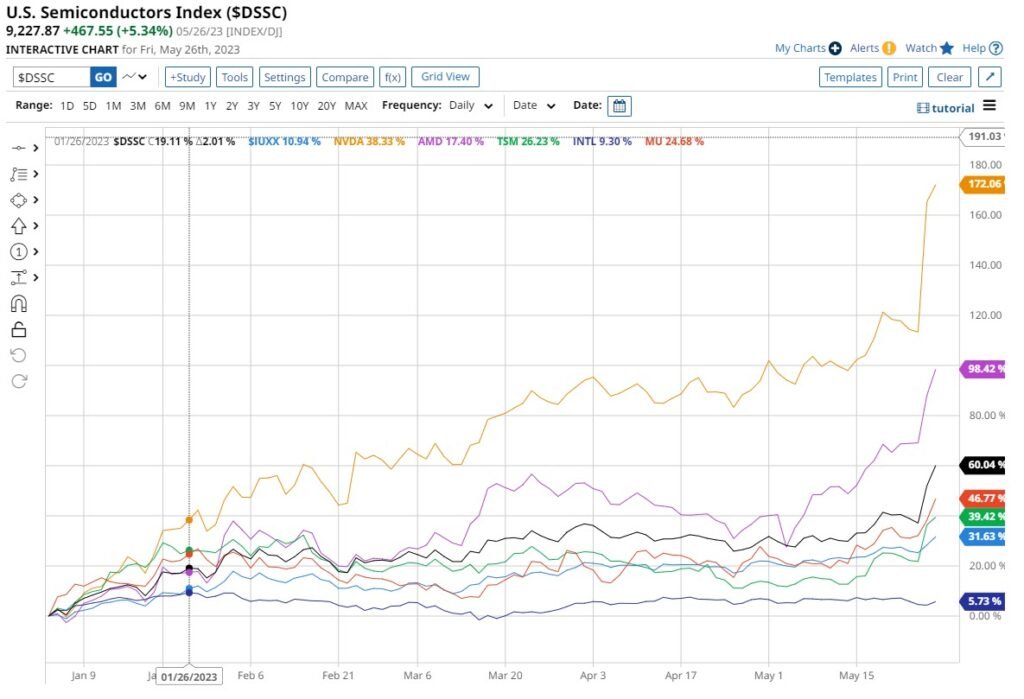

Semiconductor stocks benefit from AI

Prominent semiconductor stocks:

- Advanced Micro Devices Inc. (AMD)

- Intel Corporation (INTC)

- NVIDIA Corporation (NVDA)

- Qualcomm Incorporated (QCOM)

- Micron Technology Inc. (MU)

- Broadcom Inc. (AVGO)

- Texas Instruments Incorporated (TXN)

- Applied Materials, Inc. (AMAT)

- ASML Holding N.V. (ASML)

- Lam Research Corporation (LRCX)

- Analog Devices, Inc. (ADI)

- KLA Corporation (KLAC)

- Xilinx, Inc. (XLNX)

- Skyworks Solutions, Inc. (SWKS)

- Marvell Technology Group Ltd. (MRVL)

Subscribe to

the 6 phases of an AI service

Semiconductors stocks are set to benefit from the growth in Artificial Intelligence (AI). There are six phases involved in providing an AI service. Semiconductors play a crucial role in each of these. Here’s a quick overview of how and why semiconductors are used in each phase.

Data Collection and Preparation:

Data gathering devices employ semiconductors. Cameras, microphones, and other visual and audio sensors use semiconductors. AI systems can interpret electrical signals from these sensors. Semiconductors efficiently convert real-world data into digital signals for data processing and analysis.

Machine Learning Algorithms and Models:

This phase depends on semiconductors. Matrix calculations and optimization techniques demand high-performance computers for AI activities. Semiconductors, notably GPUs and TPUs, are optimized for computational tasks. They expedite complicated mathematical calculations, speeding machine learning algorithm training and inference.

Model Training and Evaluation:

AI model training and evaluation requires semiconductors. Semiconductors power input data-based model parameter optimization during model training. CPUs and GPUs execute matrix multiplications and numerical computations. This is true for deep neural networks and other sophisticated models. Semiconductors easily process massive data sets to evaluate trained models’ accuracy and performance.

Infrastructure and Computing Resources:

AI services depend on semiconductors. They power huge dataset storage, processing, and analysis servers. Also, data centers, and cloud computing platforms. Semiconductors offer high-speed data transfer, fast memory access, and parallel computing. AI infrastructure can handle training and inference activities.

Integration and Deployment:

AI service integration requires semiconductors. They scale AI algorithms and real-time data processing. Servers, edge devices, and embedded systems run AI models. They then interact or interface with users or other systems via semiconductors. Their computational power lets the AI service quickly process data and give results.

