CHIP STOCKS AND THE AI BOOM

The main indexes continue to reach new recent highs, not all-time highs. This is reflecting the positive sentiment behind the stock markets. The Nasdaq 100 reached a 14 month high as technology stocks rose as a result of the strength in chip stocks. Further, M&A activity boosted stock prices. Granting the approval for Adenza to be purchased for $10.5 billion confirmed the deal. Novartis AG also agreed to buy Chinook Therapeutics. The price tag was around $3.5 billion.

The combination of the AI boom, growing M&A activity is indicating broader market participants. Stocks are in a Bull Market. This is known by some since last November, I have embedded one of my YouTube videos from December 2022.

To earn in the stock markets an investor is rewarded for taking risks. Investing in November and December 2022 is what taking a calculated risk is about. At the time, the rate raising cycle was beginning, with talks of a deep recession and plummeting earnings.

To earn in the stock markets an investor is rewarded for taking risks. Investing in November and December 2022 is what taking a calculated risk is about. At the time, the rate raising cycle was beginning, with talks of a deep recession and plummeting earnings. Subscribe to

Why Recession, Rates, Inflation led to this Bull Market

I will repeat the three factors that emphasized my positive view, Recession, Rates, Inflation.

Recession allows companies to restructure. This is both assets and human resources.

Rates, higher rates force companies to de-lever the Balance Sheets. This leads to an increase in asset efficiency.

Inflation, price instability is never a good thing being inflation or deflation. In this cycle inflation did reach a peak of over 9% in June 2022.

Since then, has trended down. So, what is the argument, inflation allows companies some pricing power. When stock market commentators say they are conservative, they don’t invest. They are in the wrong job.

CHIP STOCKS DRIVE THE BULL MARKET

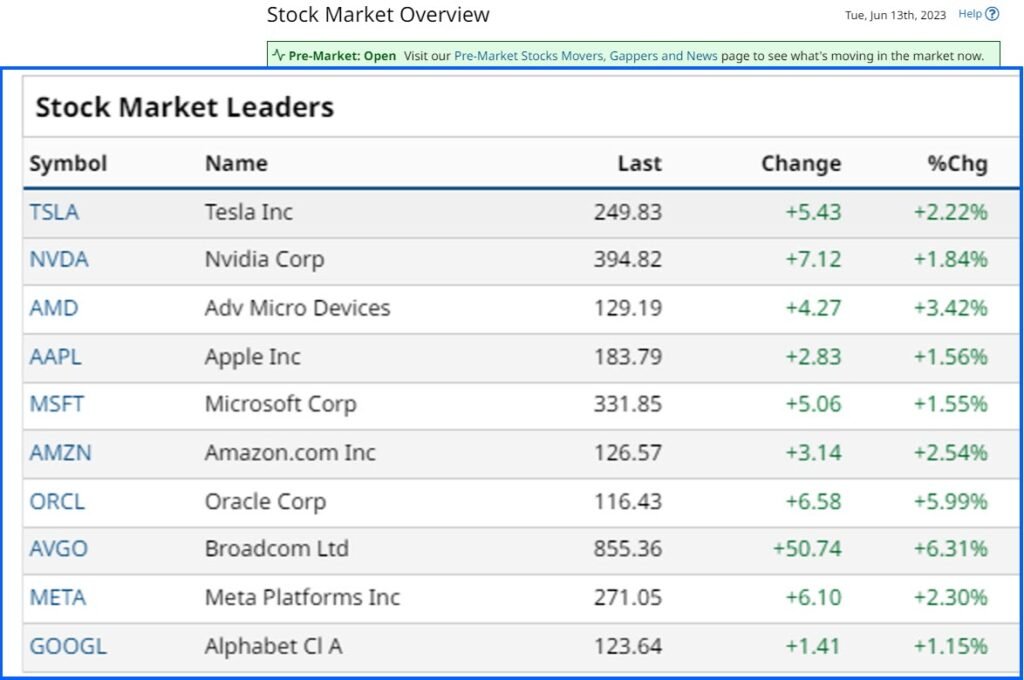

The top gainers in the U.S. stock markets were Broadcom (AVGO) +6%, Intel +5%. Then up 3% plus were Marvell Technology (MRVL), Microchip Technology (MCHP) and Lam Research (LRCX). Stock markets are becoming more optimistic that U.S. inflation pressures will continue to ease. Thus, the Fed may be inclined to postpone raising the Fed Funds Rate even higher.

