THREE WEEKS OF LOSSES, NOW NVDA IS KEY

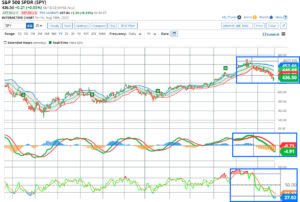

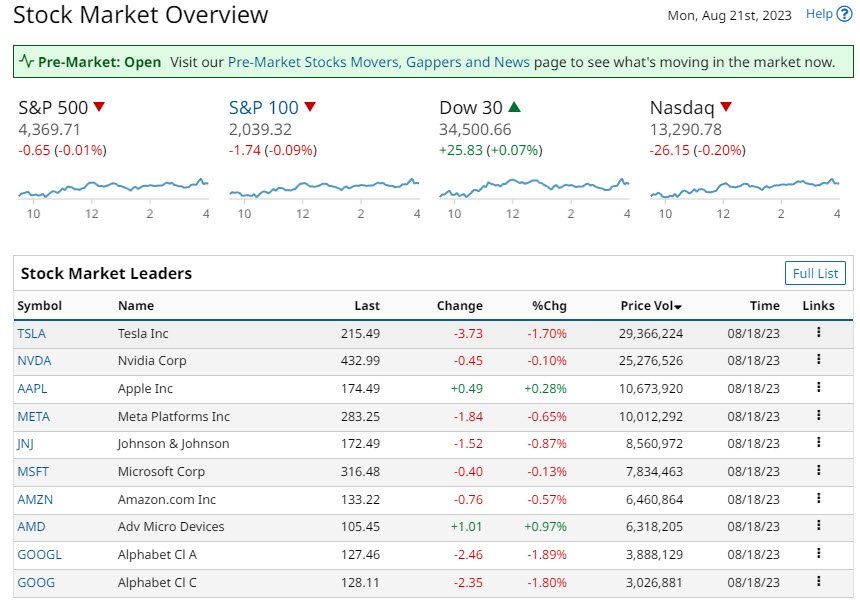

Stocks finished mixed on Friday, which added to the woes of the stock market. This culminated in three consecutive weeks of losses. The S&P 500 Index (SPY) was flat, and the Nasdaq 100 Index (QQQ) closed down -0.14%. Thus, the S&P 500 slid to a 6-week low and the Nasdaq 100 plummeted to a 2-month low. So where to from here?