Semiconductors and AI

- Data collection,

- Machine learning computation,

- Model training and evaluation,

- Infrastructure computing resources,

- Integration and deployment,

- Ongoing monitoring and improvement.

Semiconductors power AI algorithms and models.

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

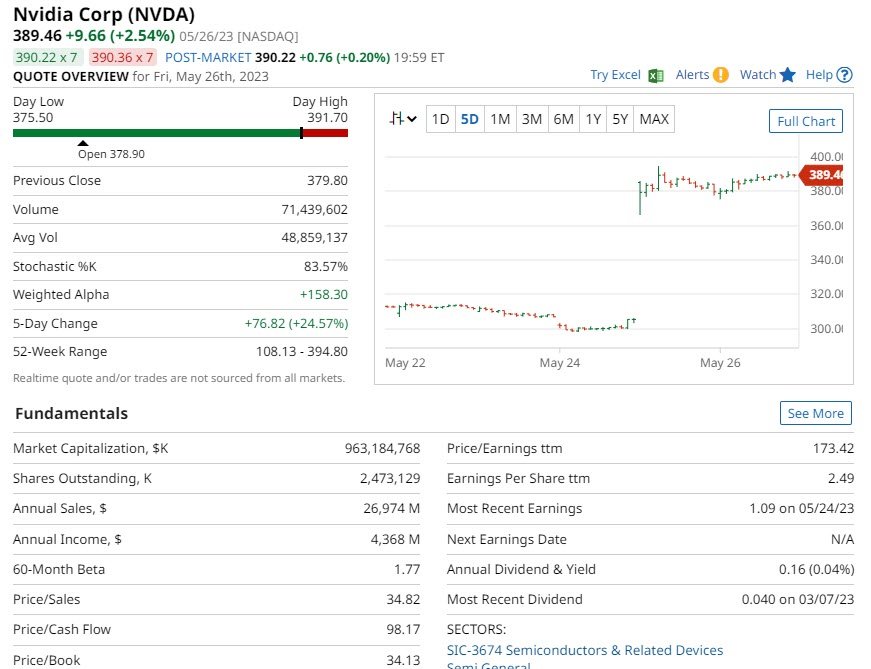

NVIDIA (NVDA)

Nvidia (NVDA)

