MEGA CAP TECH, NVIDIA AND AMD

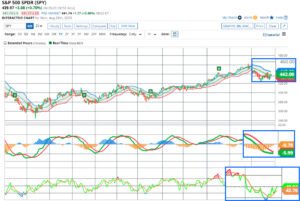

This week the stock markets will take some from the economic data to be announced. The Fed’s preferred inflation indicator and the August jobs report both due. At the Jackson Hole meeting last week Chairman Jerome Powell’s hawkish tone continued. He indicated that there won’t be much wiggle room in the fight to drive inflation down towards the 2% level. Core inflation still remains stubbornly high, and the 2% inflation target could be elusive.

The employment data on September 1 will be the final such publication before the central bank’s meeting on September 20. Treasury rates are rising, and futures trade is pricing in a 66% chance that the Fed will raise its benchmark interest rate. If done it would be by 25 basis-points in November, following a halt in September.

In evaluating whether to invest in stocks, part of the calculation must be that higher interest rates are here to stay. While there is the focus on the short-end of the real action will be in the long-end of the U.S. yield curve. Despite the recent move up in yields, at the long end the yield curve remains inverted. This is changing.

I would put this mid-term to equity investors. Over the next 2-years the U.S. yield curve will normalize. It is highly likely that yields at the short end will be lower sometime over the next two years. But the action will be at the long-end of the yield curve. Yields could increase by 150 basis points to 200 basis points.

I would put this mid-term to equity investors. Over the next 2-years the U.S. yield curve will normalize. It is highly likely that yields at the short end will be lower sometime over the next two years. But the action will be at the long-end of the yield curve. Yields could increase by 150 basis points to 200 basis points.

Subscribe to

LONG-END OF THE YIELD CURVE IS KEY

Earnings season BOOSTED BY NVIDIA AND AMD IPO

Meanwhile, important earnings reports are scheduled. Salesforce (NYSE:CRM) (analysis), Broadcom (AVGO) (preview), and Lululemon (LULU) (preview) will all announce. Other issues to keep an eye on are the FDIC’s planned new limits on small-business lending. The Biden Administration’s disclosure of the first ten pharmaceutical drugs picked for Medicare price negotiations.

China will remain an issue for the stock markets

China will remain an issue for the stock markets on economic concerns. Chinese banks slashed prime loan rates less than expected. In consultation with state-owned commercial banks, the People’s Bank of China (PBOC) lowered the prime rate for loans. Terms of a one year loan falling by ten basis points. The rate came down to 3.45%. This reduction was less than the fifteen-basis point fall to 3.40% that was anticipated.

Jackson Hole, Wyoming

Representatives of national and international monetary agencies convened over the weekend in Jackson Hole, Wyoming. While the chair of the Federal Reserve in the United States. He stated that the central bank is “prepared to hike rates further if warranted.” The president of the European Central Bank, Christine Lagarde, has stated that borrowing costs will be set as high as necessary. Then they will remain there until inflation returns to target levels.

The two-year Treasury rates, which are the most sensitive to assumptions for future policy. Rates reached their highest level in seven weeks after the remarks were made. The markets are discounting a +25 bp rate rise at the September 20 FOMC meeting at 12%.m Then a +25 bp rate hike at the November 1 FOMC meeting at 45 percent.

The Euro Stoxx 50 closed up +0.28%. China’s Shanghai Composite Index closed down -1.24%. Japan’s Nikkei Stock Index closed up +0.37%.

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

BARCHART: QUICK STOCK IDEAS

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.