U.S. Stock Markets: The Week to 19 May

So far in 2023 the U.S. stock market have been strong, with the S&P 500 +9.6% YTD and the NASDAQ 100 +22%. Recently, investors have been wondering what the future holds for the stock markets.

The week of May 15th to May 19th was no exception, with several key events impacting the U.S. Stock Markets. In this article, we will take a closer look at the U.S. stock market update for this week and what it means for investors.

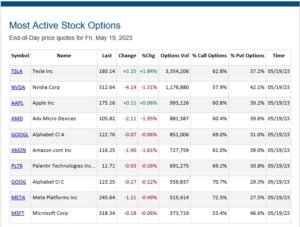

In 2023, the performance so far has been in a few large cap tech stocks. Who would have expected this? I did expect the tech stocks to be in rally mode due to the three factors and at the end of last year published a video on this. But not this strong, published 13 December. Take a look at the outperformance of the major tech stocks. The three key issues are Recession, Inflation and Rates. Probably this trend in big tech is set to continue.

While rates are rising and are bad for stocks, the balance sheets of the major tech stocks are not full of debt. Recession, or the talk of, allows restructuring and the tech stocks have does this. Tech has over earnt over the past couple of years. Corporate America and Europe are doing well, inflation will help with pricing power.

The U.S. Stock Markets

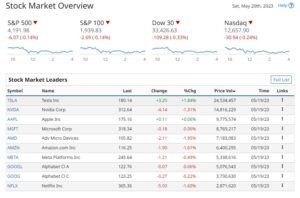

The U.S. stock market had a mixed performance during the week of May 15th to May 19th. The Dow Jones and the S&P 500 both experienced slight losses, while the Nasdaq Composite Index gained slightly. The DJIA fell by 0.53%, the S&P 500 lost 0.38%, and the Nasdaq Composite Index gained 0.34%.

Several events impacted the U.S. stock market during this week. One of the most significant was the release of the Federal Reserve’s May meeting minutes. The minutes showed that the Fed is on track to raise interest rates in June. This caused some uncertainty in the market, but then again, the market is showing only a 21% chance of a 25 bp rate hike.

The next FOMC meeting will be June 13-14. Following which, Fed Chair Powell, signaled he is inclined to pause raising interest rates at that point. Additionally, investors were watching developments in Washington D.C closely. The Debt Ceiling Debate continued to raise controversy and uncertainty.

Take a look how you can use technical indicators to improve your investing, click HERE.

Subscribe to

The party in big cap tech stocks

Follow, learn and maybe gain some investment ideas trading with EToro. The platform has over 30 million traders and investors. Invest in 3,000+ assets on a trusted and friendly platform.

77% of retail investor accounts lose money when trading CFDs with this provider

IS THIS SET TO CONTINUE?

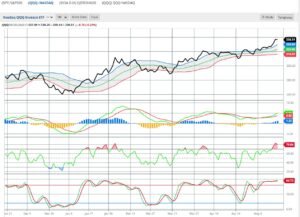

The graph indicates the massive outperformance of the major tech stocks versus the S&P 500. All the major stocks Amazon, Apple, Netflix, Tesla, Nvidia have outperformed. Is this set to continue? You have to have a very good argument to bet against the major tech stocks. Yes. The valuation differential is at all time highs, with the other peaks reached back in the early 2000’s and in the 1970’s. Of course, tech was a very different sector compared to today. I do not expect tech to over ear, as the sector did over the past 10 years. Keep in mind they have restructured, and they will have adequate pricing power.

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions. The website is designed for individual traders and investors, as well as institutional clients, including banks, brokers, and hedge funds.

Barchart provides users with access to real-time and historical data on a wide range of financial instruments. Included are stocks, futures, options, currencies, and cryptocurrencies. The website also offers a variety of tools and services for trading and investing. Customizable charts, technical indicators, and screeners for identifying potential investment opportunities.

In addition to its data and trading solutions, Barchart provides news and analysis on the financial markets, with articles and commentary from a team of experienced financial journalists and analysts.

Overall, I find Barchart to be a comprehensive platform for traders and investors looking to stay up-to-date on financial market data and news. Provides access a range of tools and services to support a wide range of investment strategies.

Outlook for Investors

One Response