STOCKS HIGHER, AI AND SEMICONDUCTORS

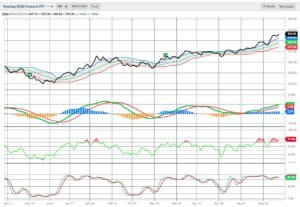

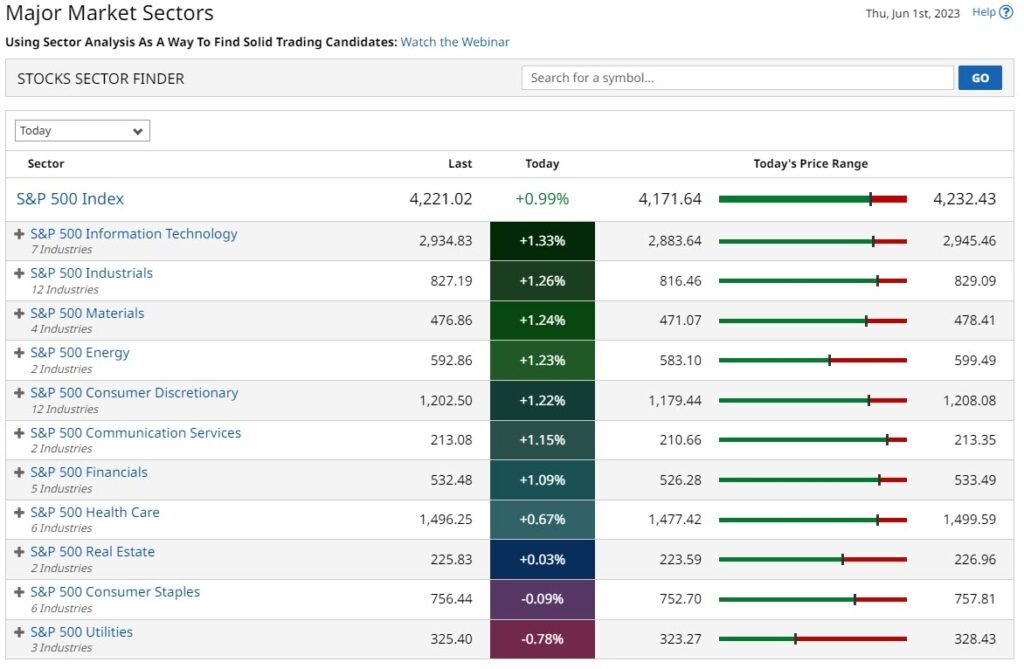

The QQQ (Nasdaq 100) +1.31%, the SPY (S&P 500) +0.99%.

Stocks higher on Thursday as the major U.S. stock indexes moved above recent highs. The S&P 500 tops a 9-month high and the NASDAQ 100 continues to exceed a 13-month high. The reduced concerns in the U.S. over the possibility of defaulting certainly helped stocks. A default would be an unmitigated disaster, end of story. Not only in the U.S. the ripple effects would be felt around the world. The other ongoing concerns is inflation. Combined the lead to a lowering of treasury yields.

The lowering of Treasury yields certainly helped stocks move higher. But this is not the only driver assisting stocks. Semiconductor stocks rallied and the sector continues to be one of the key hotspots. Driving the stock markets higher.

SEMICONDUCTOR STOCKS, DATA AND AI

Positive comments by Nvidia’s CEO to Intel lifted the INTC share price. But aren’t they competitors? In many ways yes. But Nvidia’s strength is in chip design. With the forthcoming expectation of an increase in demand, well Intel as a chip manufacturer. Thus, INTC can be a useful partner.

The semiconductor index graphs, indicates that it is maybe overbought. Or maybe more signs of strong momentum behind the sector. The growth in Artificial Intelligence and the development of Data Centers is a key driver. Investors in AI must take a cautious approach if AI stocks boom. Remember the dot.com bubble of 20+ years ago.

AI offers huge potential and will likely push stocks higher. AI is already having a major impact on the way we work and live. Consider the brief 6-month history of the chatbot ChatGPT. It has taken the world by storm. ChatGPT currently has 1.3 billion users, crossing the 1 billion users in March.

MIND THE GAP: VALUE V GROWTH

Certainly these AI growth stories and widening the valuation and performance gap in the stock markets. Take a look at the Growth v Value graph v S&P 500 graph. The growth sectors is up over 20% over the past 6-months, helping the 3.66% return of the S&P 500. The value sector is up less than 1% over the period. In some ways this does not reflect the full story behind value stocks. In 2022 they were down just over 8% and growth was down 33%

The 10-year U.S. T-note yield fell to 3.605%, in Germany, 10-year bund yields fell to 2.25%. In the UK 10-year gilts closed AT 4.12%. The Euro Stoxx 50 closed up +0.94%. China’s Shanghai Composite closed unchanged, and Japan’s Nikkei Stock Index +0.84%.

