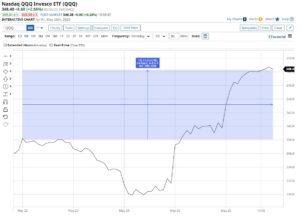

The Nasdaq indexes are set to remain the focus

The week ahead

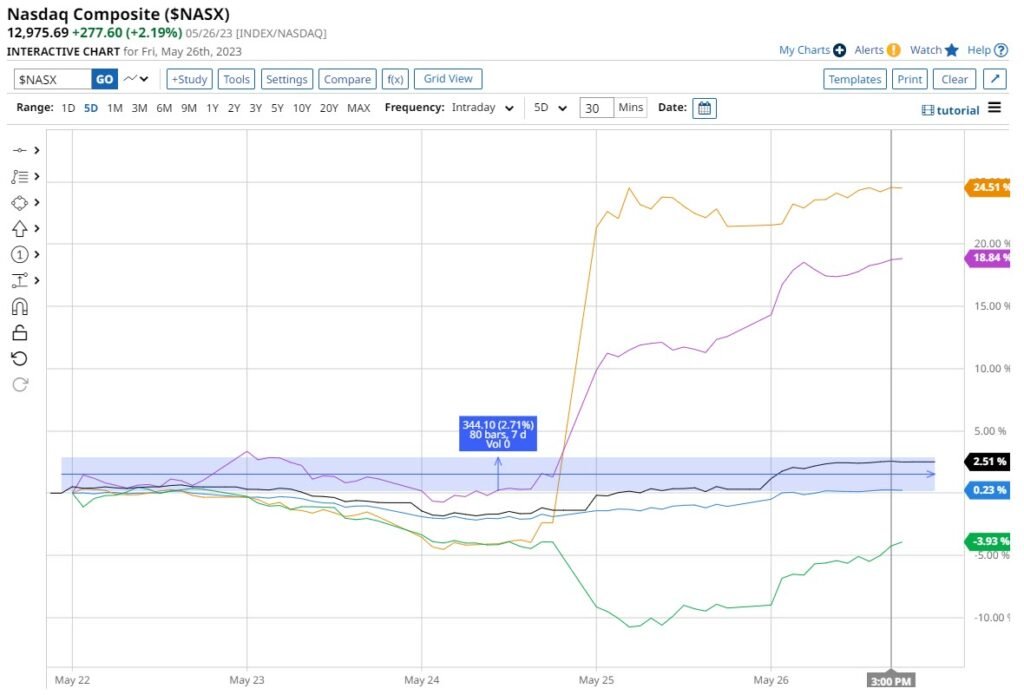

The U.S. debt ceiling crisis must be resolved. If it is resolved then the tech sector will likely to be center stage, following on from last week. Nvidia (NVDA) recorded the single biggest one-day market cap rise in the history of the stock markets. What a feat! The post-earnings surge in share price of more than 25% added over $300 billion in market cap. Other stocks also benefited, such as AMD. It is likely the debate on Nvidia to ratchet up following the AI-inspired rally.

The May jobs report, which will be released on June 2, will be the week’s key economic news. The monthly payroll increases are expected to fall to 180K from 253K in April. The unemployment rate is projected to inch up to 3.5% from 3.4%. The labor market continues to be strong and is not impacting the trend toward deflation or the slowing of wage growth.

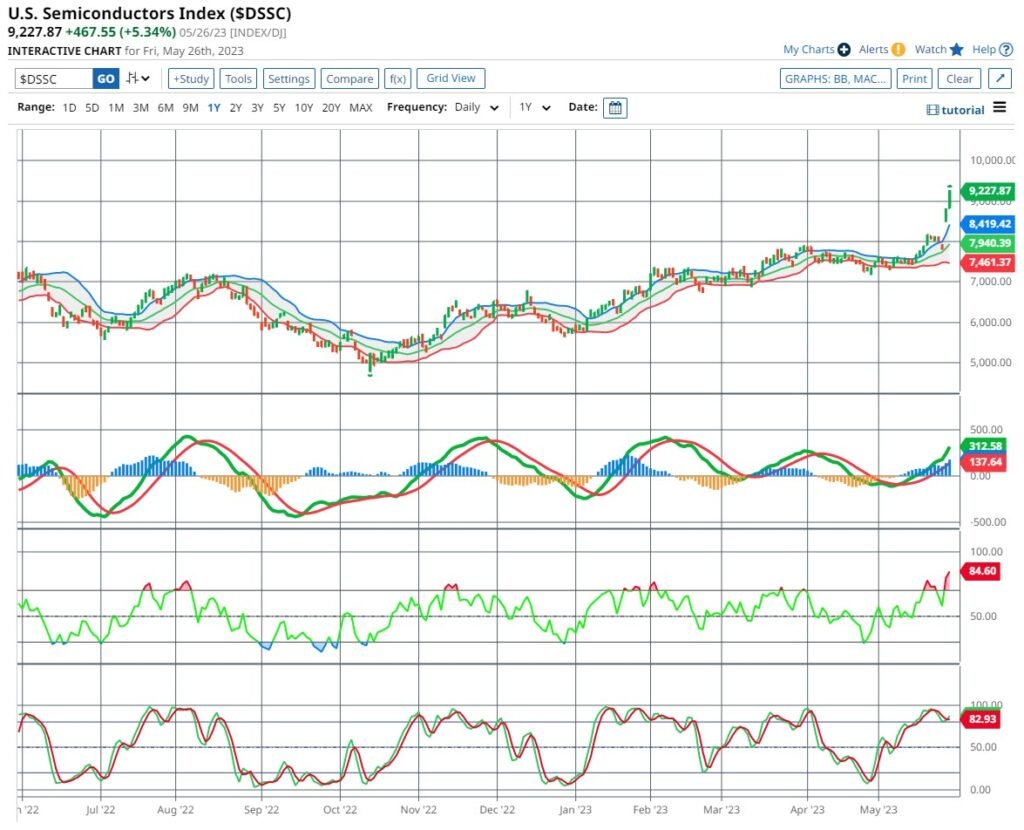

semiconductor stocks: NVDA, AMD

The semiconductor industry came to the center of the stage and the Nasdaq Indexes both benefited. AI is here as a service and real as a business and semiconductor stocks are set to benefit. Let’s take a quick look at the semiconductor industry. There are various crucial areas in which a successful company must dominate. A successful company will dominate the design, manufacture, and selling of semiconductor chips.

Subscribe to

AI is here as a service and real as a business and semiconductor stocks are set to benefit. Let’s take a quick look at the semiconductor industry. There are various crucial areas in which a successful company must dominate. A successful company will dominate the design, manufacture, and selling of semiconductor chips.

AI is here and the numbers are real

NVIDIA (NDVA)

Advanced Micro Devices (AMD)

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions. The website is designed for individual traders and investors, as well as institutional clients, including banks, brokers, and hedge funds.