BANK CAPITAL REQUIREMENTS

All eyes this week were focused on the FMOC meeting at the Fed. As expected, the FOMC raised by 25 basis points to hit a 22-year high. The benchmark rate moved from 5.25% to 5.50% Keep in mind the effective rate is less at around 5.32%. It is unclear if the new bank capital requirements will have an impact on the effective rate. The Fed made it very clear that the inflation fight continues, despite CPI sitting below 3.0%. The Fed Chair urged caution in particular in relation to the prospects for the American economy.

On Thursday, stocks gave up early gains and slightly declined, 10-year T-note yields rose above 4.0%. This was more a Japan issue rather than a U.S issue. It is believed that the BOJ could adjust its yield curve management strategy. at Friday’s policy meeting. If this were to occur the Japanese stock markets could fall as long-term yields could go higher.

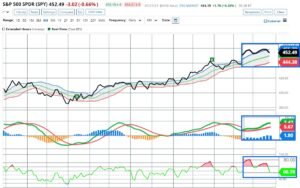

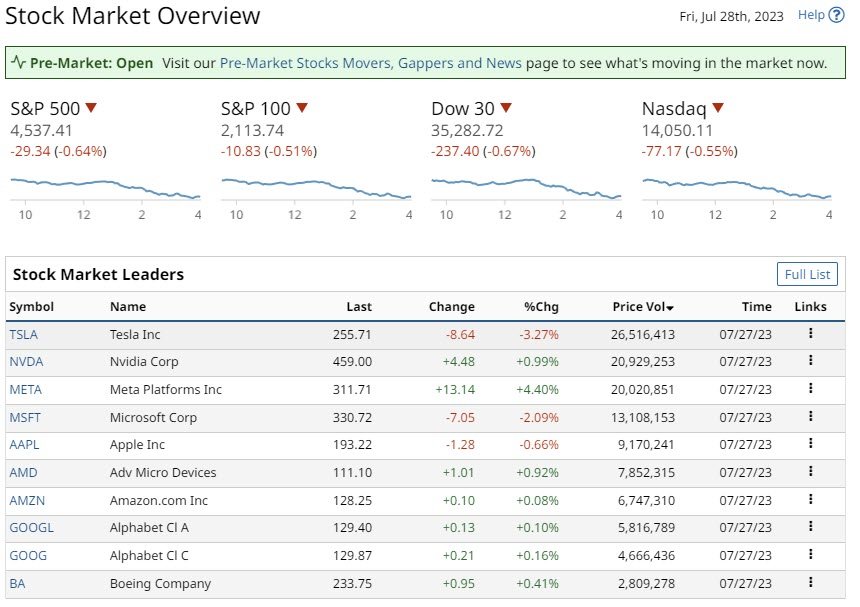

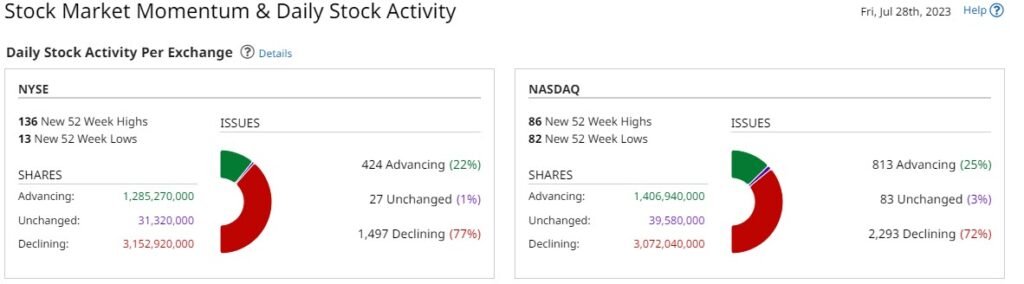

The S&P 500 posted a nearly 16-month high on Thursday. While the Nasdaq 100 posted a 1-week high on the back of strength in the technology sector. The earnings season is now in full swing and is off to a solid start. Around 80% of the companies that have already released their results, exceeded profit forecasts.

