OVER 150 STOCKS ARE TO ANNOUNCE EARNINGS

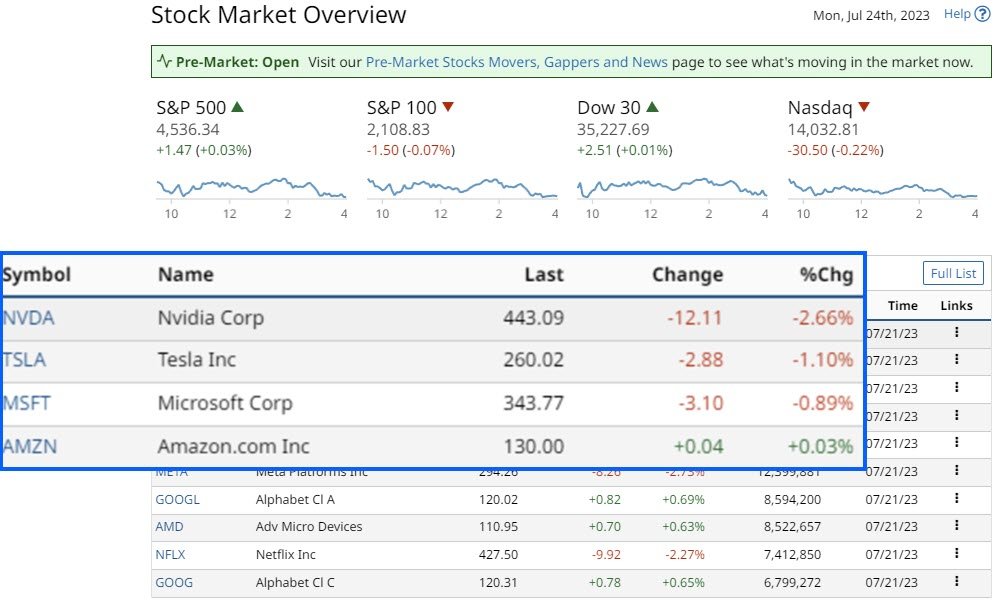

Stocks finished the week mixed, with the Nasdaq 100 sliding to a one-week low. Weakness in some major tech stocks, Netflix (NFLX) and Tesla (TSLA) did not help.

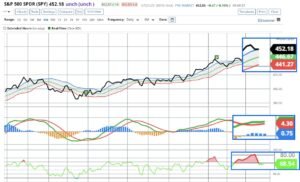

On Thursday both Netflix and Tesla revealed poor quarterly earnings results, with both stocks falling around 7% to 8% on the day. This was the driver of Thursday’s losses on the NASDAQ 100. The fall in bond yields on Friday, providing support to the broader market. The S&P 500 Index (SPY) closed up +0.03%. The Nasdaq 100 Index (QQQ) closed down -0.26%. Over the week the QQQ fell around 1.18%, and fell around 3.0% from Wednesday’s peak.

There is a realignment in the Nasdaq index, which takes effect today. The realignment is intended to lessen the index’s dominance of mega-cap technology corporations. Further it will increase the participation of smaller companies. Thus the out-of-cycle rebalance of the Nasdaq 100 Stock Index weighed on the market on Friday as well as the buying and selling of July stock options.

There is a realignment in the Nasdaq index, which takes effect today. The realignment is intended to lessen the index’s dominance of mega-cap technology corporations. Further it will increase the participation of smaller companies. Thus the out-of-cycle rebalance of the Nasdaq 100 Stock Index weighed on the market on Friday as well as the buying and selling of July stock options.

This had a major impact on the flow of funds. To July 19, Equity Funds lost -$2.1 billion, while cash and bond funds gained $7.5 billion and $1.4 billion, respectively.

This had a major impact on the flow of funds. To July 19, Equity Funds lost -$2.1 billion, while cash and bond funds gained $7.5 billion and $1.4 billion, respectively.

Subscribe to

AS COMPANIES ARE SET TO ANNOUNCE EARNINGS STOCKS RALLY

The bear market that seized the S&P 500 towards the end of the COVID pandemic is only 250 points away from being totally wiped out. All in less than 20 months. A scenario of rising economic activity in the U.S economy has been a driver. As well as the huge run so far in 2023 of the Magnificent Seven due largely to the AI Boom. Inflation is still a concern, despite what has been a dramatic drop in the inflation rate. From a peak of 9% over 12-months ago to around 3% in July 2023. now than they did then, despite the fact that it has dropped drastically this year.

