U.S. STOCK INDEXES EXTEND GAINS

Stock indexes extended gains on Thursday, with the S&P 500 reaching a 15-month high. The Nasdaq 100 toppled an 18-month high. The S&P 500 Index (SPY) was up +0.85%. The Nasdaq 100 Index (QQQ) closed up +1.73%. Stocks rallied Thursday on hopes of easing inflation in the U.S. economy. The idea will allow the Federal Reserve to take a pause, now.

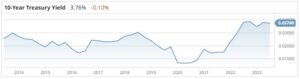

Don’t bet on it, the Fed has made its bed and has to lie in it. In short policy makers said they would continue to raise rates, and now they have to deliver. Another 50bps in total, with the current effective rate being 5.07% and a terminal rate towards year end of 5.40%. It is now unlikely that the full rate hikes with flow through to the effective rate, thus the 5.40%, not 5.57%.

If they did not raise rates, it could create an issue of credibility with the market. But really the Fed would not be concerned. Now, the June non-seasonally adjusted headline inflation is sitting at 3.0%. Certainly, an achievement considering where inflation was sitting at over 9% a year ago.

Subscribe to

very skeptical about the U.S. economy but indexes extend

There was a lot of skepticism as to the Fed’s ability to fight inflation. Rightfully so, +9% inflation had not been seen in years. In the June numbers, the big takeaway was the core inflation reading. The number came in at 4.8% instead of the 5.0% predicted by the market.

Professional investors seem to be very skeptical about the U.S. economy and the dollar. The fact that the U.S.D has been strong should not have surprised anyone. The U.S.D has defied predictions of a prolonged slump since at least the beginning of the year.

But now there is some weakness, it is now on borrowed time as US interest rates near a peak. The Federal Reserve’s aggressive tightening could begin to take a toll on the economy. But no real recession is on the horizon, some downturn maybe, but I doubt it.

The u.s. banks are reporting earnings

OK, economics are important but enough on economics. Yes we have to understand the scenario but not be obsessed. After all, this is a blog about stock investing so let’s get to it and see how stocks will perform. The earnings season starts today, and all eyes will be on the banks. Look to be prepared for a transition in the shareholder base at U.S. banks.

Over the past twenty years the U.S. bank’s shareholder base has changed. They now have the wrong shareholder base for the forthcoming business environment. As will be set by the Fed. More capital requirements, means less profit. I have heard some say as must as 2% off the banks ROE’s. Look this could be the case but banks will always find ways to cut costs.

The impact will not be this dramatic. The Fed cannot continue with, to hell with risk management we will be bailed out attitude. The future for banks will likely be less profitable but more stable. This will attract a new type of shareholder.