This would be good for stocks.

Market consensus estimates that the May CPI in the U.S. decreased to +4.2% YOY from +4.9% YOY in April. CPI data is to be released later today before today’s Open. If confirmed this is positive for stocks.

Subscribe to

THE MEETING THIS WEEK

Bond yields in the major markets are anticipating this week’s interest rate decisions. The Fed, ECB, and BOJ all hold their meetings this week. At Wednesday’s FOMC meeting, there is a 25% probability that the Fed will increase the Fed Funds rate. Any increase would be 25bps.

Global stock markets ended with mixed results. Euro Stoxx 50 +0.60%, Shanghai Composite down -0.08%, and Japan’s Nikkei Stock Index ended the day up +0.52%.

WHAT IS THE FED FUNDS RATE? TAKE A LOOK

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

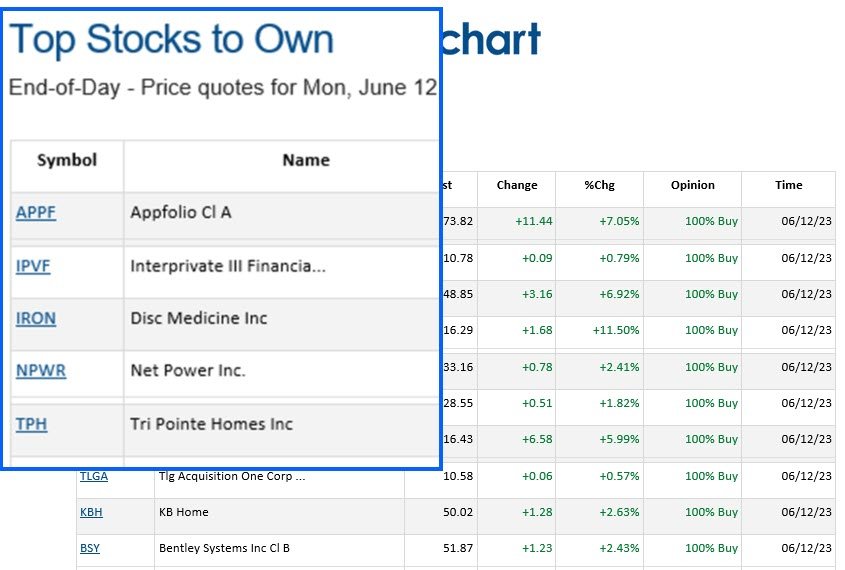

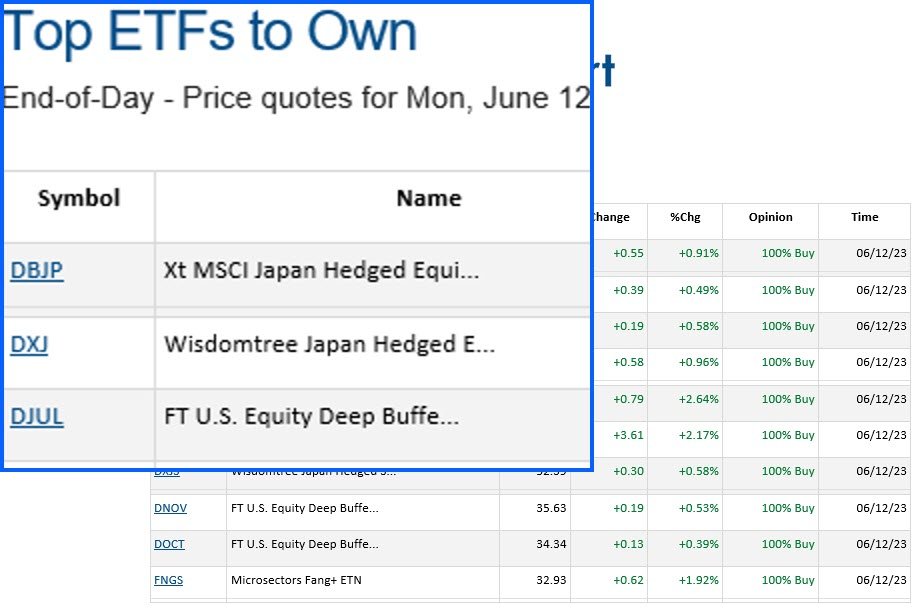

BARCHART: QUICK STOCK IDEAS

Stocks and ETFs to Own for June 13, 2023.

