indexes bounce back, time to relax?

Investors are optimistic that the Federal Reserve’s interest rate rises could have ended. The markets are factoring in a 5% likelihood of a rate rise of +25 basis points at the next FOMC meeting on December 12–13. Then there is an 11% possibility of a rate hike on January 30-31, 2024, at the next FOMC meeting.

The Fed is probably done, but keep in mind the long end of the U.S. yield curve. This is where rates could continue to rise. If this does happen, it will have the biggest impact on investors in 2024. The markets are anticipating that the FOMC will start reducing rates by mid-2024. This would be in response to an anticipated decline in the US economy.

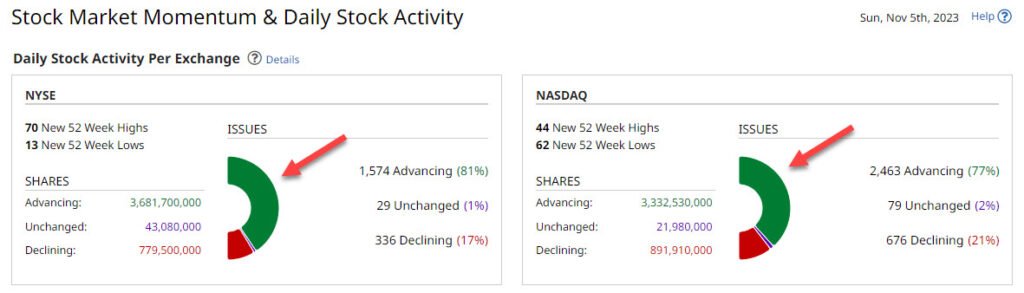

Stocks closed significantly higher on Friday, extending a huge run earlier in the week. The three main indexes sweep to their highest weekly gains of the year. There is an underlying level of support for stocks, earnings. The Q3 earnings season has, in general, been favorable. Of the S&P 500 companies reporting thus far, 82% have beaten the consensus. This is better than the year-earlier figure of 72%.

All of my Blog Posts contain Affiliate Links to products or services that are known to me. I may receive art any time a commission if a purchase or subscription is made via an Affiliate link.

Subscribe to

higher long-term rates impacts the equity market risk premium

Investors are leaving stocks due to the likelihood of higher long-term interest rates. Which is likely going to be for an for an extended period of time. Thus, the Equity Market Risk premium rises to around 8.0% if 10-year yields are around 6.0%. Global outflows from equity funds were close to $17 billion in the week ending September 22.

The small-cap stocks

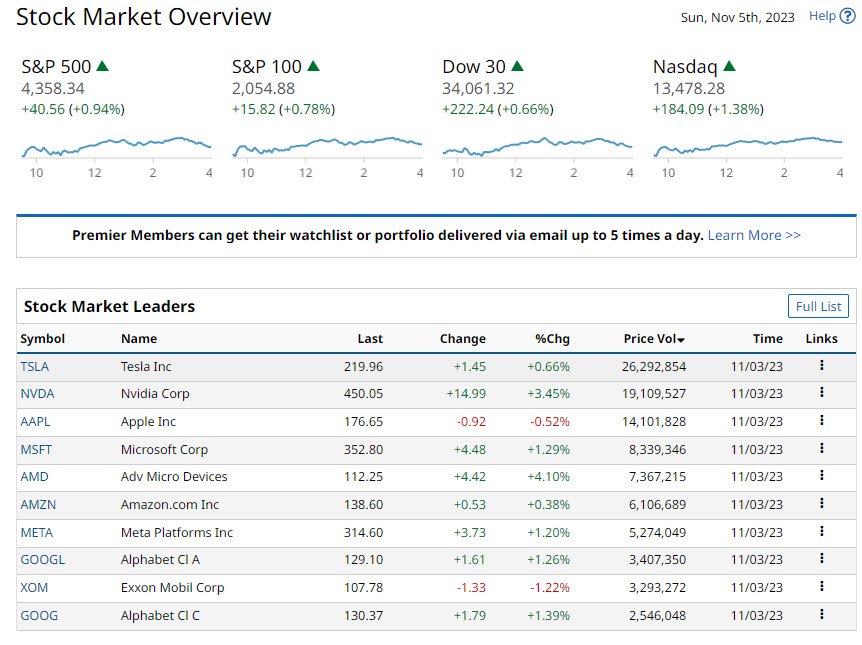

The weekly movements took the Dow Jones up by 5%. This was the largest weekly performance since October 2022. The S&P 500 increased by 5.8%, and the Nasdaq Composite increased by 6.6%. Last week’s gains were the highest for the S&P and the Nasdaq 100 indexes in a week, since November 2022.

U.S. Indices

Dow +5.1% to 34,061.

S&P 500 +5.9% to 4,358

Nasdaq +6.6% to 13,478

Russell 2000 +7.6% to 1,761.

S&P 500 Sector Indexes were higher

Consumer Staples +3.3%. Utilities +5.2%. Financials +7.4%. Telecom +6.5%. Healthcare +3.5%. Industrials +5.3%. Information Technology +6.8%. Materials +5.1%. Energy +2.3%. Consumer Discretionary +7.2%. Real Estate +8.4%.