Subscribe to

CONSIDER THE ADR: WFRD

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

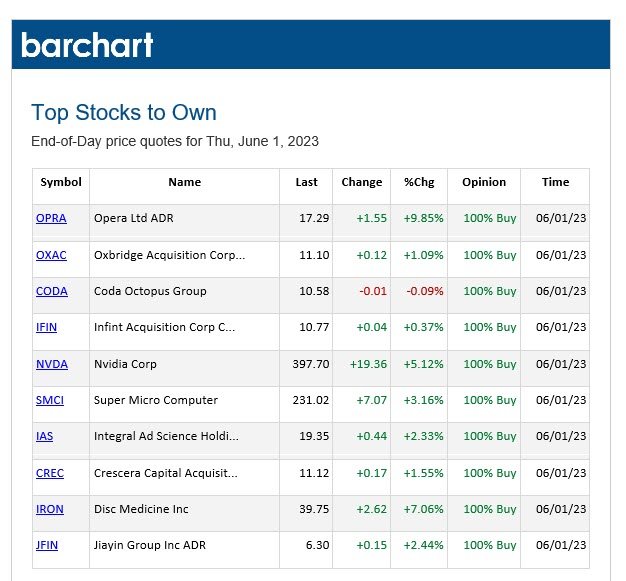

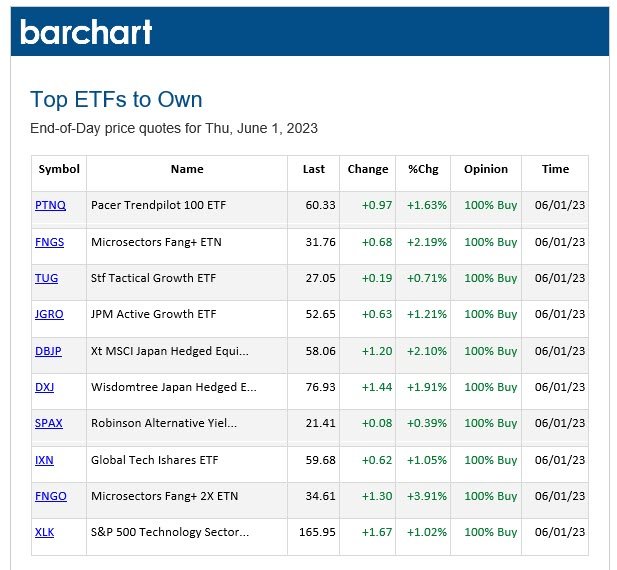

BARCHART'S PICKS

BARCHART: CONSIDER THESE

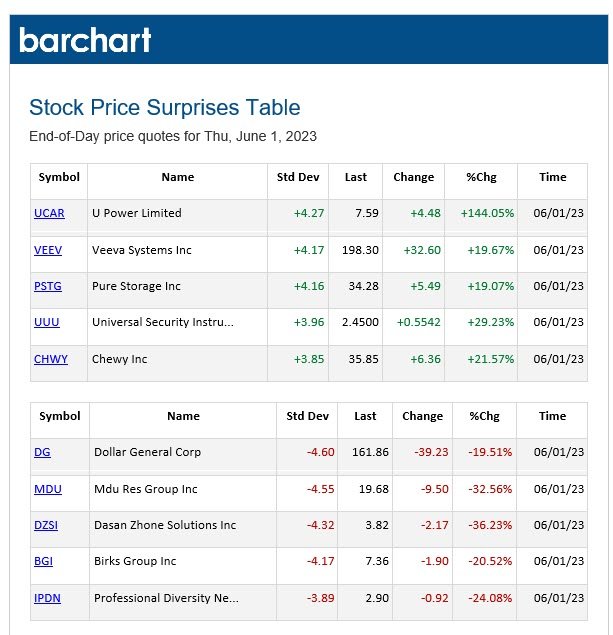

PRICE SURPRISES AND VOLATILITY

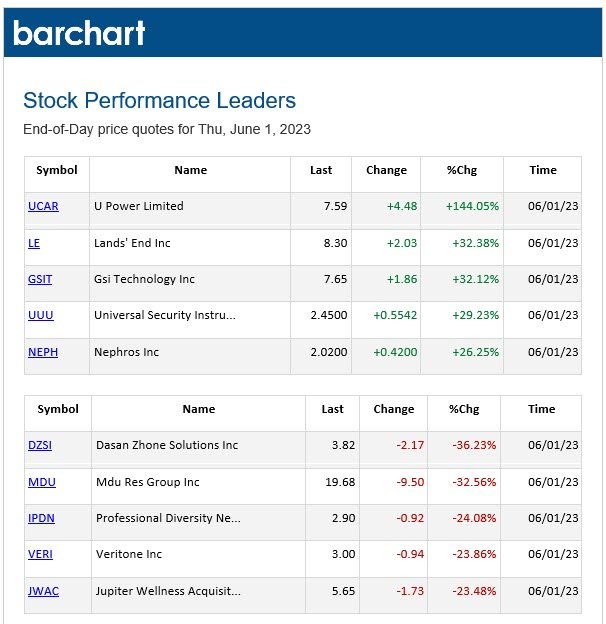

STOCK PERFORMANCE LEADERS AND LAGGARS