million traders and investors. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

in the bank, where it is safe

The combined collapse of these banks added a lot of heat to the conversation. Why? Is your money safe in the bank? One thing we all have in common is that we all have banking relationships. Our banking relationship is one of our most sensitive. The events of the past couple of months combined with the events to come. They are and will emphasise the following premise. The whole banking system is based on the promise that depositors leave their money in the bank, where it is safe.

In reality, the contract in place is this. Above USD 250,000, you are an unsecured lender to a highly leveraged shop and receive a meager return. In a Bankruptcy Court, a depositor will stand in line with all other creditors. All are above-listed shareholders and Tier 1 bond holders. The arrangement to bail out Silicon Valley Bank depositors, all of them. Bar none. In effect, this action sets a precedent for making good on all deposits in the U.S.

Is this necessary to keep your money safe in the bank?

THE 7 STEPS TO SAVE THE BANKS

Fix the Accounting Fix

Mandate Hedging of Interest Rate Risk

End the Shortening of Bank Stocks

Increase Cash Reserves

Eliminate Stock Options

Regulation Review

Increase Deposit Insurance

The Major U.S. Banks Earnings Reports

Let’s take a look.

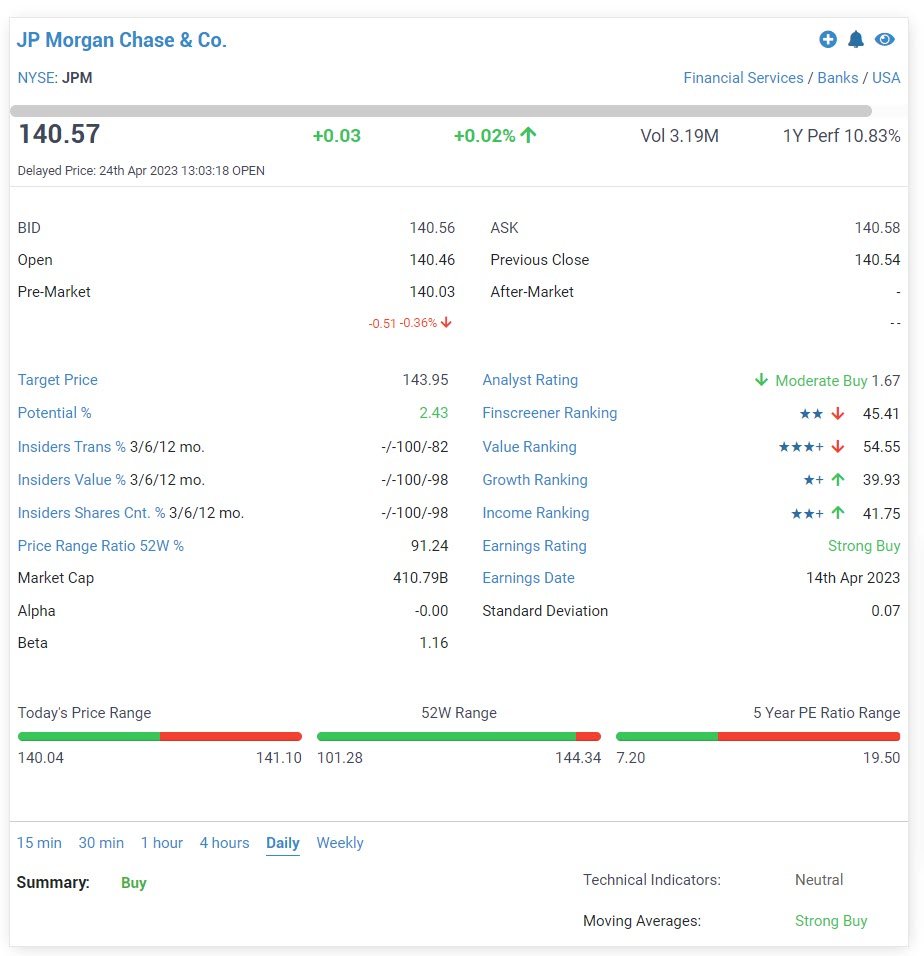

JP MORGAN CHASE (JPM)

Finscreener is a powerful financial analysis tool that allows investors and traders to screen and analyze stocks, ETFs, mutual funds, and cryptocurrencies based on various fundamental and technical criteria quickly and easily. The platform provides users with a wide range of filters, charts, and tools to help them find and analyze the right investment opportunities.

