Magnificent Seven VALUATIONS not excessive

On Friday, SPY was down -0.37% and the QQQ closed down 0.67%. The downturn in the markets was attributed to a rise in bond yields. Thus, technology stocks were put under pressure, they have been the stars so far in 2023.The increase in bond yields was due to some hawkish comments. They were made by one of the presidents at the Federal Reserve.

The SPY and the QQQ graphs indicate that the rally is showing signs of waning. For both indexes the Bollinger Bands are above the top band. The RSI is indicating over bought but this has been indicated for a while. Further, the MACD on the QQQ is attempting a crossover, see the graph below.

If the Magnificent Seven loose momentum in the short-term that would be a negative signal short term. Many reasons are given, currently there is concern over China’s slow post-pandemic recovery.

JAPAN: EWJI SHARES MSCI

MAGNIFICENT SEVEN PRICE TO SALES – NOT EXCESSIVE

The surge in global equities in 2023 has been concentrated and the valuations on stocks known as the Magnificent Seven are high. As measured by the Price to Sales ratio, with Nvidia (NVDA) being over 40X. This seems to be specific to NVDA. It is noteworthy that the Price to Sales ratios of the remaining Magnificent Seven Stocks are lower than previous highs. But this is misleading.  In the past Tesla (TSLA) has reached Price to Sales ratios of 25X, currently sub 10X. META in its early days as a public company, META’s Price to Sales ratio ranged between 14 to 21 times. Now the ratio is around 6X. Currently the Price to Sales ratio at Amazon is 2.7X. So what is this telling us? Consider this as an indication the Price to Sales Ratio for industrial stocks is around 1.2 to 1.5x. What it’s telling us is that a stock in a growth phase will trade higher on future sales expectations. This is the case for NVDA due to the boom in AI.

In the past Tesla (TSLA) has reached Price to Sales ratios of 25X, currently sub 10X. META in its early days as a public company, META’s Price to Sales ratio ranged between 14 to 21 times. Now the ratio is around 6X. Currently the Price to Sales ratio at Amazon is 2.7X. So what is this telling us? Consider this as an indication the Price to Sales Ratio for industrial stocks is around 1.2 to 1.5x. What it’s telling us is that a stock in a growth phase will trade higher on future sales expectations. This is the case for NVDA due to the boom in AI.

Subscribe to

Triple Witching

On Friday, market volatility heightened due to the quarterly occurrence. Known as Triple Witching. This is when the expiration of stock futures and options contracts for June. The Euro Stoxx 50 index was up 0.68%. The Shanghai Composite up 0.63% and in Japan the Nikkei Stock Index was up 0.66%.