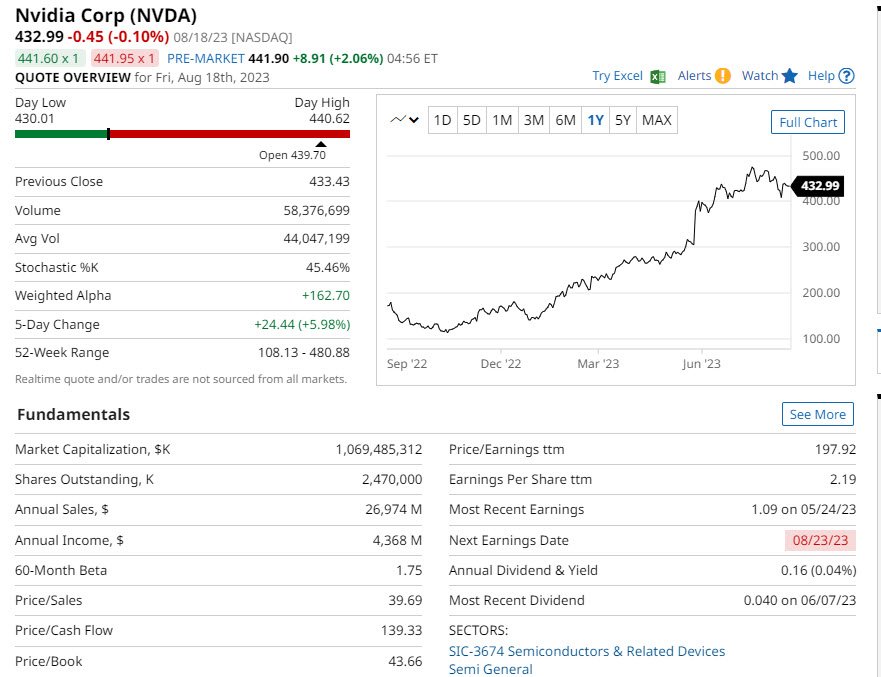

What are the major headwinds facing stocks now that the earning season is nearing a close. Remaining on the earnings front this week, are Nvidia (NVDA) Deere (DE), DICK’S Sporting Goods (DKS), and Snowflake (SNOW).

There earnings breakdown will be scrutinized, in particular NVDA. Remember earlier in 2023 NVDA set the stock markets alight with management’s forward projections.

There earnings breakdown will be scrutinized, in particular NVDA. Remember earlier in 2023 NVDA set the stock markets alight with management’s forward projections.

Subscribe to

COULD NVDA ADD TO WEEKS OF LOSSES?

OK, there is strong demand for NVDA’s AI processors. Despite this several analysts and investors expect that NVDA could provide weak earnings projections. This is not so much an NVDA problem but a problem with suppliers. Several suppliers have provided dismal forecasts. Keep in mind the poor results and guidance from the supplier SMCI. Post results the stock fell 23%.

I would break the current headwinds down to three main gusts of wind. Some are more permanent concerns that others. Thus the U.S. markets are being buffeted even rocked by a perfect storm. The three main gusts of wind are increasing interest rates, and worsening data in China. All combined with weak summer liquidity and no clear driving sentiment post earnings.

CHINA REFLECTING JAPAN 1980S?

CHINA NOT WEEKS OF LOSSES, IT COULD BE YEARS

In China, the overall strategy seems to be increase lending. The Chinese central bank and financial authorities met with bank executives again. This was to urge them to increase lending to promote a recovery. The conference also saw policymakers call for mortgage policy modifications and optimization. This all indicated growing anxiety about the domestic economy. Global stock managers expect pain as China’s sharp slowdown hurts companies that depend on it. Investors are de-risking after China’s growth projection was cut.

This has reflections of Japanese stocks in the late ‘80s. Then the government encouraged investors to buy stocks. This was in reaction to the October crash in 1987. It worked for a while, until around 1992, and then caused 30 years plus of pain.

