A BUBBLE IN China’s Real Estate SECTOR

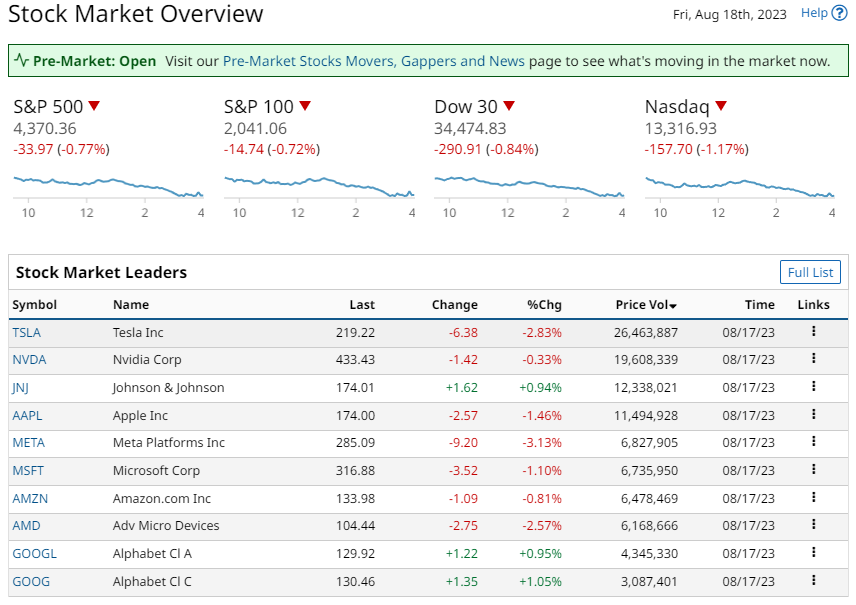

China’s Real Estate sector accounts for around 25% of Chinese GDP. The S&P 500 futures are pointing down around 20 points, selling at 0.5% below fair value. While over at the Nasdaq, the Nasdaq 100 futures are down 0.8% or 118 points below their fair value.

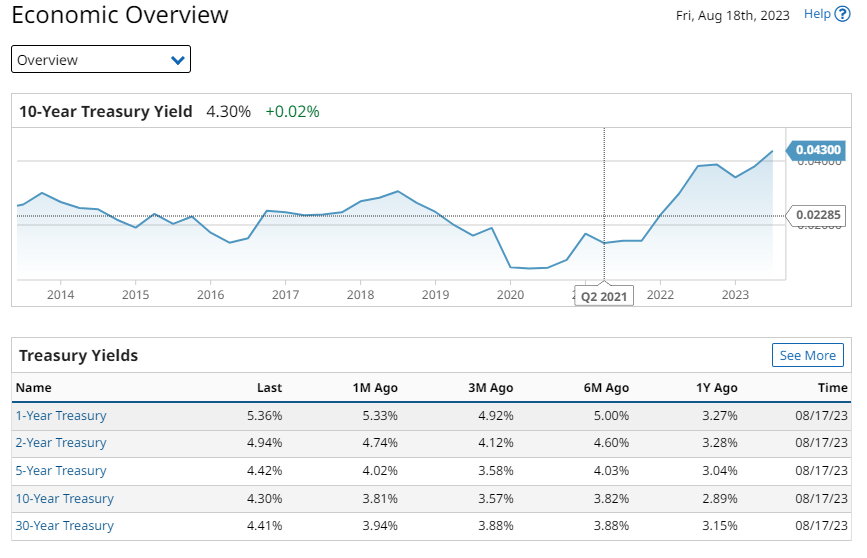

Stocks on Thursday closed moderately lower. The S&P 500 posted a 7-week low, and the Nasdaq 100 dropping to a 6-week low. Rising U.S. bond yields pressured stocks after the 10-year T-note climbed to a near 10-month high. Stocks had early support Thursday on signs that the U.S. economy can achieve a soft landing. Weekly jobless claims fell more than expected. Then the Aug Philadelphia Fed business outlook survey rose to a 16-month high.

