STRONG EARNINGS FROM THE BANKS

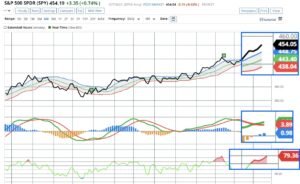

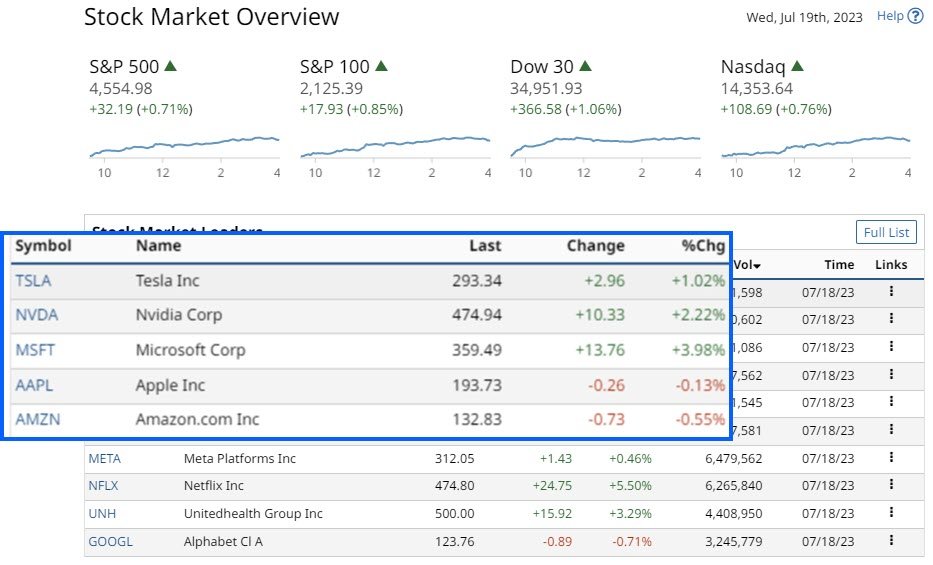

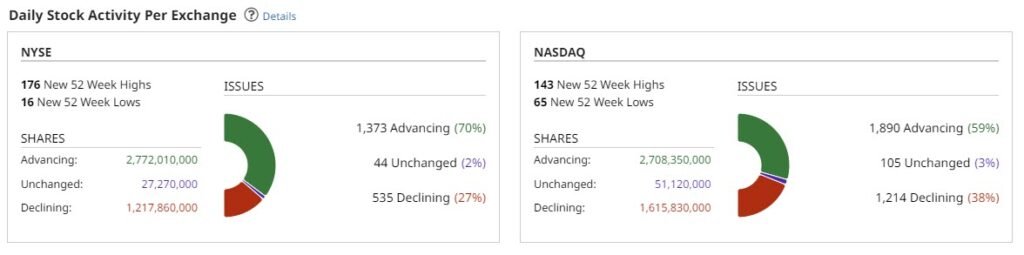

Stocks gained on Tuesday, with the S&P 500 and Dow Jones Industrials reaching 15-month highs. While the Nasdaq 100 is reaching an 18-month high. The earnings season is underway. There were strong second-quarter profits from Morgan Stanley (MS) and Bank of America (BAC). This spurred a rally in bank stocks and had the flow on effect of lifting the broader market. Thus the S&P 500 Index (SPY) rose +0.71%, and the Nasdaq 100 Index (QQQ) closed up +0.82%.

Bank stocks and their strong earnings, no surprises here. Not only did BAC and MS exceed analysts’ expectations in the second quarter. Also JPMorgan (JPM) and Citigroup (C) outperformed. In fact, with the exception of Citigroup, bank earnings exceed the earnings posted a year ago.

This should not be a surprise.

But the constant talk of a pending recession dampened expectations. If it were not for the turmoil in banks stocks in March due to the collapse of two banks the banks would be way ahead in terms of performance. Thus, bank stocks, in particular the major banks, are undervalued. BAC in particular trading below Book Value. There is a lot of catching up to do in the second half of 2023.

Subscribe to

loan balances at the major U.S. banks drive strong earnings

So far the earning reports for the banks indicate that loan balances at the major U.S. banks have continued to rise. This is despite a decline in loan applications nationwide since the first quarter. Behind the data could be a growing disparity in loan growth between the major banks and regional banks. The effects of higher interest rates are yet to fully feed through into the broad economy.

a sustained decline in loan applications?

This could set the stage for a sustained decline in loan applications for the rest of the year. At JPM, America’s biggest bank by assets, average loans rose 13% in the fiscal second quarter. This included a 19% gain in the Consumer and Community Banking (CCB) division.

U.S. economic data pushed T-note yields lower

On Tuesday, weaker-than-expected U.S. economic data on Tuesday pushed T-note yields lower. This helped stocks rally, boosting the broader stock market. Recent lower readings on inflation have lifted expectations that the Fed is nearing the end of its rate-hike cycle. The expectation of the markets is at 95% for a +25 bp rate hike at the next FOMC meeting in July. Markets expect a peak funds rate of 5.40% by year-end. Currently the effective Fed Funds rate is 5.08%.

Enough on the Fed and talks of a recession. Stocks are not listening and have not been listing since January. June retail sales in the United States grew +0.2% M.o.M. This missed forecasts of +0.5% M.o.M. Manufacturing output in the United States declined -0.3% M.o.M, falling short of forecasts for no change. The July NAHB housing market index in the United States increased +1 to a 13-month high of 56. This was in-line with expectations.

