NVIDIA STOCK PRICE IS THE STAR OF THE SHOW

This leads to two key questions:

With the increasing use of AI by everyone are we at the start of a semiconductor super cycle?

Across the board, in particular in tech, what earnings surprises do companies have coming?

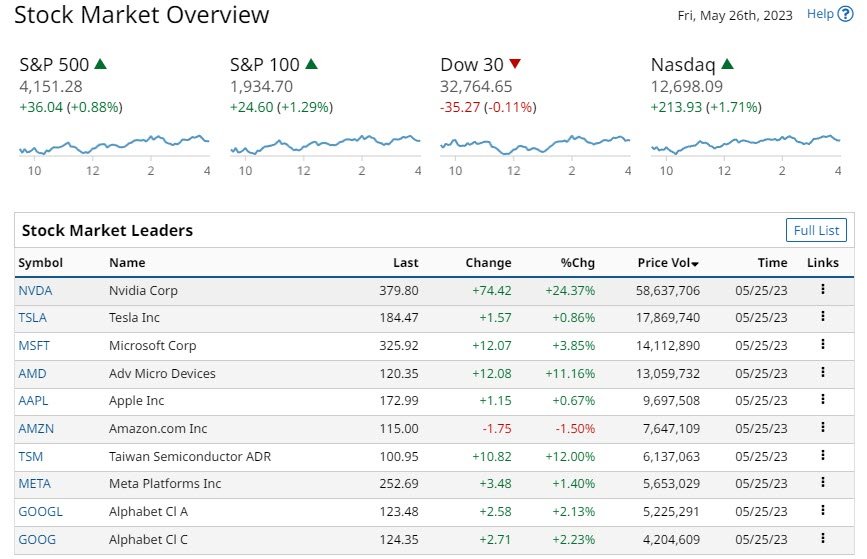

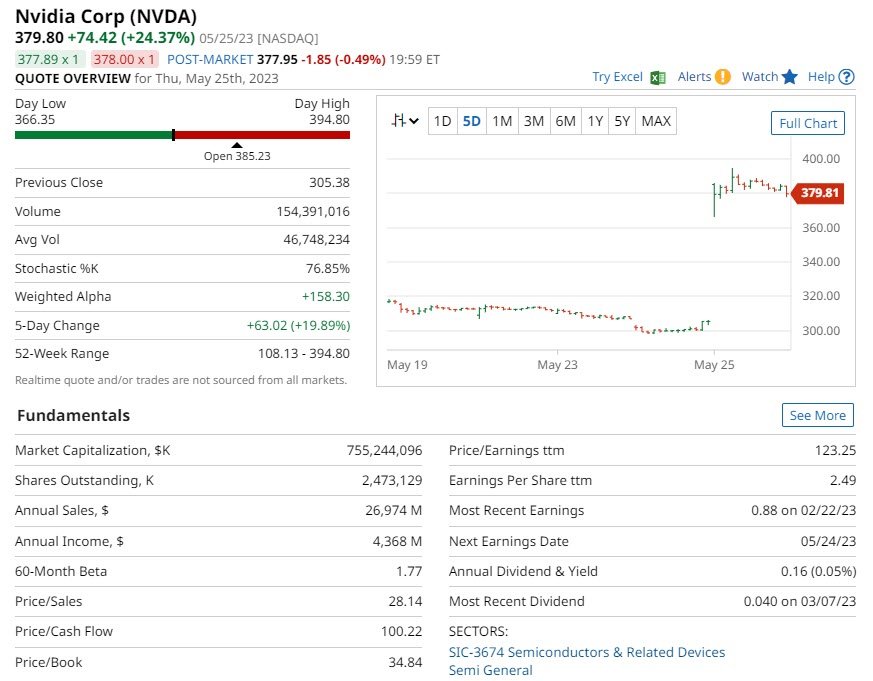

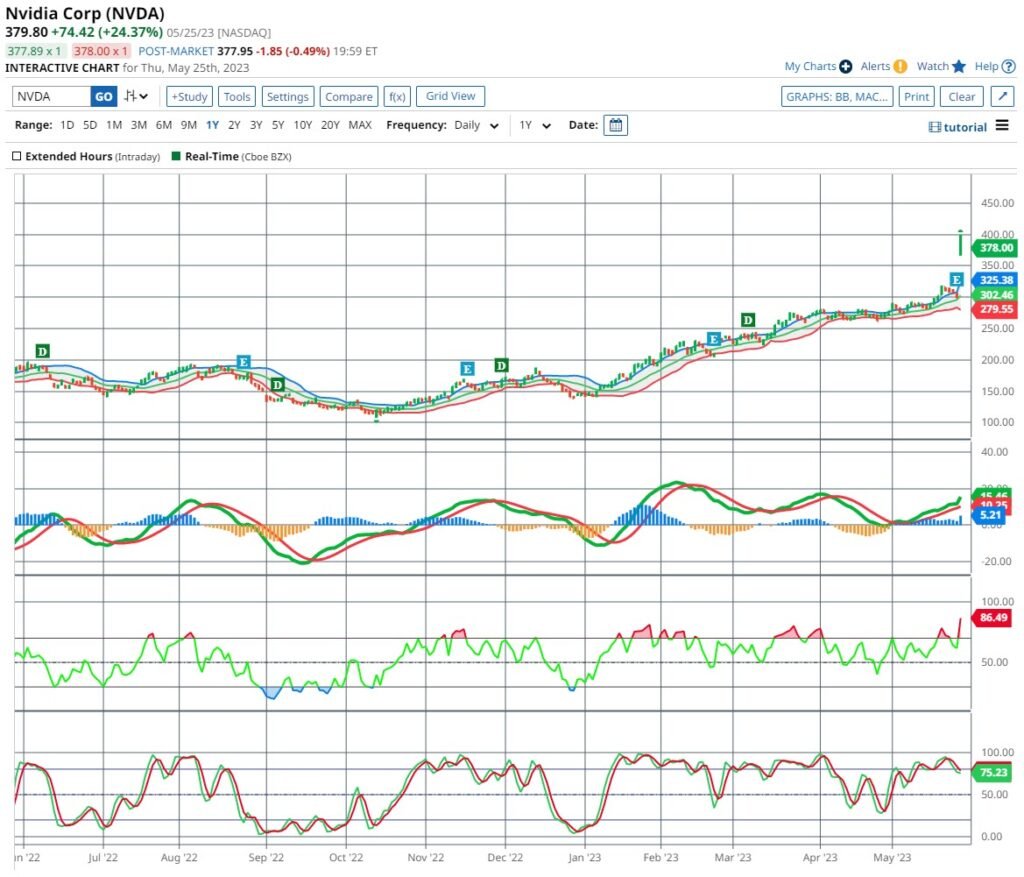

First off, the Stock indexes Thursday rallied with the Nasdaq 100 sharply up to a 13-month high. The +24% surge in the Nvidia stock price led technology stocks higher. NVDA’s management announced better-than-expected Q1 revenue and forecast stronger-than-expected Q2 revenue.

Anyway, hopefully they are getting close to a deal and it is down to details now.