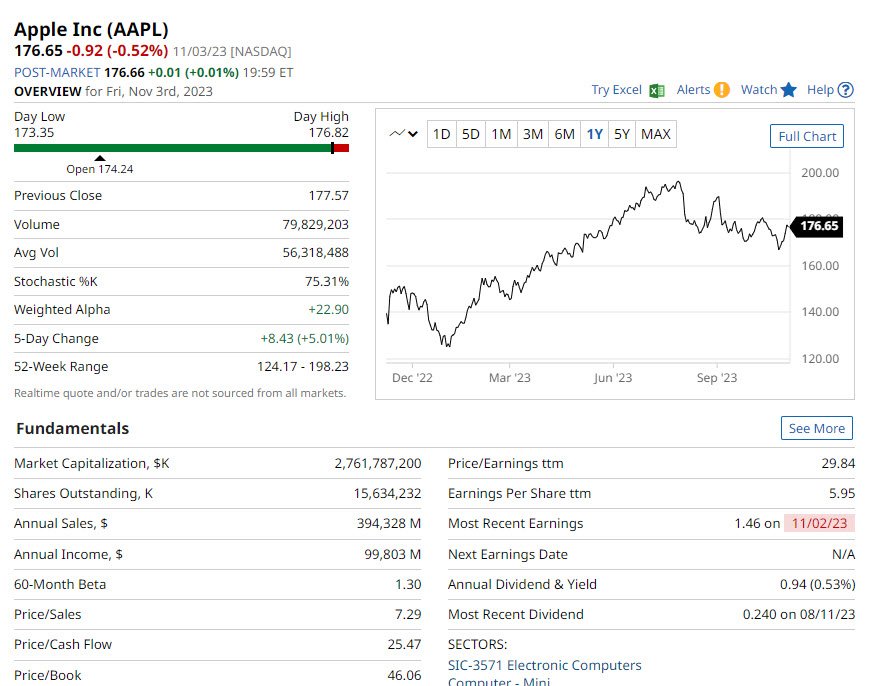

Apple (AAPL) stock fell 3.4%

Earnings Call

On the earnings call, Apple’s management stated that Q1 revenue will be comparable year over year. This is despite the fact that there will only be one week fewer than in the previous year for iPhone sales. This is not good enough, Apple is an innovation company. Without progress and innovation, the stock will suffer a contraction in its valuation multiples. For Apple’s high valuation, the numbers were not particularly impressive.

Economics Data

Poorer-than-expected October jobs data was released on Friday. This strongly suggests that the Fed’s effort to curb inflation and slow the economy is working. This week saw a sharp decline in bond rates, with the 10-year Treasury yield falling to 4.57% from 5.03% in previous weeks. The 2-year T-note yield Friday fell sharply by -15 bps to 4.84%.

The U.S. unemployment report provided a solid piece of economic data to indicate the U.S. economy is slowing. In October, U.S. payrolls rose by +150,000, weaker than expectations of +180,000. The October U.S. unemployment rate rose by +0.1 points to a 20-month high of 3.9%. The labor market is weaker than expectations for an unchanged rate of 3.8%.

U.S. Services PMI

Meanwhile, the final October S&P U.S. Services PMI was revised lower by -0.3 points to 50.6. Weaker than expectations for an unrevised report. The PMI reports indicated some slowing of growth in the U.S. service sector.

Overseas stock markets closed higher. The Euro Stoxx 50 closed up +0.12%. China’s Shanghai Composite Index closed up +0.71%. Japan’s stock market Friday was closed.

