three catalysts for U.S banks

Subscribe to

u.s banks pass the stress tests

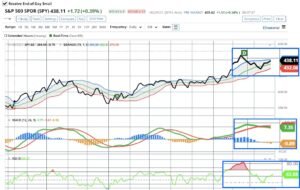

As I wrote on Monday there are three catalysts for the and the unloved regional banks. First, clarity over stress tests, ending the rising interest rate cycle. Then possible M&A activity. Thus yesterday, the Fed released the results of the stress tests. Relief came in the fact the US banking industry and all the largest U.S. banks passed the Fed’s yearly stress tests. Confirming that the U.S. banking system remains strong and resilient.

The basis for the stress tests was this year’s global market shock component. The test was based on the potential for a severe recession and fading inflation expectations. OK, there are questions about if this scenario is still valid. A review of the stress test explored the following. A possible market shock with a less severe recession but with greater inflationary pressures. This scenario is induced by the following. Higher inflation expectations, increases in interest rates, an appreciation of the U.S. dollar. Further complicated by increases in commodity prices. The banks passed based on this scenario.

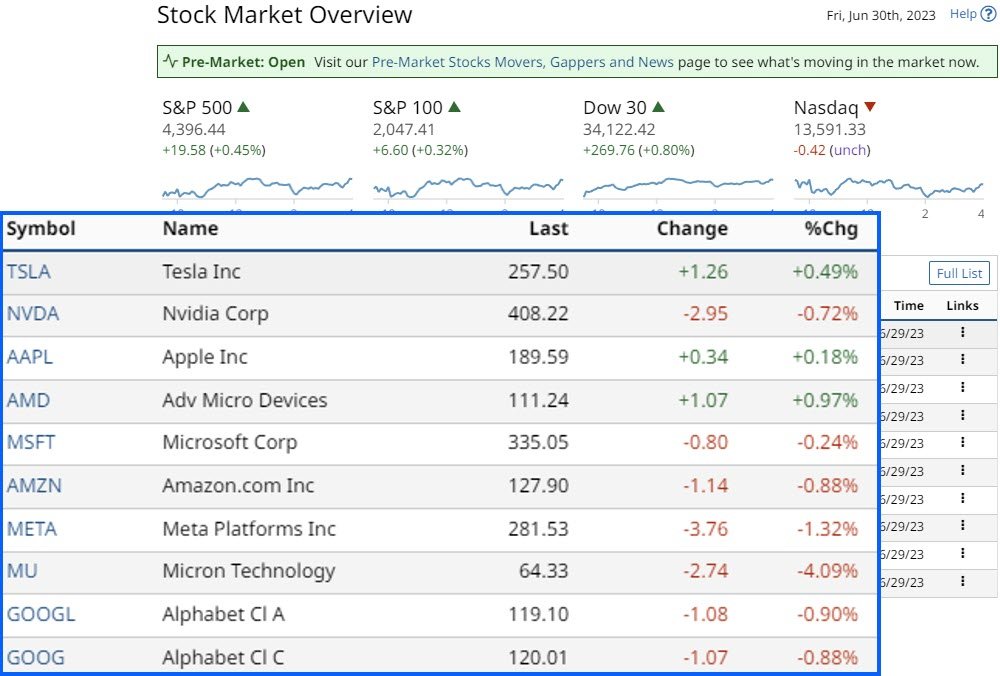

Nvidia (NVDA)

Nvidia (NVDA) after the run up in 2023 when the stock has almost tripled. NVDA is one of the world’s largest technology businesses. Benefiting from advances in visual computing and artificial intelligence. Now, in a relatively short period of time. NVDA has risen to prominence in a very competitive industry. Over the next 12 months, NVDA is expected to consolidate its market position, or dominance.

The company faces significant competitors in the technology industry. This is from companies such as Broadcom (AVGO), Intel (INTC) and Advanced Micro Devices (AMD). At this point all this is now, in the share price. Financial data for the first quarter of fiscal year 2024 was released on May 24. NVDA outperformed analysts’ estimates. It demonstrated the revenues of the two main business areas continue to rise at a significant rate.