SUBSCRIBER TO FINSCREENER, CLICK BELOW

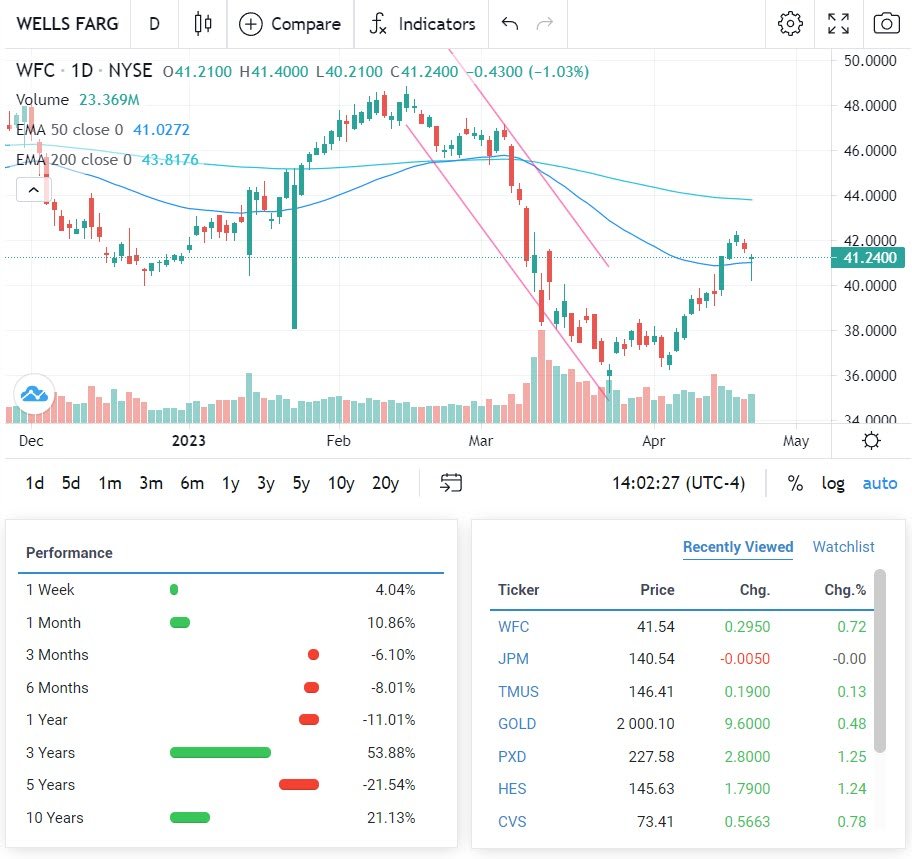

WELLS FARGO (WFC)

