Global deflation be warned it’s a risk

Signs of global inflation slowing were positive for the world’s Equity Markets. But be careful, the very early signs of global deflation are out there. Global deflation, combined with the Ukraine War, another potential war would be catastrophic. The Fed’s favourite inflation index, the PCE core deflator climbed. But this was at the slowest pace in two years, +3.9% year on year in August. This is of course a positive sign.

This was on the back of the September CPI figure in the Eurozone which fell to +4.3% year on year. This was down from +5.2% year on year in August. Thus, certainly positive news as it was the slowest rate of increase in nearly two years. Global bonds rallied on the news and the stock markets turned into an upbeat mood.

restrictive stance of monetary policy

There is still the wide expectation that a restrictive stance of monetary policy will continue for some time. But and it is a big but the very early signs of global deflation are out there. The world’s central banks must be aware of this. Keep in mind the lag time of increases in interest rates on the real economy is around 3 months. The expectation of the Financial Markets are a 19% chance that the FOMC will raise the funds rate by +25 basis points at the next FOMC meeting. The next meeting is set for November 1.

currently sits at around 15 basis points below

Then a 39% possibility that the rate will be raised by +25 basis points at the December 13 meeting. Also keep in mind will the Fed set the Fed Funds Rate but the market determines the actual or effective rate. This currently sits at around 15 basis points below the Fed Funds rate. This adds to the increasing speculation or expectation the FOMC will begin decreasing rates. Thew most likely scenario is that this will commence in the second half of 2024. All based on the continued forecast that the US economy will experience a recession.

All of my Blog Posts contain Affiliate Links to products or services that are known to me. I may receive art any time a commission if a purchase or subscription is made via an Affiliate link.

Subscribe to

COULD GLOBAL DEFLATION START IN THE EUROZONE

In Europe, interest rates are likely to remain stable for a lengthy period of time according to the ECB. All depends on inflation. As mentioned, in September the Eurozone the CPI declined to +4.3% year on year. Down from +5.2 year on year in August, marking the smallest rate of increase in over two years. In addition, September core CPI declined to +4.5 percent year on year.

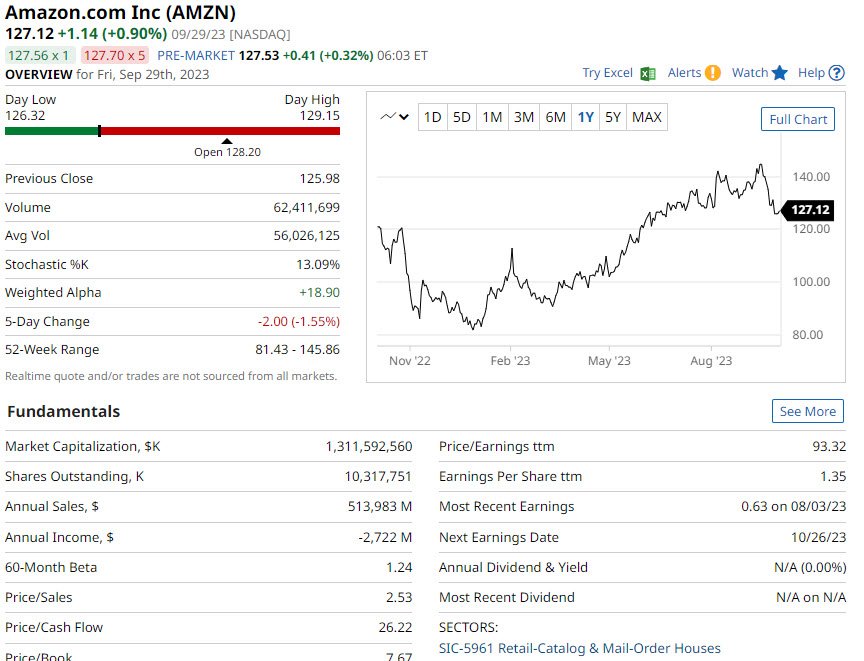

AMAZON (AMZN)

Amazon (AMZN) fell 4% on Tuesday after being formally sued by the FTC and 17 states. AMZN is alleged to be engaging in anticompetitive actions to protect its monopoly position in on-line retailing. The lawsuit claimed that the e-commerce giant’s actions barred competitors from lowering prices. Then, overpaid sellers, and prevented rivals from competing fairly. Amazon controls about 40% of the e-commerce business. Thus this is a huge antitrust case.