Thus, despite all the pessimism and the persistent calls for a recession, earnings on the whole have been solid. META reported Q2 revenue that was higher than anticipated, and this pushed the stock price around 4% higher. The S&P 500 Index (SPY) closed down -0.64%. The Nasdaq 100 Index (QQQ) closed down -0.22%.

Subscribe to

U.S. Q2 GDP increased more than anticipated

The U.S. Q2 GDP increased more than anticipated, driven by stronger-than-expected consumer spending. U.S. Q2 GDP increased by +2.4% on an annualized quarter on quarter basis, exceeding estimates of +1.8%. In Q2 personal consumption increased by +1.6%, exceeding the +1.2% forecast. Additionally, the Q2 core PCE price index increased more slowly than anticipated. PCE was better than expected at +4.0% quarter on quarter and the slowest rate of growth since Q1 2021. In Q2 the core PCE price index fell to +3.8% from +4.9% in Q1 on a quarter-on-quarter basis.

The Federal Deposit Insurance Corporation (FDIC)

The Federal Deposit Insurance Corporation (FDIC) is looking to impose tighter bank capital requirements on U.S. banks. This is the response to the regional banking crisis earlier this year. In my view the FDIC has to impose stricter capital requirements on banks. This will impact on the bank’s shareholder base. The increased capital requirements could cause an uproar among hedge funds and private equity investors.

The Fed and the FDIC are saying enough is enough with the ongoing attitude of leverage up on risk. Or risk management, who cares, remember we will be bailed out as we are too big to fail. Over the past two decades the banks have acquired the wrong shareholder base. Things are about to change. The FDIC’s new bank capital rule proposal may eliminate big banks’ excess capital. This will require banks to build up capital. Thus, banks will cut dividends and share buybacks for shareholders.

The Euro Stoxx 50 closed up +2.32%. The Shanghai Composite Index today closed down -0.20%. Japan’s Nikkei Stock Index closed up +0.68%