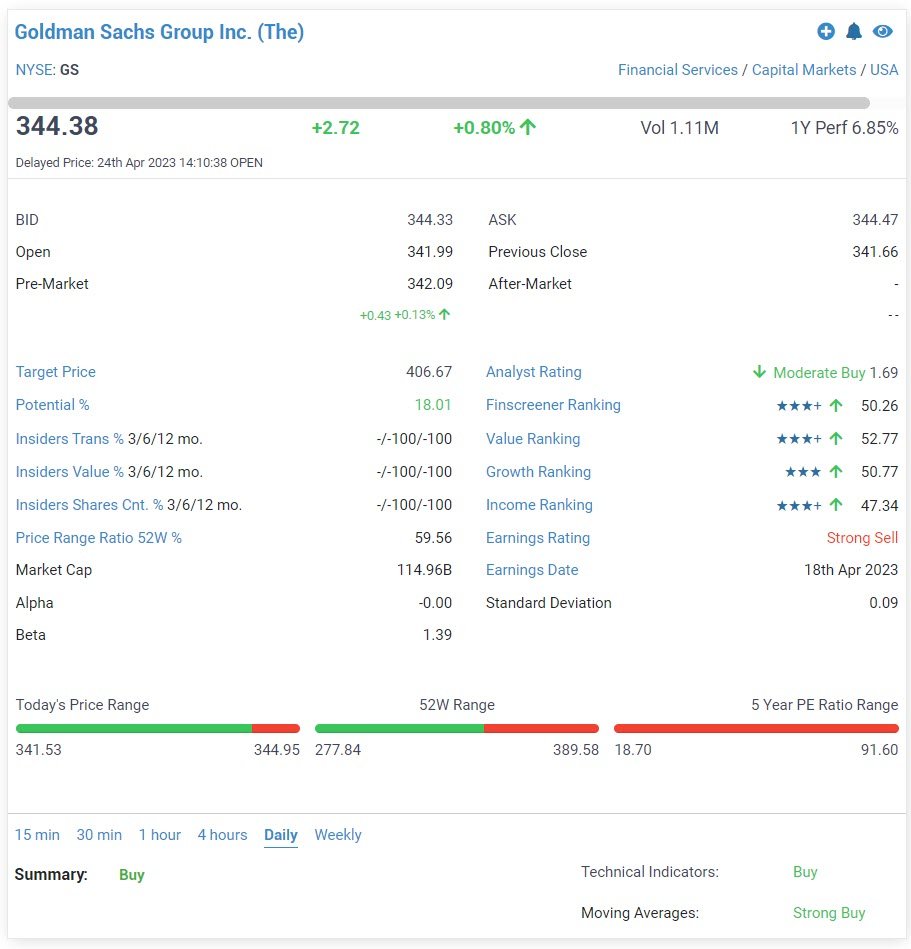

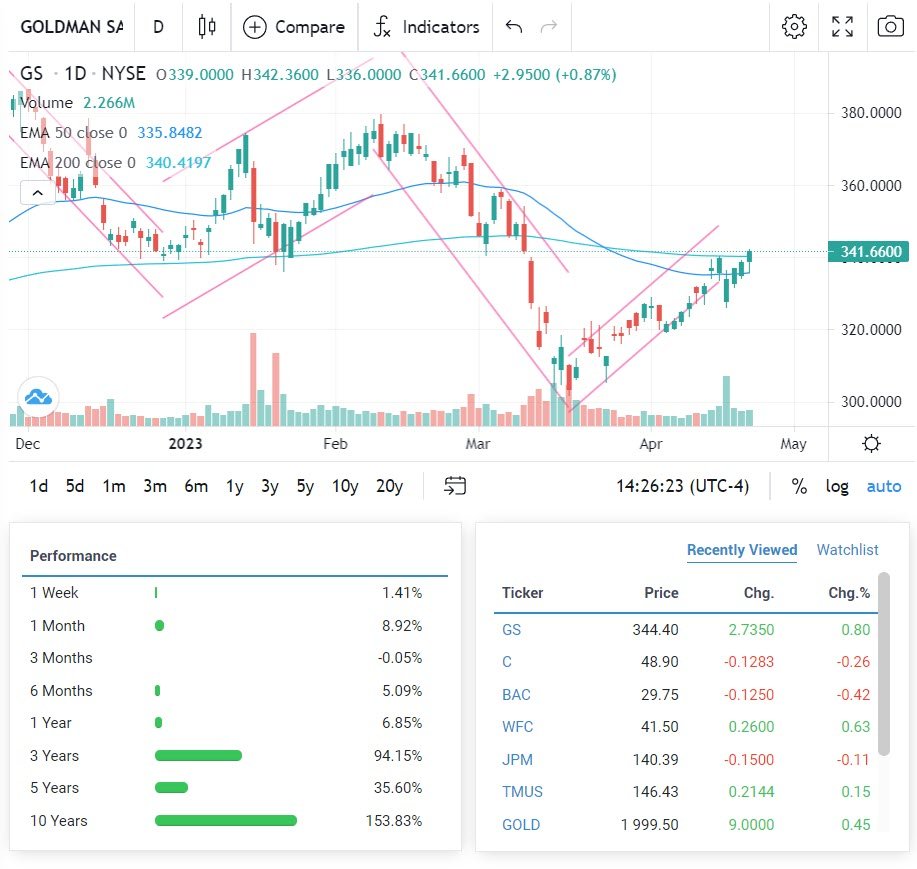

Goldman Sachs (GS)

