NETFLIX, TESLA DOWN QUESTIONS OVER TECH

A decline in Netflix and Tesla on Thursday weighed on technology stocks and the overall market. The Stock indexes closed lower, in a strong year the market with haver ups and downs. After forecasting weaker-than-expected Q3 revenue, Netflix (NFLX) plunged more than 8%. Looking at Tesla (TSLA) fell more than 9% after announcing lower-than-expected Q3 gross margins.

As the strikes in Hollywood are indicating the Netflix business model may not be all that viable. In particular, if rewards are paid equitably. Some may argue that Netflix is currently subject to a cyclical downturn. Other investors debate that the business model is broken. Broken is the more likely outcome.

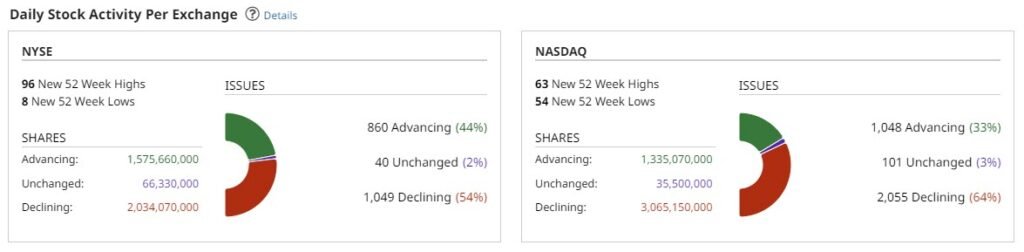

Both Johnson & Johnson (JNJ) and International Business Machines (IMB) rose. This was after both reported better-than-anticipated quarterly earnings. The S&P 500 Index (SPY) fell 0.68%. The Nasdaq 100 Index (QQQ) fell -2.28%. Basically due to NFLX and TSLA as discussed above.

Subscribe to

BANKS REPORTED SOLID EARNINGS COMPENSATED FOR NETFLIX

The Russell 2000 small-cap index closed 1.2% higher. Breadth among small and mid-cap stocks continued to strengthen. Earnings releases from Bank of America (BAC), Morgan Stanley (MS), and Charles Schwab (SCHW) all exceeded forecasts. The financial sector was a bright spot for the S&P 500. On the Earnings Call post release, many stated that they continue to see a healthy US economy. OK, it is growing at a slower rate, and the job market remains resilient.

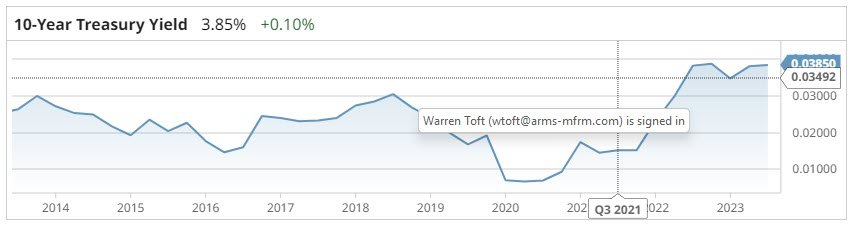

ECONOMIC DATA INDICATES THE FED COULD BE FINISHED POST JULY

Stocks were also negatively impacted Thursday by evidence of a strengthening U.S. labor market. This followed an unexpected drop in weekly jobless claims to a 2-month low. U.S. weekly initial jobless claims surprisingly decreased by -9,000 to a 2-month low of 228,000. This points to a solid labor market. While existing home sales in the U.S. decreased by -3.3% on the month, landing at a 5-month low of 4.16 million. This underperformed forecasted expectations of 4.20 million.

ECONOMY AVOIDS A RECESSION

The Philadelphia Fed business outlook survey for the U.S. in July increased by +0.2 to -13.5. This was below expectations of -10.0. The U.S. June leading indicators decreased by -0.7% m.o.m, less than anticipated at -0.6%. There is the growing expectation of a soft landing and that the Fed will stop raising rates post July FOMC. Also, inflation will be close to its objective of 2% Y.o.Y, and that the economy will avoid a recession this year.

Kodiak Sciences Inc. (KOD).

The Signal gain is derived from 68 trades

A Buy signal on the 20-Day Moving Average for Kodiak Sciences Inc. (KOD) over the past five years has led to a gain of +464.33%. This is compared to the stock’s +255.81 percent five-year market performance. The Signal gain is derived from 68 trades with an average duration of 13 days.

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

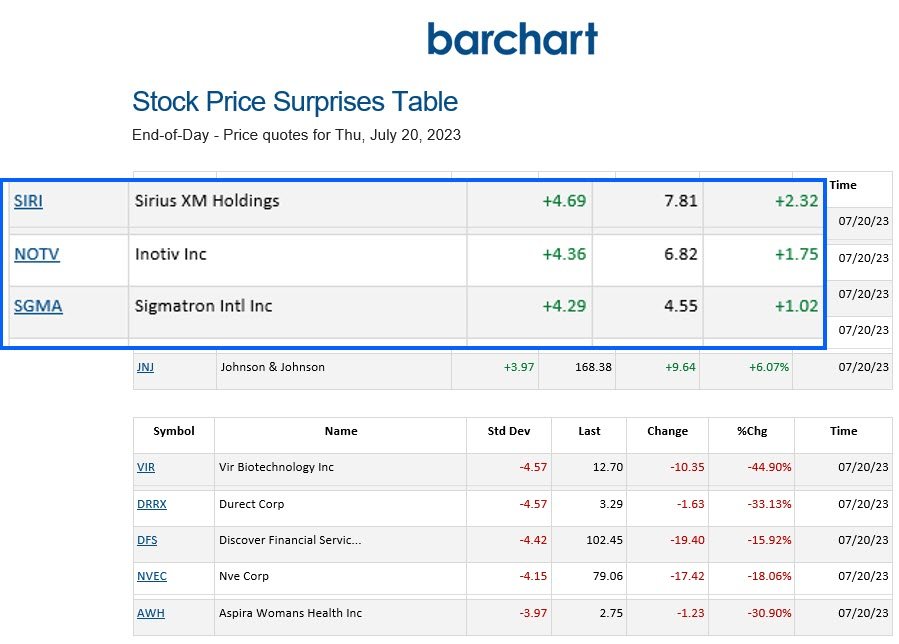

BARCHART: QUICK STOCK IDEAS

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.