STOCKS SURGE HIGHER, EARNING UPGRADES

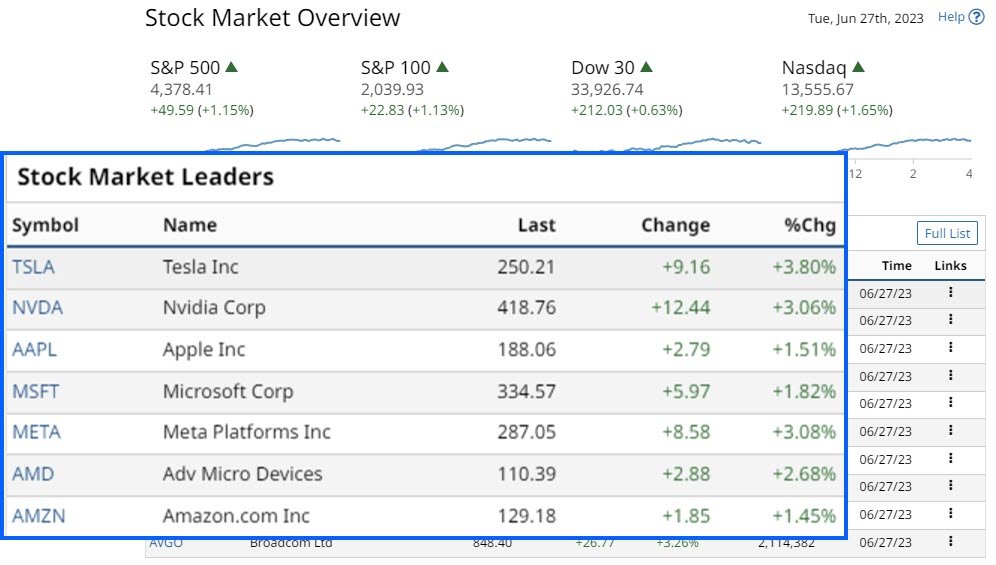

Stocks surge and tech stocks take the lead and earning are being upgraded. What a difference a day makes, with U.S. stock markets surging. For sure the remarks coming from Delta helped, but this was on the back of the strength of tech stocks. Take a look at the Overview Table below.

The Magnificent Seven or Eight, the Magnificent Seven sounds better. Or maybe it is better to say the Magnificent Seven plus. This means that stocks can be added as the AI boom continues to gather force. These stocks, which now weigh more than 28% of the S&P 500, have to move for the index to move.

Thus, with TSLA up, 3.80%, NVDA up 3.06% and META up 3.08%, the SPY closed up +1.15%, and the Nasdaq 100 Index QQQ closed up +1.75%. Also, keep in mind the mid to small caps stock surge higher with Russell 1000 iShares ETF (IWB) up 1.16%. The Russell 1000 stocks are also being upgraded and the PE Ratio for 2024 sits at around 13X.

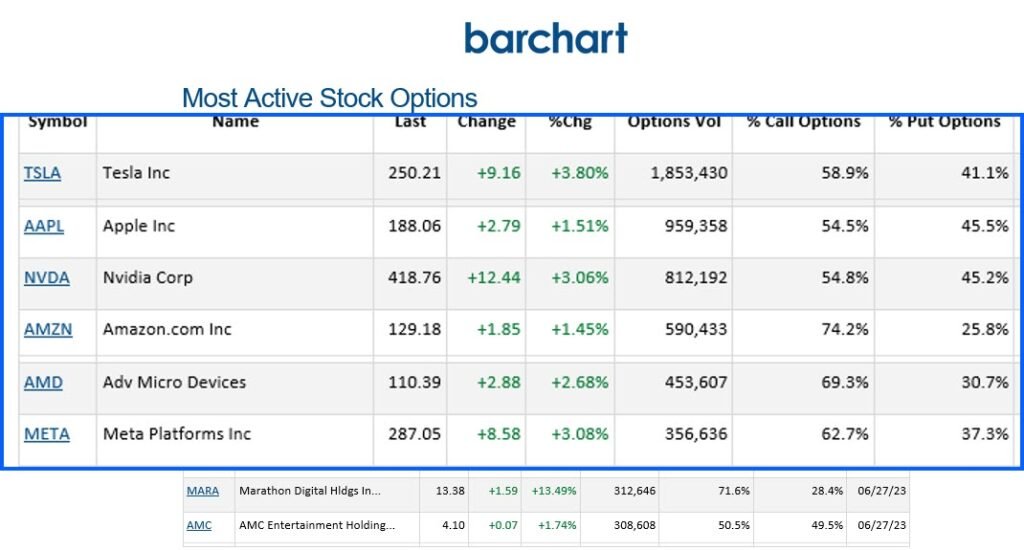

Take a look at the Most Active Stock Options table. These are the major stocks being TSLA, AAPL, NVDA, AMZN, AMD and META. All having the volume of Call Options outweighing the volume of Put Options. Investors are taking a bet that stocks surge higher. Thus Out of the Money Call Options, will prove profitable.