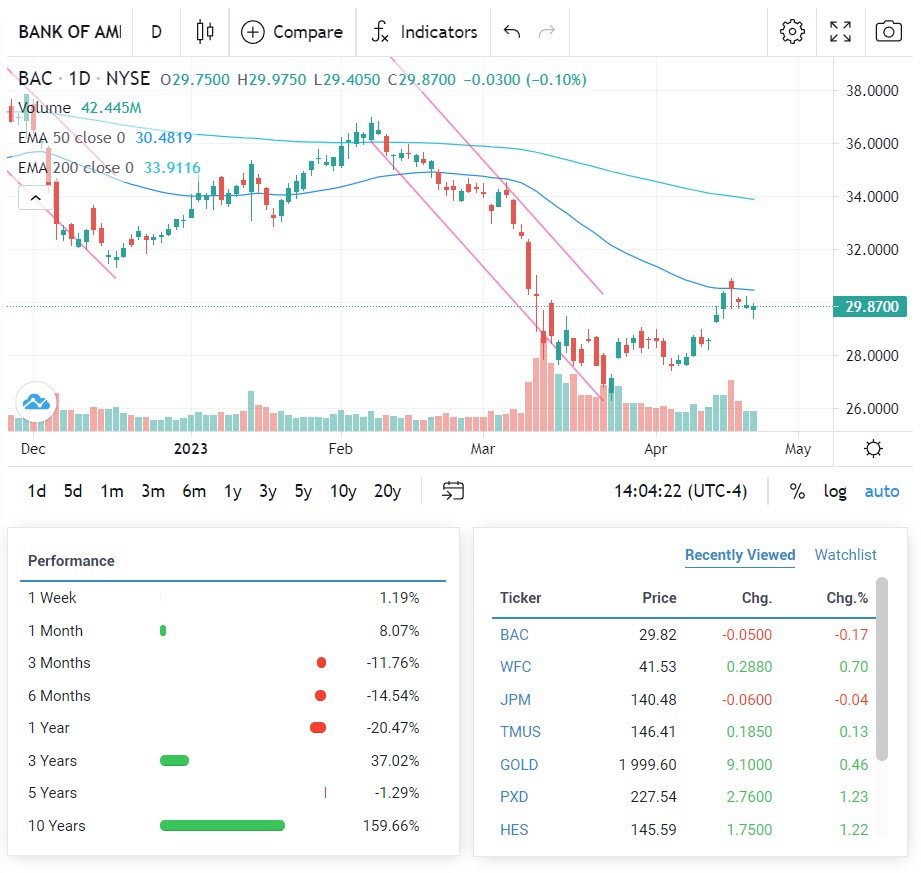

BANK OF AMERICA (BAC)

Bank of America (BAC) reported earnings of 94 cents per share for Q1 2023. The figure was higher than the consensus estimate of 80 cents. When compared to the 80 cents earned in the same quarter last year. Thus, favourable results on the bottom line. Two key aspects, the solid gain in net interest income and the robust trading performance. This came despite a decline in deposits and a worsening forecast for the economy. The company’s quarterly net revenues came in at $26.3 billion. The result was much higher than the consensus estimate of $25.05 billion. When compared to the same period the previous year, the top line increased by 13%.