U.S. stock indexes had some positive carryover from a slight recovery in Chinese stocks. China is the world’s second-largest economy. There are questions about the Chinese Real Estate sector. Construction accounts for around 25% of Chinese GDP. Thus, any reverberations in real estate is in a predicament for the economy.

Currently the property market stands at the heart of its troubles. The Shanghai Stock Index rebounded but this week, Chinese stocks continue to be under pressure. This is due to continued liquidity concerns in China’s shadow banking system. These concerns intensified after Zhongrong International Trust, missed payments on its investment products. This is a unit of Zhongzhi Enterprise Group,

The S&P 500 Index ($SPX) (SPY) Thursday closed down -0.77%, and the Nasdaq 100 Index (QQQ) closed down -1.08%.

Subscribe to

A goldilocks growth story

Based on the following economic data the markets are discounting the odds at 11% for a +25 bp rate hike. The next meeting of the FOMC is September 20. This rises to 41% for a +25 bp rate hike at the November 1 FOMC meeting.

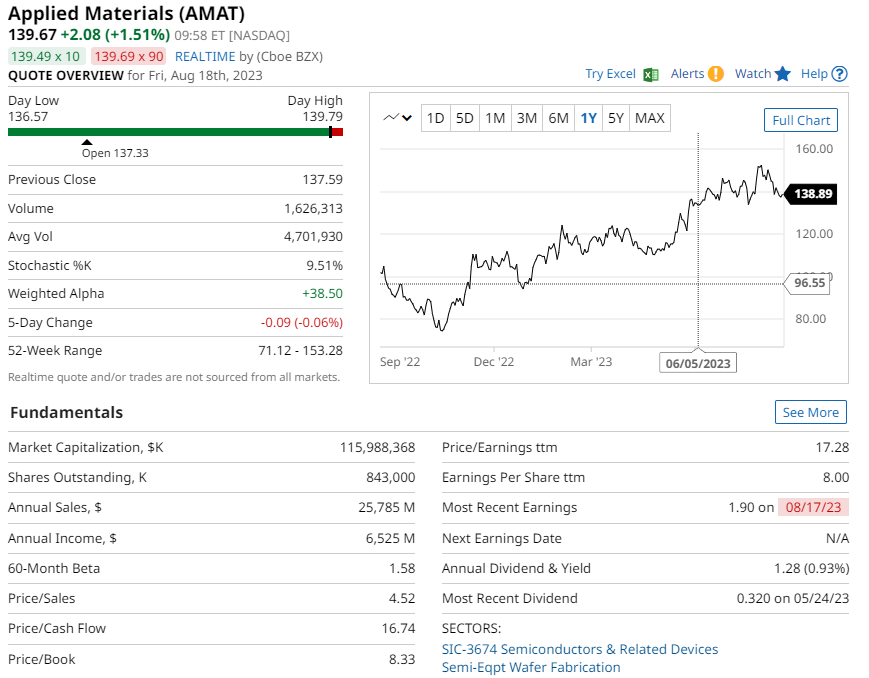

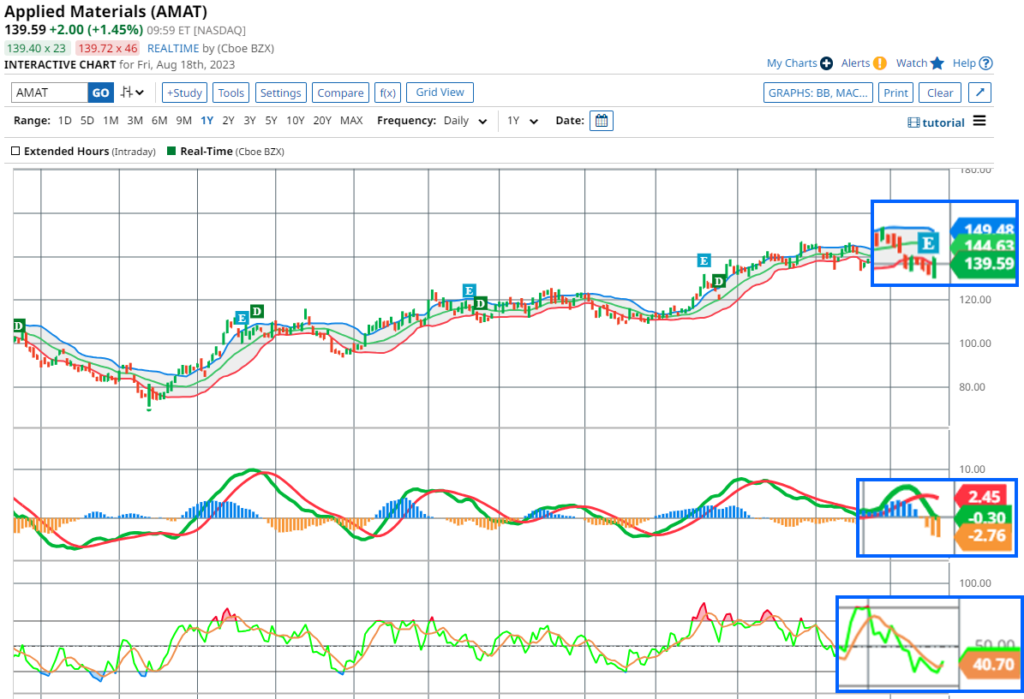

Applied Materials (AMAT)

Increases Sales Forecasts for AI and Internet-Connected Devices

For Q3, AMAT announced an EPS of $1.90 and $6.43 billion in revenue. This beat analysts’ expectations of $1.73 per share on $6.16 billion in revenue. Applied Materials’ stock increased in pre-market trading.

