A GOLDILOCKS ECONOMY??

A Goldilocks economic scenario, not too hot and not too cold. Is this starting to evolve in the U.S? On Friday, U.S. Stocks rose marginally. This was after key economic data indicated the U.S. economy could avoid a recession. The Fed’s strategy of raising the Fed Funds rate to the current 5.5% more than appears, it is working.

The U.S. economy in terms of growth, inflation and employment is heading towards a unique scenario. A Goldilocks Economy. If achieved, this will enable the Fed to achieve a soft landing or no recession at all. Stock market commentors and analysts are now predicting the major U.S. Stock Indexes will rise to new highs. Congratulations, you are 6-months too late.

The Earnings Season is well underway. To date, over 80% of companies have beaten expectations. Thus, in line with the expectations of the stock markets hitting new highs. Earnings are now being upgraded for the full year 2023. The fact that a Goldilocks Economic scenario is achievable, upgrades for FY 2024 should come. The S&P is currently sitting on a market EPS of around $229, thus a forward PE of 20X.

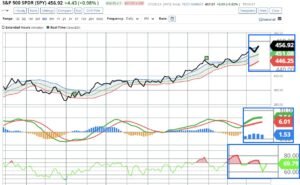

S&P 500 Index (SPY) Friday closed up +0.99%, and the Nasdaq 100 Index (QQQ) closed up +1.85%.

Subscribe to

a rebound or recovery or growth story

Investing in stocks is all about taking risks. So far, the current Earnings Season has been better than expected. An update on GDP growth is coming out this week. Keep this scenario in mind, if the S&P market EPS increases north of 17%, maybe up to 20% greater. The estimated market EPS could be as high as $275, the market PE would be around 16.7X. After the winning run ended on Thursday, the tech-heavy Nasdaq gained 2.0%, the S&P 500 up 1.0%, and the Dow Jones average gained 0.6%. Nine S&P sectors closed green. Communication Services led the week with a massive 6.8% gain.

EARNINGS ARE A KEY PART OF THE GOLDILOCKS STORY

Over the next five trading days, over a third of S&P 500 stocks will report earnings for the second week in a row. Major U.S. companies will report, including Amazon (AMZN), Apple (AAPL), Caterpillar (CAT), Merck (MRK), and Pfizer (PFE). They all report this week. The week ahead includes construction spending, U.S. manufacturing PMI, and factory orders. The July jobs report on August 4. An increase of 200,325 nonfarm payroll jobs are expected to be added.

NOT TOO HOT AND NOT TOO COLD: GOLDILOCKS

Key U.S. inflation indexes fell Friday, including a favorite inflation barometer for the FOMC being the Jun PCE core deflator. The annualized increase was less than expected as the U.S. PCE core deflator reading in June, fell to +4.1% year on year. The June reading was less than the expected +4.2%, the slowest pace in 21-months. Continuing the trend of core inflation coming under control. In May the year on year was +4.6%.

In the U.S. the economy is actually heading towards a “Goldilocks” scenario. The term “A Goldilocks Economy” describes an Economy which is sitting just about right. This is in terms of rate of economic growth, stable inflation, near full employment and interest rates are unchanged. In this state the economy is not at risk of overheating where corrective measures need to be taken. Nor too cold where the economy could need some stimulus measures.

employment cost index

Let’s take a look. The Q2 employment cost index rose at the weakest pace in two years. The U.S. Q2 employment cost index climbed +1.0%, calculated quarter on quarter annualized. This was slower than expected +1.1%, the slowest pace in 2 years. In terms of economic growth, in June U.S. personal expenditure grew +0.5% month on month.

This topped expectations of +0.4%. In June, personal income grew +0.3%, below expectations of +0.5%. OK, judging any economy, in particular the U.S. economy, is following the breadcrumbs so to speak. The University of Michigan U.S. Jul consumer sentiment was revised down to 71.6 from 72.6.

