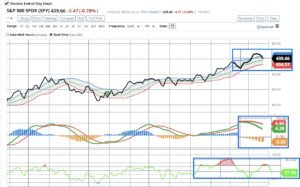

HIGHER BOND YIELDS, A PROBLEM FOR STOCKS?

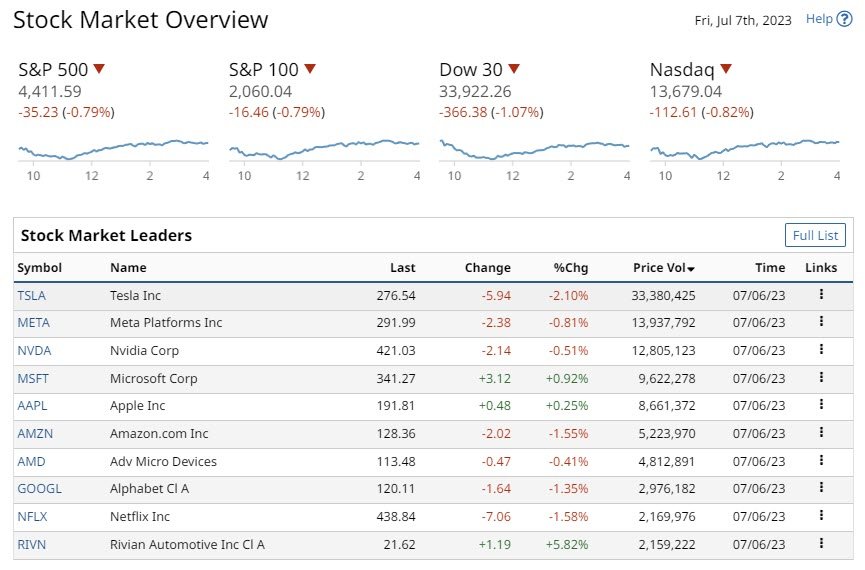

Stock indexes Thursday closed moderately lower, both stocks and Treasuries fell on Thursday. This followed the release of U.S. economic data for June. All in all this turned out to be stronger-than-expected. The ADP employment survey revealed that companies added the most positions in June.

In total companies added +497,000, thus exceeding predictions of +225,000. This now at the highest rate for 16 months. The U.S. trade deficit in May was negative $69.0 billion, compared to a negative -$74.4 billion in April.

The data for June indicated that the U.S. ISM services index increased more than predicted. The June ISM services index increased by +3.6 points to a 4-month high of 53.9. Thus exceeding the consensus estimate of 51.4. This led to increased concerns that the FOMC will raise interest rates more aggressively.

Weekly initial jobless claims in the United States increased by +12,000 to 248,000. This data point was somewhat higher than the +245,000 expected. While weekly continuing claims declined -13,000 to a 4-month low of 1.720 million. Thus indicating a healthier labor market than the 1.737 million expected.

The S&P 500 Index (SPY) fell -0.79%, and the Nasdaq 100 Index (QQQ) closed down -0.75%.

