STOCK INVESTORS RAISE CONCERNS

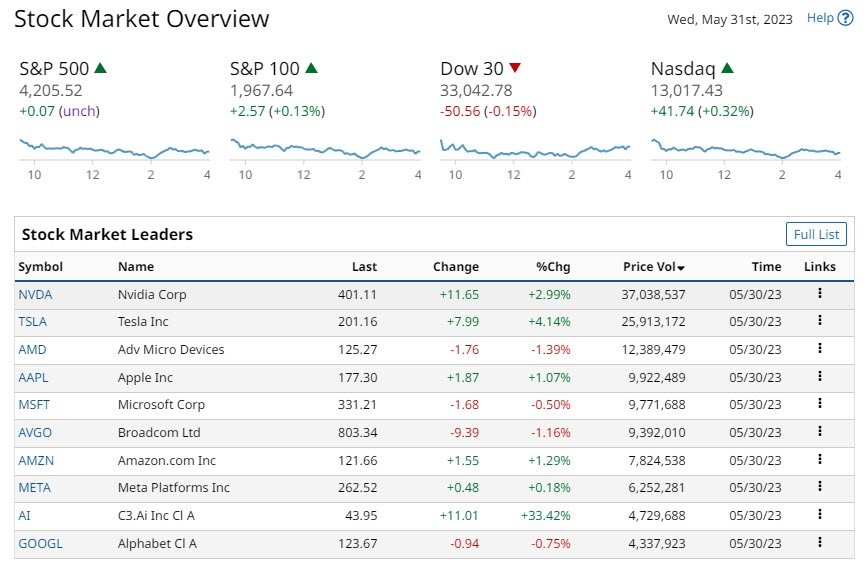

After the long weekend the SPY (S&P 500) was unchanged and the QQQ closed +40%.

After Veteran’s Day, thank you for your service, long weekend, the main U.S. Stock indices closed mixed. So far in 2023 the Nasdaq 100 has reached a 13-month high on the back of Nvidia last week. A tentative agreement to raise the US debt ceiling was reached. Stock investors do have concerns over the cuts in expenditure. Also, the proposed reduced fiscal stimulus for the US economy.

On U.S. economic news, on Tuesday was mixed for equities. Technology stocks were lifted by a fall in LT bond yields while energy stocks were weaker. The market is pricing in a 60% possibility of a +25 bps rate hike at the FOMC meeting on June 13-14. Despite current hawkish monetary policy by the FED, the U.S. economy remains strong

Bullish for stocks. Qualcomm closed up more than +5% due to a spike in demand for QCOM AI-capable products. Not to be left out, Tesla is up more than +3% a possible expansion strategy in China. Bearish for stocks, was a selloff in energy stocks and energy service providers due to a fall in the price of oil. The ADRs for Chinese stocks on concerns over the Chinese economy.

On Tuesday the Euro Stoxx 50 closed down -0.66%. China’s Shanghai Composite closed up +0.09%, and Japan’s Nikkei Stock Index closed up +0.30%.

Subscribe to

Interesting: Danaos Corp (DAC)

Danaos is a major worldwide containership owner. DAC charters ships to many of the world’s largest liner firms. A reputation has been built for providing high-quality operational support to liner companies.

The group has continued to develop maritime transport services throughout its existence. DAC operates a significant fleet and is one of the world’s largest containership charter owners. Their client list includes Maersk, COSCO, and Hapag-Lloyd.

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

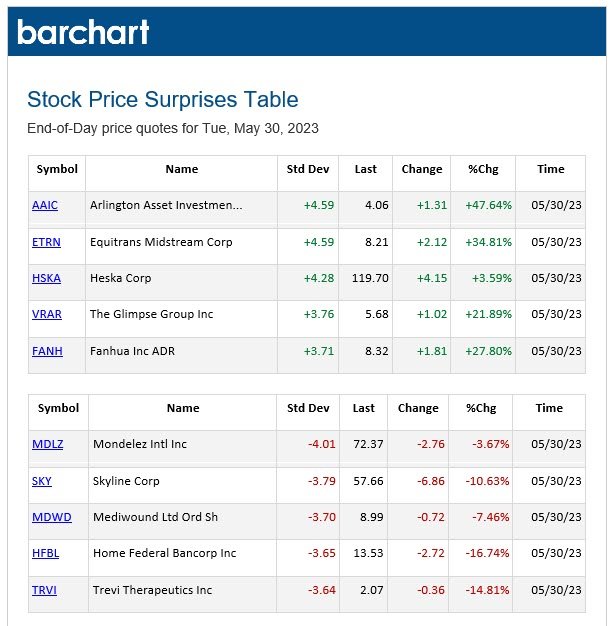

BARCHART'S PICKS

BARCHART: CONSIDER THESE

PRICE SURPRISES AND VOLATILITY

STOCK PERFORMANCE LEADERS AND LAGGARS