What was the key message from the first quarter?

You have not invested in tech stocks.

Considering everything in Q1, stocks have been strong, could stocks be heading to new all-time highs?

The S&P 500 up 6% and the NASDAQ up over 21%.

Then what could come out of the first quarter?

You could take a bet on the banks.

Follow, learn and maybe gain some investment ideas trading with EToro. The platform has over 30 million traders and investors. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

THE BANKS: THE STORY OF THE FIRST QUARTER

After 2022, when Tech stocks slumped, there was a lot of pessimism about the outlook for 2023. Rising interest rates and the talk of an eminent recession fueled the fire. In the end, the pessimism was not justified. Yes, inflation remains stubbornly high, but unemployment is low. Wage growth continues to be sound.

The first quarter has been full of drama. The low point was the collapse of the second largest bank collapse in U.S history. The Silicon Valley Bank post-mortem has been harsh as the collapse seems to have come out of nowhere. The dramatic event sent shivers throughout the U.S and international banks. Another two U.S. banks collapsed in the quarter and then Credit Suisse. Credit Suisse, which has significant operations in the U.S.

SECTOR DIVERGENCE

The shock waves reverberating from the demise of these banks were a shock. Made worse by turbulent swings in inflation and rate hike expectations.

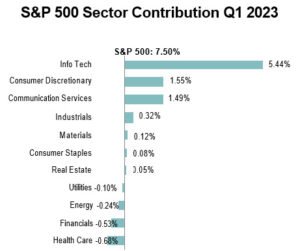

In Q1, the dichotomy in performance has been dramatic. The banks, energy and healthcare all underperformed the S&P 500. Then, seemingly defying the negative rhetoric, the Tech Stocks stormed back. The S&P Tech Sector had a strong performance in Q1, up over 21%. Small caps have lagged over Q1, with the S&P Mid-Cap 400 up 4% and the S&P Small-Cap 600 up 3%. All in all, High Beta and Growth led the markets, while defensive strategies lagged. The iShares ETF (QQQ) recorded the largest quarterly gains since 2020.

There are three factors which are working for stocks.

- Recession can lead to Restructuring

- Interest rates should lead to asset efficiency

- Inflation can lead to pricing power

In December 2022, I published two videos on YouTube. One discussing a recession and the positive impact for stocks.

The other discussing the potential rally in stocks. I will put the links at the end of the blog.

The forecasts for stocks made in December remain valid.

MARCH: SIGNS OF BETTER TIMES, ALL-TIME HIGHS?

The performance of stocks in March may have signaled that stocks are set to move higher. Despite the surrounding chaos, over the banks and fall out, in March stocks were strong. Tech stocks continued to be the main driver, but we can start by looking at two other sectors. Sectors that were Q1 laggards.

The energy sector is back in focus as news about Crude Oil has signed looming cuts in production. Shocking the crude markets are production cuts by the OPEC+ group of producers. This sent prices higher, with WTI Futures Contracts above $80 per barrel. The highest level since January. The May delivery contract is up roughly 8%. This comes at a time when the United States is still mired in a period of high inflation. Higher oil prices have the potential to upend both economic and monetary policy. This could impact decision-making in future rate hikes. This is what Federal Reserve is planning to do.

TECH: INSIDERS SELLING

There are indications that executives at technology companies are selling their shares. This could suggest that the Tech leaders have a lower level of optimism than other investors. This could be over the future earnings prospects of tech stocks. The fact that company insiders are selling their shares does raise a red flag. This in the face of the Nasdaq 100 rising over 21% in Q1 2023. Recent reports suggest around a thousand tech insiders sold shares over the quarter.

It is possible that tech insiders are selling shares due to a declining trust in Q1 earnings results. The belief is that the upcoming earnings season may not be very impressive. Year on year, in Q1 earning could fall by a couple of percent. Keep in mind Q4 2022, watch the video.

THE BANKS: A DRAG ON STOCKS REACHING ALL-TIME HIGHS

Could bank stocks start to rebound?

The action taken by the U.S authorities has restored much needed confidence in the Bank Sector. Bank stocks are risky. They should not be, but they are. The detrimental effects of low interest rates and capital misallocation caused this crisis. Uncertainty remains high. News of more small banks failing could swiftly lead to increased selling pressure. There is always the possibility that bank stocks could fall below the lows seen in 2020. Investing in times of uncertainty is how you make money in investing in stocks. It can even be exciting.

IMPROVING?

The situation going into April has improved. The earnings estimates are leading to the outlook being more optimistic. SVB was unusual, and Credit Suisse’s issues are not new. The shotgun wedding of UBS and CS, like the AT1 bondholder wipeout, was annoying. The banking system is vulnerable, but what is the alternative? These events do illustrate that central banks will do whatever it takes to protect the banks. Most crucially, depositor confidence needs to be restored and it seems that it has been. For more information on the Bank Crisis, click HERE.

Industry consolidation and large economies of scale will benefit the major banks. In the current crisis, the major banks can be seen as a safe haven. Or too big to fail. The major banks could take inexpensive deposits and lend at higher interest rates. Still, the Net Interest Margin will be key to lifting earnings.

The sell-off of the banks in the first quarter was exaggerated, but it was justified. For stocks to move towards all time highs, the banks will have to participate.

Subscribe to

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions. The website is designed for individual traders and investors, as well as institutional clients, including banks, brokers, and hedge funds.

Barchart provides users with access to real-time and historical data on a wide range of financial instruments. Included are stocks, futures, options, currencies, and cryptocurrencies. The website also offers a variety of tools and services for trading and investing. Customizable charts, technical indicators, and screeners for identifying potential investment opportunities.

In addition to its data and trading solutions, Barchart provides news and analysis on the financial markets, with articles and commentary from a team of experienced financial journalists and analysts.

Overall, I find Barchart to be a comprehensive platform for traders and investors looking to stay up-to-date on financial market data and news. Provides access to a range of tools and services to support a wide range of investment strategies.