VIDEO: MARKET CYCLE

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

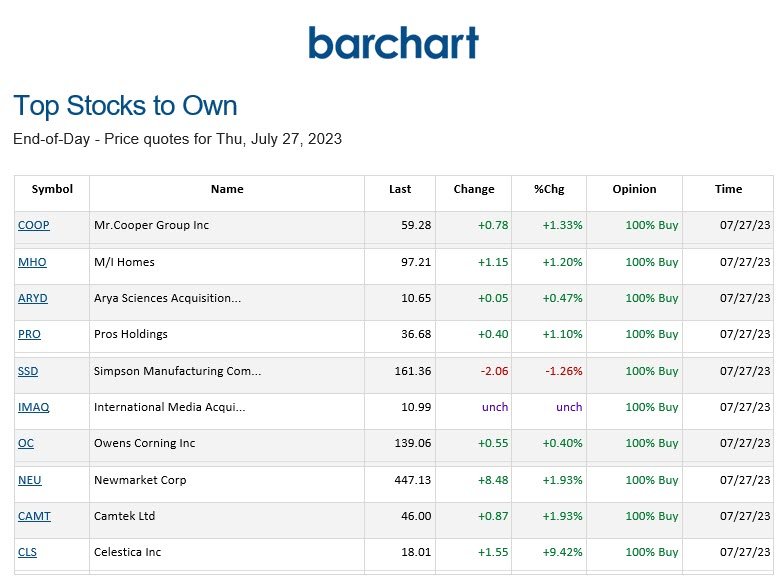

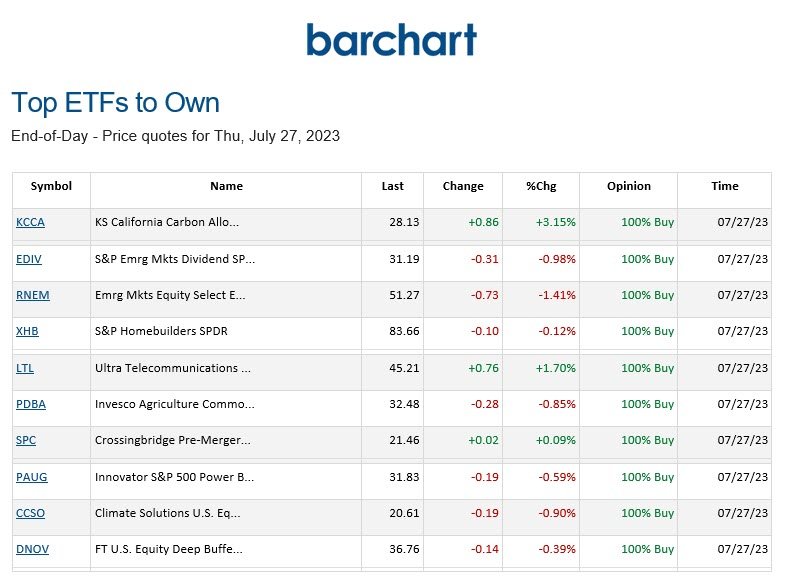

BARCHART: QUICK STOCK IDEAS

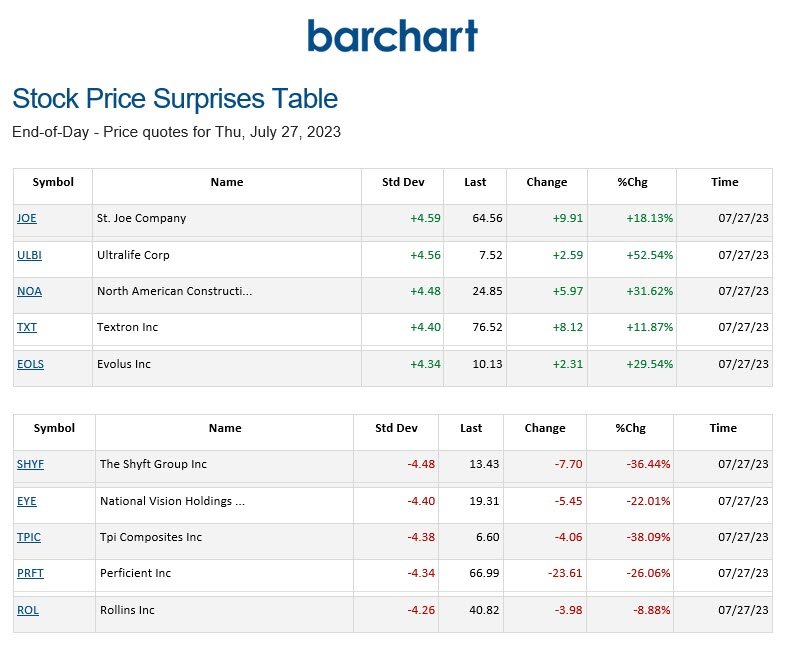

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

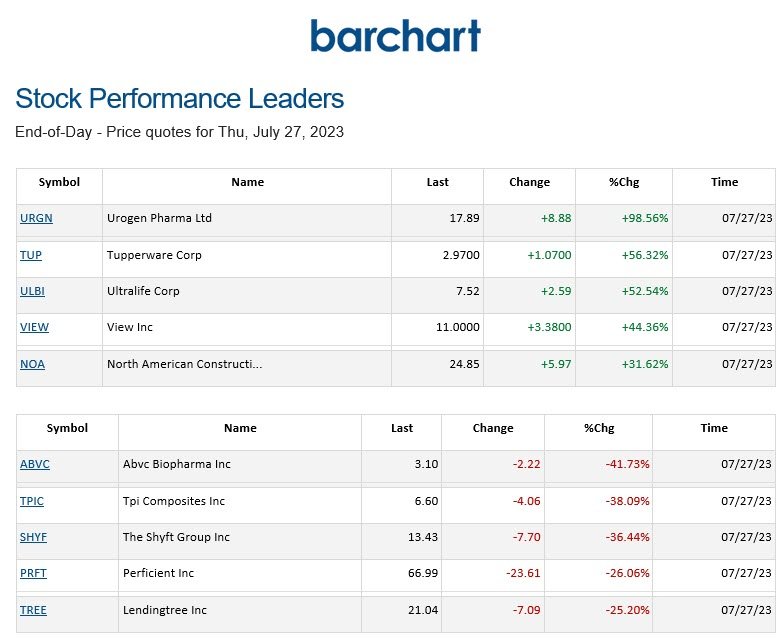

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.