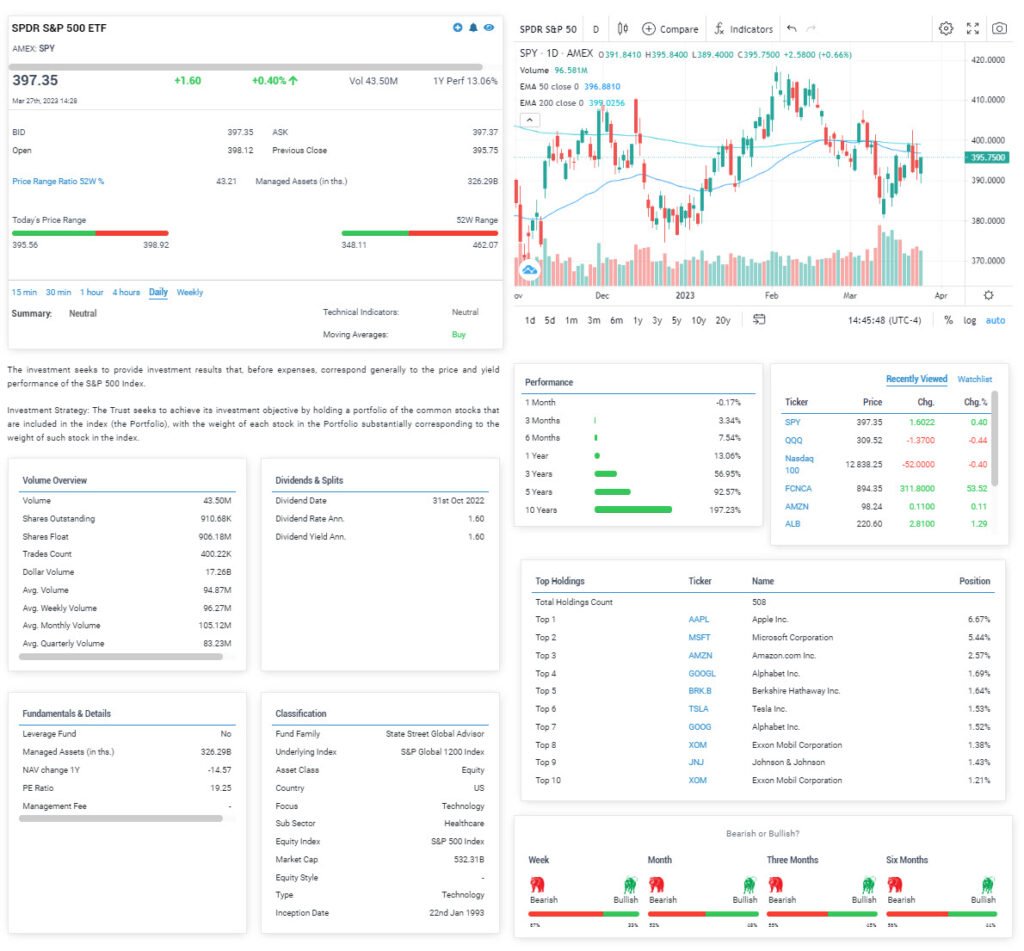

The Bank and Tech stocks driving the Stock Markets higher

In the U.S. the major index are set to continue on the strength last week. For the week the S&P 500 and the Dow opened up, the NASDAQ down slightly. The NASDAQ is sensitive to increases in Treasury yields, due to higher discount rates. Driving the Indexes higher are reports of assistance to the bank sector by U.S. Regulators. The U.S. regulators are considering increasing an emergency loan line for banks. This will allow much needed time for Banks to rebuild their balance sheets. This is a relief for investors in the Bank Sector.

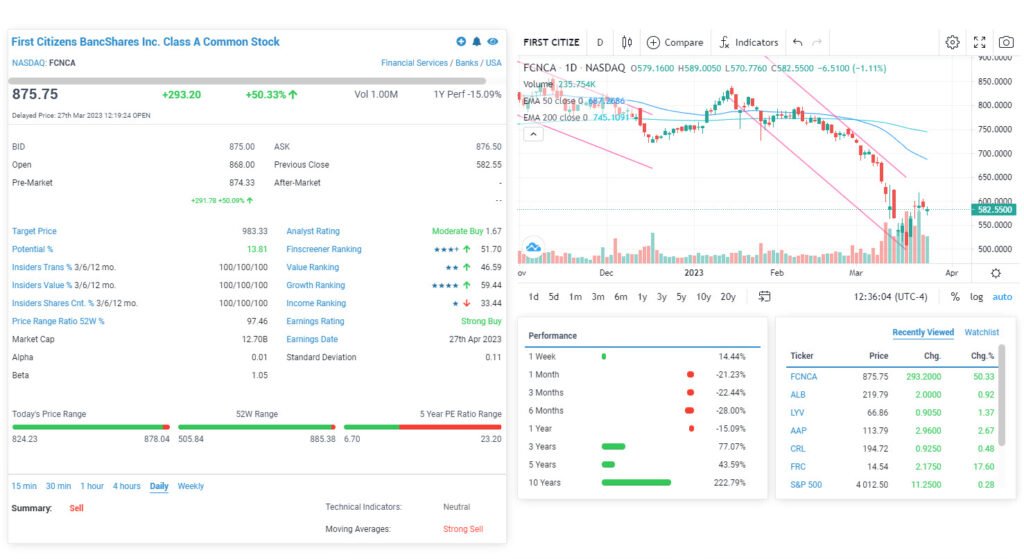

The acquisition of Silicon Valley Bank by First Citizens Bancshares, drove shares higher. The bank will purchase a book of performing loans and deposits, see below. This action was a relief as it eased concerns about the stability of the Bank Sector. Meanwhile, the Nasdaq 100 lost ground, crossing into negative territory.

