TECH STOCKS OR TIME FOR MID SMALL CAPS

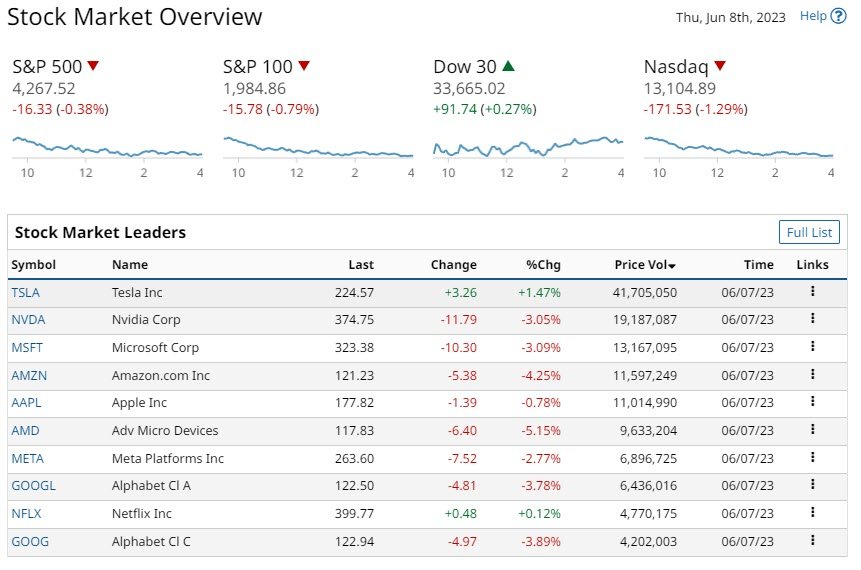

On Wednesday the stock index closed flat. The SPY was down -0.38%, and the tech stocks in QQQ closed down -1.75%. Is it time to focus on small caps? Russell 1000 IShares ETF (IWB) closed down 0.59%, but a recent outperformance has been occurring. One key thing is earnings revisions for 2023 and 2024 are starting to come through from stock analysts. Over the past week, more than 50% of the Russell 2000 had their earnings upgraded.

After an incredible performance in 2023 by the Magnificent Seven. The mega-cap tech stocks, closed lower. Amazon.com (AMZN) closed down greater than 4%. Alphabet (GOOGL) and Microsoft (MSFT) both closed down greater than 3%. Additionally, Meta Platforms (META) and Nvidia (NVDA) declined by more than 2%.

THE IMPACT OF TECH STOCKS

The impact on the market was to be a drag on the main indexes, in particular the Nasdaq 100. But is the rally finished, to the extent of the strong gains so far in 2023, probably yes. The growth in AI continues to speed up into 2024. There are two markets with investors focusing on tech. Money has flowed into the much-hyped artificial intelligence trade.

Subscribe to

The question is, is time for investors to focus on the broader market. After 2022, the rebound is in only a few companies, the magnificent Seven. A clearer picture is emerging on the broader economy. If a recession does eventually occur, at best or worst it will be a mild one. The stock prices in certain parts of the stock markets have factored this in.

A quick look at cyclical equities. They could outperform the indexes as recession fears subside. For example machinery and building products stocks. This includes Caterpillar (CAT) up 3%, Parker-Hannifin (PH), and Masco (MAS) increased +3%. Then Stanley Black & Decker (SWK) and United Rentals (URI) both closed up over 6%.

TIME FOR CYCLICAL STOCKS

The rise in WTI oil prices rose over 1%, lifting energy equities and service companies. Marathon Oil (MRO), Phillips 66 (PSX), and Marathon Petroleum (MPC), were all up +4%. Also, Valero Energy, Hess closed above Devon Energy (DVN), Exxon Mobil (XOM), beat the broad index on the day up over +2%.

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

Subscribe to

LIQUIDITY IS KEY

First, the level of volume traded as a percentage of Market Cap. Assess this by analyzing the recent volume compared to Average Daily Volume traded. Second. The percentage of a stocks free float, with small-cap stock as a guideline less than 50% is a red line. Also, calculate the percentage volume traded. Then compare this to other Stocks with a similar Market Cap. Then what is the recent trend, if decreasing in Volume this is a concern. Take a look at the video below.