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

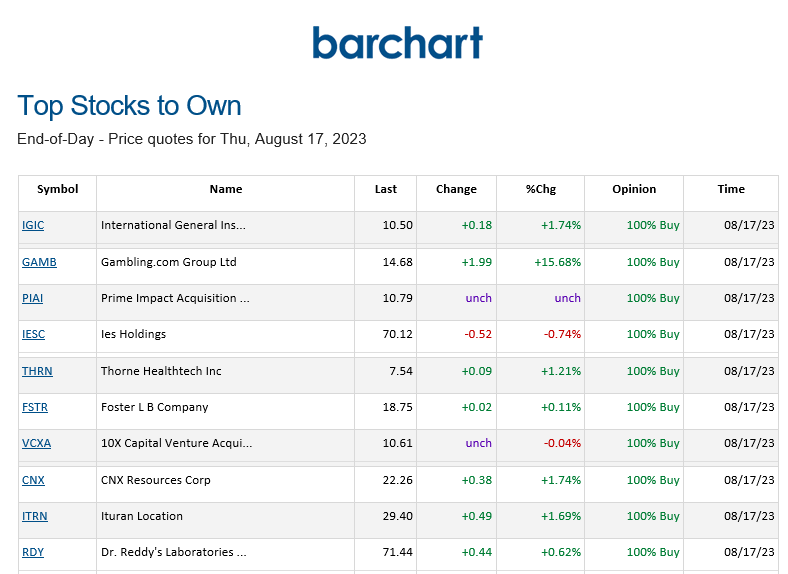

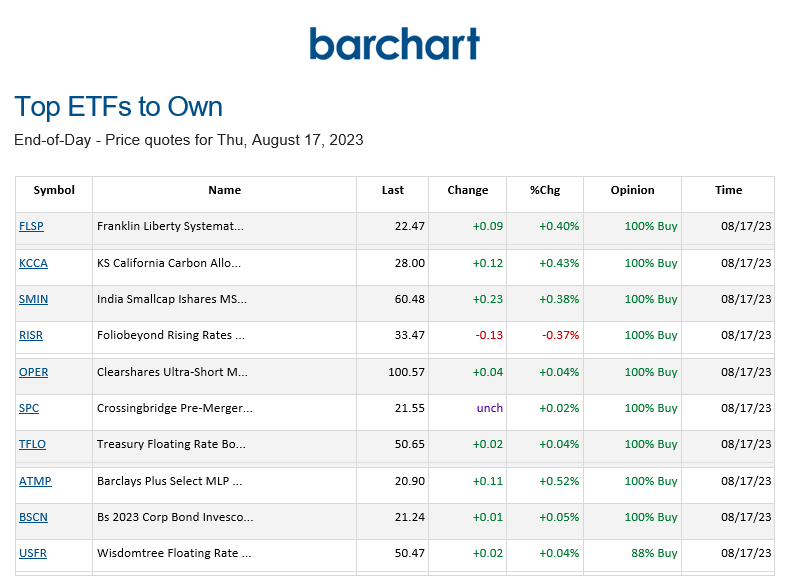

BARCHART: QUICK STOCK IDEAS

