equity INDEXES HIGHER, NOW WHAT?

Subscribe to

NASDAQ equity indexes

Bull Market and stock indexes

But what is next?

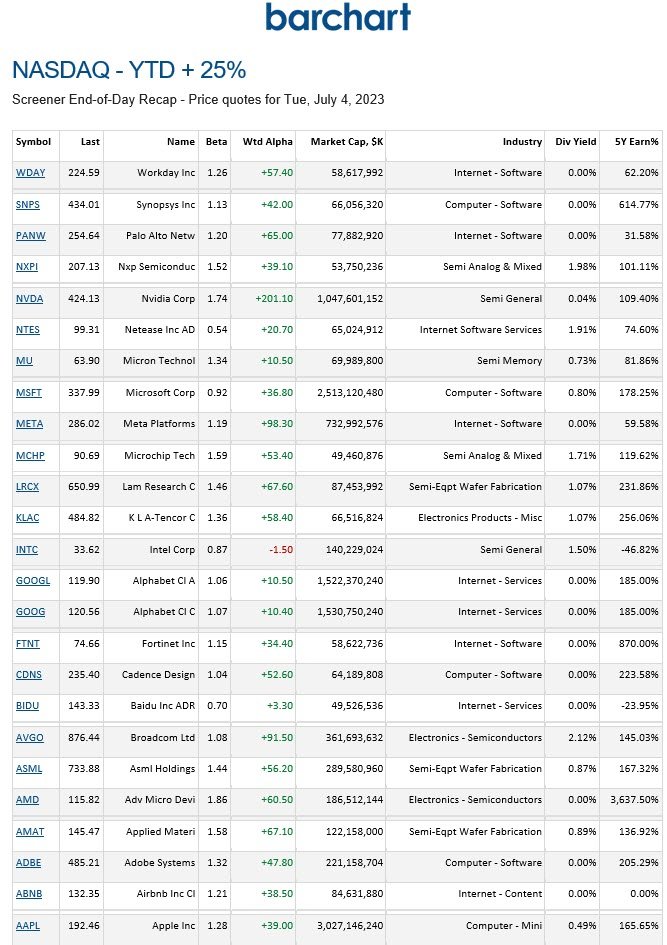

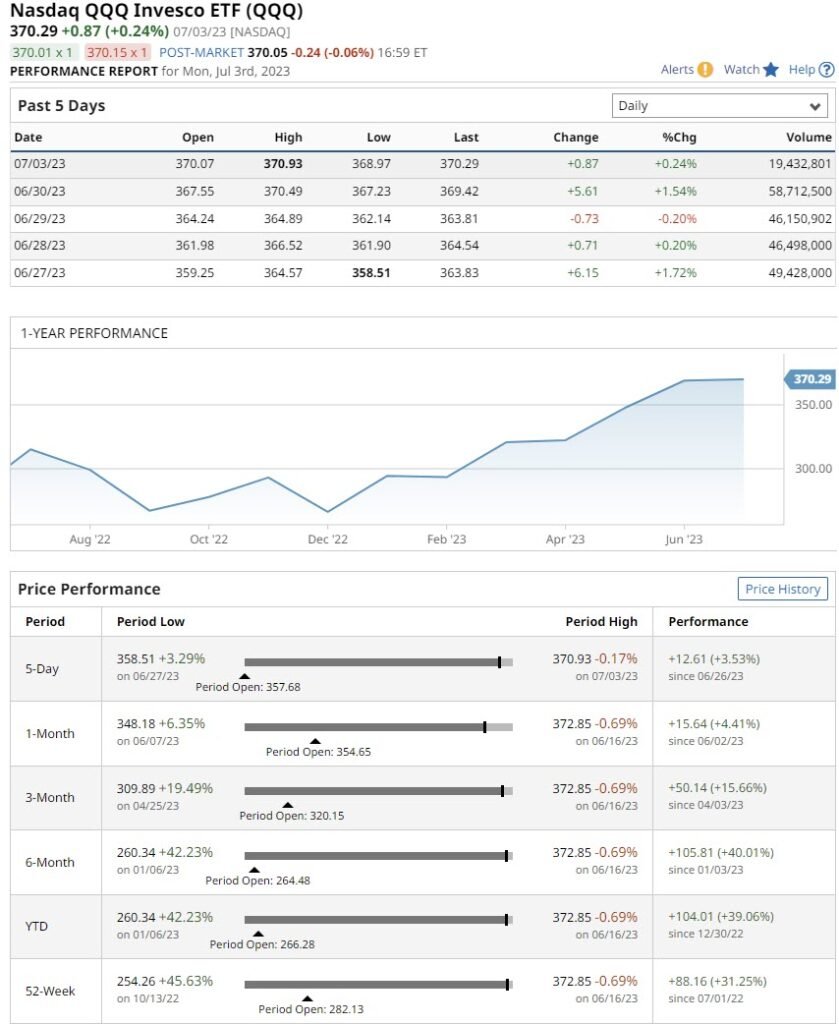

Investors are keen to see the solid returns of U.S. stocks continue. They are also feeling some frustration at market experts who have been way behind the market. Some are still calling for a recession, stating they have a conservative view. The market returns in 2022 were disappointing and at that point were priced in for a recession. At this point the market is pricing in returns for the end of 2024. The market always does this. Remember this “Equities lead earnings and earnings lead the economy”.

It is worth noting, be advised against premature exuberance, expecting the same performance in the second half of 2023. It is highly unlikely that mega-cap stocks will record the same performance. But this should not cast doubt on the current rally’s sustainability albeit at a slower pace. There is the threat of a recession is still hovering over the US economy and the Fed fights inflation. This year’s advances have been driven by a small number of very large corporations, known as the Magnificent Seven. Without these stocks, the first half return for the S&P 500 would be around 2% and around 14% for broader tech.

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

a broader participation

For the rally to continue there must be a broader participation in other sectors. Sectors to keep an eye on include banks, mainly the major banks, GS, MS, JPM and BAC. A mixture of a retail focus and capital markets. Also, broad industrial stocks and material socks could post gains. Utilities will likely continue to be laggards and too early for pharma stocks.

The Euro Stoxx 50 fell -0.02%, the Shanghai Composite Index in China finished up 1.31%. The Nikkei Stock Average in Japan closed up 1.70%.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.