The major banks start THE EARNINGS SEASON ON Friday

CPI AND EMPLOYMENT

Subscribe to

HAVE EARNINGS AT THE MAJOR BANKS PEAKED?

EARNING SEASON STARTS FRIDAY

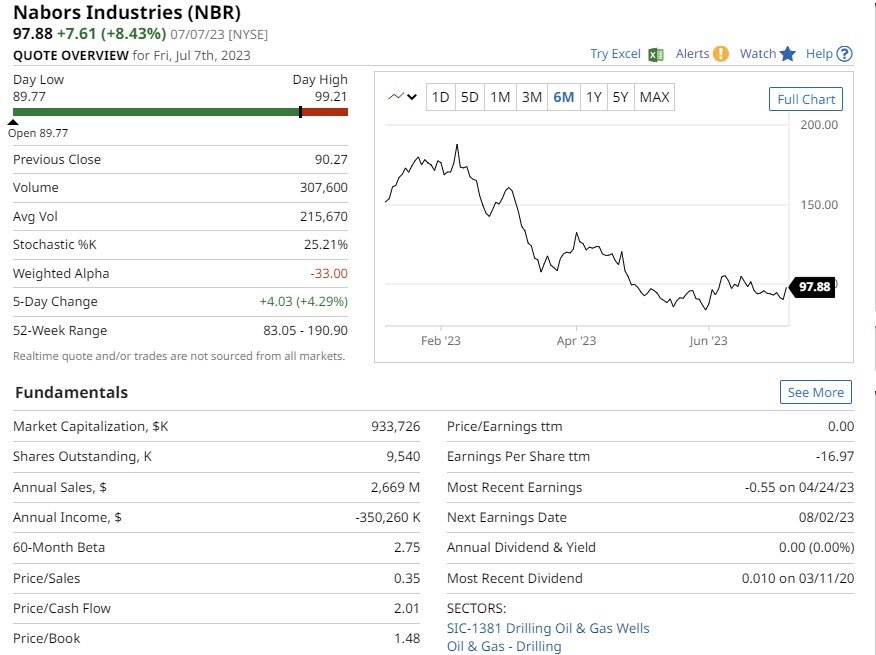

Nabors Industries (NBR)

The Top Stock Pick for Fri, July 7, 2023

The 20-Day Moving Average for Nabors Industries issued a New Buy Signal, with an Entry Price of $97.88.

On this basis NBR has outperformed the stock price over the previous five years. The returns +443.17% have been on a 20-day moving average buy signal compared to the market’s loss of -70.38%. The average transaction duration for the 61 trades used to calculate the Signal gain was 15 days.

NBR is one of the largest contractors in the world

In oil, gas, and geothermal land drilling activities, NBR is one of the largest contractors in the world. Nabors Arabia is the Saudi Arabian company that owns the company. The services offered cover oilfield management, engineering, and transportation. As well as construction, maintenance, well logging, and other support services.

NBR has four primary divisions

NBR’s four primary divisions are U.S. Drilling, International Drilling, Drilling Solutions & Rig Technologies, and Other Businesses. Drilling in the United States includes both onshore and offshore operations. Operations are in the continental United States, Alaska, and the Gulf of Mexico.

International Drilling operates in virtually all of the world’s significant oil and gas fields. The Drilling Solutions division supplies cutting-edge tools and techniques that improve drilling efficiency. The Rig Technologies division produces drilling rigs and offers maintenance and repair services.

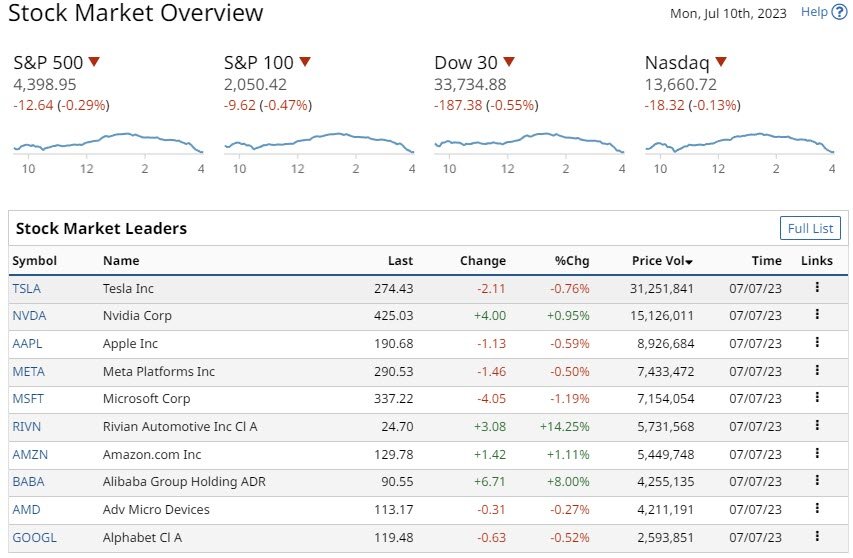

Bond yields MOVE EVER HIGHER

Bond yields around the world continue to climb higher. In the U.S. the yield on the 10-year Treasury note is at a multi month high of 4.054%. The yield on the 10-year German bund is at 2.637%. The yield on 10-year UK Gilts declined to 4.650%, but the current yield is at a 14 year high.

On Friday the Euro Stoxx 50 closed up +0.32%. Shanghai Composite Index was down -0.28% and Japan’s Nikkei Stock Index was also down -1.17%.

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

BARCHART: QUICK STOCK IDEAS

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

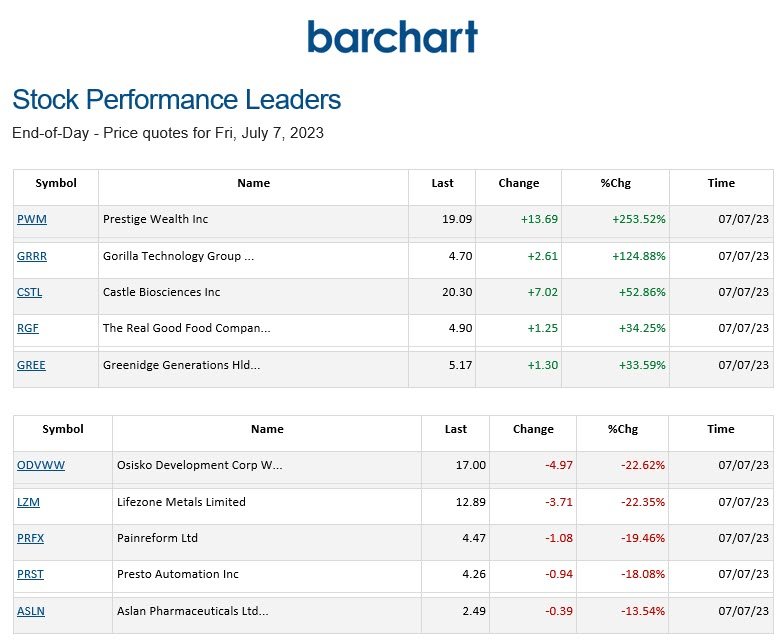

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.