TOPPED ANALYSTS FORECASTS BY 78%

Subscribe to

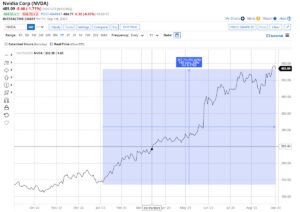

NVDA AND ANALYSTS FORCASTS

In the case of Nvidia earlier this year they pushed their guidance out of years. It was extremely positive, the move up in their share price was historic, more than doubling. Nvidia is now a $ 1trillion plus market cap company, take a look at the graph.

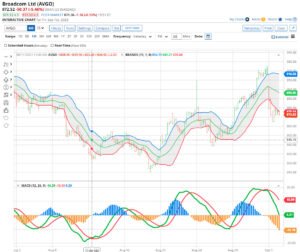

Then in this earnings season, Broadcom released solid earnings. The forward guidance given was in line with current forecasts, expectations. The stock fell. Even if a company reports earnings for the prior quarter were better than expected. The possibility of poor performance in the current quarter can cause stock prices to decline.

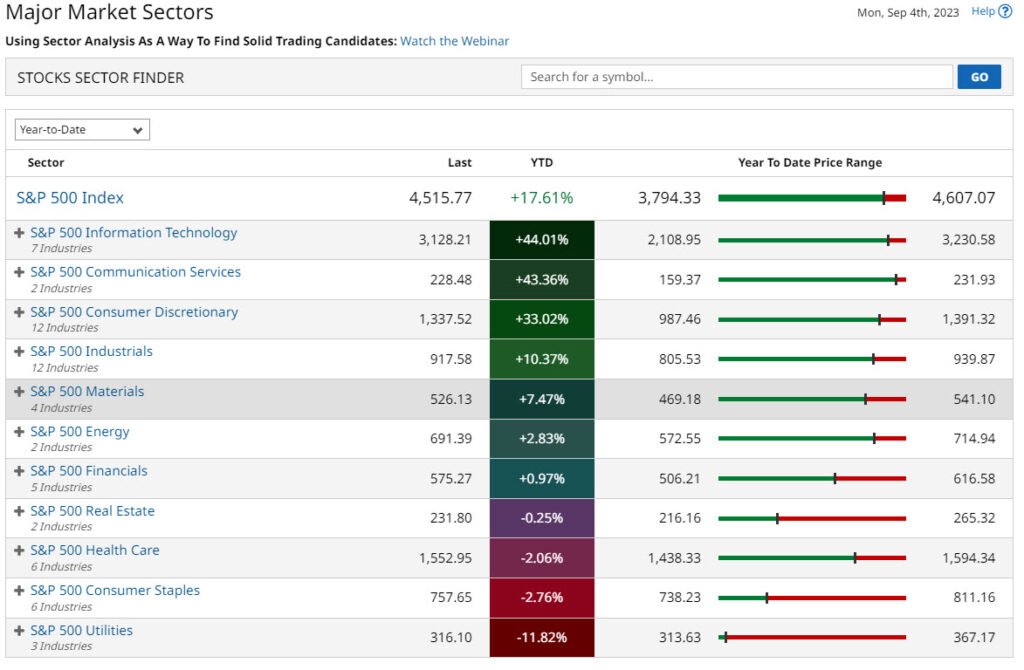

The group coined the “Magnificent Seven” are seven mega cap US-based companies. Apple (AAPL) , Microsoft (MSFT), Amazon (AMZN), Google (GOOG,GOOGL), Nvidia (NVDA), Tesla (TSLA), and META (Facebook). Collectively they have outperformed the S&P 500 in 2023 at least in part due to the boom in AI. Heading into September, the Magnificent Seven make up 28% of the S&P 500 Index.

The group coined the “Magnificent Seven” are seven mega cap US-based companies. Apple (AAPL) , Microsoft (MSFT), Amazon (AMZN), Google (GOOG,GOOGL), Nvidia (NVDA), Tesla (TSLA), and META (Facebook). Collectively they have outperformed the S&P 500 in 2023 at least in part due to the boom in AI. Heading into September, the Magnificent Seven make up 28% of the S&P 500 Index.