In 2023, stocks have been on a bull run

In 2023, stocks have been on a bull run, for sure very concentrated. If the current level of confidence persists, last year’s bear market could be unwound fast. In fact faster than all but three of its predecessors over the past 60 years plus. The Fed appears to have pulled off the soft landing. The real issue is that after the bear market of 2022, Equity Funds Managers have been caught underweight in equities.

The most common reason given is that they we taking a conservative position. It is very likely the equity fund mangers will try now to realign their equity portfolio exposure. This will be from underweight equities to an overweight position. If not so much in terms of exposure but certainly in terms of taking on higher Beta stocks. This gets harder every day.

MAJOR STOCKS TO ANNOUNCE KEY EARNINGS REPORTS

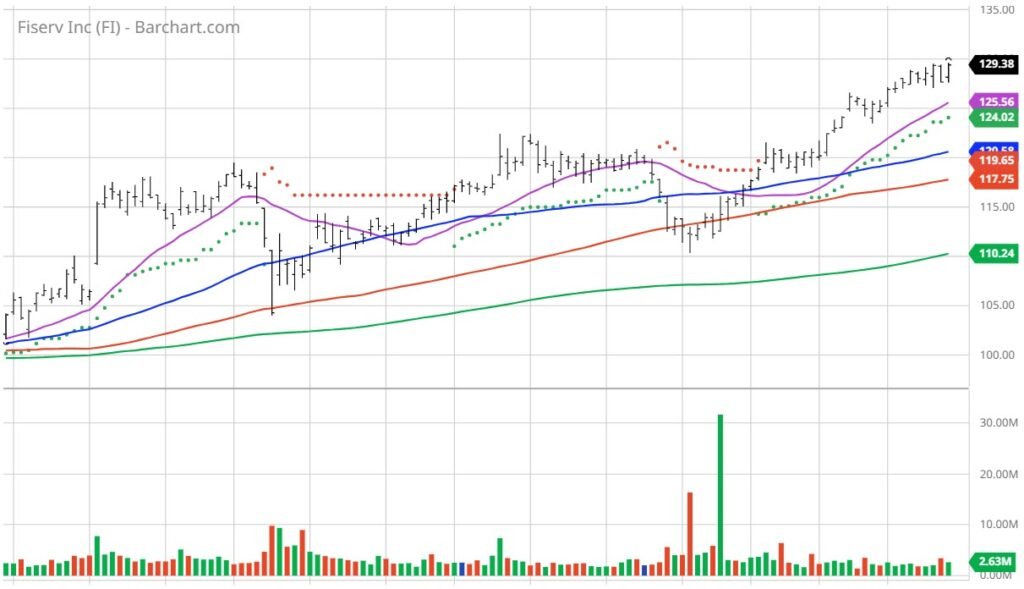

Fiserve (fi) – July 21, 2023

Fiserv (FI), a financial services technology business. Barchart has sophisticated screening functions. Fiserv came out as a stock with the high technical buy signals. This includes the highest Weighted Alpha, superior current momentum.

provides payment and financial services technology worldwide

Fiserv, provides payment and financial services technology worldwide. The company operates through Acceptance, Fintech, and Payments segments. The Acceptance segment provides point-of-sale merchant acquiring and digital commerce services. This also includes mobile payment services and security and fraud protection products.

FOMC MEETS

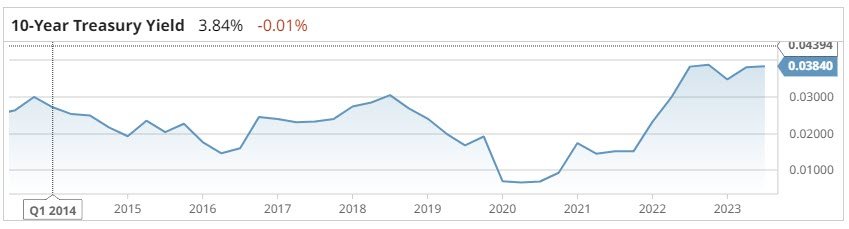

The Fed’s FOMC meeting commences this week, and the bets are on 95% probability for another +25 basis point rate hike. Market economists expect a peak Fed Funds funds rate of 5.40% by year end. The current effective Fed Funds rate is 5.08%.

Global bond yields on Friday were mixed. The 10-year T-note yield fell -1.3 bp to 3.837%. The 10-year German bund yield fell -2.1 bp to 2.469% and the 10-year UK Gilt yield rose +0.3 to 4.280%. The Euro Stoxx 50 closed up +0.40% on Friday. The Shanghai Composite Index today was down -0.06%. Japan’s Nikkei Stock Index closed down -0.57%.