Subscribe to

Most Active Stock Options table

Consol Energy Inc (CEIX)

The Top Stock Pick for Tue, June 27, 2023

CONSOL Energy Inc. mines and exports high-Btu bituminous thermal and crossover metallurgical coal. It owns and operates profitable longwall mining operations in the Northern Appalachian Basin.

Over the last five years, a Buy signal on the 20-200 Day MACD Oscillator for CEIX has resulted in a gain of +703.5%, compared to a +69.02% market gain on the stock. The Signal profit is based on only two trades that lasted an average of 426 days.

Rate expectations a further 50bps

Markets are discounting the probability of a +25 bp rate hike at the next FOMC meeting on July 25-26 at 74%. On top of this the market expects two further rate rises in 2023, with a +25 bp rate hike by November. Keep an eye on the leading economic indicators, one of which is U.S. durable goods orders.

The May report indicated a +1.7 percent MOM increase. This massively beat expectations of a -0.9% decrease MOM. Capital goods orders ex-defense and ex-aircraft, surged +0.7% MOM, above estimates of +0.1% MOM. This data series is a better indication for corporate capital investment,

A RECESSION, IF IT DOES OCCUR WILL BE MILD

Economists rapidly losing credibility now expect a recession in the second half of 2023. If it does occur, I will attend the party because the celebration for finally being right will be massive. Remember a stopped clock is correct twice a day. The Conference Board’s June U.S. consumer confidence index increased by +5.7 points to 109.7. This exceeds estimates for an increase to 104.0.

The +12.2% increase in new home sales in May, reached a quarter- year high of 763,000. This was far higher than market estimates for a modest decrease to 675,000. Then the Richmond Fed manufacturing index increased by 8 points to -7 from -15 in May. Again, above predictions for an improvement to -12.

MARKET MOVERS AND STOCKS TO SURGE HIGHER

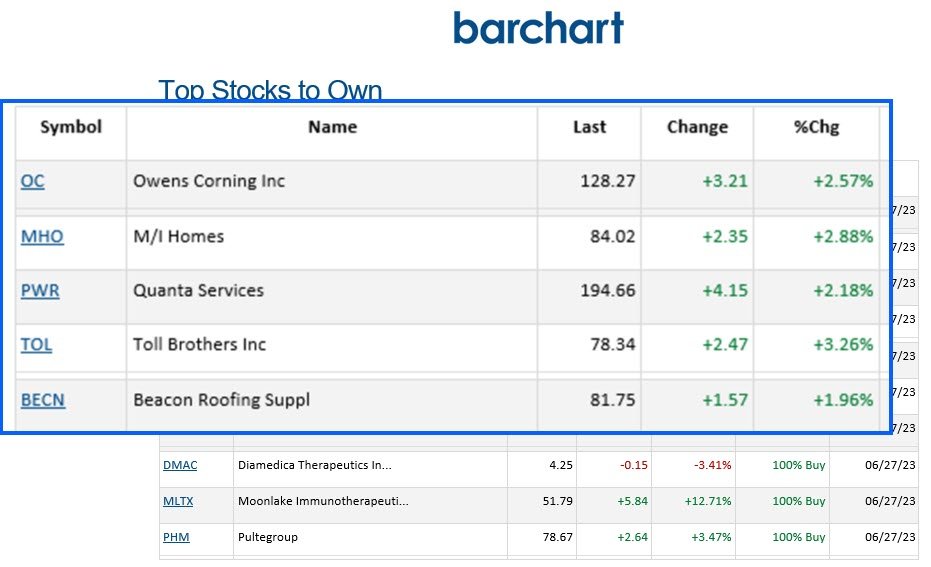

Keep an eye on housing data. Apart from proving that the U.S. economy is in good shape, the data is reflected in the Stock and ETFs to own. On the ETFs to Own table, three out of the top five ETFs are home builders. They include, PKB, ITB, and NAIL.

On the Stocks to Own table, again of the stocks listed three out of five are in home construction. Stocks surged higher, and they include OC +2.75%, TOL up 3.26% and BDCN 1.96%. Also keep an eye on the Leaders and Surprises table. While often the same stocks appear, they do indicate the sectors that are moving. Also possibly other sector related stock ideas.

The Euro Stoxx 50 finished +0.58%, the Shanghai Composite index closed up 1.23%. The Nikkei was down -0.49%, for the fourth consecutive session.

