the unloved regional banks

The U.S. stock market will likely face continued uncertainty this week. On Friday the SPY fell by -0.77%, and the Nasdaq 100 Index QQQ was down by -1.00%. The stock markets are facing some headwinds. Is it time to look for value and opportunities, maybe even in regional banks.

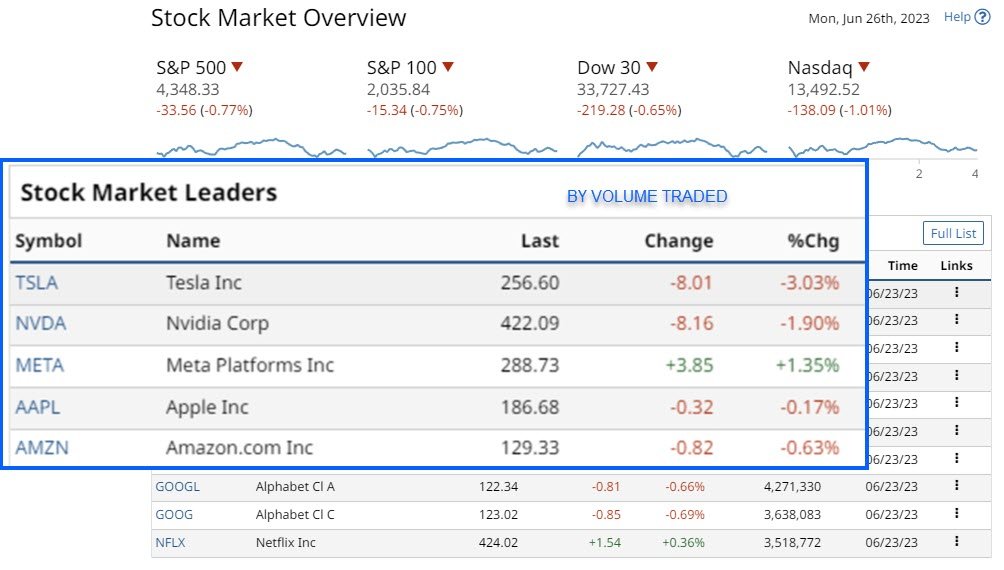

Economic data pulled markets lower on Friday. Disappointing data Purchasing Managers Index (PMI) for both the U.S. and Eurozone. This weighed on US markets. As can be seen on the Stock Market Overview Table from Barchart, only one of the stocks, Meta +1.35%, finished in positive territory. The remaining four stocks, Tesla down 3.0%, Nvidia down 1.9% and both Apple and Amazon closed down. Market. In a way this does indicate that both the US and Eurozone economies are struggling. Further they are facing the continued prospects that the Fed and ECB will continue their rate hikes. As soon as the July meetings, is likely for the Fed, then September or October.

Even before the PMI results, investors were on the pessimistic side. This was about further rate hikes, after the Fed Chair warned that higher interest rates are expected. The Bank of England boosted rates by +50 basis points. The FOMC maintained its funds rate target range of 5.0% to 5.25%. If as expected, the FOMC delivers another 50 basis points rise in 2023. The target range would then sit between 5.5% to 5.75%.

Subscribe to

WHY PLAY THE BANKS?

Let’s look at stocks. What are currently out of favor sectors could benefit from an end to a rising interest rate cycle. Dare it be thought, even possible cuts in interest rates in 2024. Regional bank stocks will at some point start to benefit. Take a look at the graphs for the U.S. Banks Index. If you are a skier, this is certainly a Black Slope. The turmoil in the bank sector in March this year and the collapse of two major regional banks. SVB, the second largest in U.S history and First Republic sent shock waves through investors.

THE REGIONAL BANKS UNLOVED, FOR THE MOMENT

REGIONAL BANKS winners and losers, etfS

Yes, in a way and there will be winners and losers. The biggest banks are less vulnerable. Remember they were not excluded from the stress prior to the banking crisis. Changes to capital requirements are likely to significantly impact the profits of the regional banks. But it is not that this uncertainty is likely to weigh on bank stocks, that I would argue is already in the price.

What investors need now is clarity. Regulators will eventually come to a consensus agreement. There are three main areas of debate currently. They are loosening M&A limits, and mark-to-mark accounting. Then there is any acquirer’s reluctance to inherit uncertainties. In particular, prior to a possible economic slump. Yes, these are obstacles, but they can be overcome.

The catalyst for the regional banks will be, clarity over stress tests, and ending the rising interest rate cycle. Then the end to talks of an economic recession. Will there be increased M&A activity in the bank sector due to the stress tests? Hard to measure, but the stress tests are unlikely to increase M&A. But then again it could be an attractive bonus. One of the best ways to take a bet at this point would be an ETF such as the S&P Regional Banking ETF SPDR, ticker KRE.

STOCKS TO OWN

Take a look at the key daily charts to get some stock ideas. Top Stocks to Own, KB Home, Amphaster Pharma and First Light Acquisition Group were the top three. Thus, a home builder, pharma and Calidi Biotherapeutics. They have entered into a business combination agreement to acquire First Light Acquisition Group.