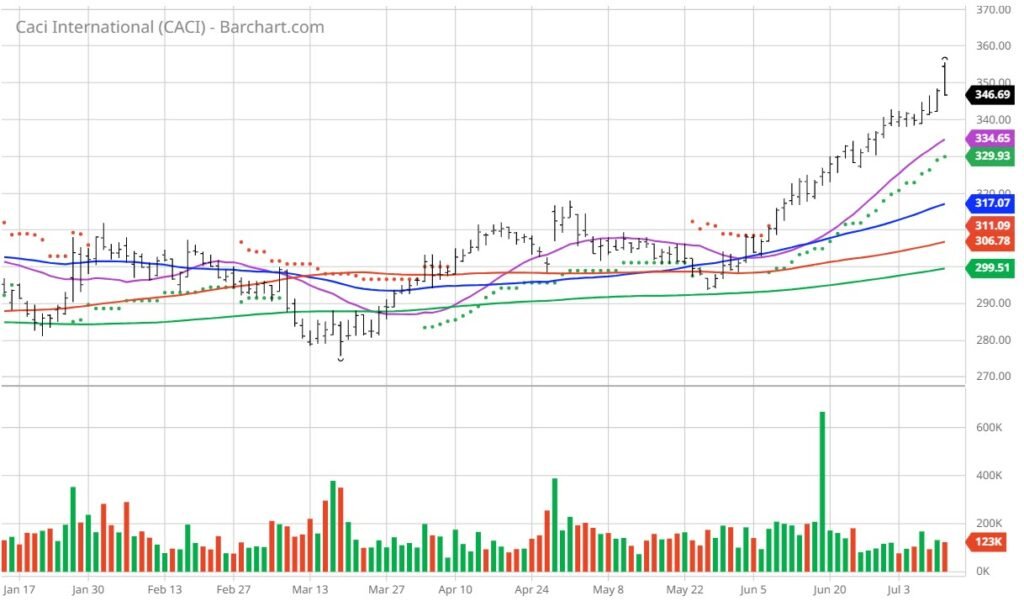

CACI International – String of All Time Highs

July 13, 2023

The IT and network solutions company CACI International (CACI) is in focus. Barchart’s powerful screening functions finds stocks with the highest technical buy signals. Including highest Weighted Alpha and superior current momentum.

CACI Price vs Daily Moving Averages

CACI International Inc.

CACI International Inc. and its subsidiaries serve enterprise and mission customers with knowledge and technology. This is in support of national security missions. Also government modernization or transformation in the intelligence, defense, and federal civilian sectors. CACI is divided into two divisions: domestic operations and international operations.

Domestic Operations provides solutions and services to U.S. federal agencies. As well as commercial organizations in areas such as digital solutions, and C4ISR. Also, cyber and space, engineering services, enterprise IT, and mission support. The International Operations division supplies commercial and government customers. The company creates, deploys, secures, and manages enterprise IT solutions. It also provides software-defined, full-spectrum cyber, electronic warfare, and counter-unmanned aircraft system solutions.

The are the Barchart Opinion Trading systems are listed below. Check out the Barchart Website as they are updated live during the trading session.

Barchart Technical Indicators:

- 100% technical buy signals

- 27.60+ Weighted Alpha

- 21.95% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 8.53% in the last month

- Relative Strength Index 74.82%

- Technical support level at $343.65

Recently traded at $346.69 with 50 day moving average of $317.07

The Euro Stoxx 50 closed up +0.72%, the Shanghai Composite Index was up +1.26%. Japan’s Nikkei Stock Index today closed up +1.49%.