UNDERWEIGHT EQUITIES

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

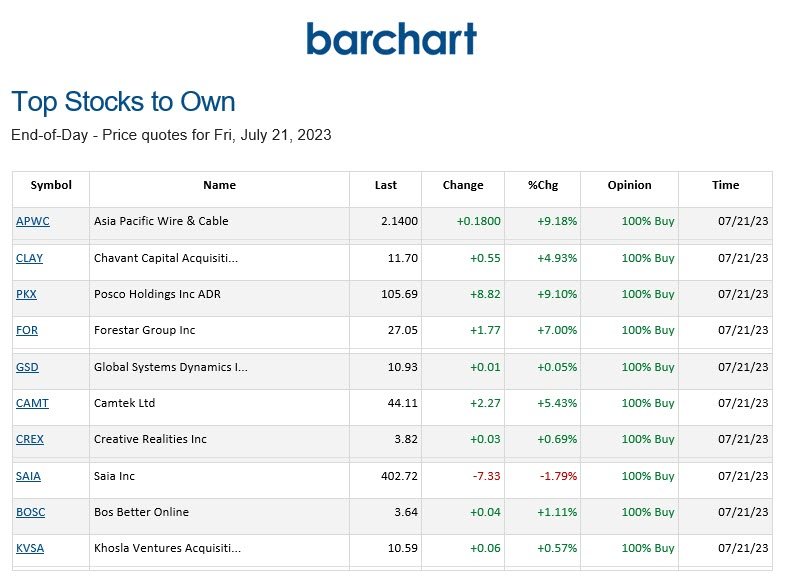

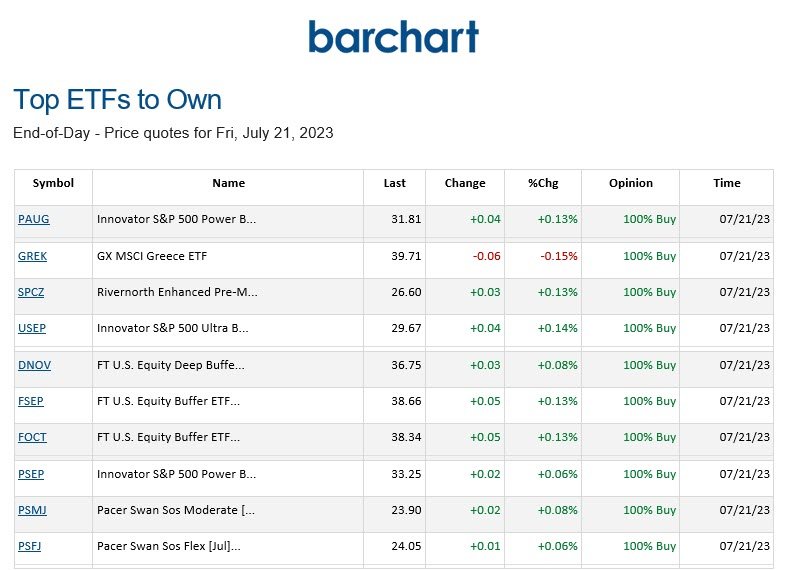

BARCHART: QUICK STOCK IDEAS

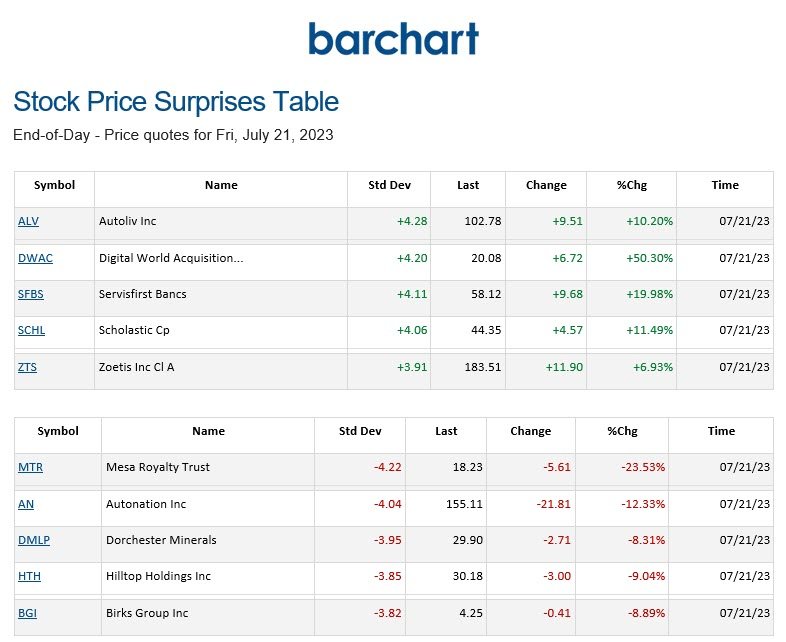

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.