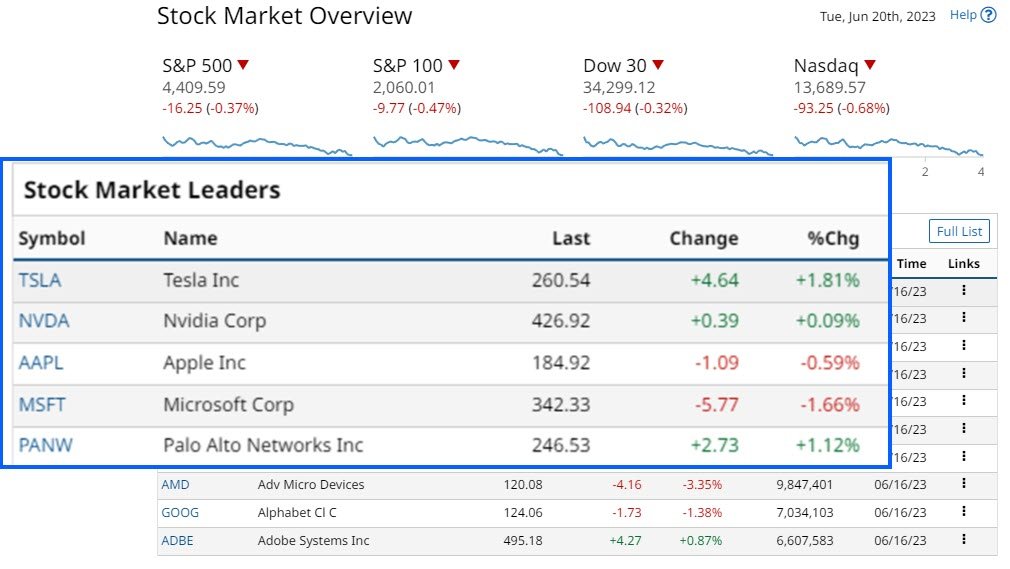

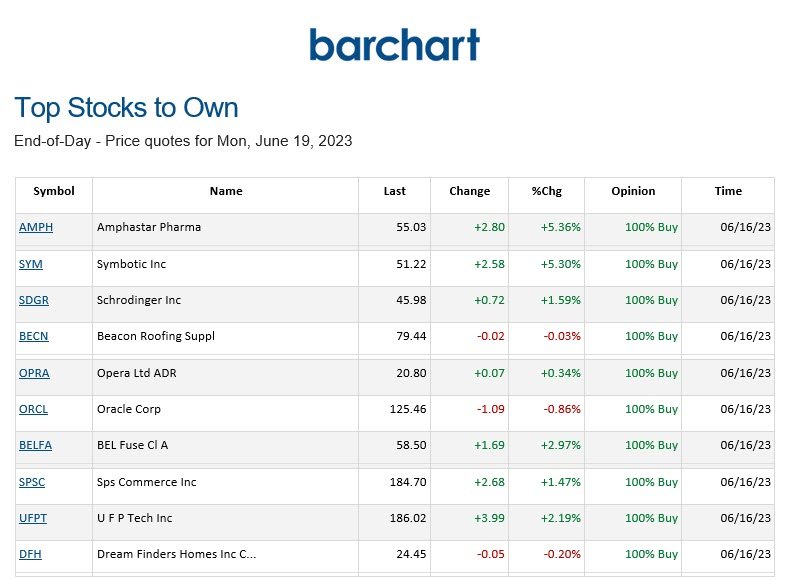

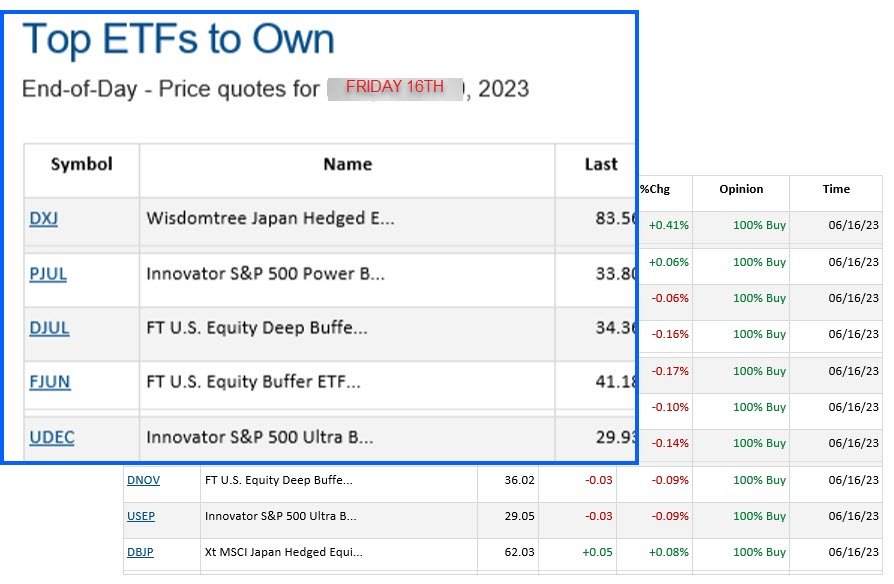

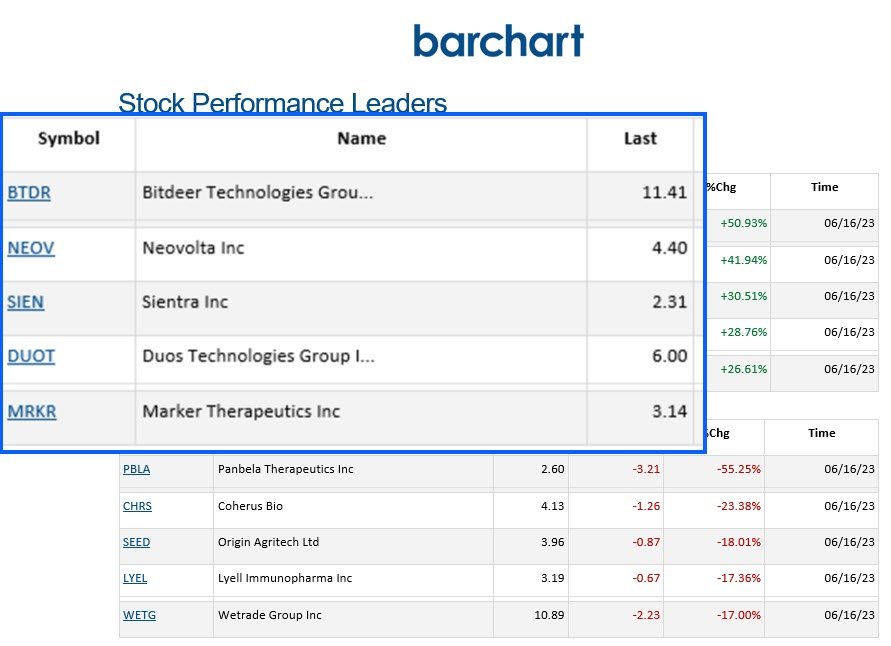

BARCHART: QUICK STOCK IDEAS

Stocks and ETFs – June 20, 2023.

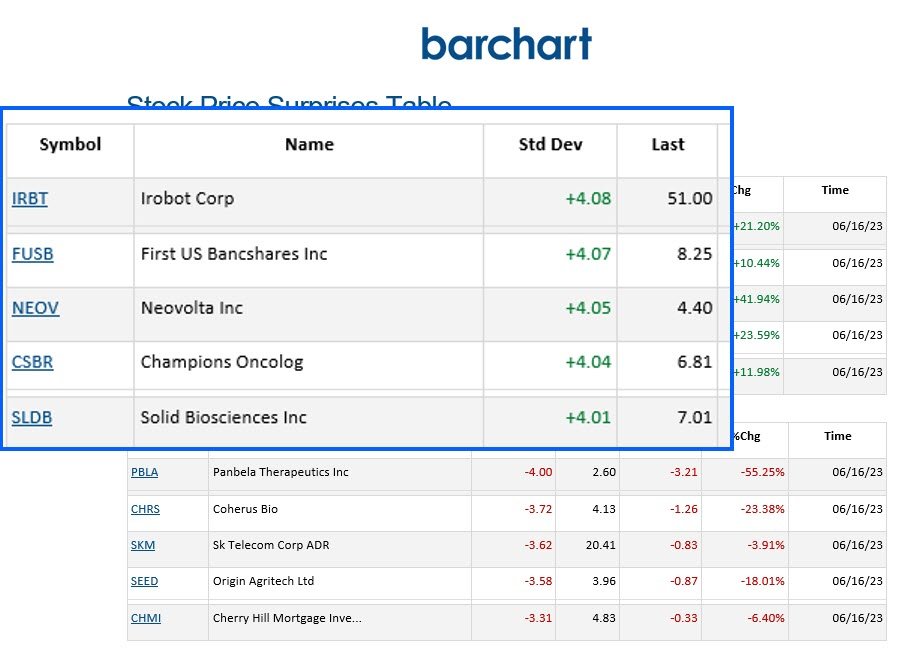

PRICE SURPRISES AND VOLATILITY

![]() surprises both upside and downside.

surprises both upside and downside.

STOCK PERFORMANCE LEADERS AND LAGGARS

The Highest Daily Percentage Change.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions.