Manage risk in your Stock Portfolio:

E-Micro Index Futures contracts

How to invest in Stocks, like a Pro using futures contracts, which is a financial agreement between two parties. They agree to buy or sell a specific asset or security (the underlying asset) at a future price and date. Trading in futures contracts Futures contracts are on organized exchanges. In the U.S. are the Chicago Mercantile Exchange (CME) and the New York Mercantile Exchange (NYME).

Investors trade in futures contracts for two objectives. To either manage risk or gain exposure in the underlying asset. A farmer sells futures contracts for the crops they expect to harvest. This locks in the price in the future to hedge against a potential drop in crop price. An investor may buy futures contracts on a stock index to gain broad exposure to the stocks.

All futures contracts have standardised terms and conditions. This includes the size of the contract, the delivery date, and the price of the underlying asset. Futures contracts are marked-to-market daily allowing the settlement of gains and losses. Done daily makes sure that both parties have enough margin to cover potential losses. A futures contract will have a minimum allowable price change. This is also known as its “tick size,” at which trading can occur.

Exchange-Traded Contracts Futures cover a wide variety of securities, including:

Stock indices:

An index futures contract is based on stock indexes. The S&P 500, NASDAQ-100, Dow Jones Industrial Average, and Russell 2000 all have futures.

Bonds:

Futures contracts can be based on fixed income securities. Examples are US Treasury bonds or corporate bonds such as the high yield bonds.

Currencies:

Futures contracts can be based on an exchange rate such as the euro/dollar or yen/dollar.

Commodities:

Futures contracts can be based on commodities, both resources and agricultural. Resource futures contracts include crude oil, natural gas, gold, silver, and copper. Agricultural products like wheat, corn, soybeans, and coffee.

Interest rates:

Futures contracts can be based on interest rate products such as Eurodollar futures. This allower investors to speculate on the future direction of interest rates.

Exchange-traded futures contracts offer investors a broad range of options to gain exposure. This could be to various securities and markets, either to manage risk or gain exposure to an asset.

THE FUTURES EXCHANGE

Beating the Pros, in managing risk in your Stock Portfolio, the Futures Exchanges make the trading of futures contracts possible. An exchange provides an efficient marketplace for investors to trade. As the counterparty, the exchanges are regulated by the CFTC. The Commodity Futures Trading Commission, handles the derivatives markets in the United States. The regulation of futures, swaps, and options.

Futures exchanges do many things:

Counterparty Risk:

The futures exchange act as an intermediary between buyers and sellers. They are the central clearinghouse for transaction settlement managing the counterparty risk.

Margin Accounts:

The exchange will set the requirements for margin accounts. They are funded before trading in futures can start. There are two margin accounts, the Initial Margin, and a Maintenance Margin. The required funds in the accounts will be calculated by the exchange. Making sure that both parties have enough margin to cover potential losses.

Standardisation:

For futures contracts to trade on an exchange must be standardised. This creates a transparent and equal trading environment for futures contracts. The exchange handles the creation the contracts. The standard terms and conditions of the futures contract include:

contract size,

underlying asset,

delivery date

settlement price

Price discovery:

The market price of the underlying asset is determined by trading activity. An exchange provides a marketplace where investors can trade. The prices become benchmarks for related financial instruments and physical assets.

Risk management:

Futures exchanges enable investors to manage risk by hedging or locking in prices. A strategy employed by commodity producers and investors.

Transparency:

Futures exchanges provide a transparent trading environment for futures contracts. Prices, volumes, and other key trading data are published. Market participants can then make informed, educated decisions about their trading strategies.

Futures exchanges play an important role in facilitating the trading of futures contracts. Done in a transparent and efficient marketplace for investors to use their strategies. This could be to either manage risk in or gain exposure in the underlying asset.

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

INDEX FUTURES CONTRACTS

Index futures are used by the the Pros, to manage risk in their Stock Portfolios. Futures contracts offer investors a flexible and cost-effective way to gain exposure. They are financial derivatives and the exposure could be to securities or commodities. The CME offers a wide range of stock index futures, including both US and international. Some of the most popular US stock index futures traded on the CME include:

S&P 500 Futures:

The underlying value is based on the S&P 500 Stock Market Index, which is made up of 500 large cap stocks.

Dow Jones Industrial Average Futures:

The underlying value is based on the Dow Jones Industrial Average. An index consists of 30 large cap stocks.

Nasdaq 100 Futures:

The underlying value is based on the Nasdaq 100 Index. The index includes 100 large cap stocks that trade on the Nasdaq Stock Market.

Russell 2000 Futures:

The underlying value is based on the Russell 2000 Index. The Index includes 2000 small cap stocks that trade on US exchanges.

Before trading in Index Stock Futures can start, the margin accounts are calculated. The two accounts are the Initial Margin and a Maintenance Margin. An investor could be trading Index Futures for one of two objectives. To manage Equity Market risk, thus shorting Futures. Or taking an Index Long position in Futures to gain market exposure.

STANDARD TERMS OF A CONTRACT

Index Stock Futures vary depending on the underlying Index, they are standardised. This is to allow efficient trading and includes contract size and expiration. Contracts are cash settled daily, most have quarterly expiration. The dates will be at the dates at the end of March, June, September, and December.

Here are specific standard conditions for an exchange-traded Index Futures Contract:

Contract size:

Each index futures contract represents a notional value of the underlying index. The S&P 500 E-Micro futures contract represents a notional value of $5, times the value of the S&P 500 Index.

Tick size:

The tick size for each index futures contract is determined by the exchange. The size can vary depending on the contract. For example, the tick size for the S&P 500 E-Micro futures contract is 0.25 index points.

Contract months:

Index futures contracts are available for trading in different contract months. Contracts are listed for the current month and the next two calendar months. Then quarterly thereafter.

Trading hours:

The trading hours for each index futures contract and can vary depending on the exchange. In general, trading is open for several hours each day, with a break for settlement.

Settlement:

Index futures contracts can be cash-settled or physical delivery of the securities. Most contracts are settled in cash. This means investors do not take physical delivery of the underlying securities.

Margin requirements:

To trade index futures contracts, investors must post two margins. An initial margin and a maintenance margin. The margin requirements are determined by the exchange, they are subject to market conditions.

Investors can make informed decisions trading Index futures, understanding these points.

![]()

Barchart is a financial data and technology provider that offers a variety of tools and resources for investors. For this article information about exchange-traded funds (ETFs) was researched using Barchart. A wide range of ETFs can be screened on Barchart by performance data, charts, news, and analysis. These are only some of the data that can searched for using Barchart. The user interface allows for a search for a specific ETF, or a perusal of the available options based on asset class, investing strategy, industry, and other criteria.

Barchart also features analysis and comparison tools for exchange-traded funds (ETFs). Users can compare the performance of several ETFs side by side, and screeners allow users to filter ETFs based on parameters like expense ratio, yield, and asset class. Investors may learn more about ETFs and other investment vehicles, as well as keep up with market news and analysis, through Barchart’s news and analysis and instructional materials.

In summary, Barchart can be a helpful tool for anyone who want to learn more about ETFs, conduct in-depth analysis, and then make educated investment decisions.

I am a member of the Barchart Affiliate Program, please use the attached link if you would like the Subscribe.

Subscribe to

E-MICRO INDEX FUTURES CONTRACTS

E-MICRO FUTURES

The micro S&P500 and the NASDAQ 100 micro are two examples of stock index futures traded on the CME. The micro S&P500 is a cash-settled contract that is based on the S&P 500 Index. The contract is a measure of large-cap US stock market performance. The NASDAQ 100 micro is a cash-settled contract based on the NASDAQ 100 Index. A measure of large-cap US tech stock market performance.

Both contracts are popular with investors, speculating on the direction of US stocks. They are leveraged, meaning that both gains and losses are magnified. As they are cash-settled, investors do not take possession of the underlying assets.

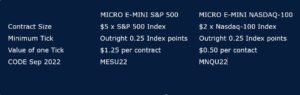

Each Index Futures Contract will have standard conditions. This includes contract size, minimum tick fluctuation, and the dollar value of one tick. Here is a side by side comparing two Index Futures Contract the Micro E-micro S&P 500 and the Micro E-micro NASDAQ 100.

NASDAQ E- MICRO

The NASDAQ 100 E-Micro futures contract is used in the example below. To show specific standard conditions and trading strategies. The contract is traded on the CME in Chicago

Size:

The NASDAQ 100 E-Micro futures contract represents a notional value of 1/10th of the NASDAQ 100 Index. So, if the NASDAQ 100 Index is trading at 14,000, then the notional value of one contract would be $1,400.