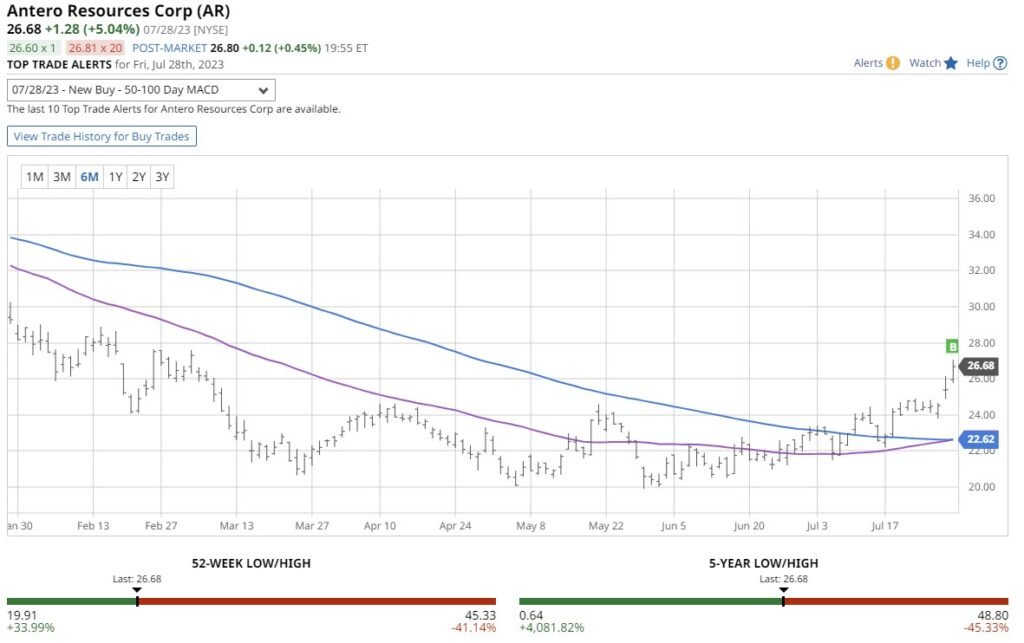

Antero Resources (AR)

Antero Resources Corp’s 50-100 Day MACD Oscillator signaled a buy at $26.68.

Antero Resources Corp (AR50-100)’s Day MACD Oscillator Buy signal has yielded a +488% gain over the past five years. Compared to the stock’s +31.04% gain. Signal gain is based on 5 trades that averaged 171 days.

The 50-100 Day MACD Oscillator crossover signaled a New Buy at $26.68 on July 28, 2023. Buy signals are when the shorter-term moving average closes above the longer-term moving average. This indicates an upward trend.

independent explorer

AR is an independent explorer. The group acquires and develops Appalachian Basin natural gas, natural gas liquids, and oil resources. It is a fast-growing US natural gas producer. Unconventional reservoirs are its specialty. It owns Appalachian Basin oil and gas in West Virginia and Ohio.

Euro Stoxx 50 closed +0.43%, and the Shanghai Composite Index rose 1.84%. In Japan, Nikkei Stock Index fell 0.40%.