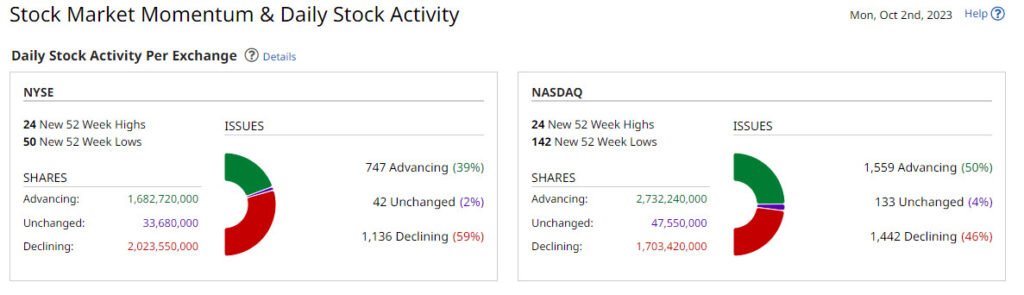

WHAT IS NEXT FOR THE MARKETS

On to general aspects for the markets as if the early signs of global deflation was not enough. The fast-approaching shutdown of the U.S. government has been averted for the moment. Still, the near certainty of a US government shutdown is a negative issue for stock markets. China’s Vice Premier He Lifeng and Foreign Minister Wang Yi are exploring possible visits to Washington. They are preparing for a prospective summit between President Xi Jinping and President Biden.

Personal spending in the United States increased by +0.4 percent month on month in August. This was below the estimated +0.5% month on month. Personal income increased by +0.4 percent month on month in August, in line with expectations. The University of Michigan’s consumer confidence index was revised up by +0.4 to 68.1. This was above forecasts of no change at a steady 67.7. The September MNI Chicago PMI in the United States plummeted -4.6 points to 44.1. This fell way short of estimates of 47.6.

Bond yields in the United States and Europe were mixed on Friday. The 10-year T-note yield increased by 0.8 basis point to 4.58%. In Germany, the 10-year German bund yield dropped -9.1 basis points to 2.84%. While in the UK, the 10-year UK gilt yield declined by 4.7 basis points to 4.44%.