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

BARCHART: QUICK STOCK IDEAS

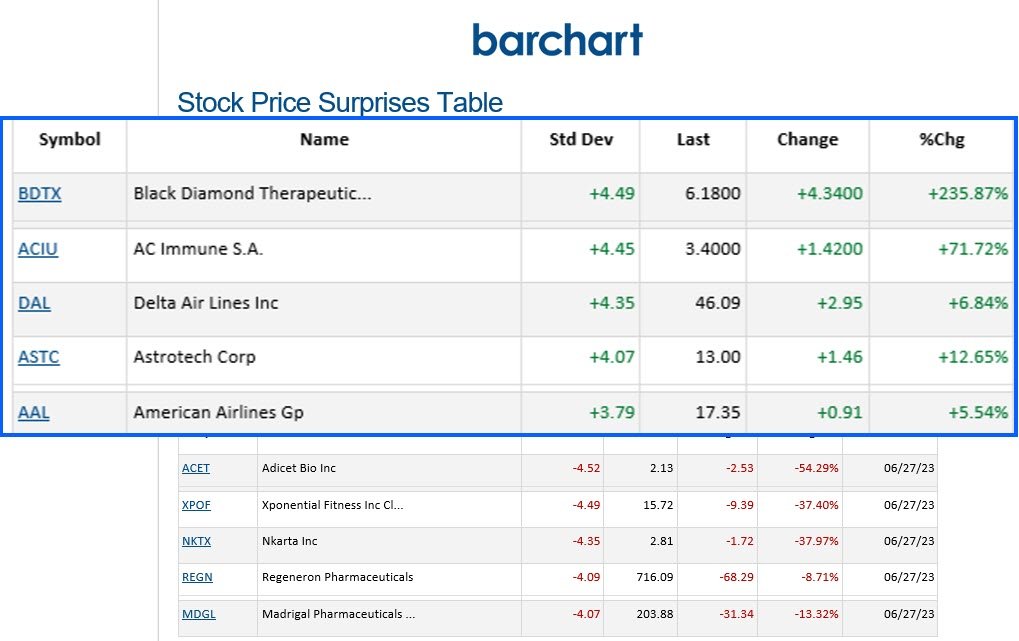

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

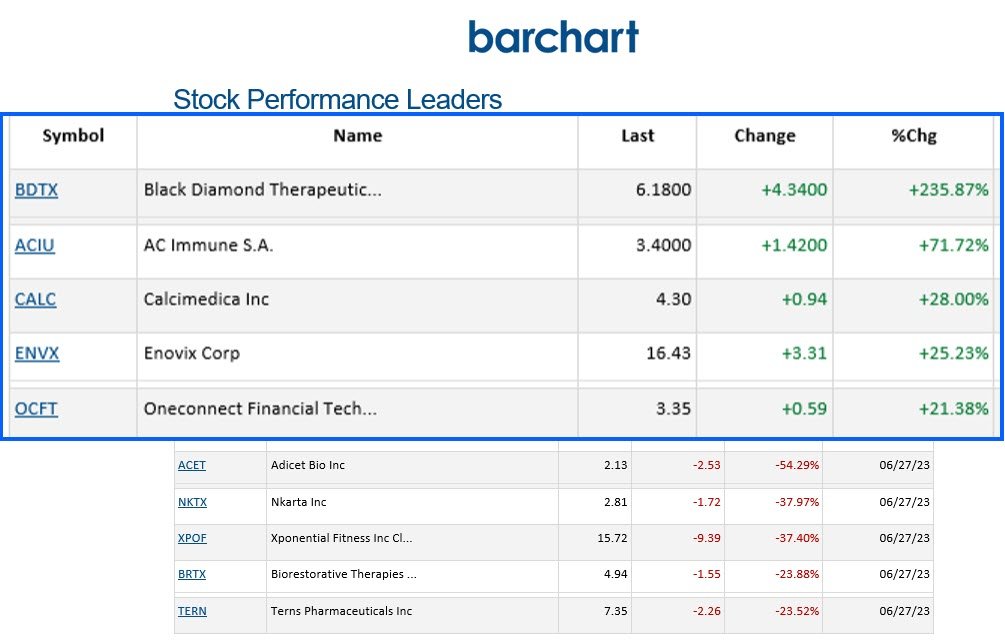

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.

One Response

Stocks surge higher with tech stocks leading

ayktnexxgd

[url=http://www.g334ebeh8flm1b68g3w1n8uc2195n5u6s.org/]uyktnexxgd[/url]

yktnexxgd http://www.g334ebeh8flm1b68g3w1n8uc2195n5u6s.org/