GRAPHS BY FINSCREENER

ECONOMICS

Last week, the FOMC raised the Fed funds rate 25 bps to 5.0%. The Fed revised its economic forecasts for pricing, growth, unemployment, and interest rates. The markets’ reaction was positive. In anticipation, the markets are pricing cuts in interest rates later in 2023. Possibly even significant cuts. This is in contrast to the current rhetoric from the Fed, and the Fed’s forecast.

The importance of this meeting was in the Fed’s revised economic estimates. First, the Fed confirmed its 2023 Fed funds prediction of 5.1 percent. This would indicate one additional rate hike in 2023 followed by a hold of interest rates for the rest of the year. Second, the Fed expects GDP growth of 0.4 percent in 2023, down from 0.5 percent in December. They also reduced their growth forecast for 2024 from 1.6 percent to 1.2 percent.

SUBSCRIBE TO FINSCREENER

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

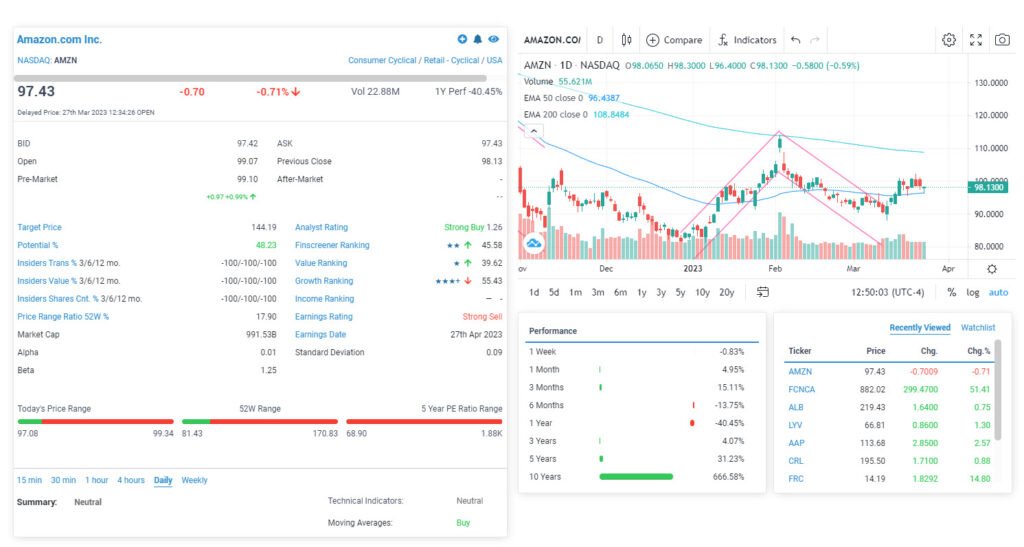

Amazon (AMZN)

The Amazon stock price is trading around pre-pandemic levels. The global pandemic drove an acceleration in e-commerce and cloud computing. This highlights the impact of a massive and rapid increase in interest rates. Compounding valuation parameters are Amazon’s profit margins.

The group’s ‘margins have been squeezed over the past few years. Price inflation and CAPEX has led to a deterioration in e-commerce margins. Investors turned their focus squarely on Amazon Web Services (AWS). Amazon has indicated that it expects a steep deceleration in AWS growth rates. This has dragged on the stock price. Analysts are assigning little value to the long-term growth potential for AWS. In particular if AWS moves into a new period of expanding margins.

First Citizens Bank (FCNCA)

The bank has agreed to buy the deposits and loans of Silicon Valley Bank (SIVB). In total, the acquisition is for USD 72 billion in assets, at a 23% discount. The FDIC is set to lose around as a further USD 90 billion in securities and other assets. The FDIC will also get equity appreciation rights in First Citizens’ common stock.

The acquisition is a positive for First Citizens Bank. The preacquisition PE ratio for First Citizens Bank was around 12.50X, the price-to-book (PB) ratio is 1.3, a PEG ratio of 2.3. The ROA is 1.17% and the ROE is 14.7% are expected to increase post-acquisition.

Tech Stocks driving the Stock Markets higher

Apple (APPL), Alphabet (GOOGL), and Microsoft (MSFT) rallied in March. This is due to their perceived safe-haven status. Concerns over contagion from the banks has driven investors into the Tech Sector. The cash-rich balance sheets and reliable income streams of Tech Sector businesses have been a driver. Nvidia (NVDA), Meta Platforms (META), and Tesla (TSLA) have also benefitted.

Bond Yields and Bank Stocks

The decrease in Bond yields and the turbulence Bank Sector were the joint drivers. So far in March the Nasdaq 100 +6% and up over 20% for the low in October. Tech stocks could be pushing towards becoming overvalued. Expecting a recession has given concern to the uncertainties over the Tech Sector’s earnings. If the Fed keeps rising interest rates, falling bond yields, which helped the surge in Tech Stocks, may be short-lived.

The Rally

The rally in Tech Stocks, in particular, the large caps has occurred without fundamental improvement in net earnings. Earnings in the Tech Sector could be down around 7.7% in 2023, down from +5.2% six months ago. The growth in revenue for the Tech Sector has fallen from +6% to 0%.

The recent tech stock rally and falling earnings estimates have raised valuations. This has driven the long-term multiples for the Tech Sector to be above its recent averages. The Nasdaq 100 trades at 24X forecasted earnings, above its 10-year average of 20. Apple and Microsoft, the Nasdaq’s largest businesses, are above their long-term averages. Nvidia is over 2X it 10-year average.