THE SEMICONDUCTORS AND AI BOOM

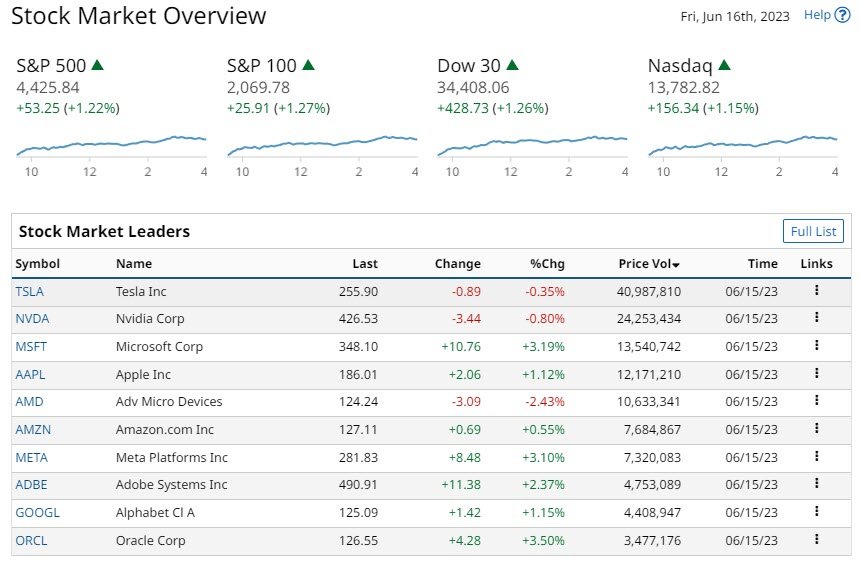

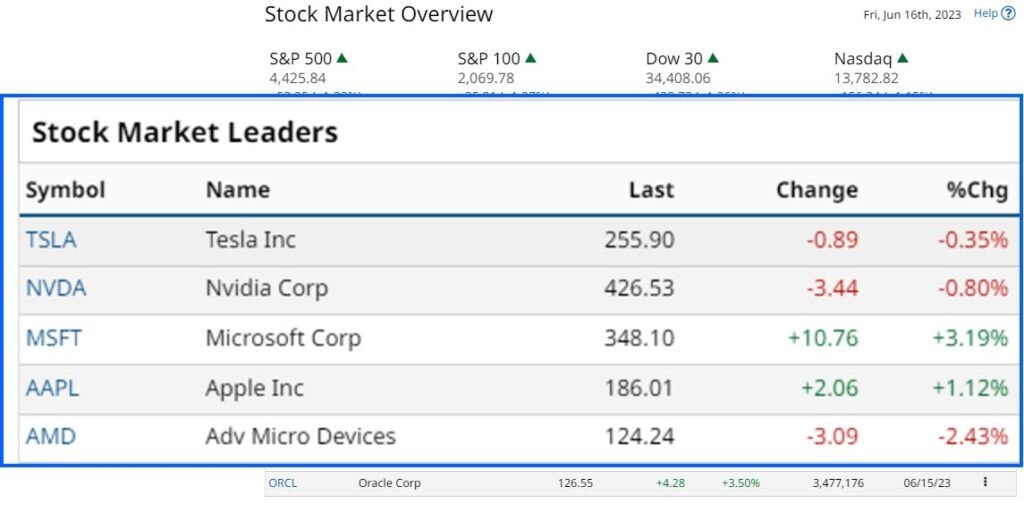

Yesterday was a strong trading day, the SPY up +1.22%, the IWB was up +1.24%, and the QQQ closed up +1.20%. Driving the stock markets was the Cava IPO which popped up +11%. Also, a general positive sentiment that this is real as semiconductors rally. Some have known this since January, watch the video below.

As I write this the US futures are in the negative, but this could change heading towards the open at 9:30am Eastern. Based on current performance this week, the three major indices are on course to end the week on a high note. Global bond yields mixed and European indices closed down. This followed the ECB’s projected 25 basis point rate hike.

debut of Cava (CAVA) NOT ONLY SEMICONDUCTORS

The debut of Cava (CAVA) on the New York Stock Exchange was successful. At $43.30, the Mediterranean fast-casual restaurant brand was worth $4.8 billion. Around double the company’s Wednesday evening closing price of $22 per share. Thus CAVA’s total market cap is valued at $2.5 billion.

Last Monday, Cava raised its common stock price range to $19 to $20, valuing the company at $2.1 billion. Cava’s US exchange IPO ranks sixth larget this year. What is the largest so far in 2023? In May, JNJ consumer health business Kenvue (KVUE) went public for $4.37 billion. The critical issue is that IPOs are back and that’s a key point in the Bull Market.

