3 months performance: S&P 500 +6.2%, Dow Flat, NASDAQ 100 +18%

Top 10 Stock Picks +12.4%

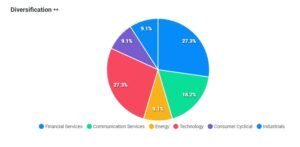

concentrated but diversified

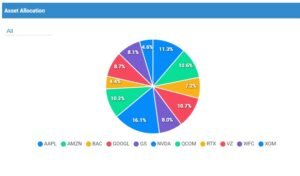

At the end of 2022, CNBC ran a segment, Top 10 Stock Picks by Wall Street Analysts for 2023. The portfolio is designed to be concentrated in the number of stocks but diversified by sector. A stock picker’s portfolio. The sectors initially represented by CNBC were: tech, oil, media, and industrial. The 10 stocks originally selected were as follows. Alphabet, Amazon, Tesla, Exxon Mobile, Nvidia, Comcast, Raytheon, Netflix, Qualcomm, and Boeing.

The key adjustments I made to the original selection were as follows. Verizon over Comcast, purely on valuation. Tesla was exchanged for a bank, Wells Fargo. I was not comfortable with the position of the company’s management. Boeing for Caterpillar, due to concerns over air travel. I removed Caterpillar in late January. As always, you win some, lose some. The key is to maintain your portfolio objectives. For this, my aim was to have a balanced approach to portfolio allocation. Then I will follow my convictions.

Key Sectors: Banks and Tech

Top 10 Stock Picks: Key Bets

Key moves in the first three months were to add banks and tech stocks. The banks were at the center of the turmoil in the stock market in the first quarter. The failure of Silicon Valley Bank in early March created suspense and drama and served as the first act. This was quickly followed by the failure of Signature Bank and then Credit Suisse.

BANK STOCKS

The Federal Reserve and the FDIC worked together to stabilise the banking sector, easing investor concerns. Widespread concerns about potential bank instability have proven to be unwarranted. The current weighting of banks in the Top 10 Stock Picks portfolio is 27%. The following bank stocks are in the Top 10 Stock Picks portfolio, BAC, GS, WFC. For more information on the bank crisis, click HERE.

TECH STOCKS RALLY

Following a difficult 2022, the tech sector performed well in the first quarter of 2023. The NASDAQ 100 is up over 21%. The outperformance is due to several factors. One key one has been the reduction in employees. Tech companies could also gain from increased demand for technology products and services.

The reorientation to operate and communicate remotely post-pandemic has driven the sector. This has meant that companies and individuals have become more reliant on technology. This trend has driven several sub-sectors, including software, cloud computing, and e-commerce. Mega-tech companies, like Apple, Amazon, and Facebook have performed well. As has Nvidia, up over 80% and Tesla +75%. For more information on the tech rally, click HERE.

TESLA +75% YTD

WHAT'S NEXT: TOP 10 STOCKS

5 FACTORS

Graphs and data by Finscreener

Google Inc. (GOOGL)

Amazon (AMZN)

Amazon’s performance in 2023 will be via e-commerce, and cloud computing expansion. Investments in new sectors such as healthcare could be positive as well. Amazon is a powerhouse, but it is facing increased rivalry in the e-commerce business. It is unclear how Amazon will fare over the rest of 2023.

Year-on-year performance, Amazon is down 36.32%, YTD up 21.5%. AMZN stock has a five-year performance of 45.26%. Its 52-week range is between $81.43 and $168.11, which gives AMZN stock a 52-week price range ratio of 23.80%.

The current PE ratio is 78.80X, if EPS in 2024 is above $1.70, the forward PE is around 60X. Currently, the price-to-book (PB) ratio of 6.39X, a price-to-sale (PS) ratio of 2.44X. The stock is not cheap on current multiples. Sales growth must improve to justify these multiples going forward. ROA is 3.01%, and a ROE of 9.45%.

Apple Inc.(AAPL)

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

Bank of America (BAC)

Exxon Mobil Corporation (XOM)

The Goldman Sachs Group Inc. (GS)

Finscreener is a powerful financial analysis tool that allows investors and traders to screen and analyze stocks, ETFs, mutual funds, and cryptocurrencies based on various fundamental and technical criteria quickly and easily. The platform provides users with a wide range of filters, charts, and tools to help them find and analyze the right investment opportunities.

SUBSCRIBER TO FINSCREENER, CLICK BELOW

NVIDIA Corporation (NVDA)

QUALCOMM (QCOM)

Raytheon Technologies Corporation (RTX)

Verizon Communications Inc (VZ)

VZ is a multinational telecommunications conglomerate that operates in over 150 countries. VZ’s core wireless and wireline businesses will be the main drivers of revenue growth in 2023. In 2022, Verizon’s wireless business experienced strong growth in its customer base. This resulted in increased revenue from wireless services. Due to its investments in fiber optic networks, VZ’s wireline business also grew.

VZ is currently trading at a PE ratio of 9.20X. The price-to-book (PB) ratio is 2.03X, and the price-to-sale (PS) ratio is 1.71X. The ROA is 5.30%, and the ROE is 23.45%. The company’s profit margin is 14.82%. Its EBITDA margin is 33.80%. The valuation parameters are attractive.

One Response