ETFS TO OWN

ETFs to Own, they included VS TR Short VIX, Dynamic Building and Construction and Short VIX. Ok, so two hedging ETFs and a home builder. The investment objective of the ETF ticker SVXY, is to produce daily investment results. The returns are negatively correlated or the inverse (-1x) of the daily performance of the SP 500 VIX Short-Term Futures Index. The index measures the daily change in price of the VIX index on short-term futures contracts.

Follow, learn and maybe gain some investment ideas trading with EToro. The platform has over 30 million traders and investors. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

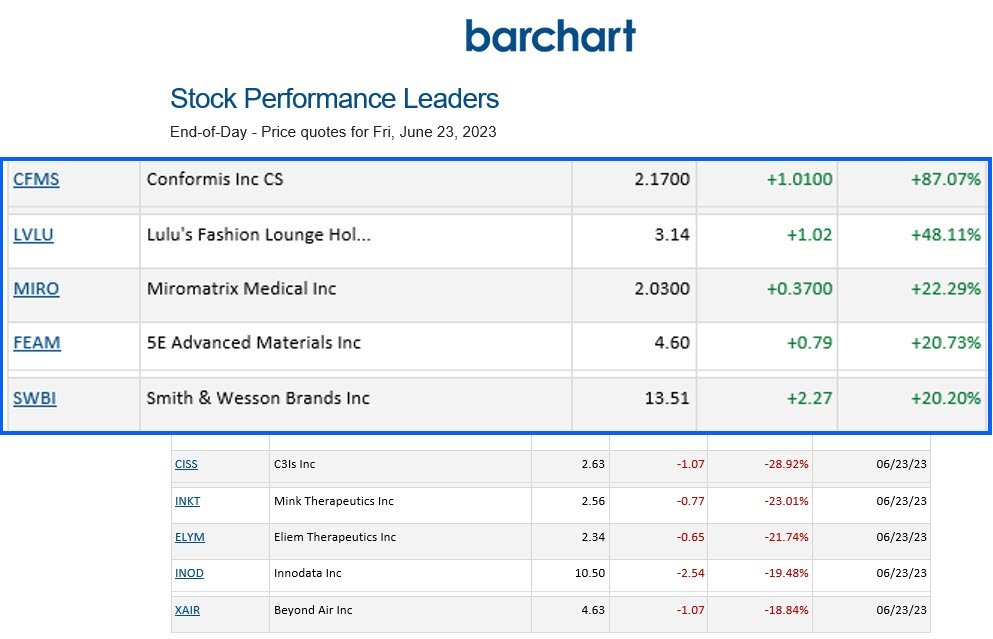

STOCK PERFORMANCE LEADERS AND LAGGARS

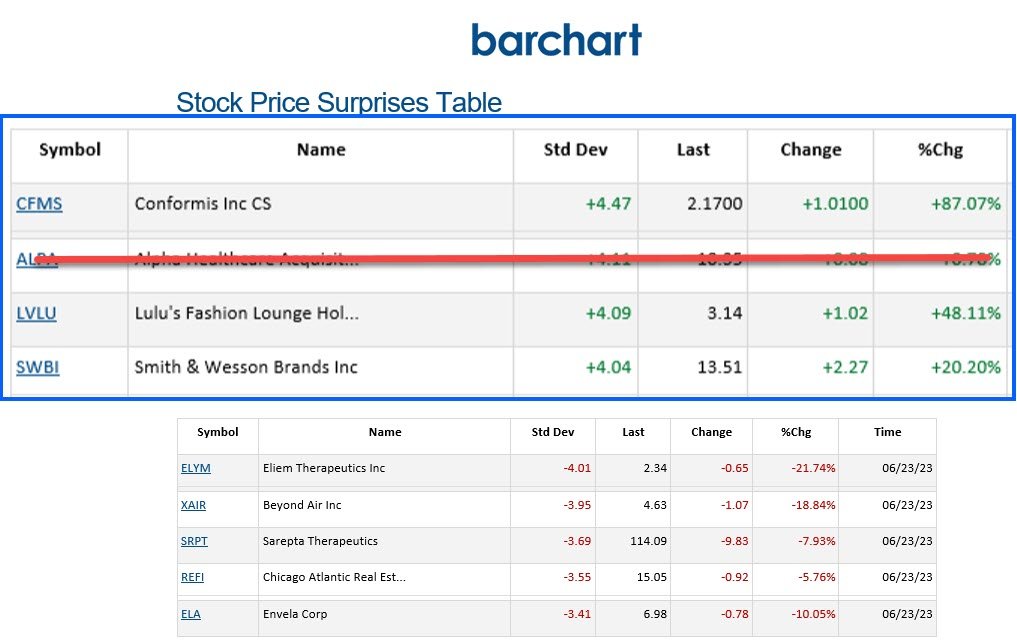

The Leaders on Friday were, CFMS, LVLU and MIRO. On the Surprises both CFMS, LVLU appeared again and Smith & Weston SWBI.

PRICE SURPRISES AND VOLATILITY

The Euro Stoxx 50 was down 0.76%, marking the fifth straight daily fall. The Nikkei Stock Average in Japan fell 1.45% on Friday after a strong run up.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.