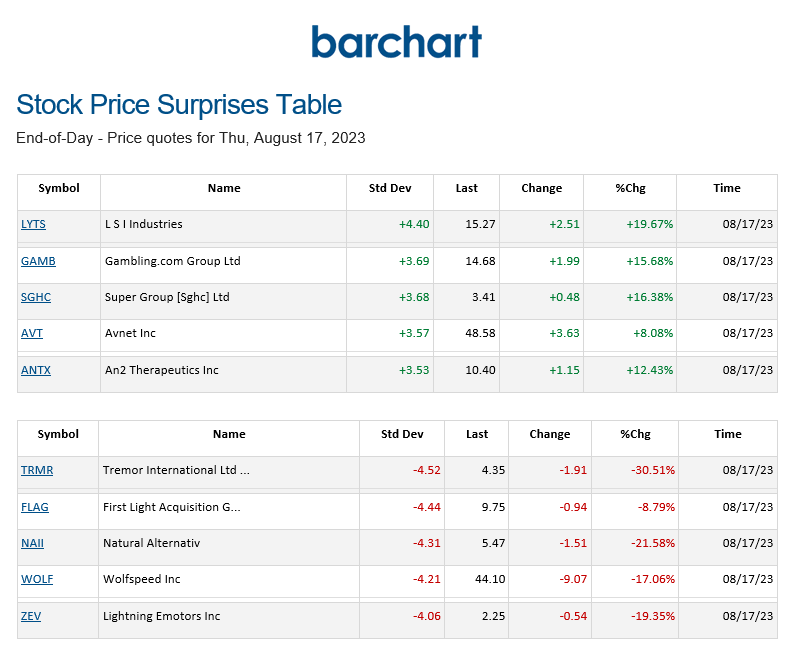

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

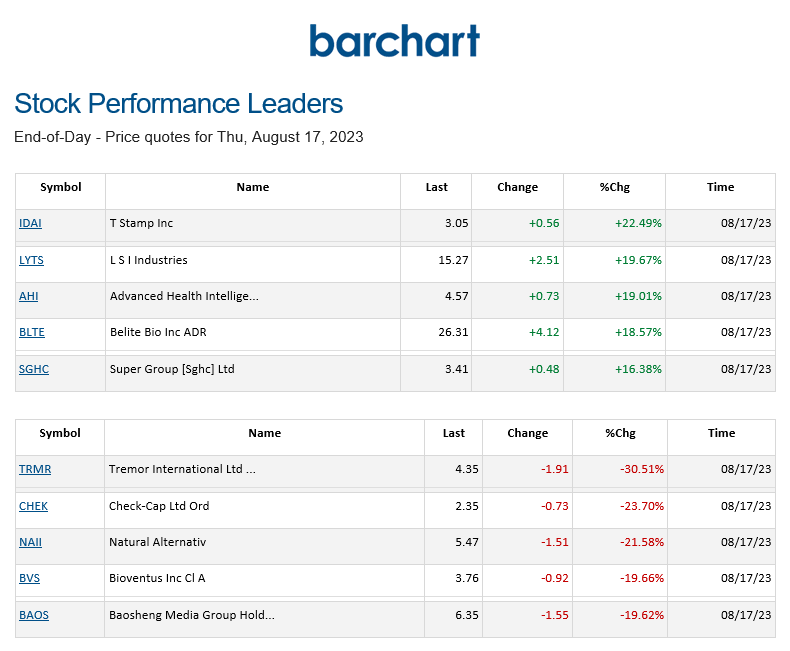

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.