HAPPY 4TH OF JULY!

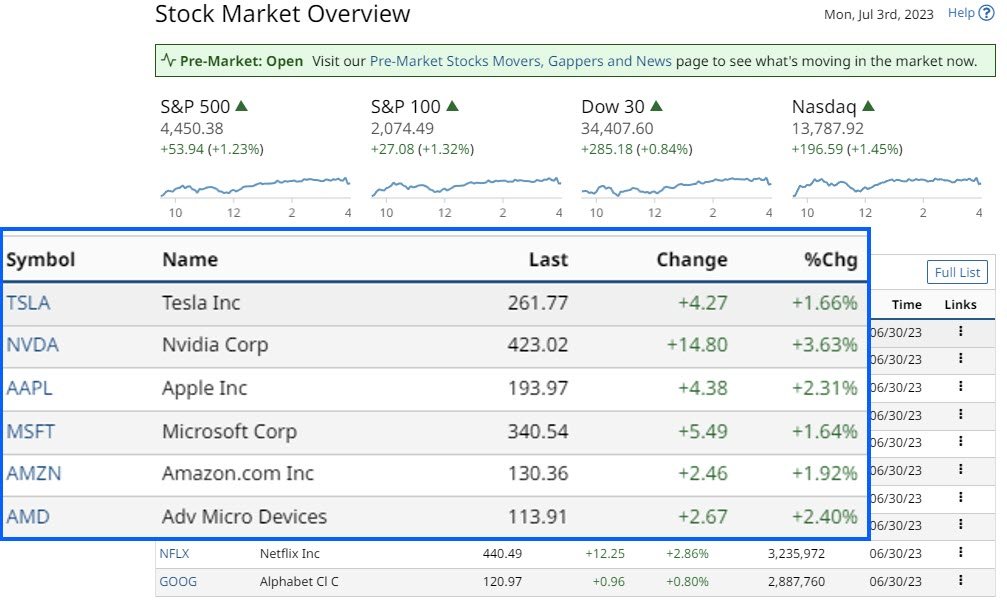

As the second quarter has closed, and to all happy 4th of July. Let’s take a quick review at U.S. equities as gains were posted across the board in the second quarter. The S&P 500 completed its best first half since 2019, up 17% YTD. This was led by mega-cap tech stocks or the Magnificent Seven.

Information Technology led the sector with an impressive gain of 17% in Q2. Utilities lagged the index. The Top 50 was up 13% in Q2, outpacing smaller caps. But towards the end of the quarter mid-small cap stocks have been recording solid gains.

Stocks rose on Friday, boosted by Friday’s +0.5-point increase in the University of Michigan’s U.S. consumer sentiment index. The Index is now at a 4-month high. Also, the PCE deflator report was announced on Friday. This is the Fed’s preferred inflation indicator, is rose +0.1% MoM and +3.8% YoY, all in line with market forecasts. While the key core PCE deflator for May rose +4.6% YoY, below the market predictions of +4.7%.

In summary, the deflator report showed that inflation is trending upward. But with the headline deflator falling. Thus, the presumption by the market is that the Fed could be inclined to be more Hawkish. The next FOMC meeting in mid-July. However, the expectation of a further 50 basis point rise by year end has not changed.

The S&P 500 Index SPY ETF, closed up +1.23%, the Nasdaq 100 Index QQQ ETF closed up +1.60%. The Russell 1000 iShares ETF, IWB, closed up 1.14%.

Subscribe to

Personal Income

Further boosting the U.S. economy is that Personal Income in the U.S. increased +0.4% MoM higher than expectations. The Personal spending data series indicated that spending in the U.S. increased by +0.1% MoM in May, less than the predicted +0.2%. Then as mentioned before, the final-June University of Michigan U.S. consumer confidence index was revised up by +0.5 points. Now it is at a 4-month high of 64.4. All things considered, in particular the 15-month rising interest rate cycle, the U.S. economy remains sound.

For the week ahead, the economic data releases will cover broad aspects of the U.S. economy. Covering construction spending, factory orders, and initial jobless claims. Economists forecast 215K jobs were added during June and for the unemployment rate to fall to 3.6%. Average hourly earnings are forecast to be 0.3% MoM and 4.2% YoY. Thus the Y.S. consumer remains in good shape.

Looking into the 2nd half, the U.S. banks

Major banks will also be watched closely next week after the group passed the Federal Reserve’s stress tests. A test that went so far as to simulate a severe recession. Now the stress tests are done it is assumed it will be back to business as usual for the banks. The Analyst’s expectations are that dividends could be increased by most of the major U.S. banks. While, share repurchases are expected to be subdued in the near term. At least until the economic picture for the U.S. economy becomes clearer.