An AI supercomputing company

A strong ecosystem

Subscribe to

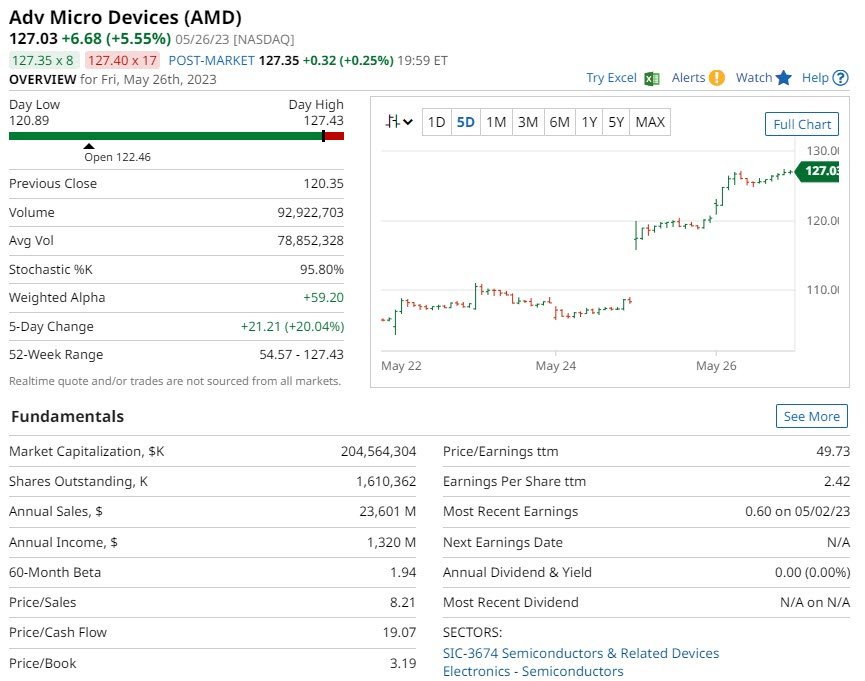

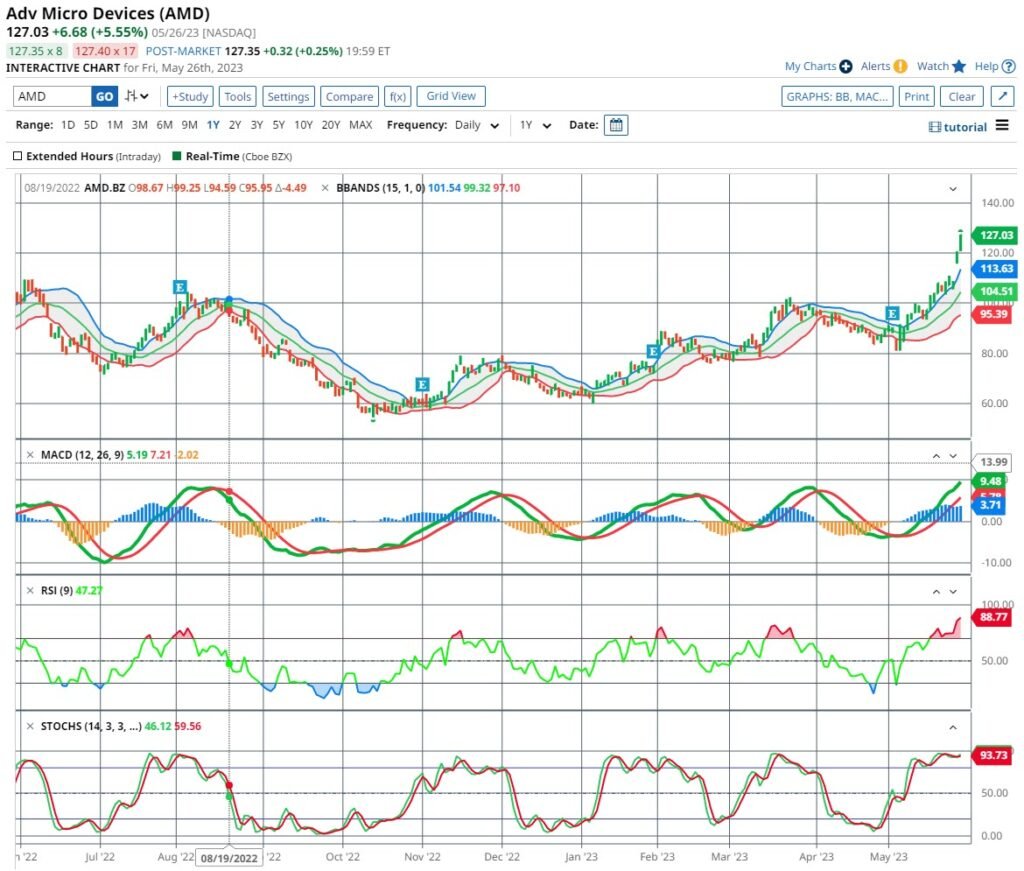

ADVANCED MICRO DEVICES (AMD)

Advanced Micro Devices (AMD)

INTEL CORPORATION (INTC)

INTEL CORPORATION (INTC)

Chip Design:

Chip Manufacture:

Chip Sale:

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions. The website is designed for individual traders and investors, as well as institutional clients, including banks, brokers, and hedge funds.

QUESTIONS

Question:

How do semiconductors contribute to the development of AI services?

Answer:

Semiconductors contribute to the development of AI services in a variety of ways. They are used for data collection and preparation, machine learning algorithms and models, model training and evaluation, infrastructure and computing resources, integration and deployment, and continuous monitoring and improvement. They power AI algorithms and models, facilitate real time data processing and analysis, and enable the scaling of AI algorithms and real time data processing.

Question:

How can semiconductors perform and what are they used for?

Answer:

Semiconductors are materials which, under specific conditions, can conduct electricity. The materials they are composed of have electrical conductivities similar to metals and insulators like plastic. They form the backbone of modern technology, powering gadgets such as smartphones, computers, televisions, automobiles, and more.

Question:

What are the six phases involved in providing an AI service?

Answer:

The six phases involved in providing an AI service are data collection and preparation, machine learning algorithms and models, model training and evaluation, infrastructure and computing resources, integration and deployment, and continuous monitoring and improvement.

Question:

How does the semiconductor industry benefit from the growth in Artificial Intelligence (AI)?

Answer:

The semiconductor industry benefits from the growth in Artificial Intelligence (AI) as the demand for semiconductors is driven by developing technologies. These are technologies such as AI, the Internet of Things, 5G networks, and self-driving cars. Key firms in the sector engage in R&D programs to manufacture smaller, quicker, and more efficient processors.

Question:

What is the semiconductor industry?

Answer:

The semiconductor industry is involved in the design, development, manufacturing, and distribution of semiconductors. These are electronic components fundamental to the operation of a variety of electronic devices. It is a dynamic sector which includes a range of established and emerging companies.

3 Responses