THE storms brewing in the stock markets

There are storms brewing

All of my Blog Posts contain Affiliate Links to products or services that are known to me. I may receive art any time a commission if a purchase or subscription is made via an Affiliate link.

Subscribe to

THE STORMS BREWING WILL PASS, TIME HORIZON IS KEY

what are the potential remedies to the storms?

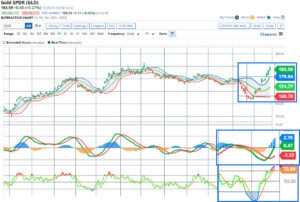

What’s pushing the stock markets down and what are the potential remedies. The first and most important issue facing stock investors are the rising yields on U.S. Treasuries. In particular at the long end of the U.S. Yield Curve. It is important to keep in mind, with regard to the Long-end of the U.S. Yield Curve. Interest rates are expected to increase, they are still turbulent. In 2024, the yield curve in the U.S. should invert.

Long-end of the Yield curve

Thus, short term interest rates could come down. But this is not where the real action will be for stocks. This will be at the Long-end of the Yield curve, where there could be an increase of 100 basis points or even more. The second is that after the terrorist attacks in Israel. The third is the broader issue around the U.S. economy. Then the fourth is selecting a speaker of the House of Representatives. I thought this one would have been easy.