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

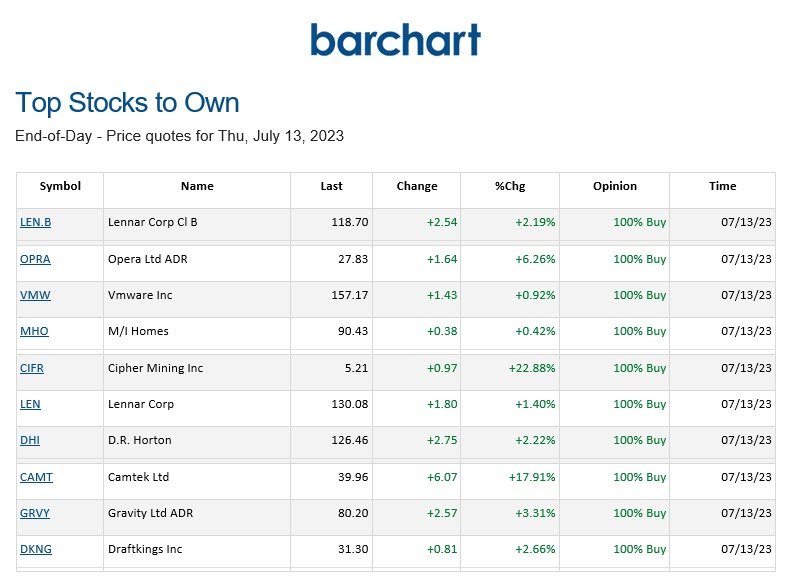

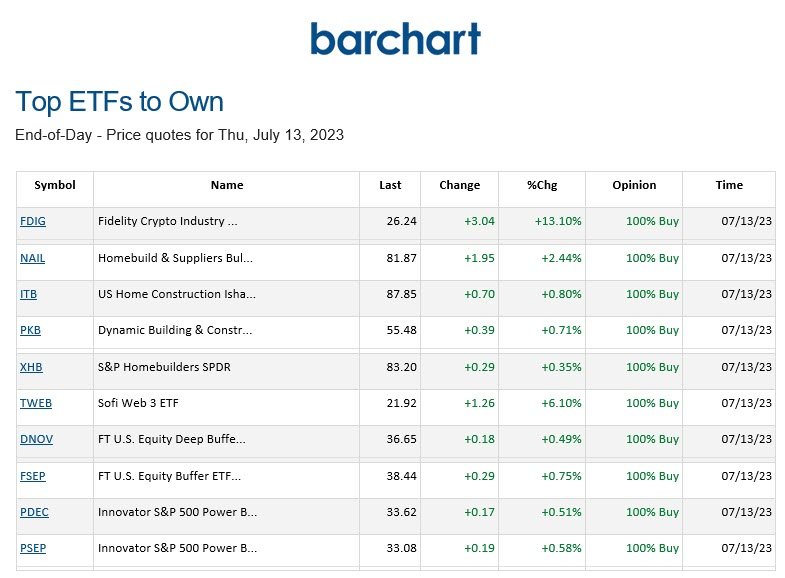

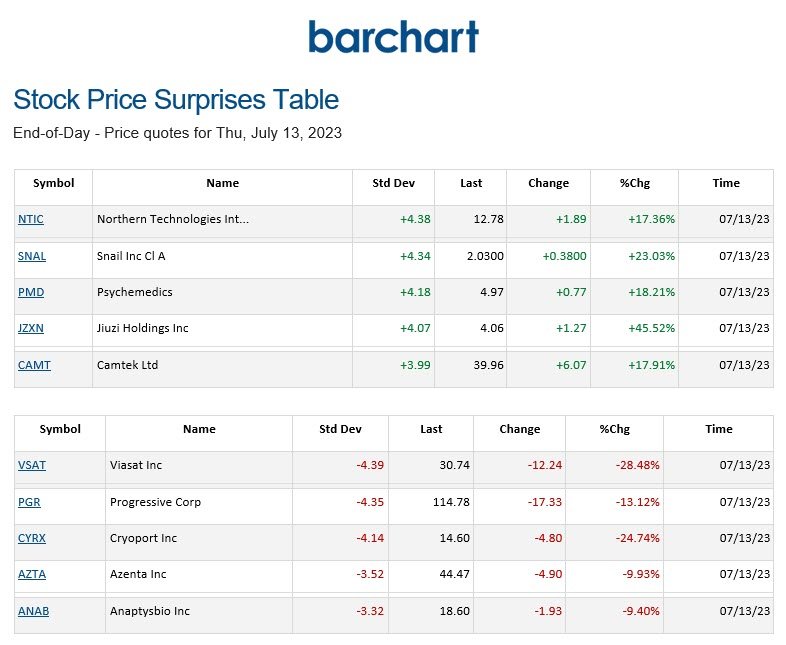

BARCHART: QUICK STOCK IDEAS

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

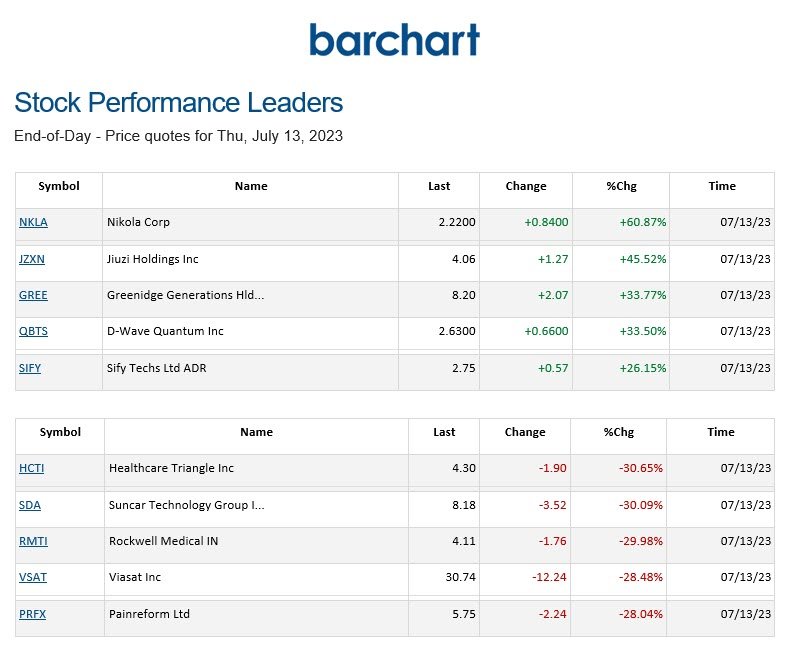

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.