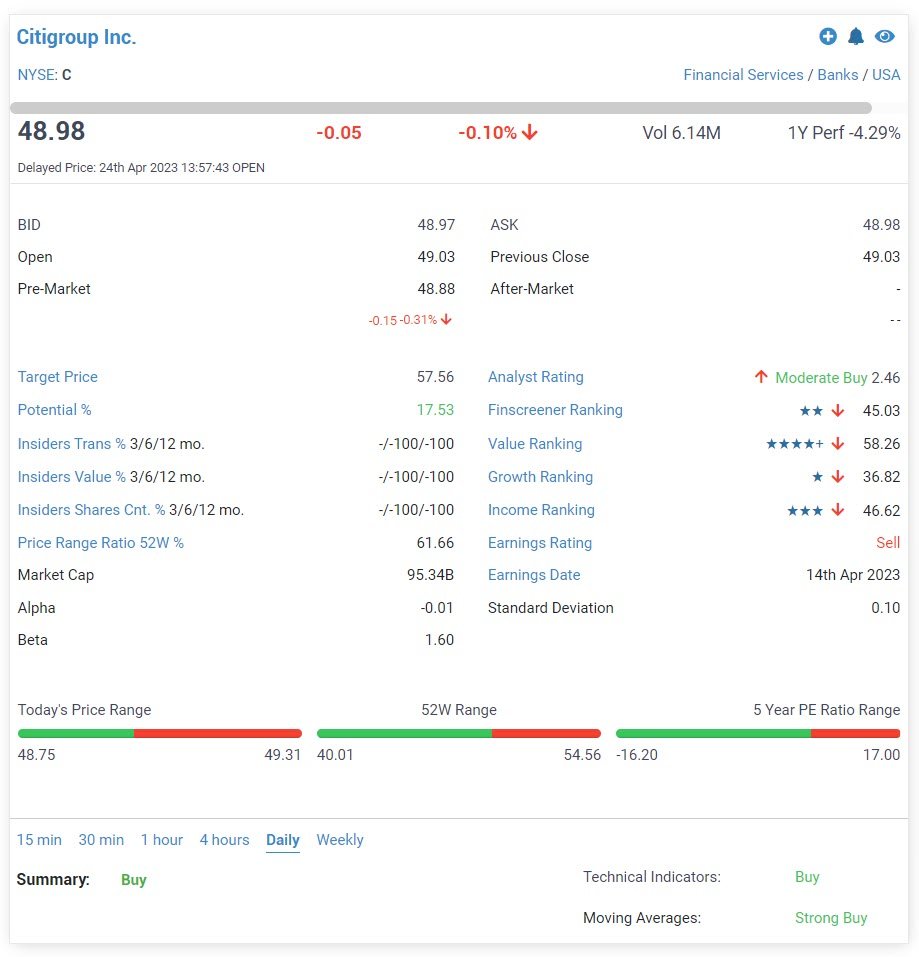

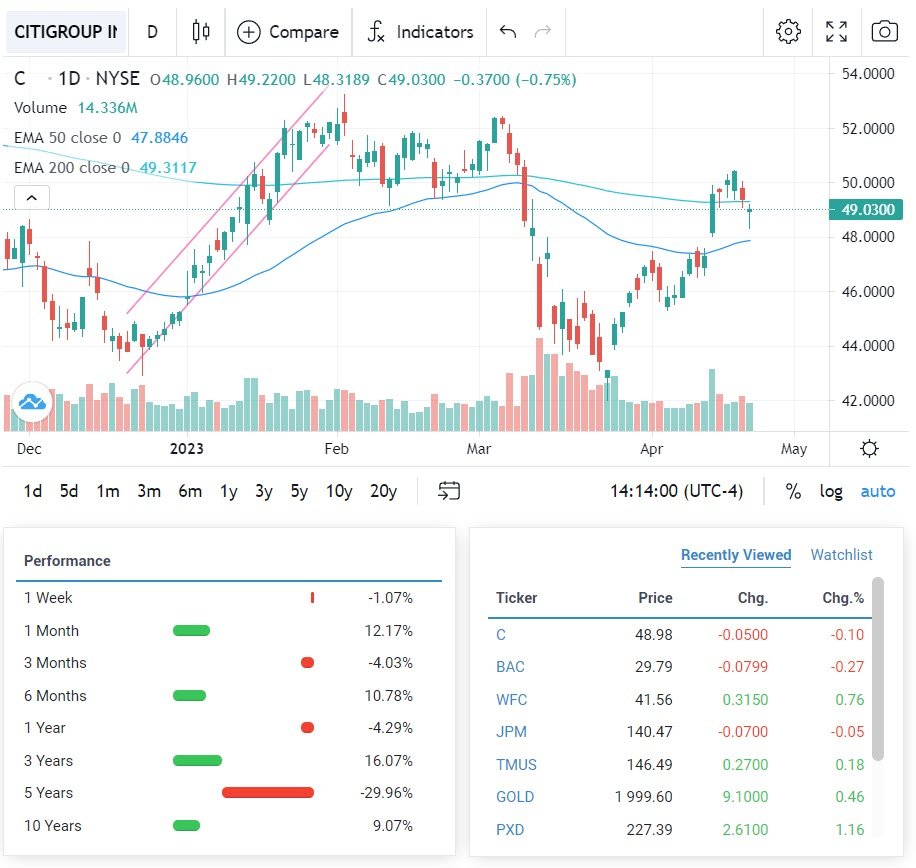

CITIGROUP (C)

