EARNINGS INCREASES PUSHING STOCKS

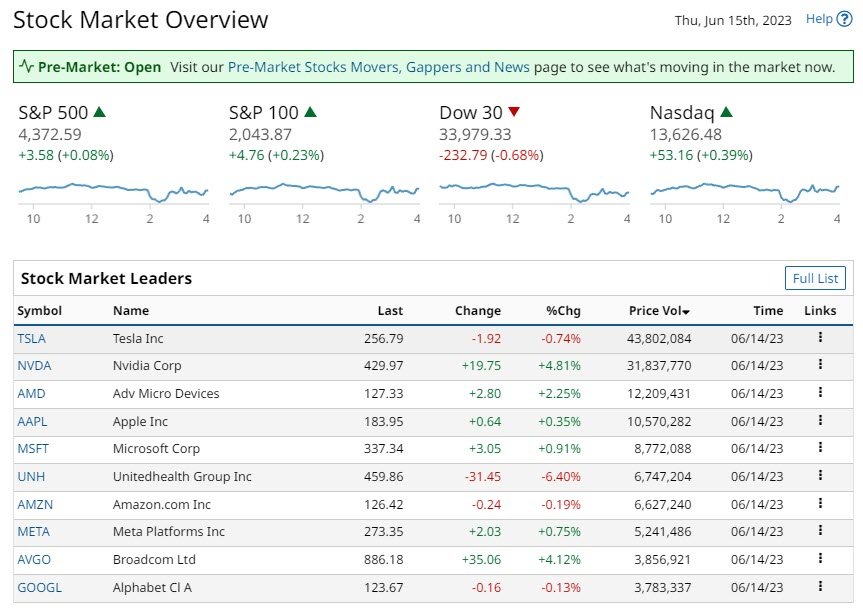

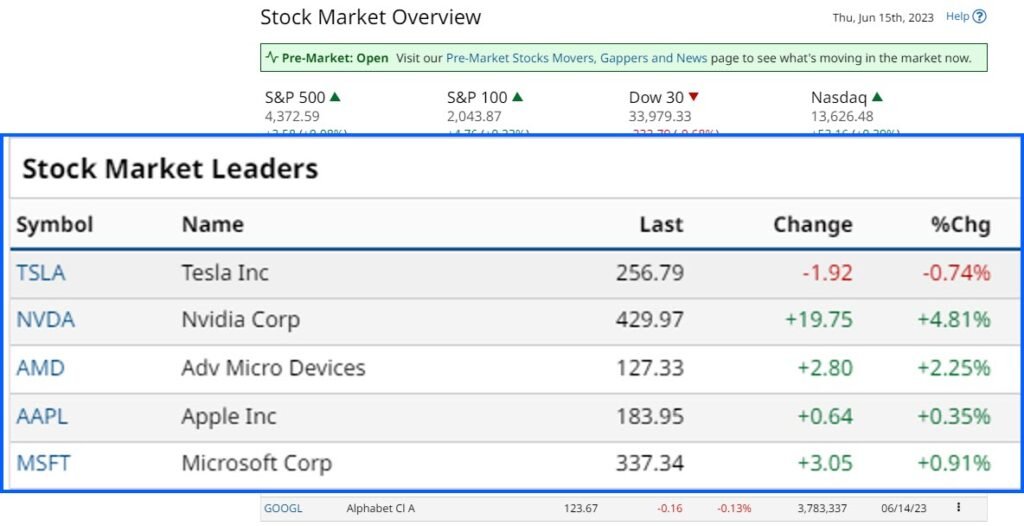

SPY up +0.08%, the and the Nasdaq 100 Index, QQQ closed up +0.70%.

This week the focus of the market was the meeting of the FOMC at the Federal Reserve. Stocks had minimal reaction, as they closed with mixed, earnings increases. To try to summarize the comments from the FOMC is as follows. After 15 months of interest-rate hikes, FOMC officials announced rates, unchanged. There is the suggestion from many Fed officials, that that there will be further rises in rates. This included the Chairmean. The focus is on inflation and the Chairman stated they remain committed to reducing inflation. Inflation must be contained being in the 2% range and rates could rise by a further 50bps to 5.6%

Today, Thursday 15 June it is the turn of the European Central Bank. The ECB is poised to deliver what could be the penultimate increase. So far, the ECB has led an unprecedented campaign of interest-rate hikes. Economists expect the deposit rate to increase 25bps to 3.5%

Subscribe to

WHAT DOES THIS MEAN FOR STOCKS?

What does this mean for stocks. In my view not much to nothing. Many are declaring that a new Bull Market has just started. After a 14% rise the S&P 500, since mid March and reaching a 13-1/2-month high over the past six months. Further the Nasdaq 100 reached a 14-1/4-month high. I would say it is a bit late, to call a Bull Market now. This should have been done by the end of January at the latest.