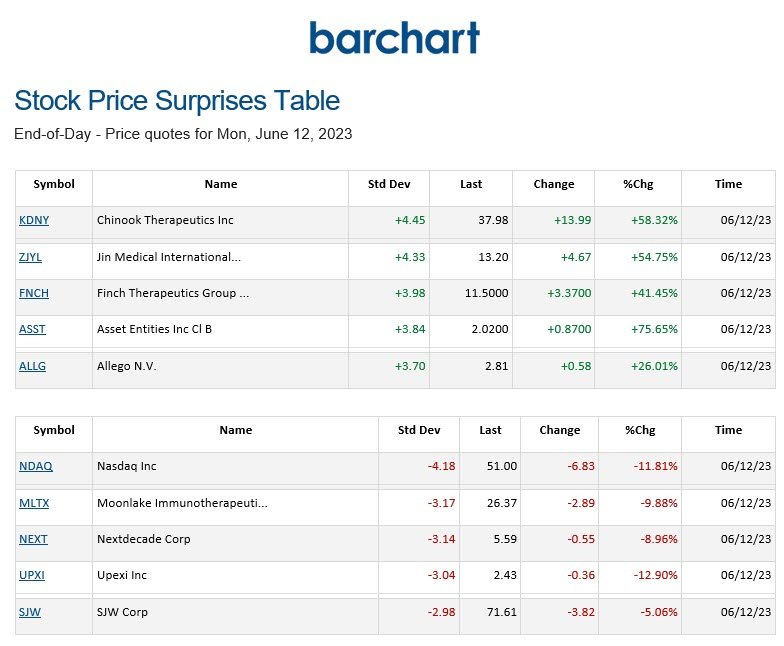

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

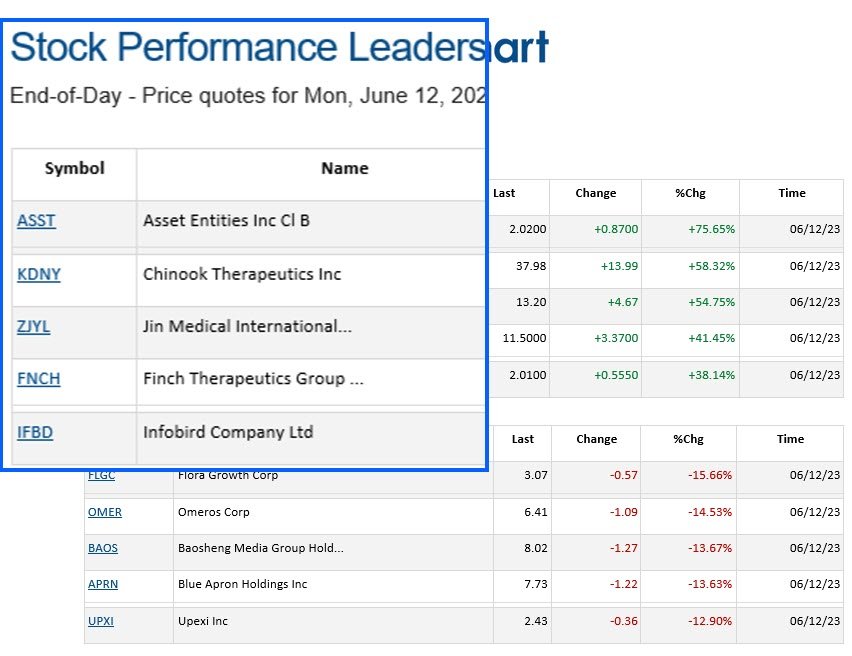

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.