The U.S. economy remains strong despite the current hawkish monetary policy by the FED. Thursday’s U.S. Q1 GDP, and initial unemployment claims, were stronger than expected. U.S. Q1 GDP was revised upward to +1.3% (q/q annualized) from +1.1% as Q1.

The driver of this was personal consumption, indicating the consumer remains strong. The Q1 figure was revised upward to 3.8% from 3.7%. The markets are betting on a 50 / 50 chance of a 25 bp rate hike at the June 13-14 FOMC meeting.

Subscribe to

TAKE A LOOK AT: AVIS (CAR)

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

NVIDIA (NVDA): EARNINGS UPSIDE

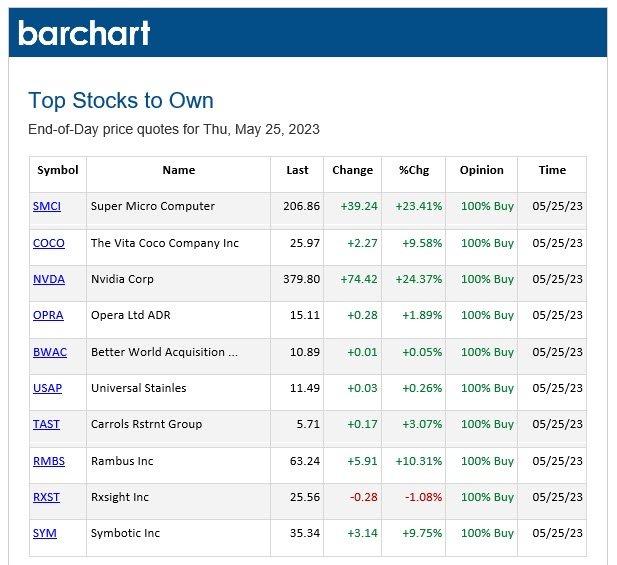

BARCHART: CONSIDER THESE

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.