COULD THE STOCK INDEXES MOVE HIGHER?

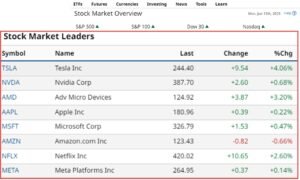

The week will open on a solid footing as the major U.S indexes, the SPY, QQQ and IWB were all higher on Friday. The S&P 500 is at almost a 10-month high and the Nasdaq 100 is at a 14-month high. Today, continued strength in technology stocks could drive stock indexes higher. So far in 2023, the Magnificent Seven has driven stock indexes. Friday Tesla was up over 5%. Take a look at the table and graphs below.

The debate among commentators and analysts about the direction of stock indexes continues. There are increasingly strong claims that the Bear Market is over. Then others think the recession is just around the corner. It appears the fear of missing out (FOMO) is winning. If the Bear Market is over then this is the end of the longest bear market in the S&P 500 since the 1940s is over.

The strength in U.S. stock indexes in 2023 has been fueled by a few stocks showing outsized increases. The mega cap tech stocks performed well on Friday as they have done so far in 2023. The Big Cap Tech stocks or the Magnificent Seven, such as Tesla (TSLA), and the AI darling Nvidia (NVDA). Also, there has been some comeback in economic optimism. A contrast to the attitude that plagued the market in 2022.

Subscribe to

macroeconomics and the key central bank meeting

Subscribe to

MARKET MOVERS

On the positive side of the market, Tesla is up more than 5%. This was based on the announcement by GM that it would adapt its electric vehicles to Tesla’s Superchargers. Also, Etsy is up more than 6% after Sensor Tower reported that Etsy’s May app downloads increased +27% YOY. CRM is up more than 3% after announcing that it was expanding its AI product offerings. On the negative side, after a recent run, regional bank stock indexes were weaker.

International stock markets are mixed, Japan continues to be strong up 1.97%. Take a look at the ETFs to Own table. ETFs focused on Japan continue to be strong. The Euro Stoxx 50 closed down while the Shanghai Composite closed up 0.55%.

Follow, learn and maybe gain some investment ideas trading with EToro. The platform has over 30 million traders and investors. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

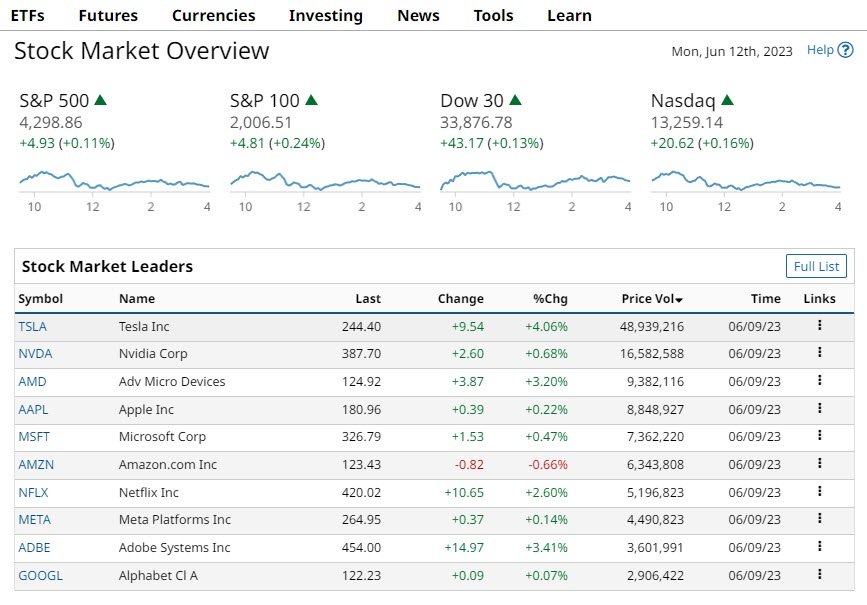

BARCHART: QUICK STOCK IDEAS

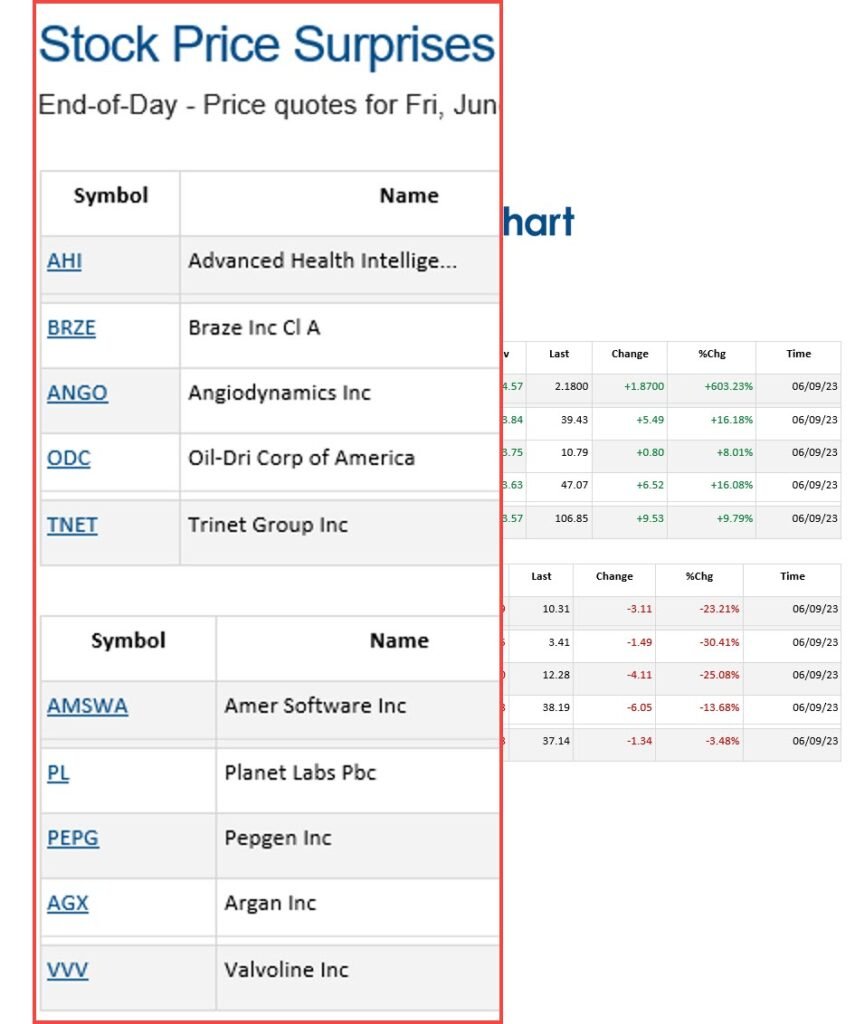

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.