BANK OF AMERICA (BAC)

In picking a bank to benefit from a rebound, one could take a look at Bank of America (BAC). Like many of the US banks, BAC’s stock price has been under pressure. The bank crisis in March, the collapse of First Republic and SVB have left a mark. Consider a couple of points, BAC’s current share price is below book value. In Q1, BAC required less than 7% of the net income line to cover preferred dividends. For an income orientated investor, preferred shares are interesting. They are currently yielding around 6%.

The U.S. Banks: EPS and dividend growth

All the major U.S. banks are in focus for equity allocations, as the stress tests are now behind them. The U.S economy is holding up well. Thus Goldman Sachs (GS), Morgan Stanley (MS) could benefit from increased activity is the capital markets. The U.S consumer remains sound and retail orientated banks could benefit. JPMorgan Chase (JPM), Bank of America (BAC), Wells Fargo (WFC) and Citigroup (C), will weather the storm. In reality many of the smaller regional banks may be subject to take over in the next 2 years.

The Euro Stoxx 50 closed up +1.02%, the Shanghai Composite index closed +0.62% and the Nikkei Stock Index closed down -0.14%.

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

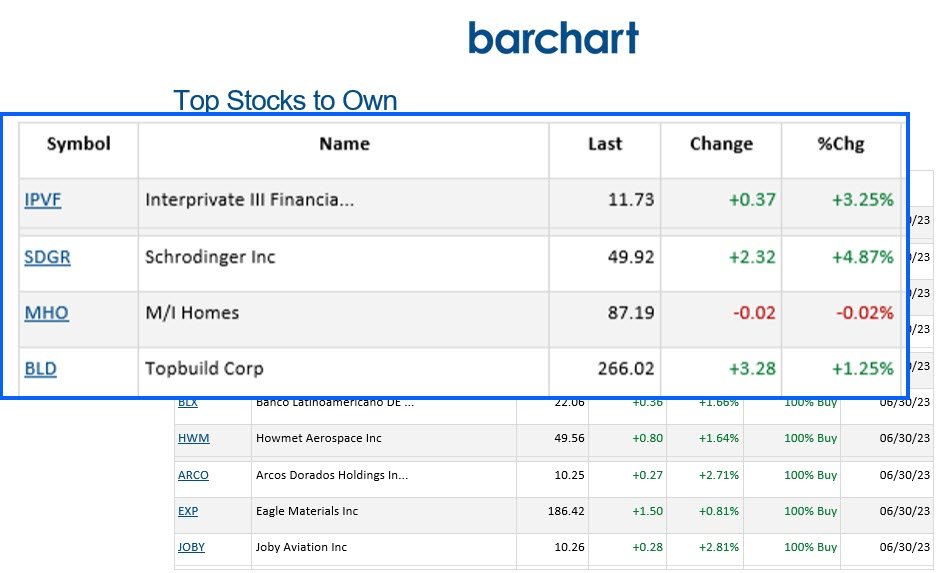

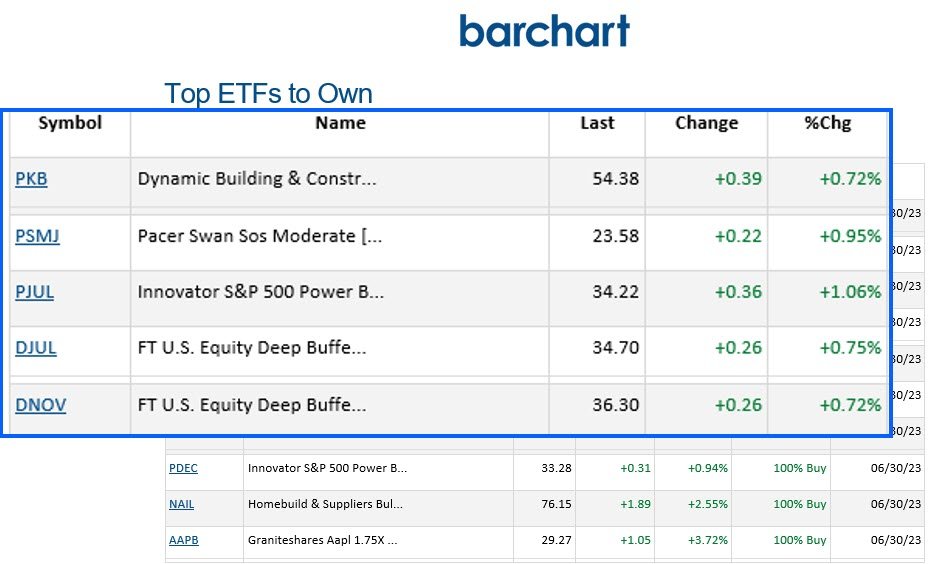

BARCHART: QUICK STOCK IDEAS

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.