They have contributed over 65% of YTD returns.

Concentration can limit stock selection

Market concentration has happened in the past, but to this extent the last time was back in the early 1920s. Concentration to this extent can limit stock selection. In short, you have to own these stocks if you are an active manager. In 2023, most didn’t.

This was due to a disbelief in the AI story, rising interest rates and the widely held view of a recession. Portfolio performance are influenced more by idiosyncratic or stock-specific risk. More than by underlying factor exposure in concentrated portfolios or markets.

the Fed could pause its rate hike campaign

The Fed’s Beige Book

The important economic events for the Labor Day week will be. Manufacturing orders, initial unemployment claims, and consumer credit. The Fed’s Beige Book for September, will add to the spotlight on the Fed. The markets are discounting a +25 basis point rate rise at the September 20 FOMC meeting at only 7%. Then a +25 basis point rate hike at the November 1 FOMC meeting, currently sits at 40%.

Global bond yields rose on Friday. The U.S. the 10-year T-note yield is higher at 4.17%. While the 10-year German bund yield is currently 2.55%. The 10-year UK gilt yield is higher at 4.43%.

Investment ideas from 30 million users. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

Subscribe to

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

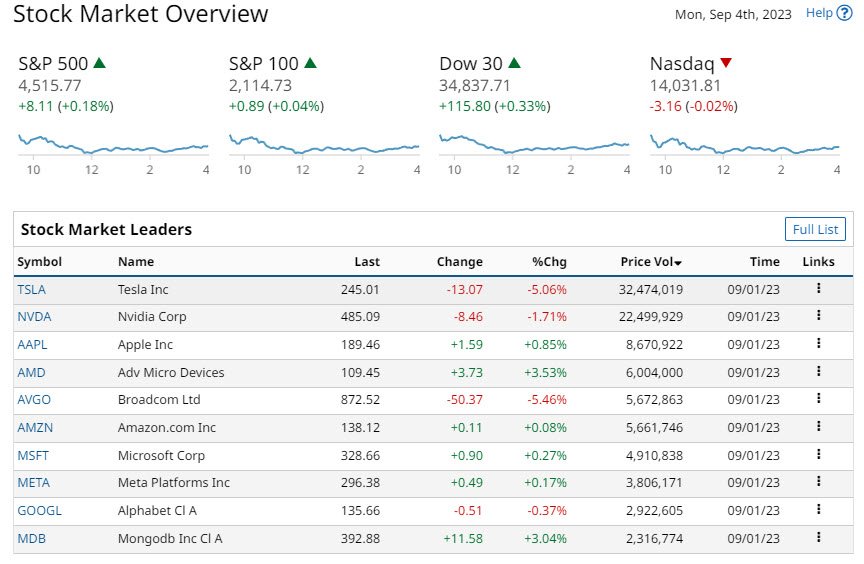

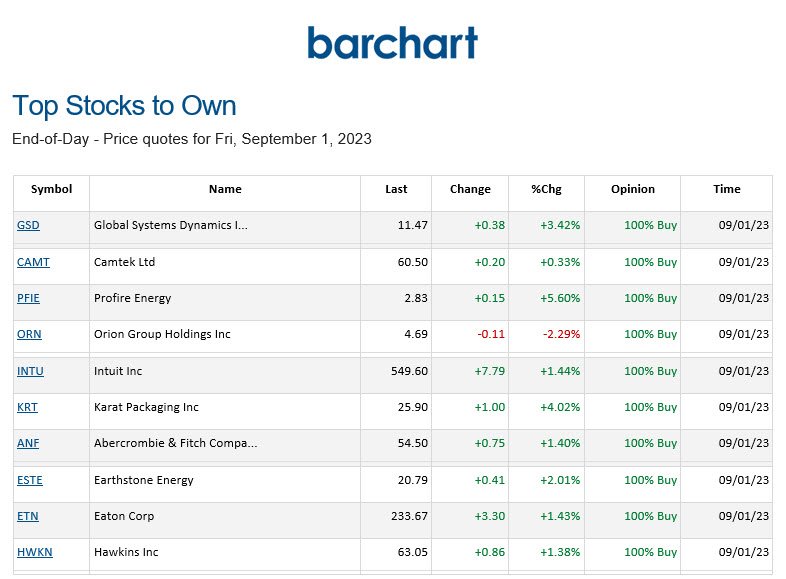

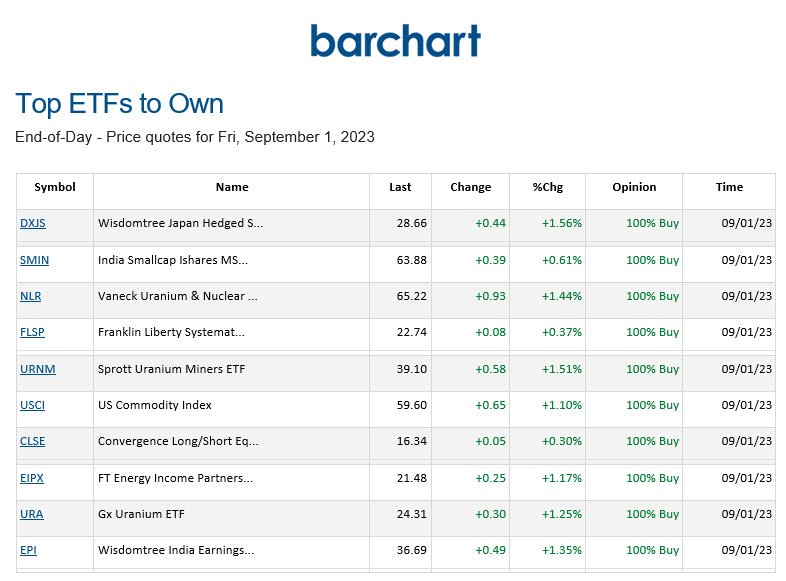

BARCHART: QUICK STOCK IDEAS

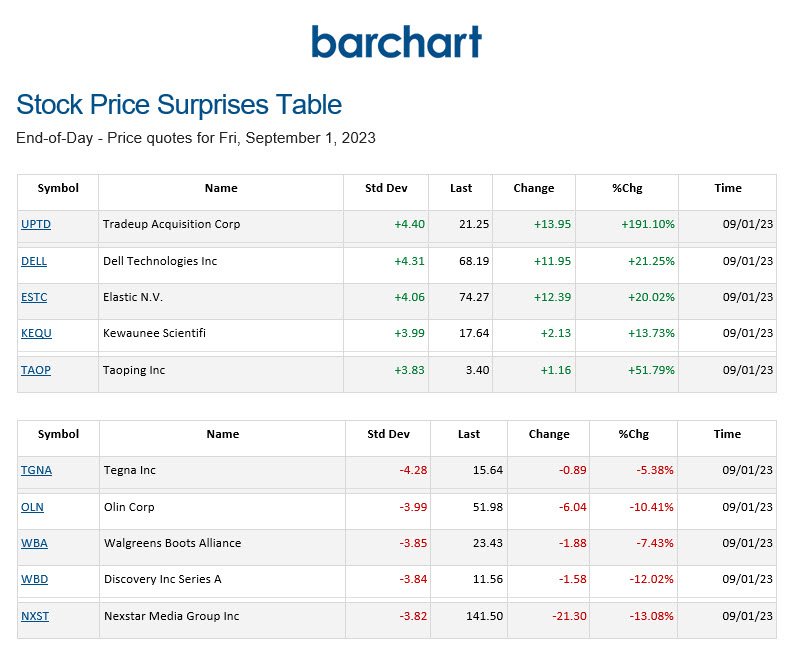

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

STOCK PERFORMANCE LEADERS AND LAGGARS

Stocks below are ranked by Barchart based on the Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.