THE INVERTED YIELD CURVE

Bonds surged for a second day. There is now increasing confidence that around the world the central banks are nearing the end of an aggressive rate rise cycle. The deeply inverted yield curve in the U.S. has increased market fear of a recession. Most investors believe that an inverted yield curve has a near perfect track record of predicting recessions. Now, as inflation cools, a “plausible path” for the Fed to ease off on interest rates without triggering a recession opens up.

The Euro Stoxx 50 closed up +0.30%, the Shanghai Composite Index was down -0.37% and Japan’s Nikkei Stock Index closed up +0.32%.

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

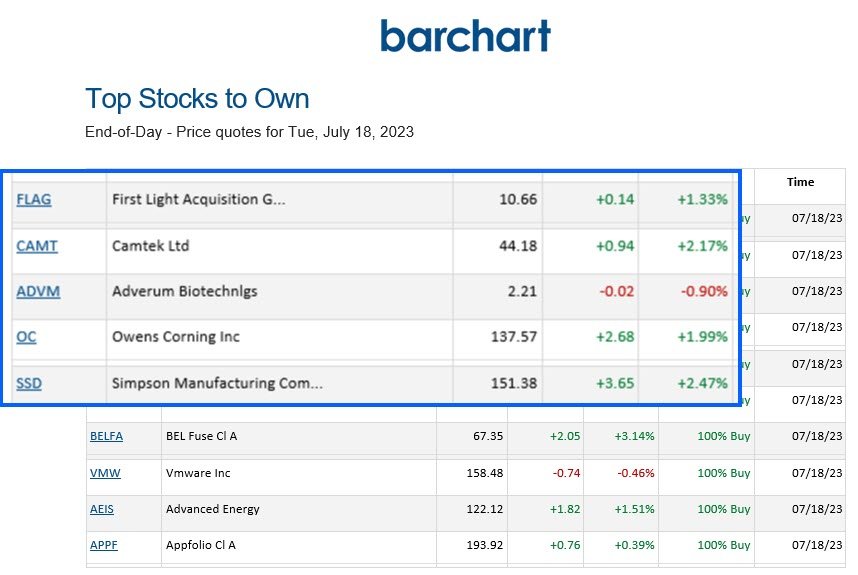

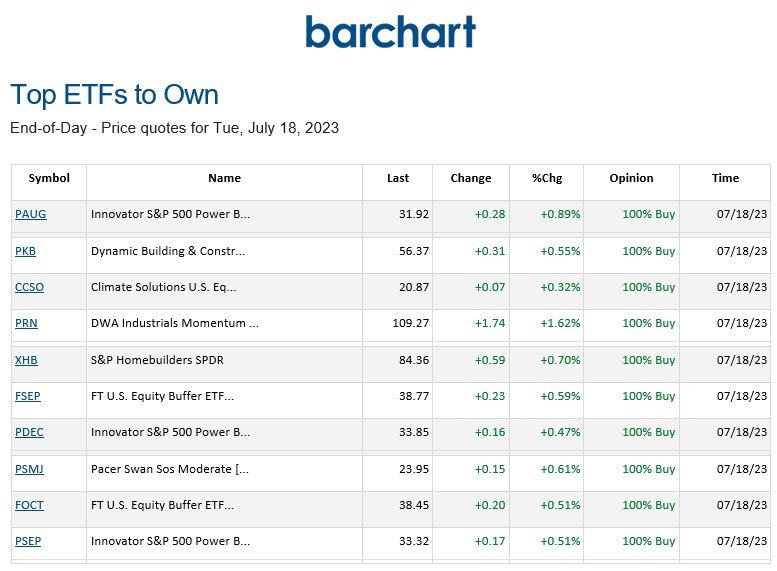

BARCHART: QUICK STOCK IDEAS

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

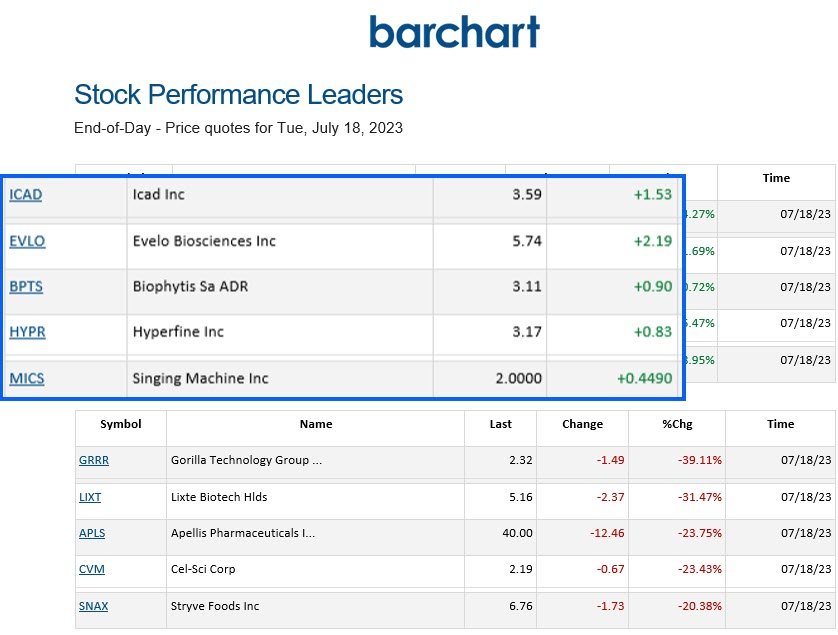

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.