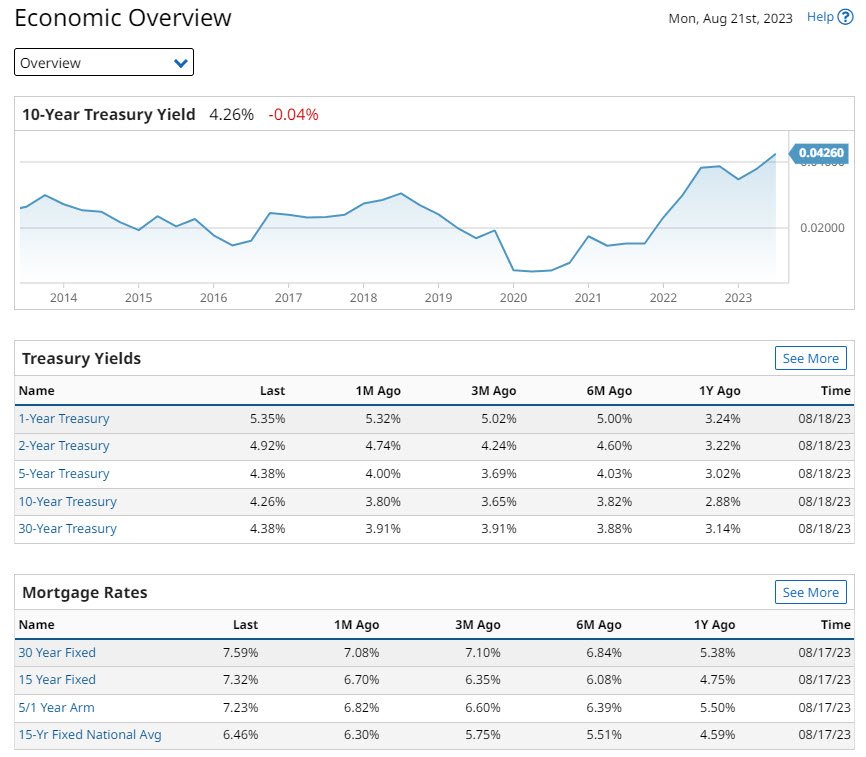

INTEREST RATES, THE STORY IS NO FOCUSING ON THE LONG END

The story on Short-term interest rates has been discussed at length. Market economists are discounting at 10% probability a +25 bp rate rise at the September 20 FOMC meeting. Then at the November 1 FOMC meeting +25 bp rate hike at a 36% probability. OK but the real action to impact stocks will be at the Long-End of the U.S. Yield Curve. At present the U.S. Yield curve is inverted. This will change, Long-term interest rates are set to rise. In the end the Yield Curve will normalize.

Despite current sentiment, at some point the Fed will cut the Fed Funds Rate. By some point, the time horizon is over the next two years. For sure, the Fed will probably reassert its commitment to keep interest rates high. Even for a protracted period to prevent inflation from escalating. So, cutting rates is still way off, thus at least two years. This week Economists will evaluate global flash PMI prints. Also U.S. durable goods orders, and European sentiment indicators early in the week.

But impacting stocks and the Equity Market Risk premium is the Long-end of the yield curve. Long-term rates are set to rise. Impacting the long-end with be receding concerns over a recession. More importantly will be with long run unwinding of the Fed’s Balance Sheet or Quantitative Tightening.

Global bond yields on Friday moved lower. The 10-year T-note yield fell -2.1 bp to 4.253%. The 10-year German bund yield fell -8.7 bp to 2.622%. The 10-year UK gilt yield fell -7.1 bp to 4.675%. Overseas stock markets Friday settled lower. The Euro Stoxx 50 closed down -0.35%. China’s Shanghai Composite Index closed down -1.00%. Japan’s Nikkei Stock Index closed down -0.55%.

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

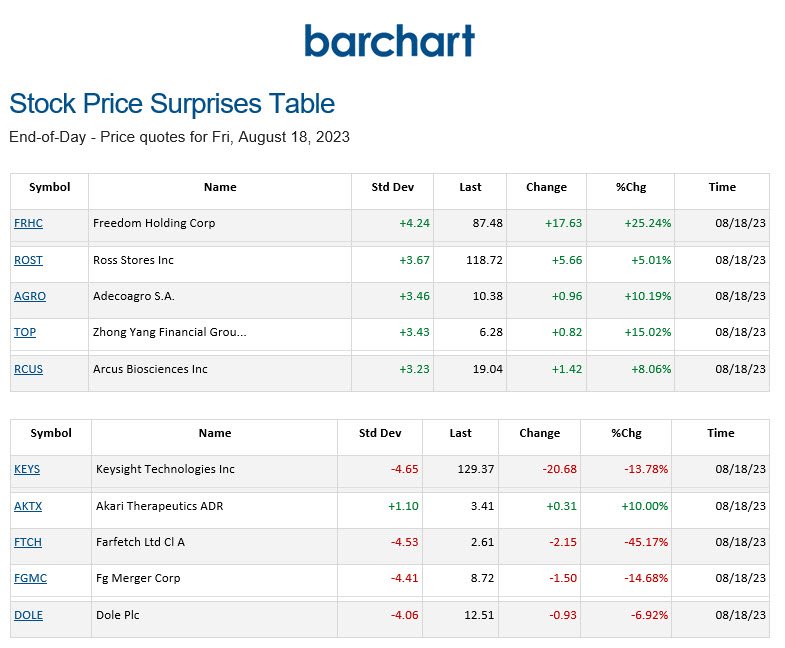

BARCHART: QUICK STOCK IDEAS

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.