Citigroup (C) reported Q1-2023 EPS of $1.86. This excludes divestiture-related impacts. The EPS reported was higher than the consensus estimate of $1.65. The Institutional Clients Group, Personal Banking, and Wealth Management segments were all strong. All made solid contributions to Citigroup’s revenue during the quarter.

The first-quarter revenues came in at $21.44 billion, a YOY increase of 12%. Top-line revenue came in higher than the $17.90 billion consensus estimate. Citigroup is currently trading at a PE ratio of 6.50X, a price-to-book (PB) ratio of 0.51X. The ROA is 0.55% and the ROE is 7.18%. Valuations are low, and so is profitability.

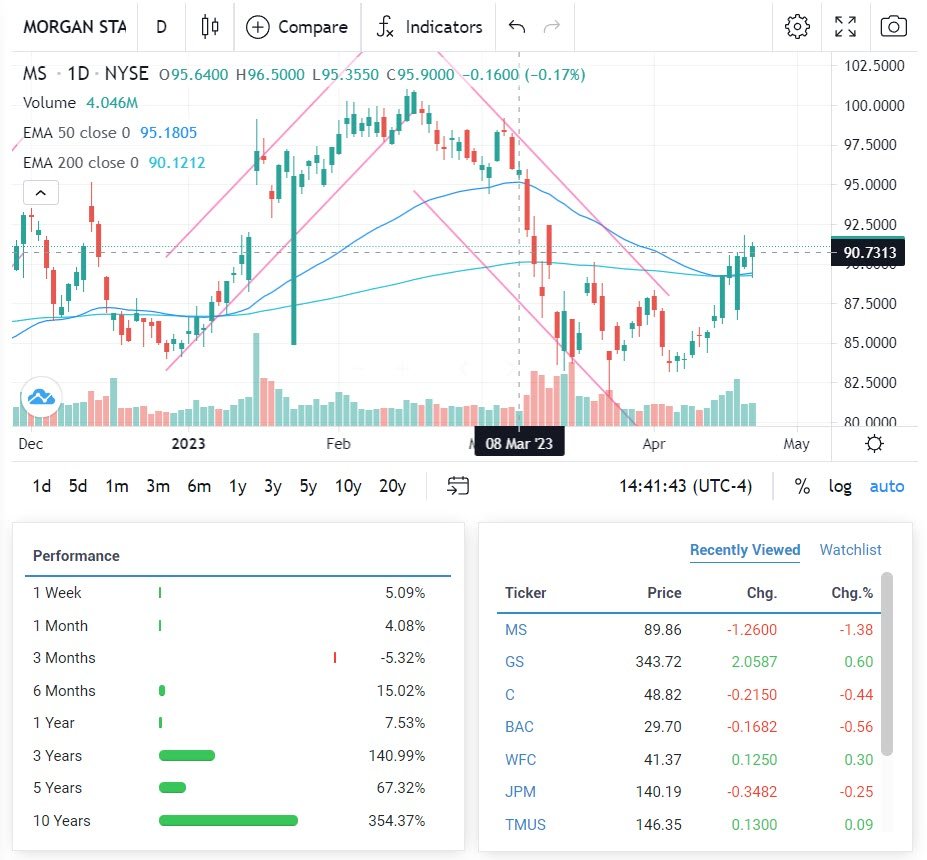

Morgan Stanley (MS)

Morgan Stanley (MS) reported an EPS of $1.70 for Q1-2023, higher than the consensus estimate of $1.66. The earnings forecast was $1.69. The poor performance of trading and investment banking weighed on investor sentiment. Quarterly net revenues came in at $14.52 billion, which is a 2% decrease from the same period the previous year. The top line came in higher than the $13.91 billion consensus estimate had anticipated. According to projections, total revenue was expected to be $13.47 billion.