MIXED SIGNALS FOR STOCK INVESTORS

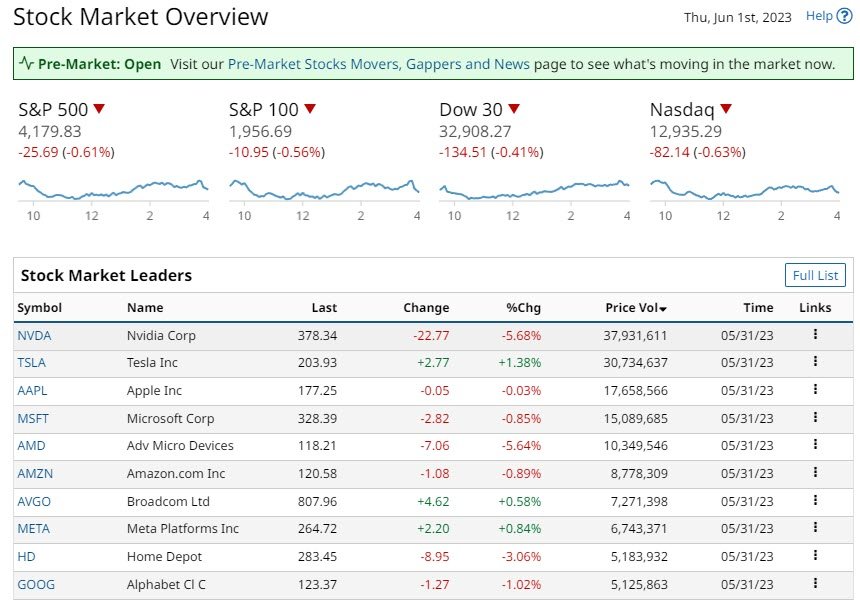

The SPY closed down -0.61%, and the QQQ (Nasdaq 100) closed down -0.70%.

Over the past couple of weeks by the strength of mega-caps, have outpaced mid and smaller cap stocks. Stock market indices on Wednesday were down slightly. Chinese data revealed that manufacturing and service sector activity slowed more than expected.

In May, Chinese manufacturing PMI unexpectedly declined -0.4 to 48.8, below expectations of 49.5. Thus, these economic worries weighed on equity markets. Dovish remarks from two Fed Governors both indicated support for a pause in Fed rate rises.

Over the past week or two the U.S. stock market has been faced with uncertainty. Inflation continues to be too high for the Fed. Thus, stock investors have struggled to predict the Fed’s rate hike trajectory. On top of this was debate over the outcome of the congressional debt ceiling negotiations.

Despite these fears, solid profits in tech stocks, in particular the semiconductor sector lifted equities. Concerns over a May 31 House of Representatives vote on the debt ceiling accord weighed hard on markets. Congress is under intense pressure to pass the bill by June 5. Beyond this date Treasury Secretary Yellen warns the United States risks default.

STOCK MARKETS LACK DIRECTION

The mixed signals do not give the stocks markets direction. The Fed may still be signaling a halt in its rate-hike campaign to combat inflation. But the U.S. economy continues to be strong and the labor market has not slowed. In April, vacancies at U.S. companies rose to their greatest level in three months.

This places the Fed in a difficult position in the face of wage pressures. Retail, healthcare, transportation, and warehousing led the increase in new openings. Questions over interest rate hikes and commentators say they do not see a compelling reason to pause.

Global bond yields fell on Wednesday, giving a boost to stocks. The 10-year T-note yield is 3.63%. In Europe, 10-year German bund yield fell to 2.28% percent, while the UK 10-year gilt yield 4.12% percent.

Semiconductor stocks continue to be in focus. Intel gained more than 4%. INTC’s CFO Zinsner stated that Q2 sales will at the upper half of the expected range of $12 billion to $12.5 billion. Also, Nvidia”s CEO made favourable comments towards INTC.

Verizon Communications gained more than 2%. The company signed a 10-year digital upgrade contract with the US Postal Service.

The Euro Stoxx 50 closed down -1.71%. China’s Shanghai Composite closed down -0.61%, and Japan’s Nikkei Stock Index closed down -1.41%.