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

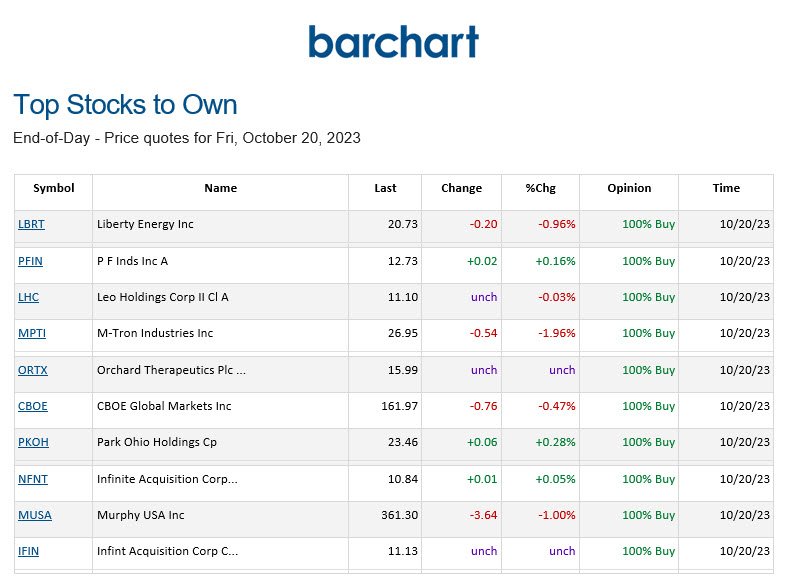

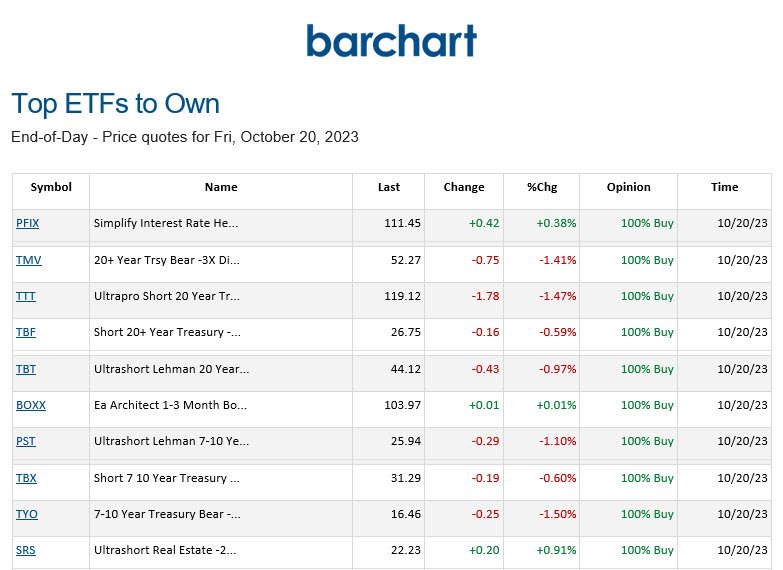

BARCHART: QUICK STOCK IDEAS

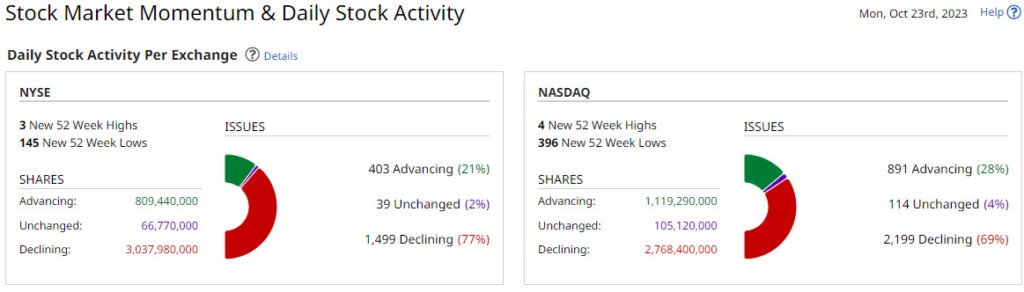

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

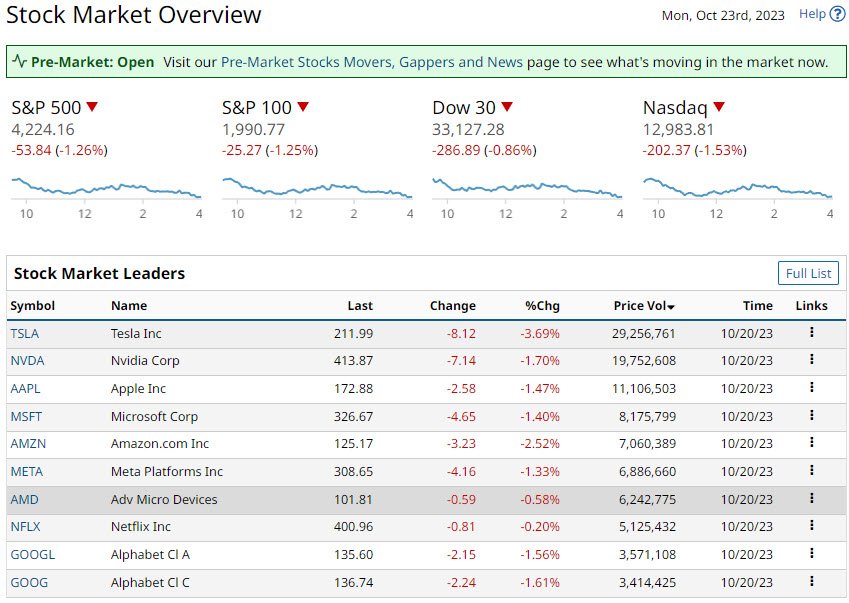

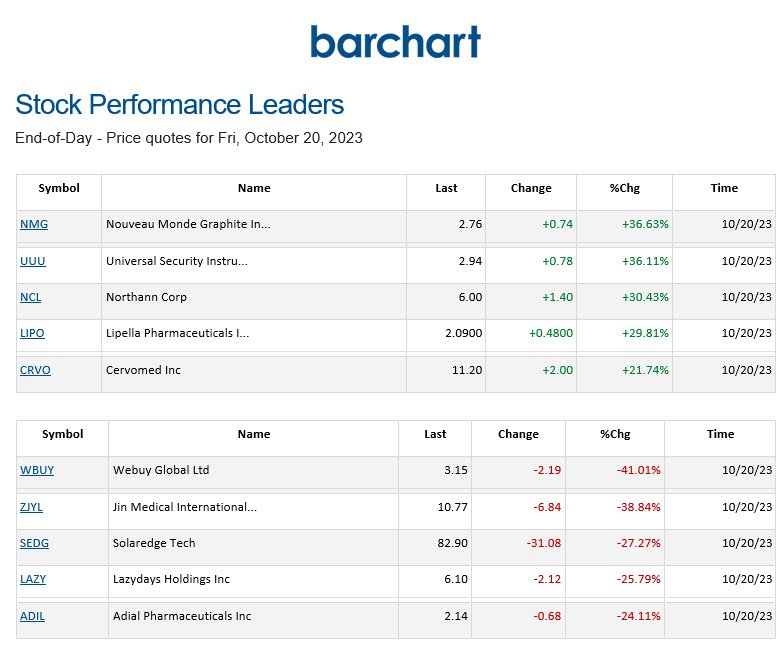

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.