Tick size:

The tick size for the NASDAQ 100 E-Micro futures contract is 0.25 index points. This means that the contract can move in increments of 0.25 index points, and no smaller. The value of each tick is $0.25.

Months:

The contract months for the NASDAQ 100 E-Micro are March, June, September, and December.

Trading hours:

The trading hours for the NASDAQ 100 E-Micro futures contract are Sunday to Friday. This is from 6:00 pm to 5:00 pm Eastern Time (ET) the next day, with a one-hour break each day from 5:00 pm to 6:00 pm ET.

Settlement:

The settlement for the NASDAQ 100 E-Micro futures contract is cash-settled. The contract is settled in cash based on the final settlement value of the NASDAQ 100 Index.

Margin:

To trade the futures contract, investors are required to post the two margins. The exchange with calculate the initial margin and maintenance margin. They are subject to change based on market conditions.

Strategies:

Investors can use the NASDAQ 100 E-Micro contract to take both long and short positions. The short position is used to hedge against potential losses in a portfolio of NASDAQ 100 stocks.

The NASDAQ 100 E-Micro futures provides investors with a flexible way to gain exposure. The NASDAQ 100 Index, one of the most widely followed equity indices in the world.

CRACKING THE CODE LIKE A PRO

As Futures Contracts are Exchange Traded, they have a Ticker Code and they are standardised contracts to facilitate trading. An example of a Code for a Futures Contract, the CME trades the E-Mini S&P 500 Contract.

Defining the Code ESU23

This signifies the E-mini S&P 500, September 2023 Contract.

If you wanted to trade the December 2023 Contract the Futures Code would be ESZ23.

The Contract – EN = E-mini S&P 500

The Month – U = September, December = Z

The Year – 23 = 2023

WHAT IS HEDGING?

An example of hedging risk a portfolio of U.S. stocks, portfolio AuM USD 10 million. The S&P500 is currently trading at 4,000.

The investor has continued concerns over the short-term. This based on the level of inflation, rising Interest Rates and the risk of a possible recession. Further, the bank sector is in crisis as two banks have collapsed and there is a general run on deposits.

The investor will use the Micro E-mini S&P500, using the September 2023 Futures Contract. The Ticker is MESU23. First the Hedge Ratio needs to be calculated this is the number of MESU23 contracts that need to be sold.

Hedge Ratio = Portfolio Value / Notional Value = Number of Contracts

Hedge Ratio = 10,000,000 / (5 X 4,000 = 20,000) = 500

The number of MESU23 contracts to be sold is 500.

The beat has been a correct one as S&P500 falls by 20% reaching 3,200.

The investor decides to close the position by Buying the 500 MESU22 contracts.

Thus, the profit would be.

4,000 – 3,200 = 800 Index Points and each index point = $5

Per contract, 800 x $5 = $4,500

Multiplied by the 500 contracts covered or bought.

Fully hedged the Profit = 500 *$4,000 = $2,000,000

Once a position has been established, the investor needs to monitor it closely. If the value of the index increases, your losses will increase as well. An investor can close out a position at any time.

EXPLAINING A TICK IN MANAGING RISK

In futures trading, a tick is the smallest possible price movement that a contract can make. For the S&P 500 E-Micro futures contract, the minimum tick outright is 0.25 index points. This means that the contract can move in increments of 0.25 index points, and no smaller.

For example, if the price of the contract moves from 4500.00 to 4500.25, that would be a one-tick move. Similarly, if the price moves from 4500.25 to 4500.50, that would also be a one-tick move.

The value of one tick for the S&P 500 E-Micro futures contract is $1.25. This means that for every one-tick move in the price of the contract, the value of the contract changes by $1.25.

For example, if you buy one contract at a price of 4500.00. If the price moves up by one tick to 4500.25, the value of your contract will increase by $1.25. If you sell one contract at a price of 4500.00 and the price moves down by one tick to 4499.75. The value of your contract would increase by $1.25.

BEWARE LEVERAGE IS EVERYWHERE

As discussed, future are leveraged and both gains and losses are magnified,

Exchange-traded futures contracts offer investors a range of options to gain exposure. This could be various indexes and securities. Investors can manage risk and speculate on price movements across various asset classes.