Subscribe to

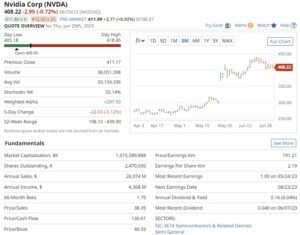

MARKET MOVERS

Overseas stock markets closed mixed. The Euro Stoxx 50 closed up +0.23%, the Shanghai Composite index closed -0.22%, and Japan’s Nikkei Stock Index closed up +0.12%.

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

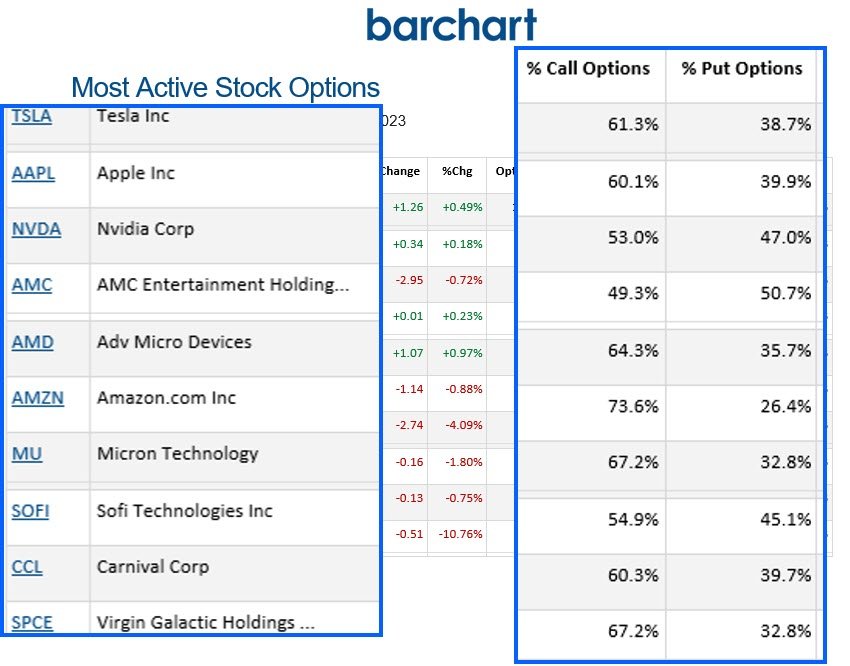

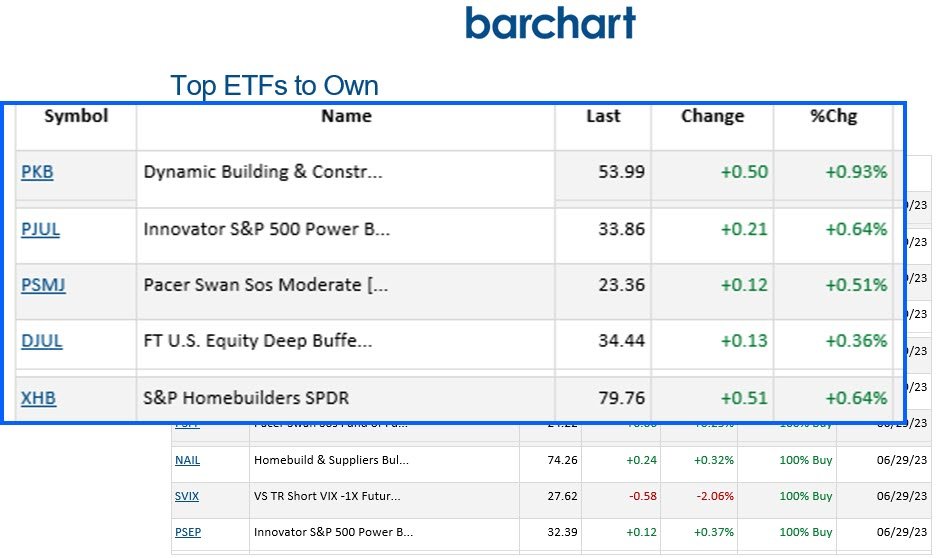

BARCHART: QUICK STOCK IDEAS

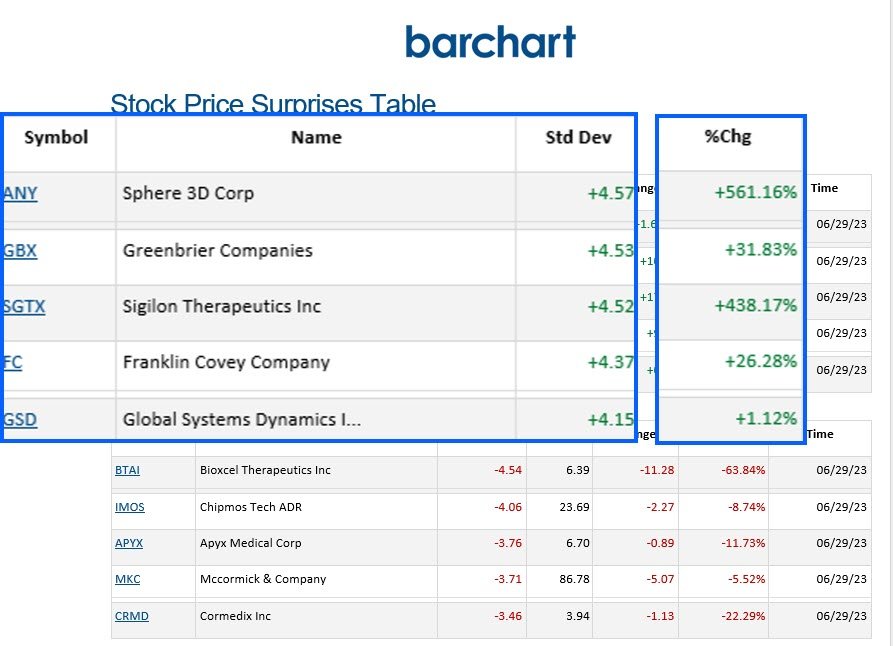

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

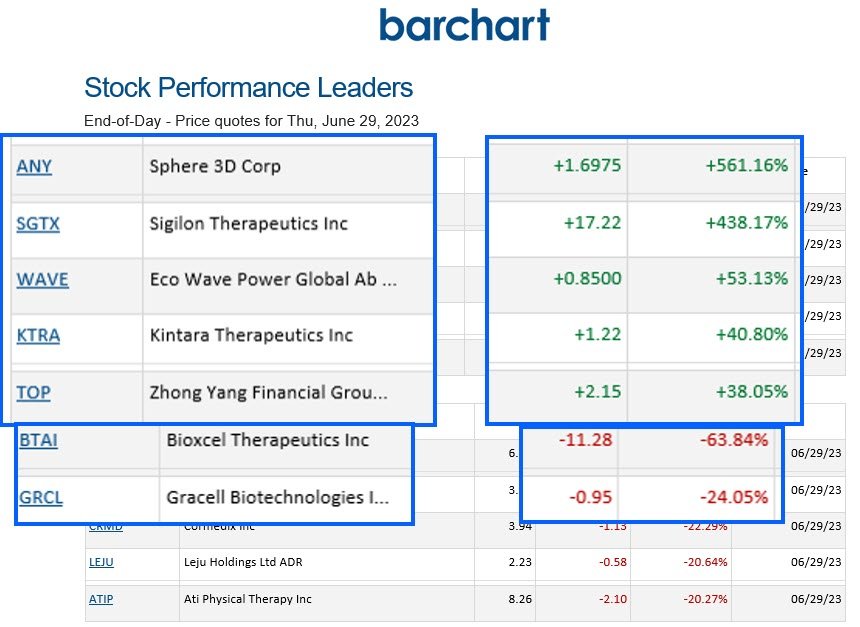

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.