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

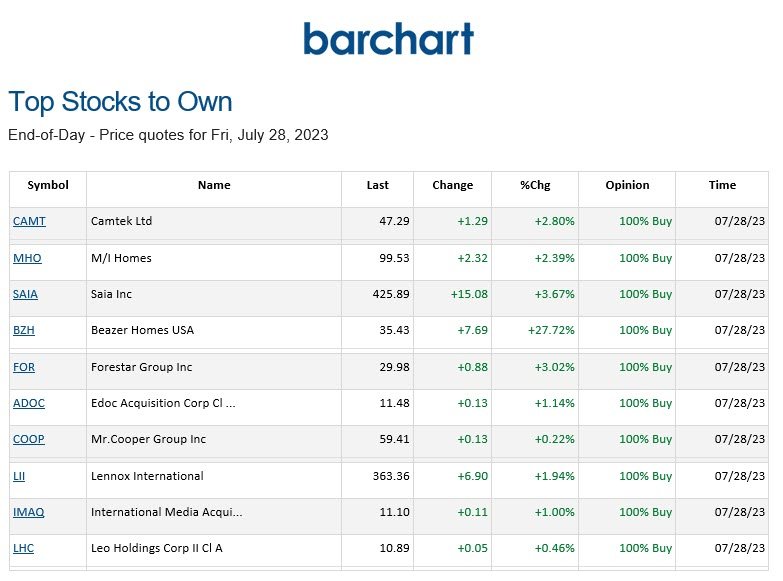

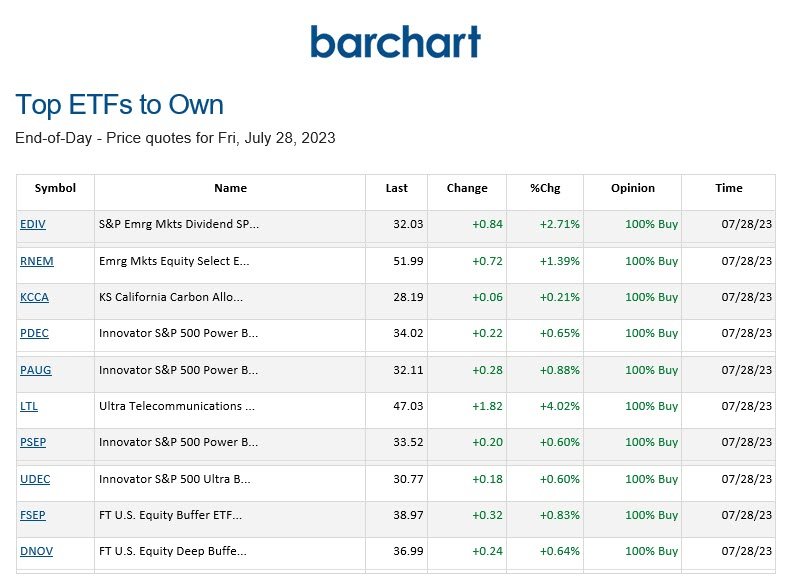

BARCHART: QUICK STOCK IDEAS

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

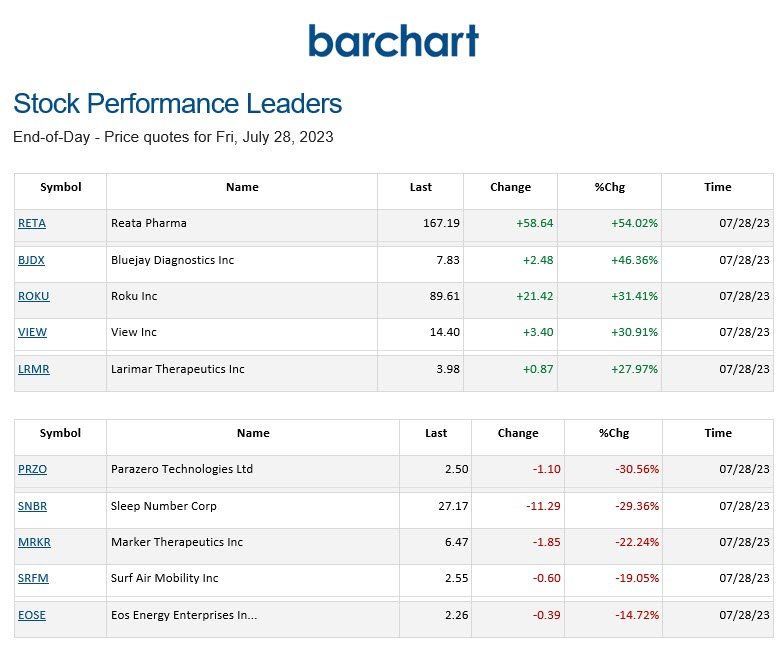

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.