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

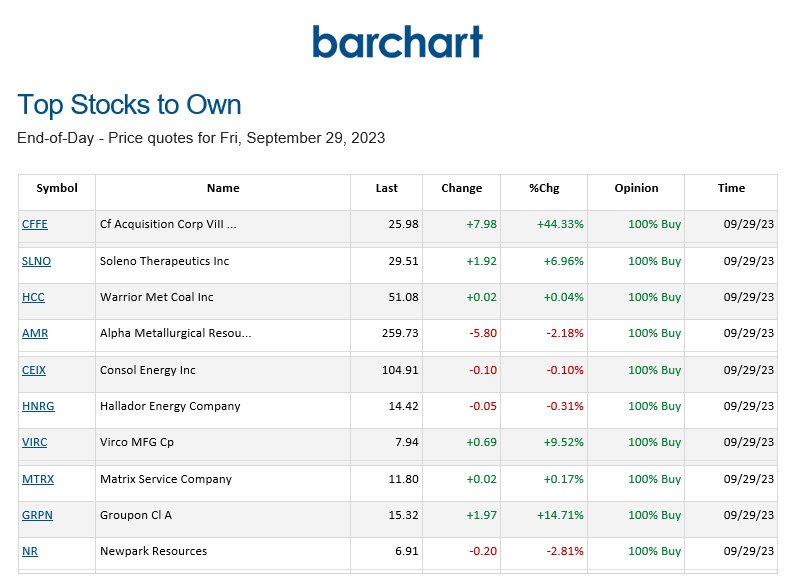

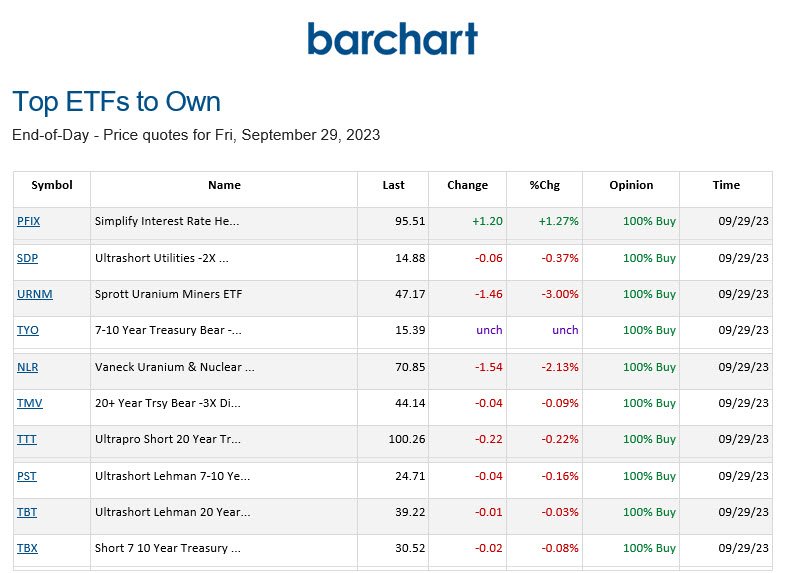

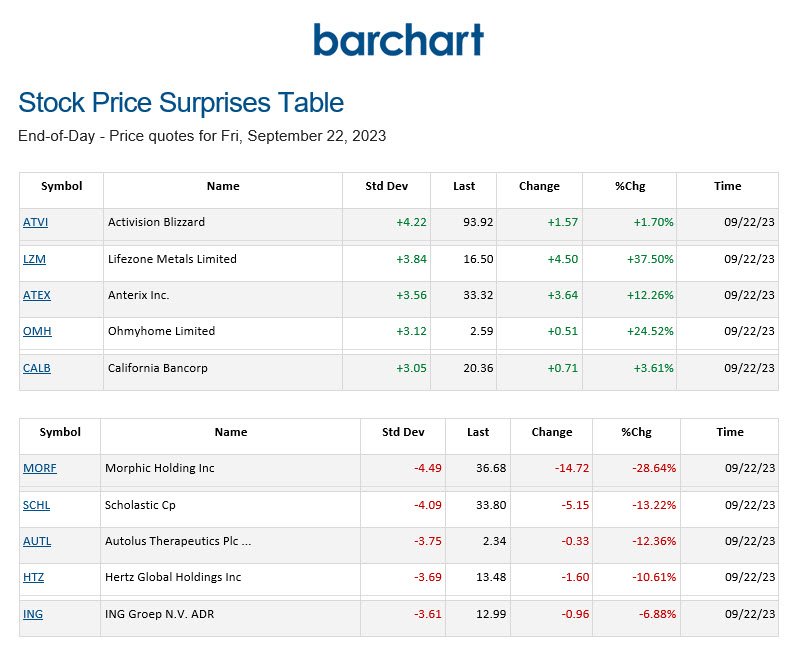

BARCHART: QUICK STOCK IDEAS

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

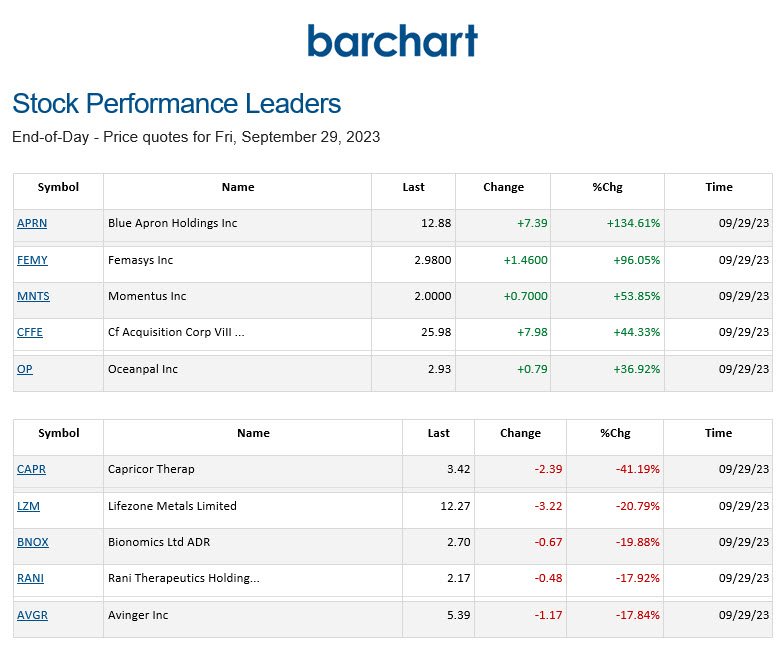

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.