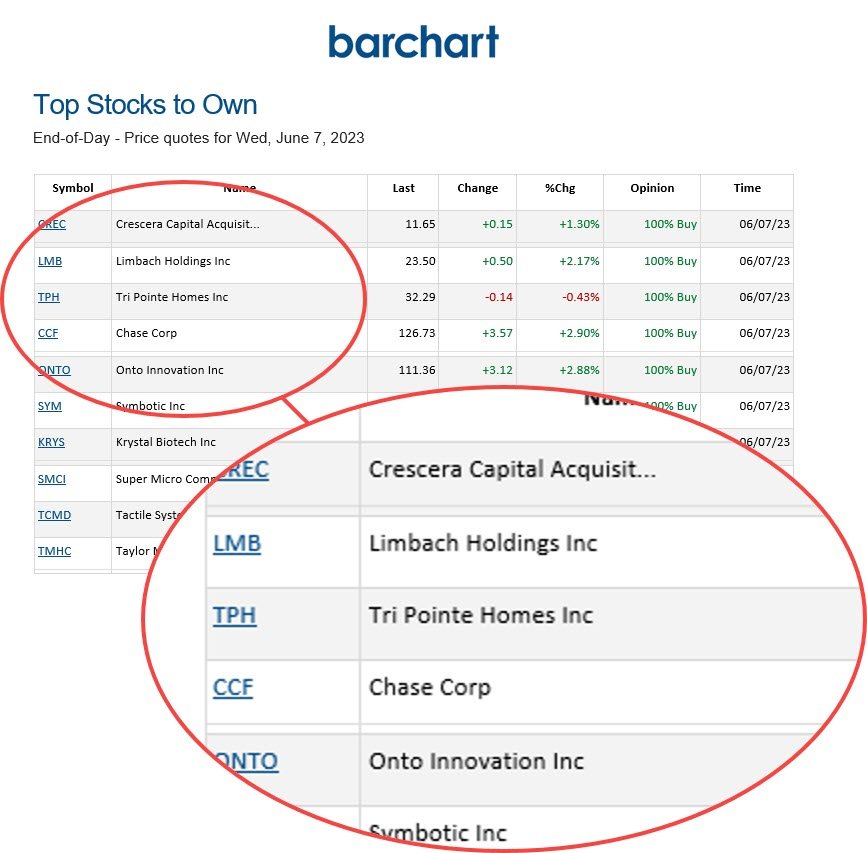

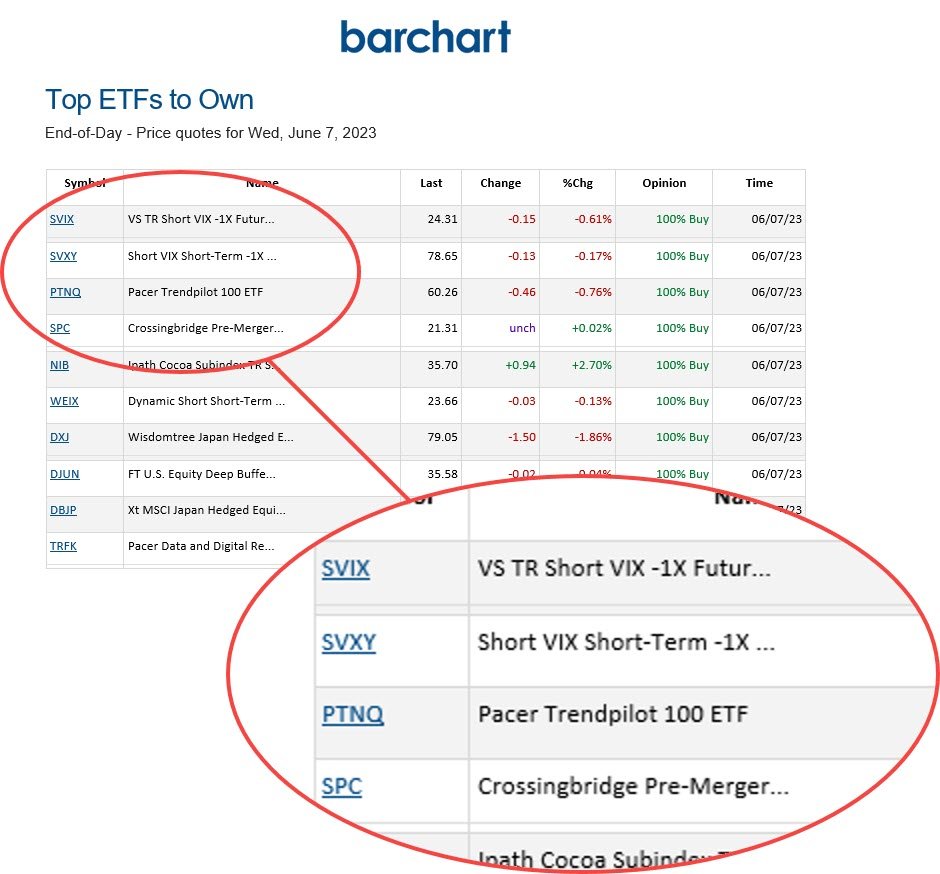

BARCHART: QUICK STOCK IDEAS

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.