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

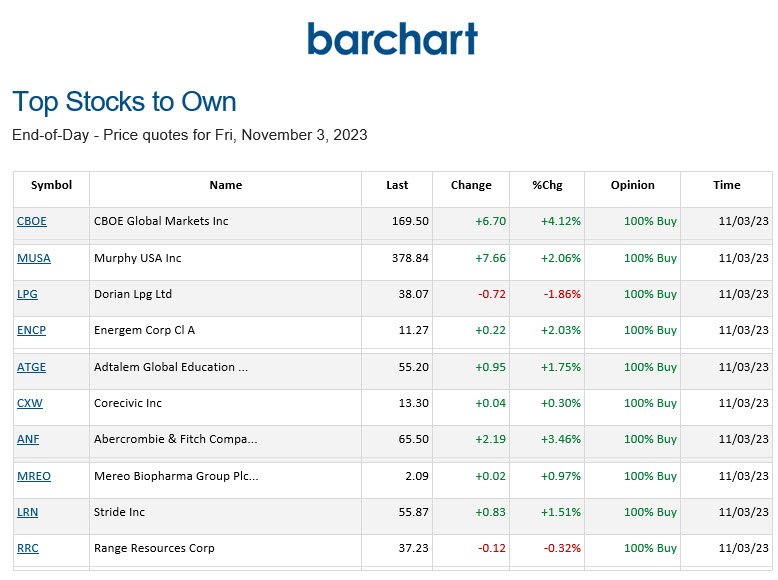

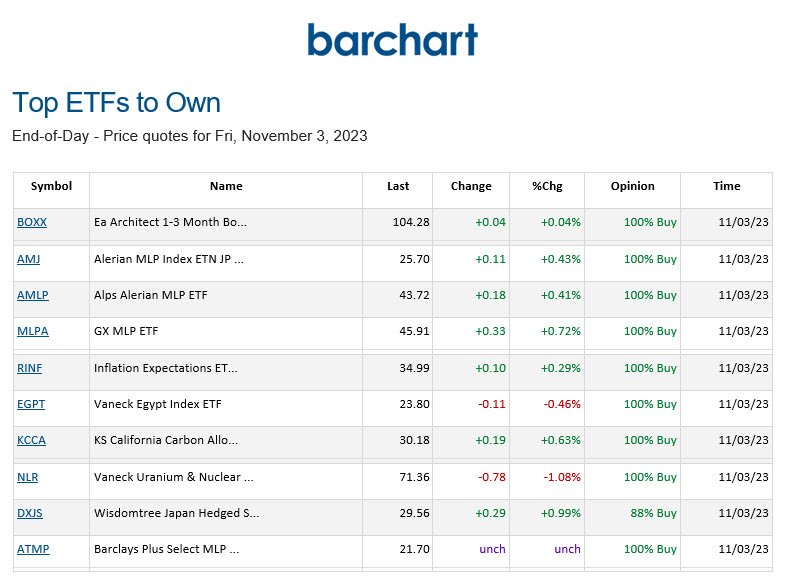

BARCHART: QUICK STOCK IDEAS

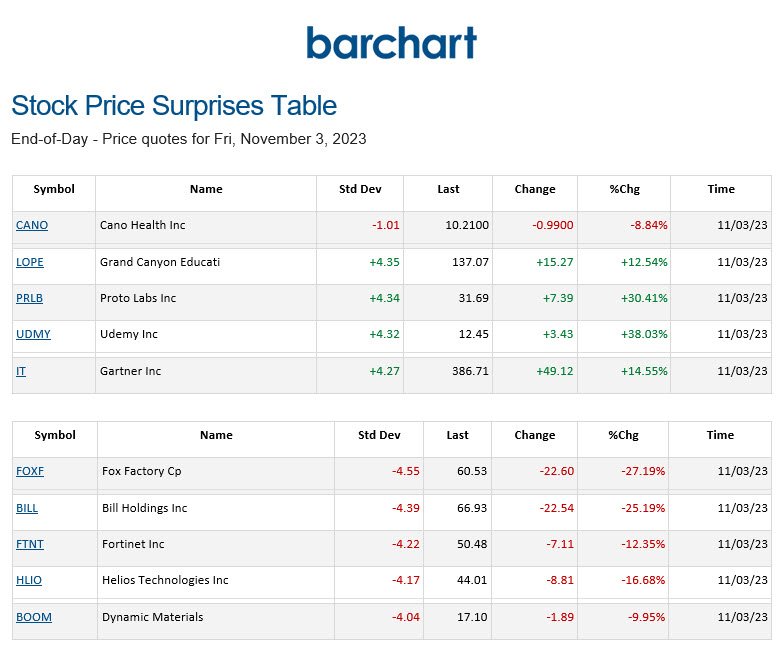

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

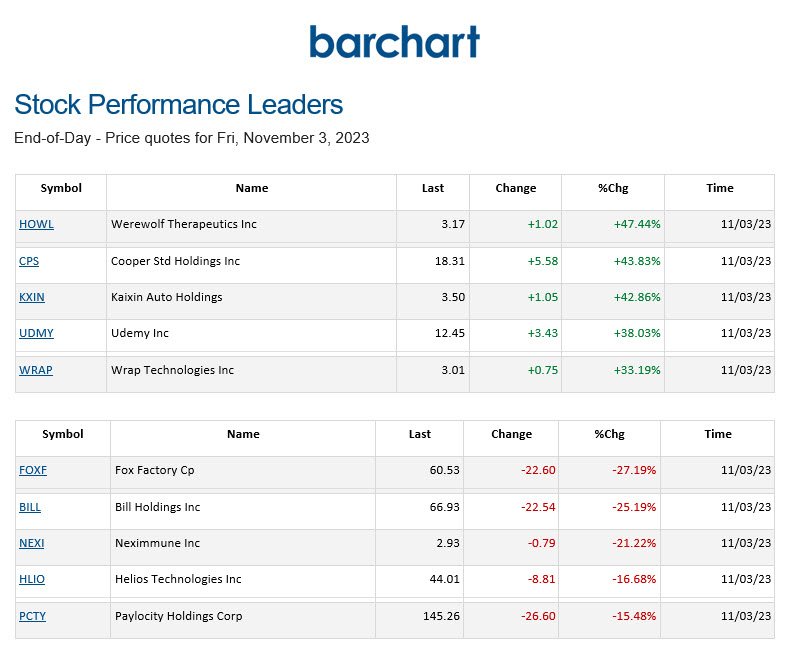

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.