Subscribe to

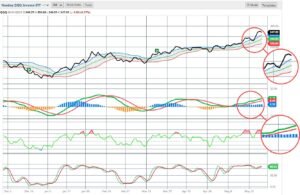

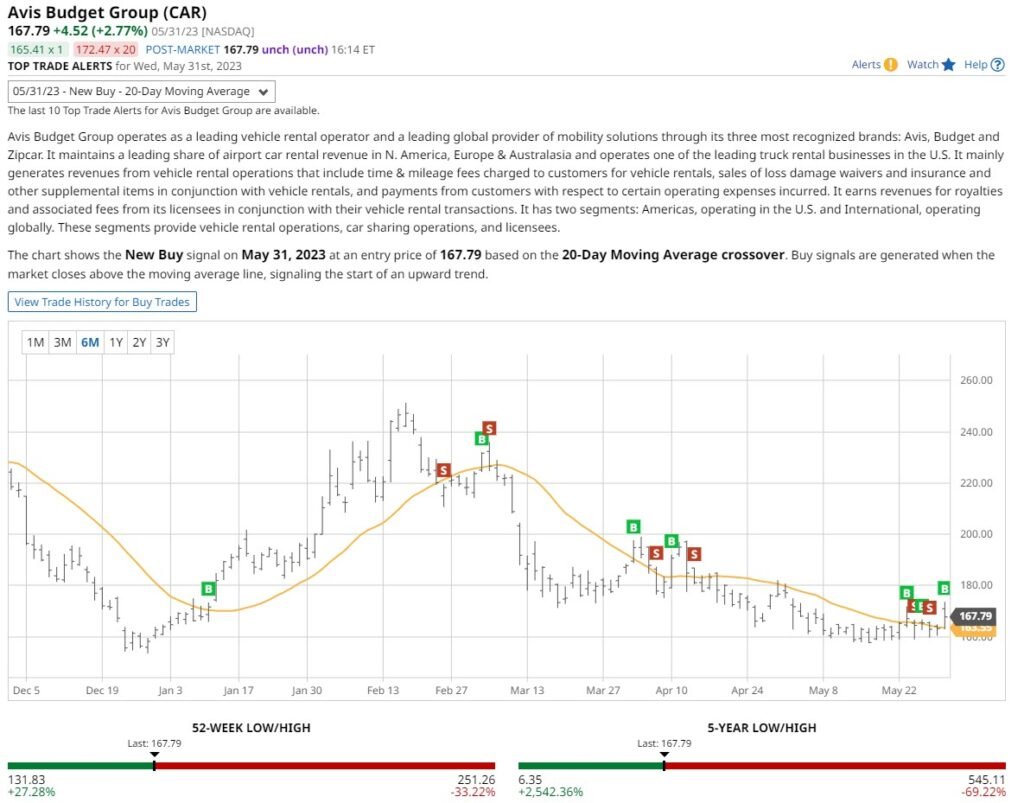

BACK TO: AVIS (CAR)

Buy signal on 20-Day Moving Average for Avis Budget Group.

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

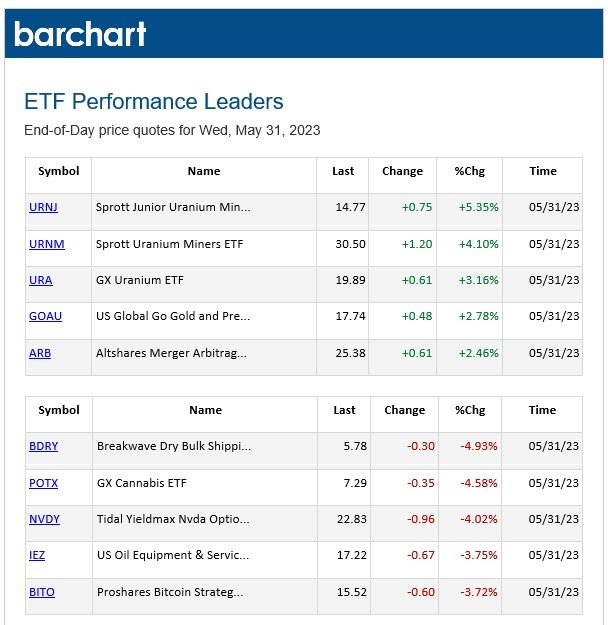

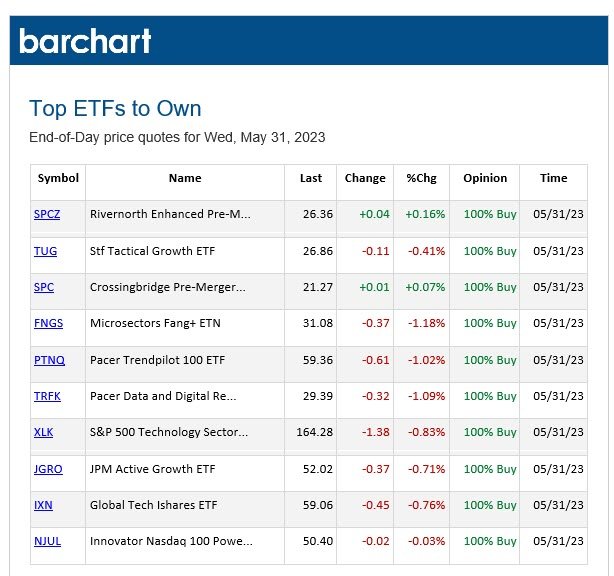

BARCHART'S PICKS

BARCHART: CONSIDER THESE

1 June, 2023: Stocks and ETFs to consider

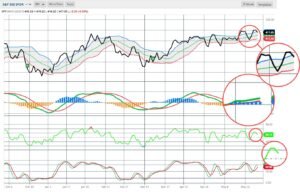

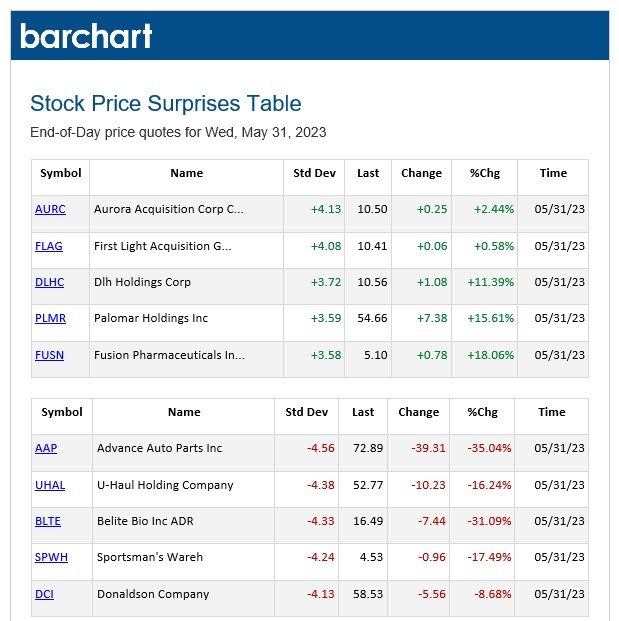

PRICE SURPRISES AND VOLATILITY

STOCK PERFORMANCE LEADERS AND LAGGARS