Subscribe to

QUICK DEFINITION VIDEO: IPO

macroeconomics mIXED

It is true that economic indicators continue to be mixed. Retail sales data came in higher than predicted, up +0.3% MOM, above expectations of a -0.2% MOM decline. Weekly initial jobless claims stayed unchanged at a 19-month high of 262,000. This is reflecting a weaker labor market than predicted.

Traders will be watching preliminary Michigan Consumer Sentiment data. A key measure of consumer behavior. I would make the case that while the FOMC meetings are a major media event, stock investors do not take notice. The last time the Fed’s actions influenced stock markets was back in February.

Subscribe to

SEMICONUCTOR STORIES: INTC

The AI Boom and Semiconductors continues to gain momentum and so it should. Chip designer Arm is in discussions with potential strategic investors. This includes Intel (INTC). As ITNC faces the challenge of continuing to define its niche or role in the AI story.

Intel is one of the world’s largest semiconductor manufacturers. A provider of microprocessors and chipsets is expanding into data-centric, like AI. Thus, it is looking to be an anchor investor for Arm’s proposed US IPO. It is worthy of note that Japanese conglomerate SoftBank is Arm’s parent.

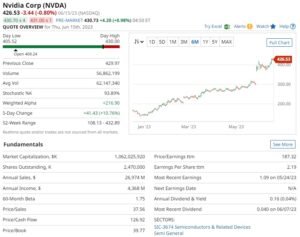

NVDA: THE WINNER IN SEMICONDUCTORS, SO FAR

The AINTC has disclosed that the company’s foundry business will collaborate with Arm. This will be to produce the next-generation of mobile chips. So, this is not new news. INTC at its Q1 2023 earnings briefing referred to the co-operation with Arm. Stating that a strong ecosystem for the foundry offerings and that INTC will play a broader role. So far there is the perception that INTC is behind.

NVIDIA (NVDA) has been the front runner so far, but it is early days. INTC has an interest in having a role in Arm, with the prospect of increasing collaborations in the future. Note on the two tables, there exists a valuation gap between NVDA and INTC. Yes, their roles are different. NVDA designs and INTC manufactures chips.

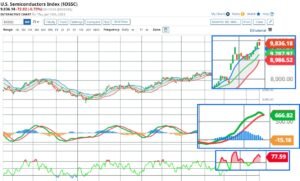

THE SEMICONDUCTOR sector

NVDA has had an interest in acquiring Arm back in 2020, but NVDA gave up on such plans. The reason started is due to regulatory hurdles. At the end of last month, NVDA and Softbank revealed that they were in fact working together on a possible JV. So, watch this space.

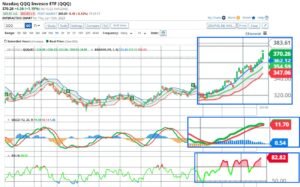

The JV is on a platform for generative AI, using the Arm-based NVIDIA GH200 Grace Hopper Superchip. The AI story is in a 10-year cyclical bull market in AI tools. This started in November 2022, with the launch of ChatGPT. Of course, AI technologies have been here for a while. But it is commercialization that is gathering pace. As can be seen on the graphs, the MACD is starting a cross-over and the RSI, is in over-bought territory.

Follow, learn and maybe gain some investment ideas trading with EToro. The platform has over 30 million traders and investors. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

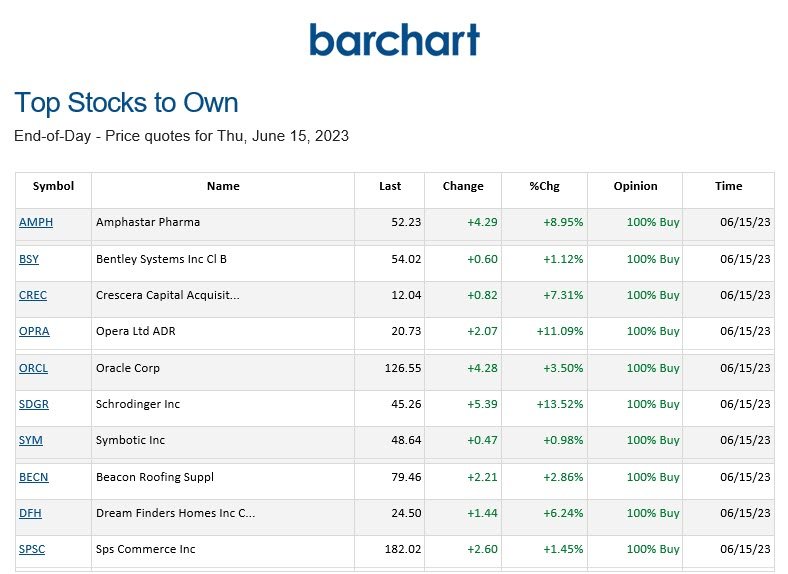

BARCHART: QUICK STOCK IDEAS

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.