Subscribe to

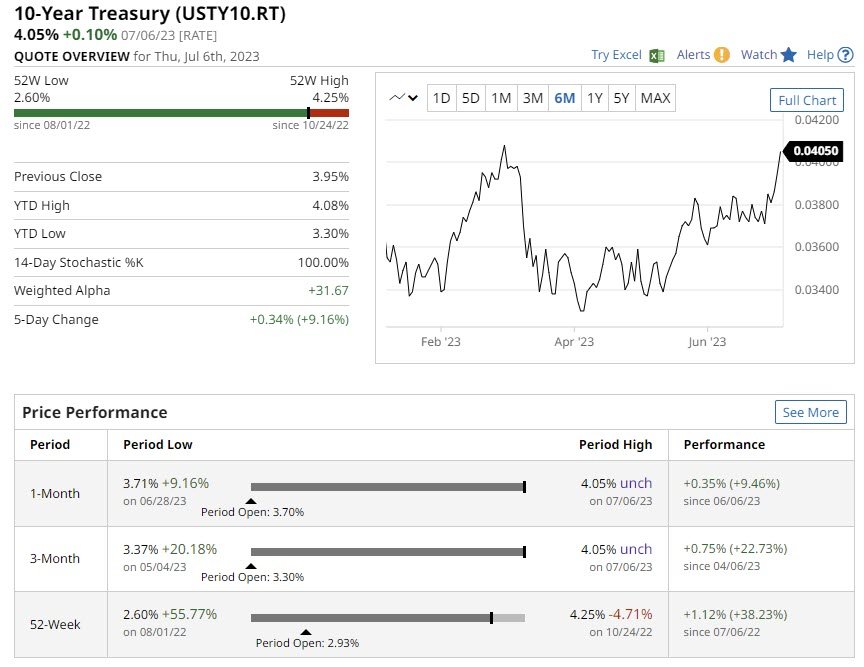

BOND YIELDS AND the Fed’s hawkish statements

UK bond yields are around a 14-year high

Keep in mind expectations for future EPS growth

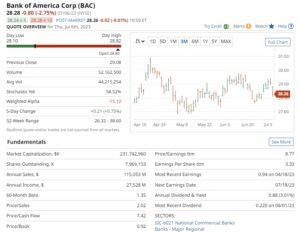

Last Friday Federal Reserve announced that the banks sailed through the stress tests. Even under a scenario of a harsh recession. Following the announcement, the banks JPMorgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC). Also, Goldman Sachs (GS) and Morgan Stanley (MS) all increased their third-quarter dividends.

Bank of America (BA), followed with an increase to its quarterly common stock dividend. The dividend will be raised to 24 cents per share from 22 cents per share beginning in the third quarter of 2023.

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Titan International (TWI)

The Top Stock Pick for Thu, July 6, 2023

The 20-100 Day MACD Oscillator for Titan International issued a New Buy Signal, with an Entry Price of $11.07.

The rally in mega cap tech stocks

Driving the stock markets in 2023, apart from earning has been a combination of the following. One key one has been the end of the 15-month long rising interest rate cycle. There is the growing expectation of the Fed adopting a more dovish posture to monetary policy. There is possibly another 50 basis points in rises in the pipeline. But while inflation remains outside the target range don’t count your chickens, so to speak.

Subscribe to

MARKET MOVERS

Even with the Nasdaq 100 falling -1.36%, Semiconductors stocks dominated the Nasdaq 100. Gains ranged from +1.5% to +2.8%. GLOBALFOUNDRIES (GFS), Lam Research (LRCX), Applied Materials (AMAT). Qualcomm (QCOM), ON Semiconductors (ON), and NXP Semiconductors were all up on the day.

The Euro Stoxx 50 finished slightly higher +0.21 percent higher, the Shanghai Composite index closed down -1.48%..

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

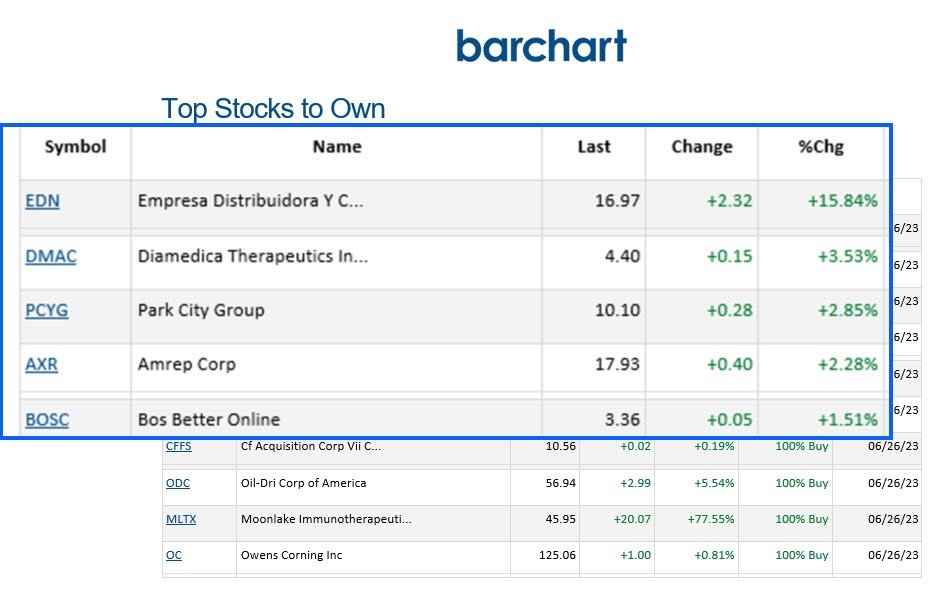

BARCHART: QUICK STOCK IDEAS

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.