The stock markets understand what the Fed must do, and it creates great media events, just watch CNBC. But the strategy of the FOMC is having limited impact on stocks. The stock markets to date have been very narrow. The Magnificent Seven has accounted for around 80% or more of the increase in market cap this year. It is now time to look at the broader market, in particular in the small to mid-cap stocks as earnings increases.

Subscribe to

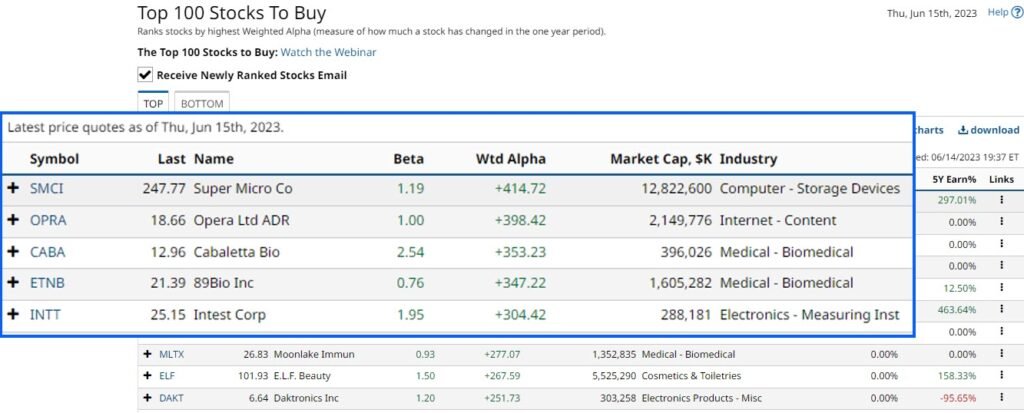

MARKET VALUATIONS AND EARNINGS INCREASES

I understand commentators stating that the S&P500 is fairly valued. I estimate the market EPS is $215 for FY 2023. Thus, the market PE for the S&P500 is trading on a current PE of 20X. It is a fair argument that the S&P 500 is fairly valued. With a market EPS for FY 2024 of $250, the market PE is 17.4X. That’s equal to a YOY growth in market EPS of 17%.

Some say that is a stretch, OK, I am sticking to it, and I think a 20% plus rebound in earnings is more likely. A recession if it does happen will be mild, and earnings are likely to be suppressed in 2023 and earnings increases for 2024.

May PPI final demand in the United States fell to +1.1% YOY, from +2.3% in April, beating estimates of +1.5% YOY. Thus, better than expected. In fact, this was the weakest increase in more than two years. But the stock markets could broaden, look at the graph of the IWB, the ETF for the Russell 1000.

In the end after the FOMC meeting global bond yields were mixed. The 10-year Treasury note yield at 3.8%. The 10-year German bund yield at 2.4%, the UK 10-year gilt yield 4.39%. Around the world stocks were mixed. The Euro Stoxx 50 finished up 0.65% Shanghai Composite -0.14%, while Japan’s Nikkei Stock Index rose +1.47%. Again.

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

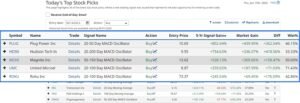

BARCHART: QUICK STOCK IDEAS

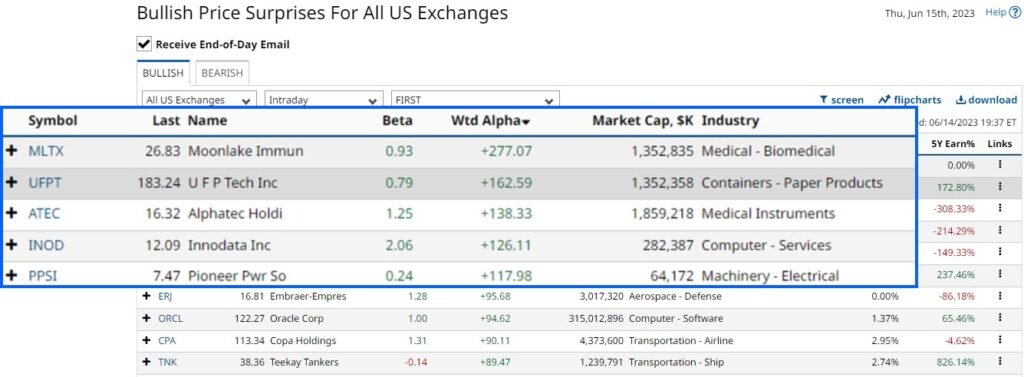

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

STOCK PERFORMANCE LEADERS AND LAGGARS

Plug Electricity Inc. (PLUG)

VALUATION – 20-50 DAY MACD

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.